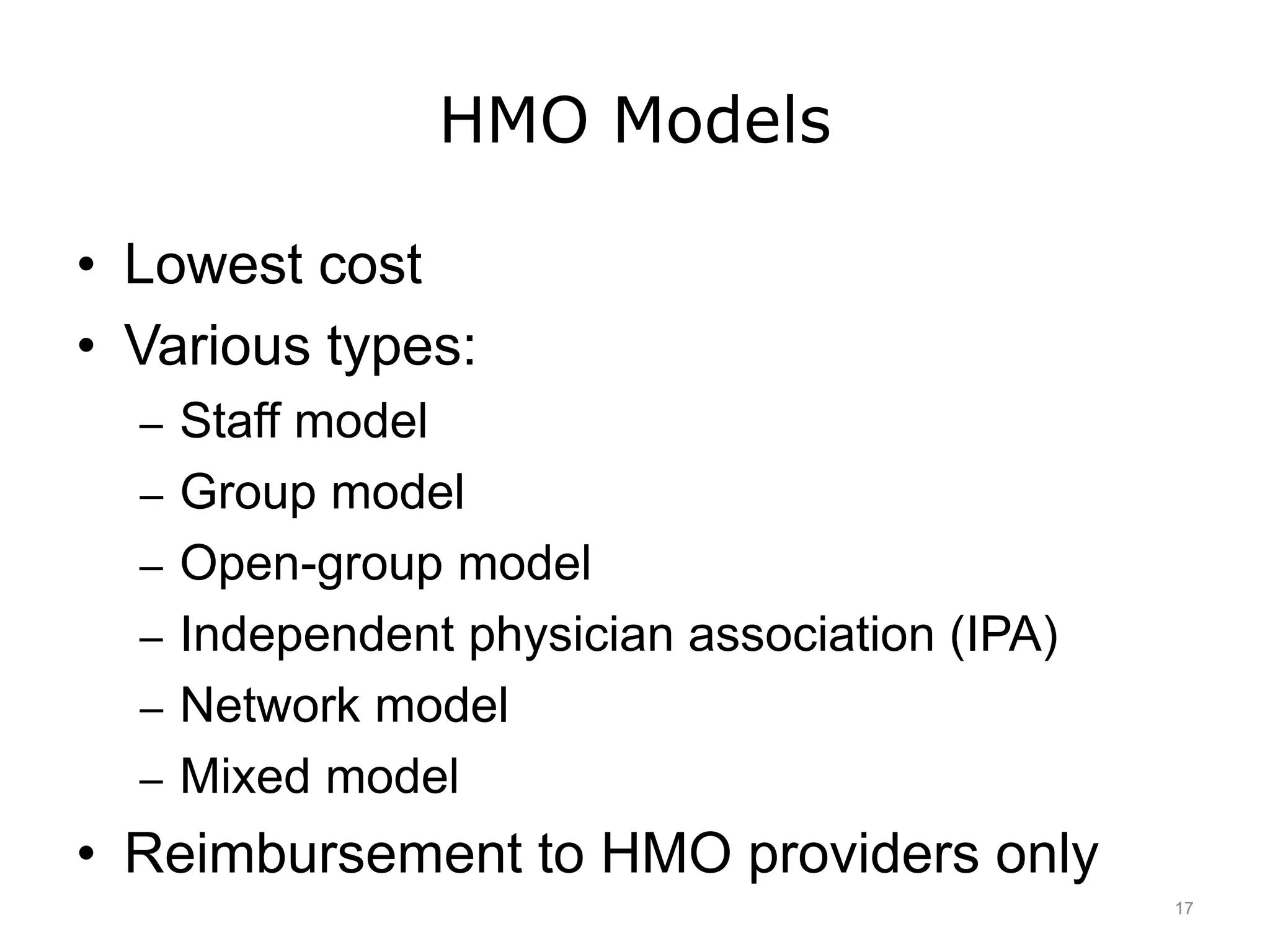

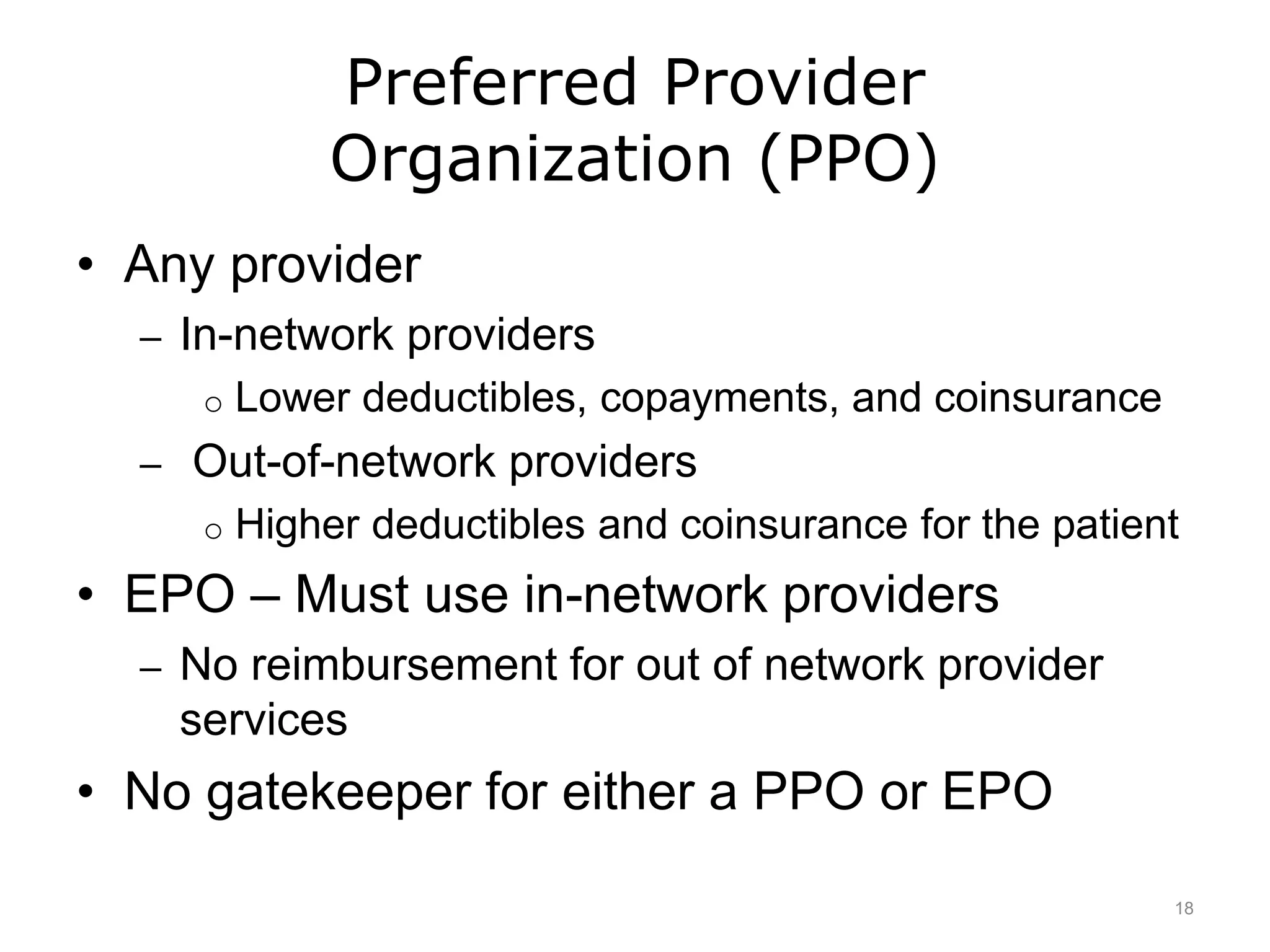

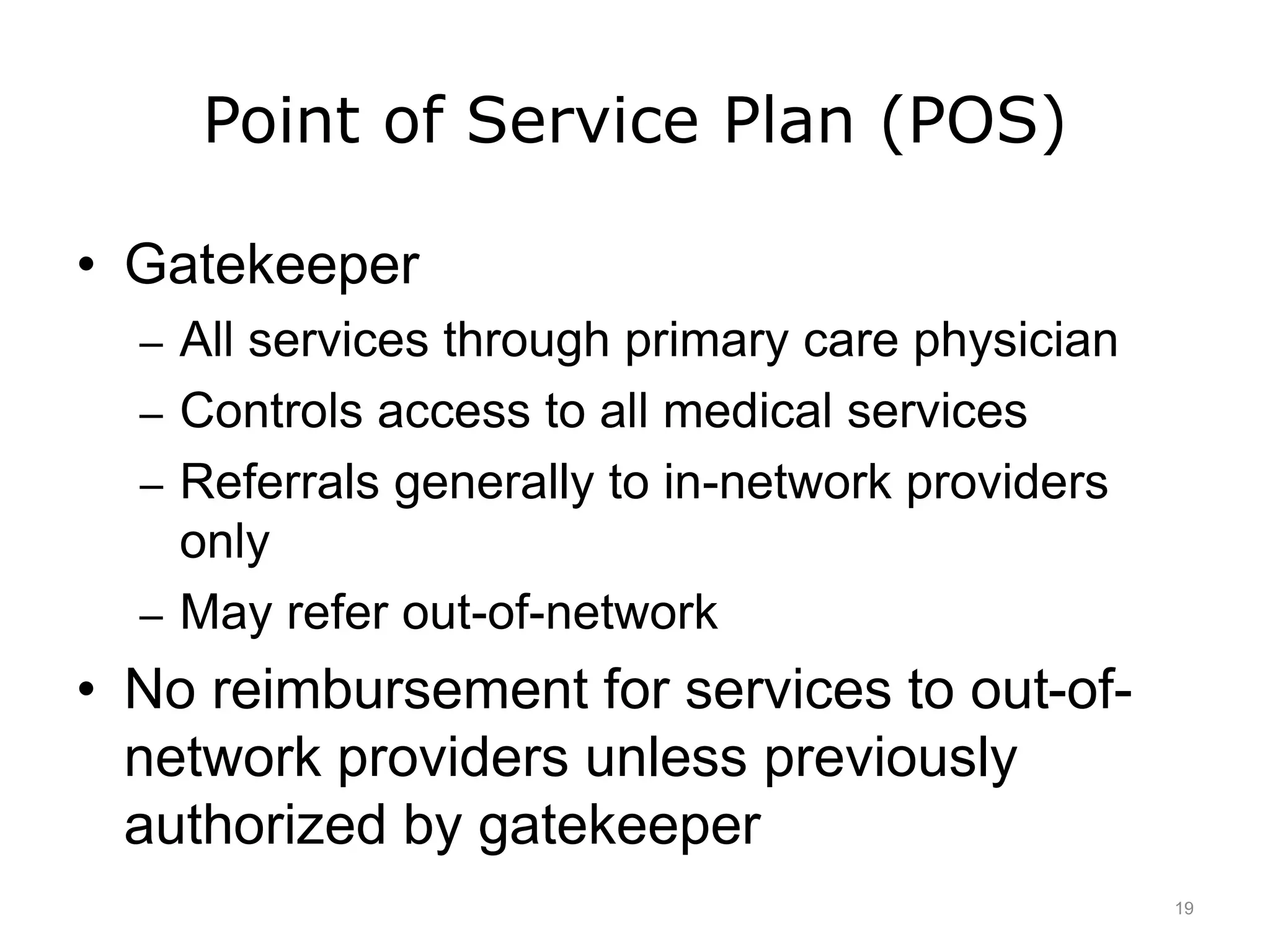

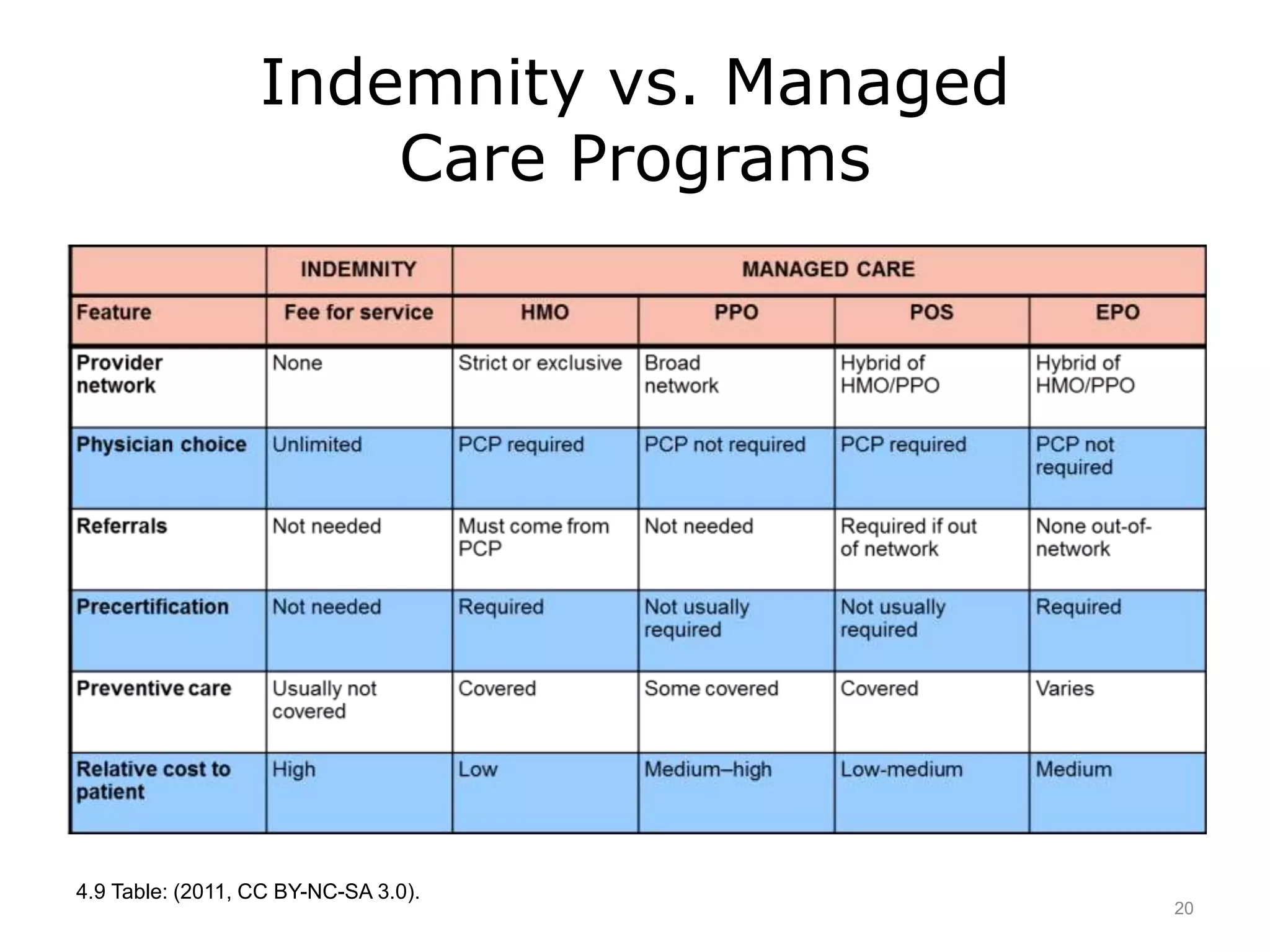

This document is a lecture on financing health care in the United States. It discusses how health insurance works by spreading risk over large pools of people. Insurers pay providers based on diagnosis and procedure codes, using contracted rates. The lecture describes the types of private health insurance like indemnity plans, Blue Cross/Blue Shield, and various managed care plans. It also discusses the roles of government programs like Medicare and Medicaid, as well as laws regulating private insurance such as ERISA, COBRA, HIPAA, and the Affordable Care Act.