More Related Content Similar to Financial analysis - MBIA Inc. provides financial guarantee insurance and … Similar to Financial analysis - MBIA Inc. provides financial guarantee insurance and … (20) 1. 04.03.2013

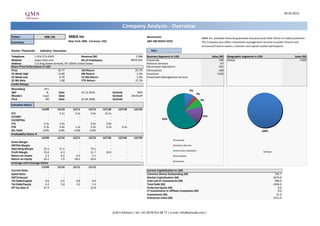

Company Analysis - Overview

Ticker: MBI UN MBIA Inc Benchmark: MBIA Inc. provides financial guarantee insurance and other forms of credit protection.

Currency: New York: MBI, Currency: USD S&P 500 INDEX (SPX) The Company also offers investment management services to public finance and

structured finance issuers, investors and capital market participants.

Sector: Financials Industry: Insurance Year:

Telephone 1-914-273-4545 Revenue (M) 2'386 Business Segments in USD Sales (M) Geographic Segments in USD Sales (M)

Website www.mbia.com No of Employees #N/A N/A Corporate 196 Global -1582

Address 113 King Street Armonk, NY 10504 United States Advisory Services 67

Share Price Performance in USD Wind-down Operations -181

Price 10.77 1M Return 25.7% Eliminations -338

52 Week High 12.00 6M Return -2.3% Insurance -1326

52 Week Low 6.78 52 Wk Return 5.3% Investment Management services

52 Wk Beta 1.88 YTD Return 37.2%

Credit Ratings

Bloomberg HY1

9%

S&P B- Date 22.12.2010 Outlook NEG

3%

Moody's Caa1 Date - Outlook DEVELOP

Fitch NR Date 26.06.2008 Outlook - 9%

Valuation Ratios

12/09 12/10 12/11 12/12 12/13E 12/14E 12/15E

P/E - 4.1x 5.5x 6.6x 16.2x - -

EV/EBIT - - - - - - - 16%

EV/EBITDA - - - - - - - 63%

P/S 0.3x 2.9x - 0.6x 5.8x - -

P/B 0.3x 0.8x 1.3x 0.5x 0.5x 0.4x -

Div Yield 0.0% 0.0% 0.0% 0.0% - - - 100%

Profitability Ratios %

12/09 12/10 12/11 12/12 12/13E 12/14E 12/15E

Corporate

Gross Margin - - - - - - -

EBITDA Margin - - - - - - - Advisory Services

Operating Margin 35.3 27.4 - 79.1 - - -

Wind-down Operations

Profit Margin 23.6 6.3 - 51.7 26.9 - - Global

Return on Assets 2.3 0.2 -4.5 5.1 - - - Eliminations

Return on Equity 34.2 1.9 -58.2 50.6 - - -

Insurance

Leverage and Coverage Ratios

12/09 12/10 12/11 12/12

Current Ratio - - - - Current Capitalization in USD

Quick Ratio - - - - Common Shares Outstanding (M) 195.7

EBIT/Interest - - - - Market Capitalization (M) 2076.0

Tot Debt/Capital 0.8 0.9 0.8 0.6 Cash and ST Investments (M) 990.0

Tot Debt/Equity 4.2 5.8 3.2 1.3 Total Debt (M) 4204.0

Eff Tax Rate % 47.9 - - 22.8 Preferred Equity (M) 0.0

LT Investments in Affiliate Companies (M) 0.0

Investments (M) 21.0

Enterprise Value (M) 5311.0

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

2. Company Analysis - Analysts Ratings

MBIA Inc

Target price in USD

Broker Recommendation

Buy and Sell Recommendations vs Price and Target Price

Price

Brokers' Target Price

25 25

100% 0% 0% 0% 0% 0%

20%

25% 25% 25% 25% 25% 25%

20 20

80% 0%

0% 0% 0% 0% 0% 0%

15

60% 15

100% 100% 100% 100% 100%

10

40% 80% 10

75% 75% 75% 75% 75% 75%

5

20% 5

0

MKM Partners

S&P Capital IQ

Pressprich &

BTIG LLC

Dimensions

0% 0

EVA

R.W.

Co

mars.12 avr.12 mai.12 juin.12 juil.12 août.12 sept.12 oct.12 nov.12 déc.12 janv.13 févr.13

Buy Hold Sell Price Target Price

Date Buy Hold Sell Date Price Target Price Broker Analyst Recommendation Target Date

28-Feb-13 80% 0% 20% 4-Mar-13 10.77 16.50 BTIG LLC MARK PALMER buy 22.50 1-Mar-13

31-Jan-13 75% 0% 25% 1-Mar-13 10.31 16.50 S&P Capital IQ CATHY SEIFERT sell 9.00 28-Feb-13

31-Dec-12 75% 0% 25% 28-Feb-13 9.67 16.50 MKM Partners HARRY FONG buy 18.00 28-Feb-13

30-Nov-12 75% 0% 25% 27-Feb-13 9.98 20.25 EVA Dimensions AUSTIN BURKETT buy 28-Feb-13

31-Oct-12 100% 0% 0% 26-Feb-13 9.90 20.25 R.W. Pressprich & Co BRIAN CHARLES speculative buy 27-Sep-12

28-Sep-12 100% 0% 0% 25-Feb-13 9.86 20.25

31-Aug-12 100% 0% 0% 22-Feb-13 10.10 20.25

31-Jul-12 75% 0% 25% 21-Feb-13 10.23 20.25

29-Jun-12 75% 0% 25% 20-Feb-13 10.41 20.25

31-May-12 75% 0% 25% 19-Feb-13 10.92 20.25

30-Apr-12 100% 0% 0% 18-Feb-13 10.73 20.25

30-Mar-12 100% 0% 0% 15-Feb-13 10.73 20.25

14-Feb-13 10.95 20.25

13-Feb-13 10.53 20.25

12-Feb-13 10.50 20.25

11-Feb-13 10.47 20.25

8-Feb-13 10.20 20.25

7-Feb-13 10.14 20.25

6-Feb-13 10.41 20.25

5-Feb-13 8.83 20.25

4-Feb-13 8.57 20.25

1-Feb-13 8.73 20.25

31-Jan-13 8.61 20.25

30-Jan-13 8.66 20.25

29-Jan-13 8.34 20.25

28-Jan-13 8.12 20.25

25-Jan-13 8.42 20.25

24-Jan-13 8.28 20.25

23-Jan-13 8.55 20.25

22-Jan-13 8.63 20.25

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

3. 04.03.2013

MBIA Inc

Company Analysis - Ownership

Ownership Type

Ownership Statistics Geographic Ownership Distribution Geographic Ownership

3% 3%

Shares Outstanding (M) 195.7 United States 91.00%

Float 73.3% Unknown Country 2.83% 1% 1%1% 1%

1%

3%

Short Interest (M) 13.0 Britain 2.82% 2%

Short Interest as % of Float 9.05% Bermuda 0.80%

Days to Cover Shorts 3.44 Canada 0.62%

Institutional Ownership 94.10% Norway 0.60%

Retail Ownership 3.17% Germany 0.58%

Insider Ownership 2.74% Others 0.77%

Institutional Ownership Distribution

90%

94% Investment Advisor 56.80%

Private Equity 24.73%

Hedge Fund Manager 12.23%

United States Unknown Country Britain

Institutional Ownership Retail Ownership Insider Ownership Individual 2.83%

Bermuda Canada Norway

Pricing data is in USD Others 3.42% Germany Others

Top 20 Owners: TOP 20 ALL

Institutional Ownership

Holder Name Position Position Change Market Value % of Ownership Report Date Source Country

WARBURG PINCUS LLC 46'159'252 0 497'135'144 23.95% 02.01.2013 Form 4 UNITED STATES 3% 3%

WARBURG PINCUS LLC 46'159'252 0 497'135'144 23.95% 31.12.2012 13F UNITED STATES

FAIRHOLME CAPITAL MA 42'495'420 -1'791'750 457'675'673 22.05% 31.12.2012 13F UNITED STATES 12%

DIMENSIONAL FUND ADV 9'898'469 483'380 106'606'511 5.14% 31.12.2012 13F UNITED STATES

THE LONDON COMPANY 9'742'153 545'324 104'922'988 5.05% 31.01.2013 13G UNITED STATES

VANGUARD GROUP INC 7'686'354 273'007 82'782'033 3.99% 31.12.2012 13F UNITED STATES

57%

MARATHON ASSET MANAG 4'879'411 -2'782'397 52'551'256 2.53% 31.12.2012 13F BRITAIN

BLACKROCK 4'835'478 398'338 52'078'098 2.51% 28.02.2013 ULT-AGG UNITED STATES

25%

BLACKSTONE 4'306'398 3'542'293 46'379'906 2.23% 31.12.2012 ULT-AGG

ELM RIDGE MANAGEMENT 3'923'432 -1'783'847 42'255'363 2.04% 31.12.2012 13F UNITED STATES

KAHN BROTHERS GROUP 2'981'590 40'849 32'111'724 1.55% 31.12.2012 13F UNITED STATES

GOLDMAN SACHS GROUP 2'810'625 2'405'219 30'270'431 1.46% 31.12.2012 13F UNITED STATES

STATE STREET 2'197'738 74'843 23'669'638 1.14% 31.12.2012 ULT-AGG UNITED STATES

RENAISSANCE TECHNOLO 2'173'700 1'709'700 23'410'749 1.13% 31.12.2012 13F UNITED STATES Investment Advisor Private Equity Hedge Fund Manager

Individual Others

SUSQUEHANNA INTERNAT 1'700'508 100'364 18'314'471 0.88% 31.12.2012 13F UNITED STATES

QVT FINANCIAL LP 1'605'654 0 17'292'894 0.83% 31.12.2012 13F UNITED STATES

TOUCHSTONE ADVISORS 1'530'804 81'640 16'486'759 0.79% 31.12.2012 MF-AGG UNITED STATES

CATLIN GROUP LTD 1'500'000 1'500'000 16'155'000 0.78% 31.12.2012 13F BERMUDA

BROWN JR JOSEPH W 1'452'456 0 15'642'951 0.75% 18.02.2013 Form 4 n/a

SG AMERICAS SECURITI 1'406'554 1'406'554 15'148'587 0.73% 31.12.2012 13F UNITED STATES

Top 5 Insiders:

Holder Name Position Position Change Market Value % of Ownership Report Date Source

BROWN JR JOSEPH W 1'452'456 15'642'951 0.75% 18.02.2013 Form 4

FALLON WILLIAM C 1'005'281 600'000 10'826'876 0.52% 21.12.2012 Form 4

CHAPLIN CHARLES EDWARD 999'221 600'000 10'761'610 0.52% 21.12.2012 Form 4

MCKIERNAN ANTHONY 562'210 400'000 6'055'002 0.29% 21.12.2012 Form 4

WERTHEIM RAM D 476'246 400'000 5'129'169 0.25% 21.12.2012 Form 4

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

4. Company Analysis - Financials I/IV

MBIA Inc

Financial information is in USD (M) Equivalent Estimates

Periodicity: Fiscal Year 12/02 12/03 12/04 12/05 12/06 12/07 12/08 12/09 12/10 12/11 12/12 12/13E 12/14E 12/15E

Income Statement

Revenue 1'464 1'869 2'054 2'303 2'712 -284 -1'267 2'685 833 -1'582 2'386 358

- Cost of Goods Sold

Gross Income

- Selling, General & Admin Expenses 103 111 120 172 94 1'413 929 475

(Research & Dev Costs)

Operating Income 1'165 1'519 1'661 1'840 2'315 -2'903 -3'895 947 228 -1'902 1'888

- Interest Expense 372 371 488 822 1'182 163 243 384 363 339

- Foreign Exchange Losses (Gains)

- Net Non-Operating Losses (Gains) 0 0 0 0 0 -410 -269 -61 -26 -49

Pretax Income 793 1'149 1'173 1'017 1'133 -3'066 -3'727 1'217 -95 -2'239 1'598 84 -50

- Income Tax Expense 206 335 332 304 320 -1'144 -1'055 583 -148 -920 364

Income Before XO Items 587 814 840 713 813 -1'922 -2'673 634 53 -1'319 1'234

- Extraordinary Loss Net of Tax 8 0 -3 2 -6 0 0 0 0 0

- Minority Interests 0 0 0 0 0 0 0 0 0 0

Diluted EPS Before XO Items 3.98 5.61 5.80 5.20 5.95 (15.17) (12.29) 2.99 0.26 (6.69) 6.33

Net Income Adjusted* 630 0 0 764 788 193 -1'259 -1'245 0 1'234 96 -17

EPS Adjusted 4.27 4.80 5.32 5.56 5.81 1.52 (5.79) (6.04) 0.26 6.33 0.67 (0.09)

Dividends Per Share 0.68 0.80 0.96 1.12 1.24 1.36 0.00 0.00 0.00 0.00 0.00

Payout Ratio % 17.0 14.2 16.3 21.1 20.4 0.0 0.0

Total Shares Outstanding 145 144 139 133 135 125 208 205 200 193 196

Diluted Shares Outstanding 148 145 145 137 137 127 218 208 203 197 195

EBITDA

*Net income excludes extraordinary gains and losses and one-time charges.

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

5. Company Analysis - Financials II/IV

Periodicity: 12/02 12/03 12/04 12/05 12/06 12/07 12/08 12/09 12/10 12/11 12/12 12/13E 12/14E 12/15E

Balance Sheet

Total Current Assets

+ Cash & Near Cash Items 83 182 366 233 269 264 2'280 803 1'130 633 990

+ Short Term Investments 16'215 18'367 22'085 25'425 30'716 35'054 16'416 12'663 16'547 11'359 7'758

+ Accounts & Notes Receivable 351 351 414 530 651 783 1'160 5'668 6'464 6'563 6'757

+ Inventories

+ Other Current Assets

Total Long-Term Assets

+ Long Term Investments 17'095 27'707 30'618 32'155 37'077 42'066 20'639 16'608 21'545 16'929 12'137

Gross Fixed Assets

Accumulated Depreciation 302 320 406 427 450 473 561 470 412 351 302

+ Net Fixed Assets 128 123 115 109 106 104 105 77 71 69 69

+ Other Long Term Assets 892 1'585 1'117 1'107 1'210 3'726 4'286 2'076 2'657 2'328 1'469

Total Current Liabilities

+ Accounts Payable

+ Short Term Borrowings 0 7'905 11'336 11'725 13'270 18'327 6'459 5'924 12'660 1'578 944

+ Other Short Term Liabilities 616 567 742 730 496 1'220 857 5'371 7'275 6'399 3'096

Total Long Term Liabilities

+ Long Term Borrowings 8'264 9'862 8'877 10'033 13'619 14'056 8'736 4'942 3'950 3'856 3'260

+ Other Long Term Borrowings 1'151 2'035 1'563 1'575 1'508 5'671 6'975 322 273 8'966 7'439

Total Liabilities 13'359 24'009 26'477 27'970 32'559 43'759 28'008 23'094 29'433 25'150 18'530

+ Long Preferred Equity 0 0 0 0 0 0 0 0 0 0

+ Minority Interest 0 0 0 0 0 0 28 17 14 23 21

+ Share Capital & APIC 1'392 1'449 1'566 1'636 1'691 1'810 3'324 3'333 3'339 3'347 3'353

+ Retained Earnings & Other Equity 4'101 4'810 4'992 4'956 5'513 1'846 -2'329 -742 -506 -1'647 -180

Total Shareholders Equity 5'493 6'259 6'559 6'592 7'204 3'656 1'022 2'607 2'846 1'723 3'194

Total Liabilities & Equity 18'852 30'268 33'036 34'561 39'763 47'415 29'030 25'701 32'279 26'873 21'724

Book Value Per Share 37.94 43.50 47.05 49.54 53.43 29.16 4.78 12.66 14.18 8.80 16.22 23.80 26.71

Tangible Book Value Per Share 37.32 42.88 46.48 48.95 52.84 28.53 4.41 12.50 14.02 8.80

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

6. Company Analysis - Financials III/IV

Periodicity: 12/02 12/03 12/04 12/05 12/06 12/07 12/08 12/09 12/10 12/11 12/12 12/13E 12/14E 12/15E

Cash Flows

Net Income 579 814 843 711 819 -1'922 -2'673 634 53 -1'319 96 -17

+ Depreciation & Amortization 14 11 14 12 9 10 10 9 8 7

+ Other Non-Cash Adjustments 25 43 -103 100 -54 -1'130 2'146 -164 -903 -1'141

+ Changes in Non-Cash Capital 255 110 128 -37 -110 4'064 361 -2'671 -414 -523

Cash From Operating Activities 873 979 881 785 664 1'022 -156 -2'192 -1'256 -2'976

+ Disposal of Fixed Assets 0 1 2 2 0 4 0 0 3 0

+ Capital Expenditures -15 -11 -9 -9 -11 -12 -11 -6 -5 -5

+ Increase in Investments -19'971 -27'852 -26'810 -17'060 -23'020 -33'209 -15'353 -10'689 -10'124 -7'744

+ Decrease in Investments 18'068 23'989 24'484 14'880 18'222 26'904 33'455 15'671 14'227 12'561

+ Other Investing Activities 22 2 2 0 0 910 -517

Cash From Investing Activities -1'919 -3'873 -2'310 -2'187 -4'807 -6'311 18'091 4'977 5'011 4'295

+ Dividends Paid -97 -111 -132 -147 -163 -173 -43 -10 -1 0

+ Change in Short Term Borrowings -64 1'527 115 -1'750 -652 1'139 -899 -284 -424 -249

+ Increase in Long Term Borrowings 4'788 5'732 9'543 11'614 14'051 16'113 4'769 603 122 237

+ Decrease in Long Term Borrowings -3'421 -4'094 -7'644 -8'090 -8'997 -11'084 -21'674 -4'521 -3'067 -1'761

+ Increase in Capital Stocks 19 26 63 23 48 46 2'035 0 0 0

+ Decrease in Capital Stocks -209 -82 -375 -370 -61 -739 -221 -16 -31 -50

+ Other Financing Activities -3 -4 -2 -3 -29 -19 114 -34 -27 7

Cash From Financing Activities 1'014 2'993 1'568 1'277 4'197 5'283 -15'919 -4'261 -3'428 -1'816

Net Changes in Cash -32 99 139 -125 54 -6 2'016 -1'477 327 -497

Free Cash Flow (CFO-CAPEX) 858 968 873 776 653 1'010 -167 -2'198 -1'261 -2'981

Free Cash Flow To Firm 1'133 1'230 1'223 1'353 1'501

Free Cash Flow To Equity 4'133 2'889 2'552 5'055 7'181 -17'971 -6'410 -4'627 -4'754

Free Cash Flow per Share 5.85 6.75 6.15 5.79 4.91 7.97 -0.77 -10.56 -6.23 -15.13

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

7. Company Analysis - Financials IV/IV

Periodicity: 12/02 12/03 12/04 12/05 12/06 12/07 12/08 12/09 12/10 12/11 12/12 12/13E 12/14E 12/15E

Ratio Analysis

Valuation Ratios

Price Earnings 11.9x 12.3x 11.8x 11.5x 12.6x 18.4x 4.1x 5.5x 6.6x 16.2x

EV to EBIT

EV to EBITDA

Price to Sales 4.4x 4.5x 4.4x 3.5x 3.6x 0.3x 2.9x 0.6x 5.8x

Price to Book 1.2x 1.4x 1.3x 1.2x 1.4x 0.6x 0.9x 0.3x 0.8x 1.3x 0.5x 0.5x 0.4x

Dividend Yield 1.6% 1.4% 1.5% 1.9% 1.7% 7.3% 0.0% 0.0% 0.0% 0.0% 0.0%

Profitability Ratios

Gross Margin

EBITDA Margin - - -

Operating Margin 79.5% 81.3% 80.8% 79.9% 85.4% 35.3% 27.4% 79.1%

Profit Margin 39.5% 43.5% 41.0% 30.9% 30.2% 23.6% 6.3% 51.7% 26.9%

Return on Assets 3.3% 3.3% 2.7% 2.1% 2.2% -4.4% -7.0% 2.3% 0.2% -4.5% 5.1%

Return on Equity 11.3% 13.8% 13.2% 10.8% 11.9% -35.4% -114.9% 34.2% 1.9% -58.2% 50.6%

Leverage & Coverage Ratios

Current Ratio

Quick Ratio

Interest Coverage Ratio (EBIT/I)

Tot Debt/Capital 0.60 0.74 0.76 0.77 0.79 0.90 0.94 0.81 0.85 0.76 0.57

Tot Debt/Equity 1.50 2.84 3.08 3.30 3.73 8.86 14.87 4.17 5.84 3.15 1.32

Others

Asset Turnover 0.08 0.08 0.06 0.07 0.07 -0.01 -0.03 0.10 0.03 -0.05 0.10

Accounts Receivable Turnover

Accounts Payable Turnover

Inventory Turnover

Effective Tax Rate 26.0% 29.2% 28.3% 29.9% 28.2% 47.9% 22.8%

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

8. Company Analysis - Peers Comparision

AMBAC FINL ASSURED RADIAN GROUP SYNCORA PRIMUS BERKSHIRE HATH- CAPMARK

MBIA INC ISTAR FINANCIAL CIT GROUP INC

GROUP GUARANTY INC HOLDINGS GUARANTY A FINANCIA

Latest Fiscal Year: 12/2012 12/2012 12/2012 12/2012 12/2008 12/2012 12/2012 12/2012 12/2008 12/2012

52-Week High 12.00 0.06 20.19 9.81 1.11 9.74 153'738.88 10.75 20.00 43.90

52-Week High Date 14.09.2012 06.02.2013 19.02.2013 04.03.2013 18.10.2012 27.02.2013 28.02.2013 15.02.2013 21.12.2012 29.01.2013

52-Week Low 6.78 0.01 11.17 2.00 0.12 5.94 117'422.00 5.37 8.85 32.29

52-Week Low Date 13.11.2012 15.03.2012 04.06.2012 18.05.2012 16.08.2012 06.03.2012 05.03.2012 05.06.2012 08.03.2012 01.06.2012

Daily Volume 187'326 165'327 445'174 7'458'422 130 830 354 499'771 55'000 105'540

Current Price (3/dd/yy) 10.77 0.04 19.20 9.50 0.45 9.72 151'149.00 10.15 12.20 42.01

52-Week High % Change -10.2% -37.7% -4.9% -3.2% -59.5% -0.2% -1.7% -5.6% -39.0% -4.3%

52-Week Low % Change 58.8% 218.4% 71.9% 375.0% 275.0% 63.6% 28.7% 89.0% 37.8% 30.1%

Total Common Shares (M) 195.7 302.4 182.2 133.6 35.1 34.8 1.6 83.8 - 200.9

Market Capitalization 2'076.0 11.7 3'730.2 1'593.5 29.3 266.4 248'302.8 849.0 1'220.0 8'447.2

Total Debt 4'204.0 15'058.7 1'038.3 772.4 - 172.3 62'736.0 4'691.5 11'593.6 22'043.7

Preferred Stock - - - - 0.0 90.1 - 545.0 - -

Minority Interest 21.0 663.4 - - 20.0 - 3'941.0 87.9 186.4 4.7

Cash and Equivalents 990.0 20.6 214.5 31.6 1'574.1 87.2 186'759.0 256.3 874.4 6'821.3

Enterprise Value 5'311.0 16'258.5 4'437.2 2'334.4 - 386.2 128'220.8 5'372.1 8'025.5 23'674.3

Valuation

Total Revenue LFY 2'386.0 685.7 973.0 825.4 669.3 (27.6) 162'463.0 400.5 475.2 3'908.7

LTM 2'386.0 863.4 973.1 817.7 (1'441.5) (27.6) 162'463.0 371.4 - 3'877.9

CY+1 358.0 - 1'202.8 942.0 - - 172'941.0 253.1 - 2'115.3

CY+2 - - 1'084.3 1'072.5 - - 178'263.0 403.0 - 2'275.9

EV/Total Revenue LFY 2.0x 23.7x 3.4x 1.9x - -12.5x 0.6x 13.0x - 5.9x

LTM 2.0x 26.6x 4.1x 1.9x - - 0.6x 14.0x - 5.9x

CY+1 - - - -2.9x - - - - - -

CY+2 - - - -2.4x - - - - - -

EBITDA LFY - - - - - - 29'524.0 167.8 (102.3) 4'006.4

LTM - - - - - - 29'524.0 170.9 - 4'704.0

CY+1 - - - - - - - 227.0 - 1'514.5

CY+2 - - - - - - - 283.0 - 1'629.0

EV/EBITDA LFY - - - - - - 3.4x 31.0x - 5.7x

LTM - - - - - - 3.4x 30.5x - 5.2x

CY+1 - - - - - - - - - -

CY+2 - - - - - - - - - -

EPS LFY 1.19 -0.31 2.81 -3.24 -26.49 0.78 7'629.00 -2.73 - -3.00

LTM 1.36 -0.29 2.79 -3.84 -65.35 1.95 7'628.00 -2.72 - -0.48

CY+1 0.67 - 2.65 (0.12) - - 8'652.04 (1.35) - 3.75

CY+2 (0.09) - 2.64 1.23 - - 9'109.42 (0.05) - 4.23

P/E LFY 7.9x - 6.9x - - 5.0x 19.8x - - -

LTM 7.9x - 6.9x - - 5.0x 19.8x - - -

CY+1 16.2x - 7.3x - - - 17.5x - - 11.2x

CY+2 - - 7.3x 7.7x - - 16.6x - - 9.9x

Revenue Growth 1 Year - 131.8% (46.5%) (57.6%) - - 13.1% (7.5%) (77.4%) (17.0%)

5 Year - - - - - - 10.6% (24.5%) - -

EBITDA Growth 1 Year - - - - - - 34.2% (24.1%) - -

5 Year - - - - - - 4.3% (32.7%) - -

EBITDA Margin LTM - - - - - - 18.2% 46.0% - 114.8%

CY+1 - - - - - - - 89.7% - 71.6%

CY+2 - - - - - - - 70.2% - 71.6%

Leverage/Coverage Ratios

Total Debt / Equity % 132.5% - 22.0% 104.9% 0.0% - 33.4% 378.7% 951.2% 264.5% FALSE FALSE FALSE FALSE FALSE

Total Debt / Capital % 56.8% 126.4% 18.0% 51.2% - 147.5% 24.7% 78.0% 89.2% 72.6% FALSE FALSE FALSE FALSE FALSE

Total Debt / EBITDA - - - - - - 2.125x 27.459x - 4.887x FALSE FALSE FALSE FALSE FALSE

Net Debt / EBITDA - - - - - - -4.201x 25.958x - 3.515x FALSE FALSE FALSE FALSE FALSE

EBITDA / Int. Expense - - - - - - 13.783x 0.473x - - FALSE FALSE FALSE FALSE FALSE

Credit Ratings

S&P LT Credit Rating B- NR A- CCC+ - NR AA+ B+ NR BB- FALSE FALSE FALSE FALSE FALSE

S&P LT Credit Rating Date 22.12.2010 30.11.2010 30.11.2011 15.10.2012 - 16.11.2010 04.02.2010 18.03.2011 04.03.2011 09.03.2012 FALSE FALSE FALSE FALSE FALSE

Moody's LT Credit Rating Caa1 WR - Caa1 - WR Aa2 B3 WR Ba3 FALSE FALSE FALSE FALSE FALSE

Moody's LT Credit Rating Date 19.11.2012 07.04.2011 - 27.02.2013 - 29.12.2010 04.02.2010 04.10.2012 28.02.2011 08.01.2013 FALSE FALSE FALSE FALSE FALSE

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |