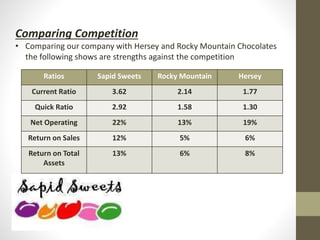

Sapid Sweets is a privately owned company that has seen increases in income after taxes, gross margin, and operating income compared to last year. They are considering introducing a new line of energy bars, which would require a new plant and equipment purchase. An analysis shows the energy bars could improve Sapid Sweets' finances and ratios, allowing them to perform better than competitors Hersey and Rocky Mountain Chocolates. The projected results estimate the energy bars would see a 19% return on investment and allow Sapid Sweets to break even within 5.8 years.