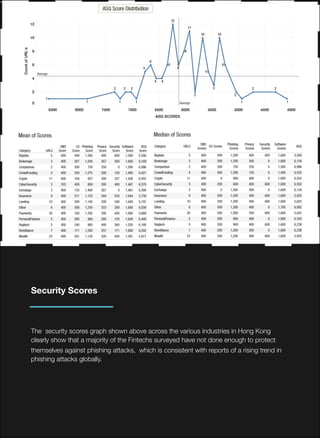

This survey of over 100 Hong Kong fintech companies in 2017-2018 found that:

- A majority had medium cybersecurity risks with scores over 6000 but below 8000.

- Over 1/3 had not configured SPF and over 3/4 had not configured DKIM or DMARC, leaving them vulnerable to phishing.

- 70% had not set up a privacy policy or terms page on their site, risking noncompliance with GDPR.

- 42% were susceptible to the CRIME SSL vulnerability and under 7% to POODLE, showing risks from outdated encryption.

- Over half had vulnerabilities like lack of XSS protection, WAF, or HTTPS that could enable attacks.