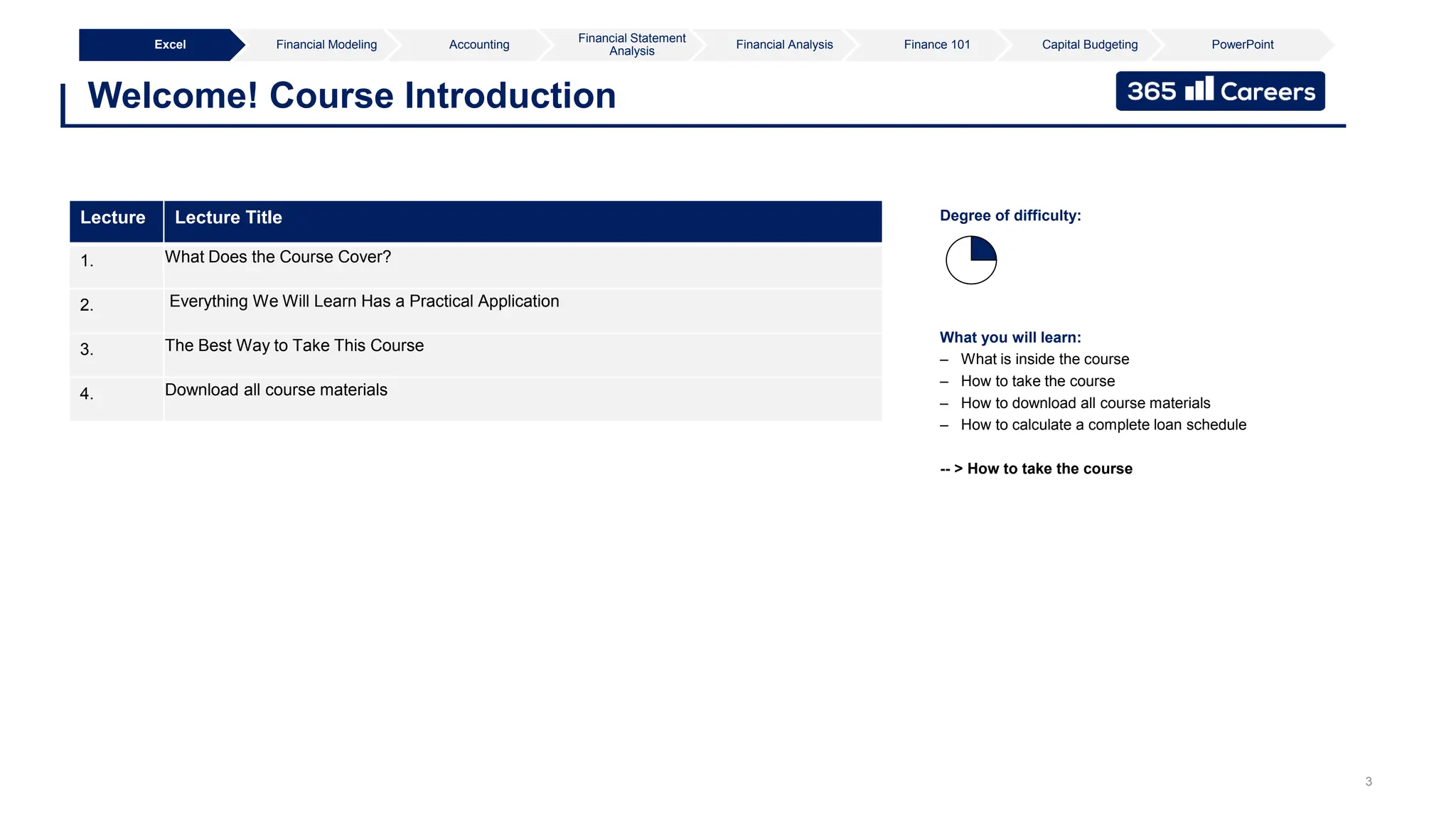

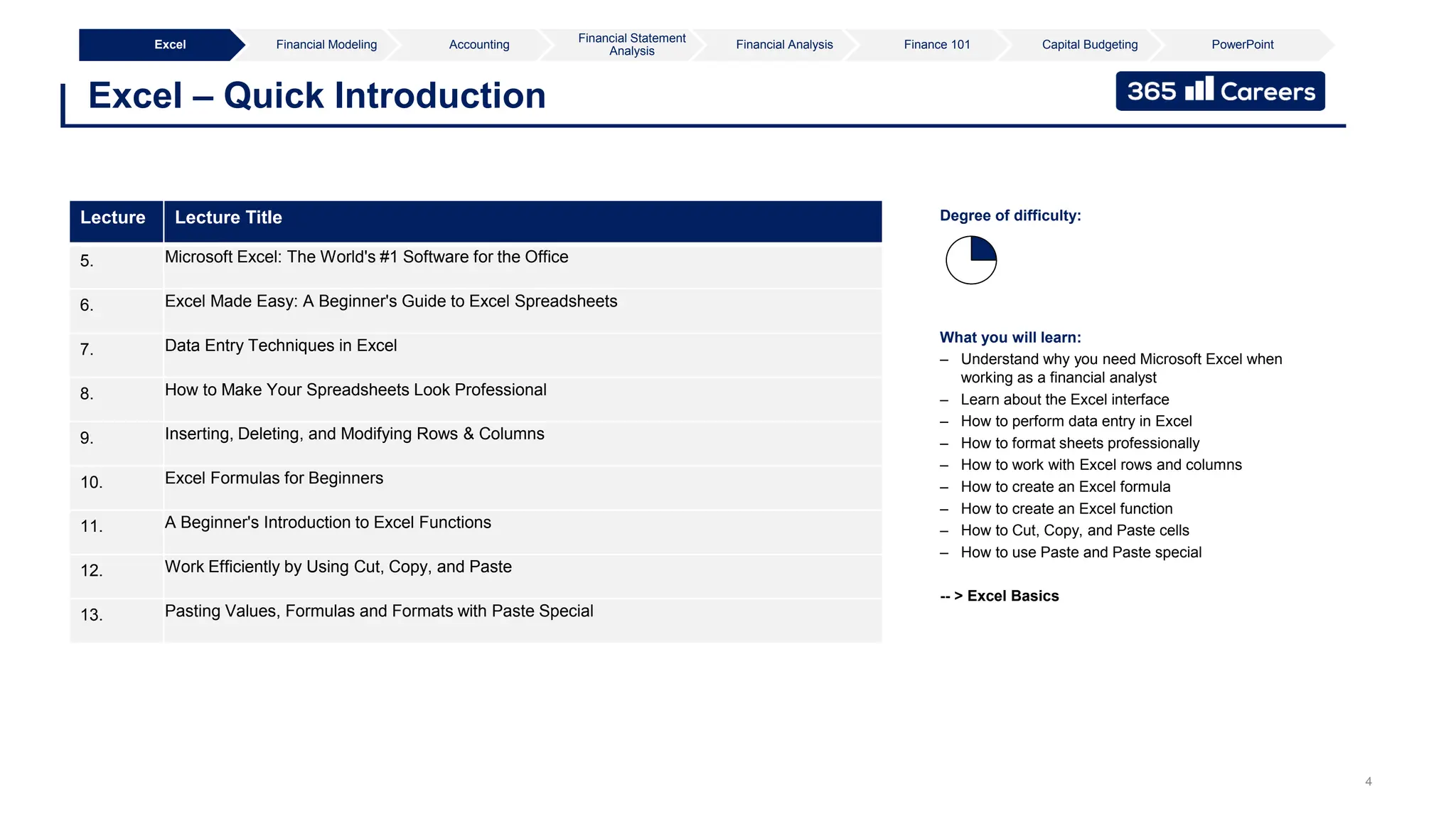

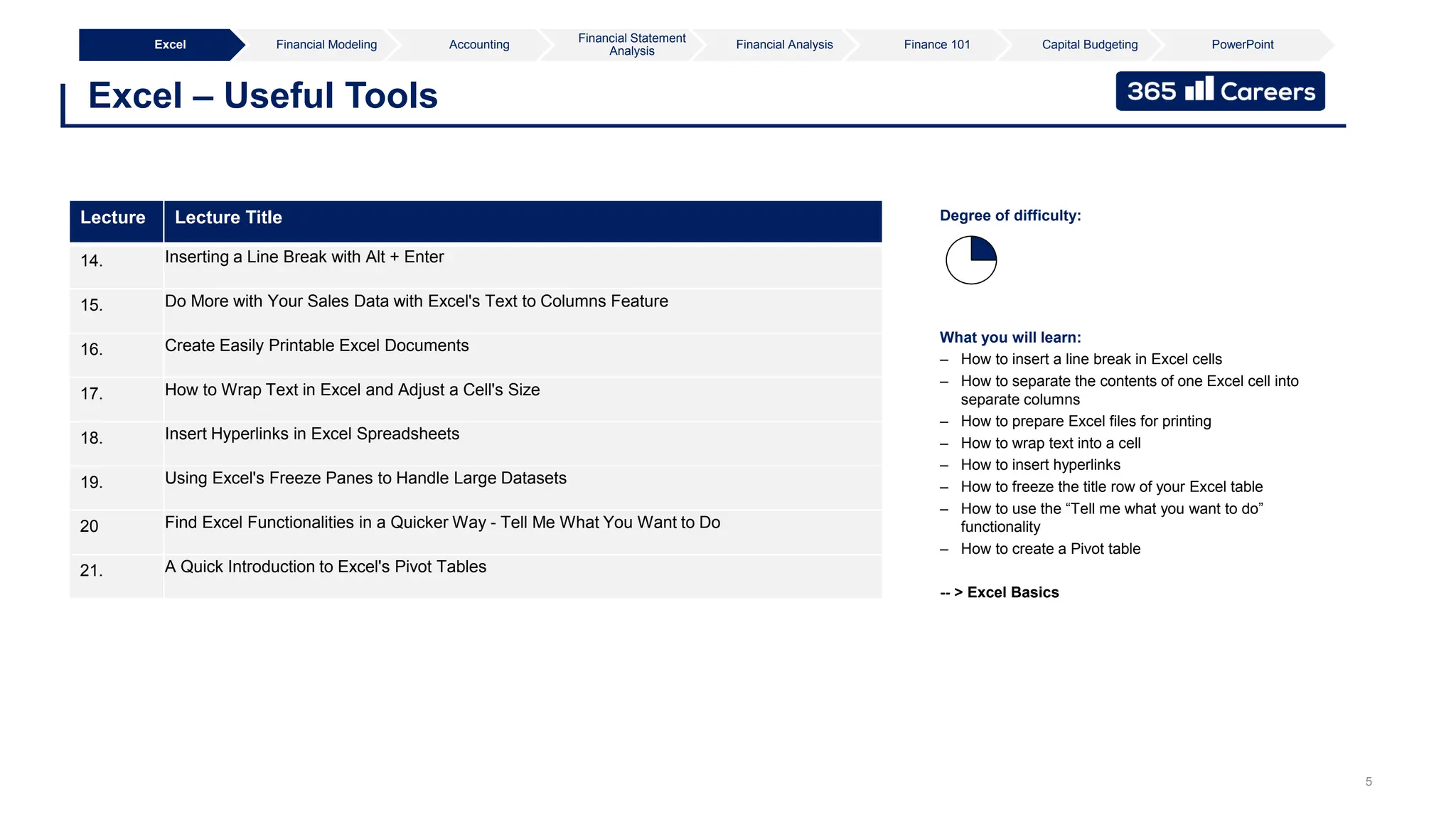

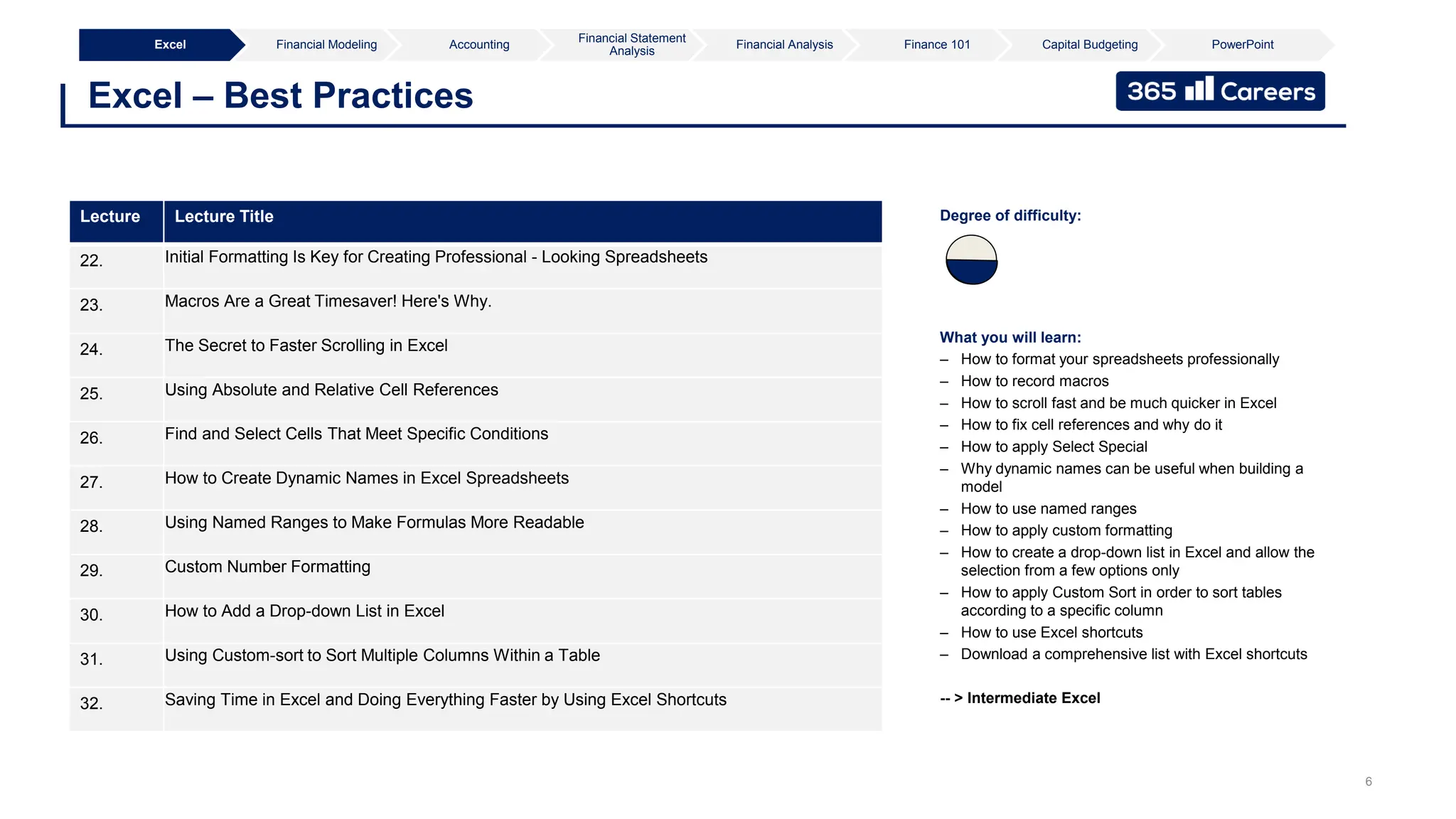

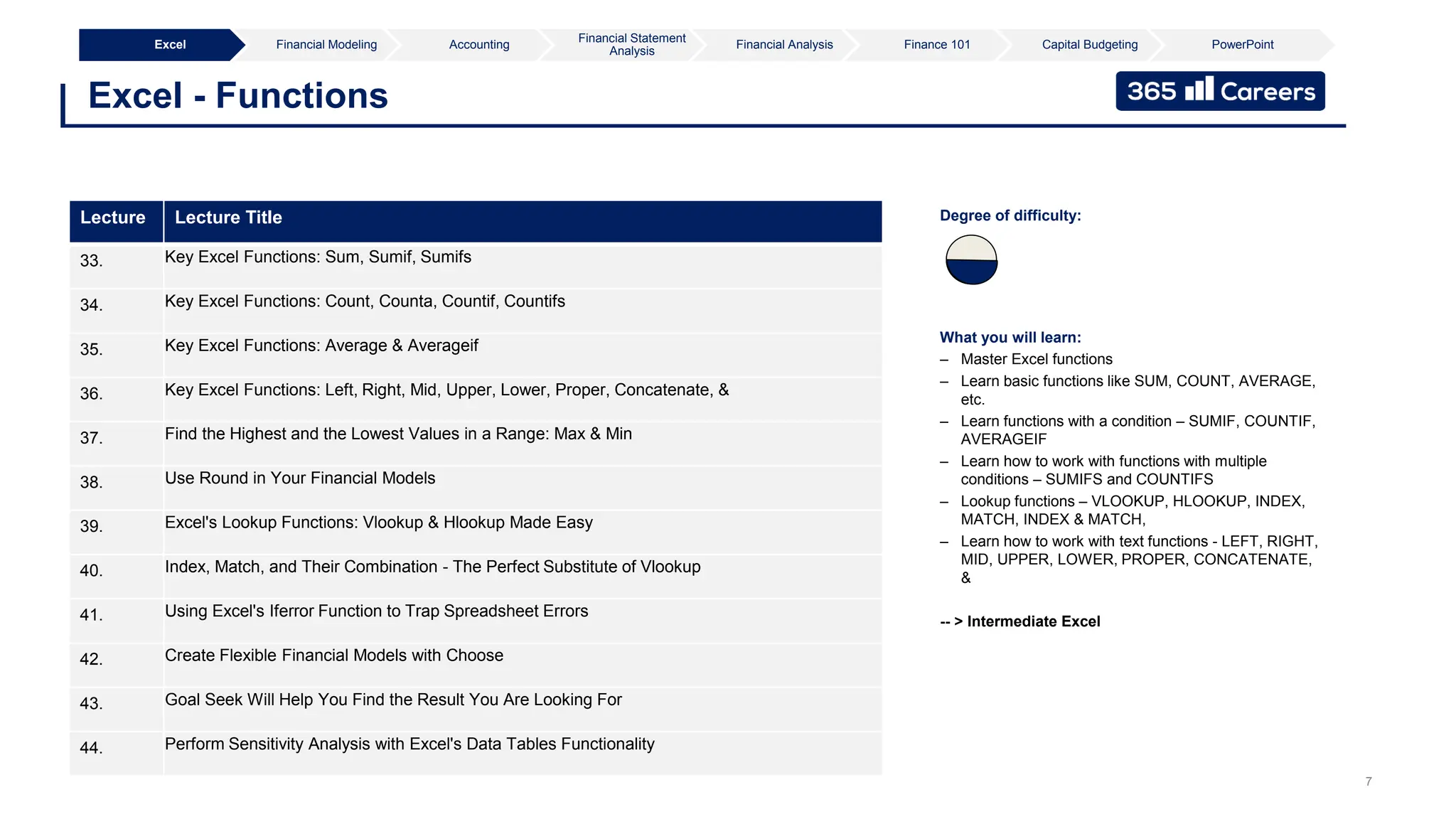

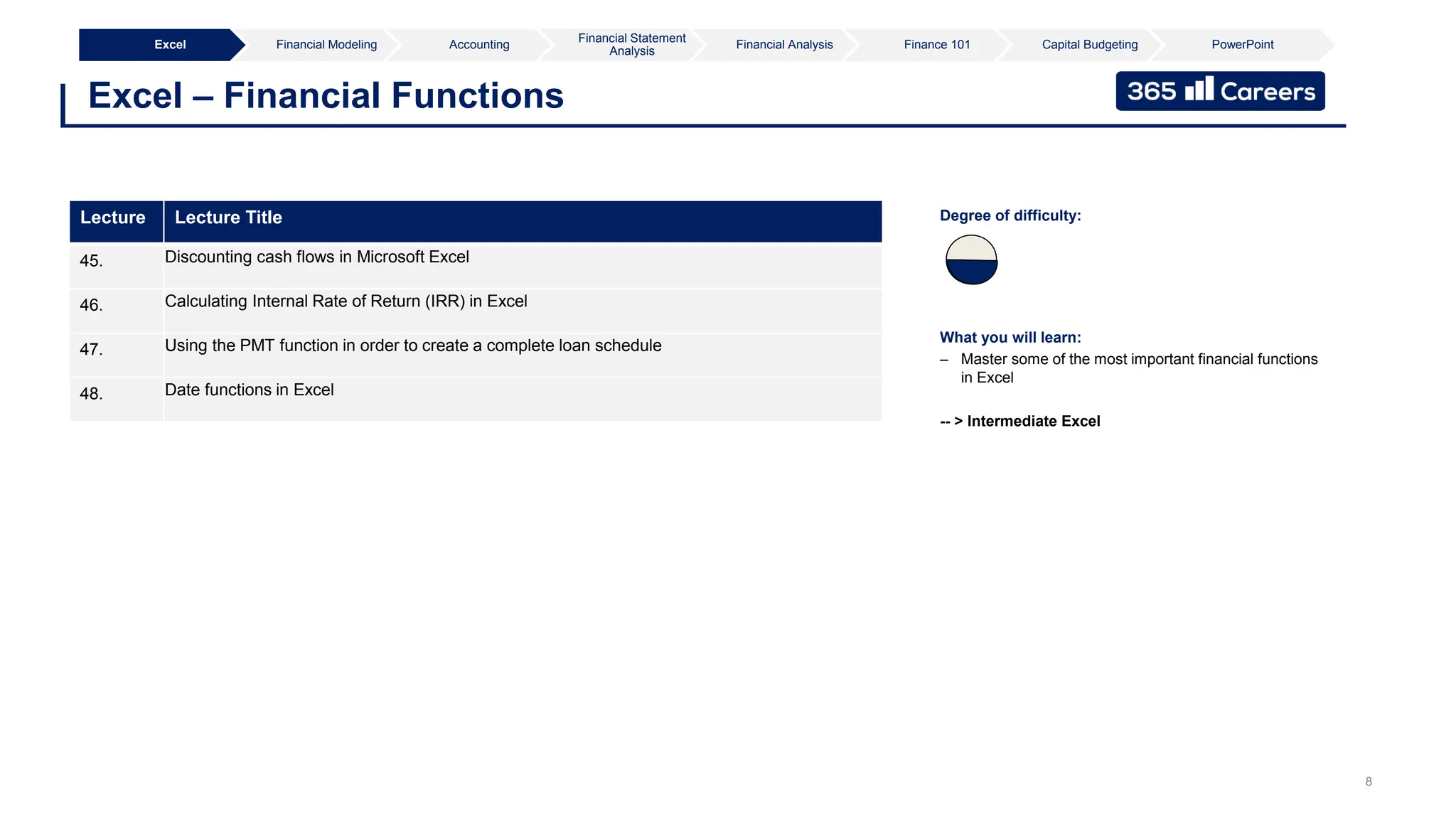

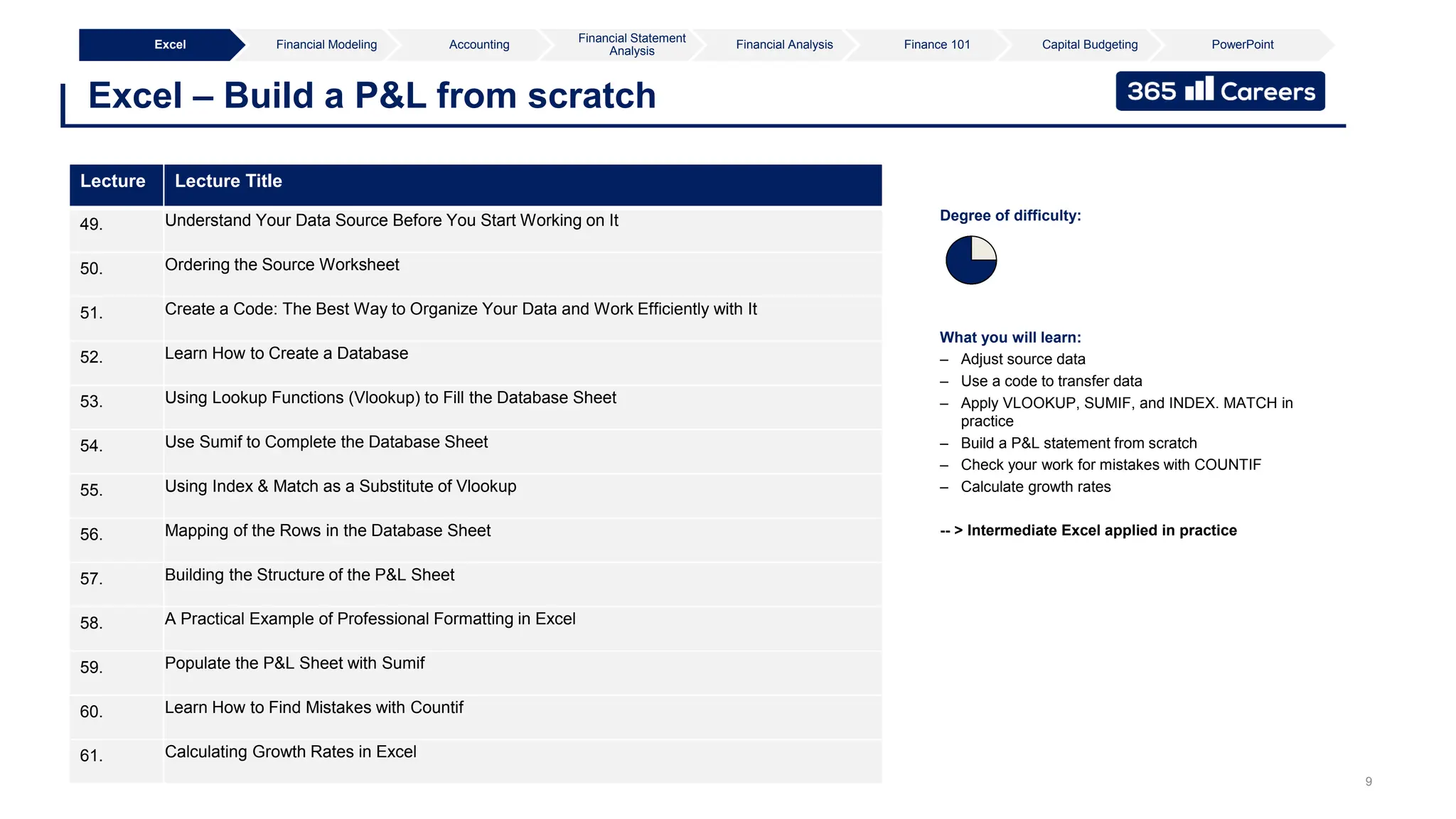

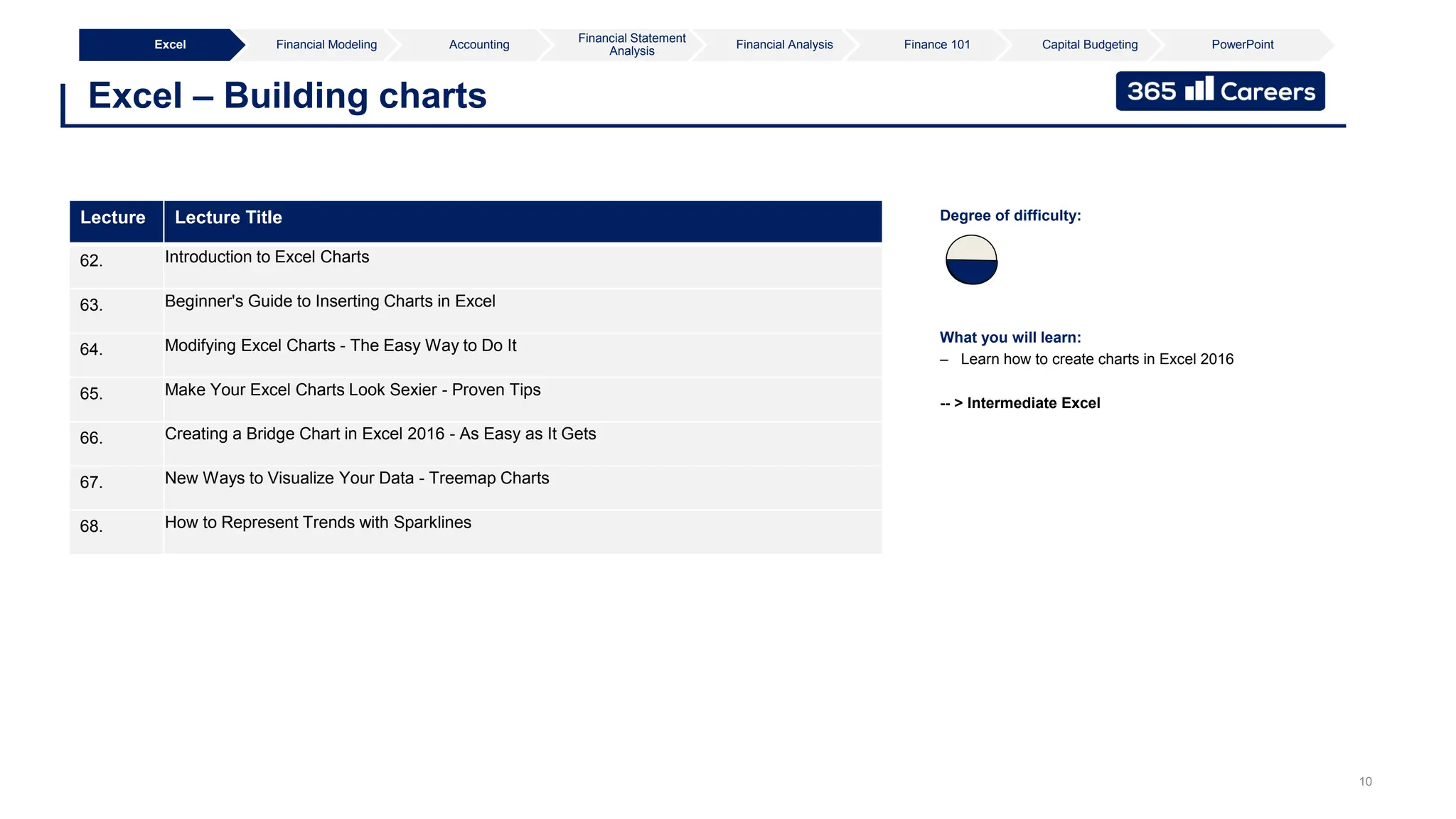

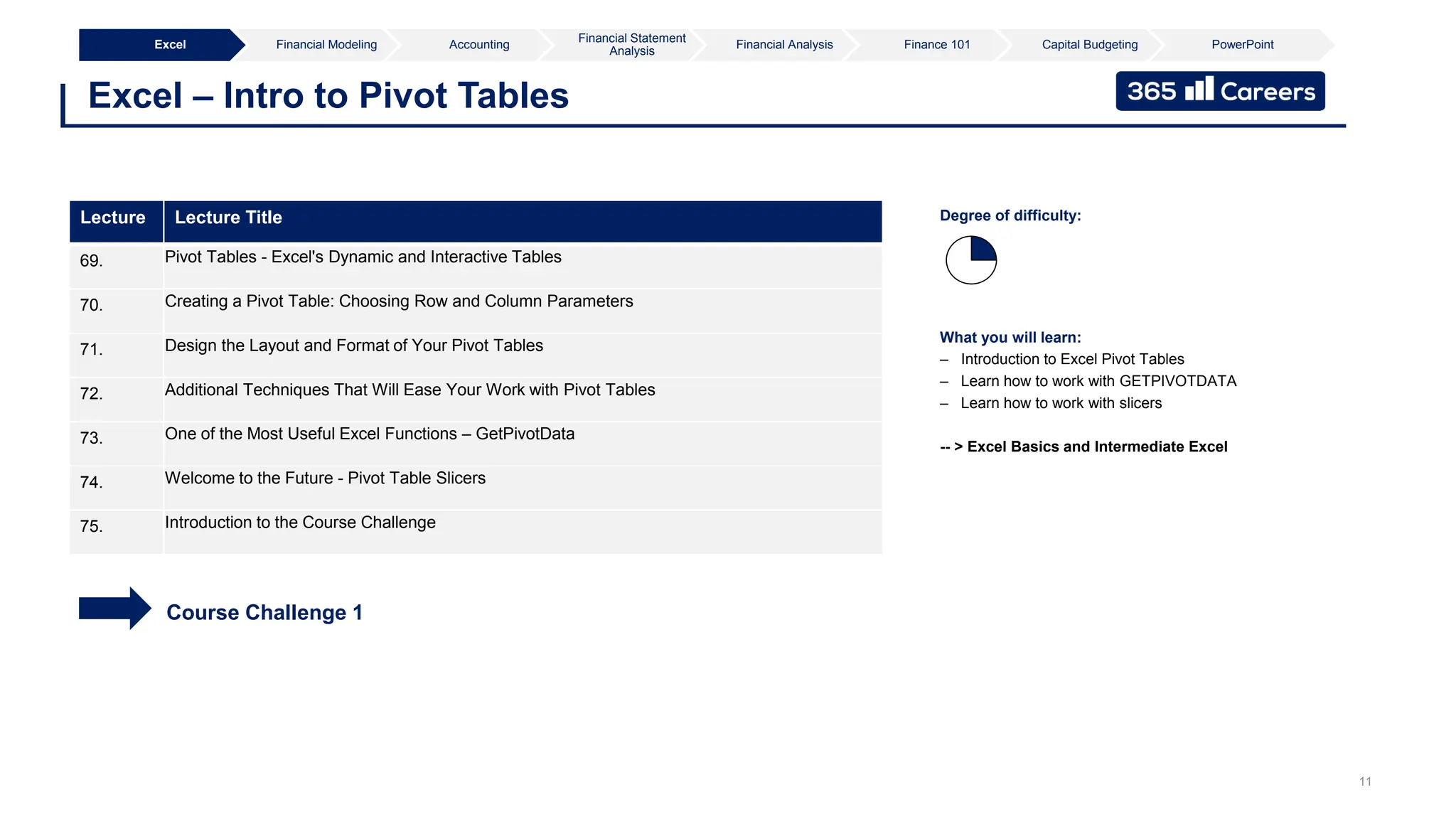

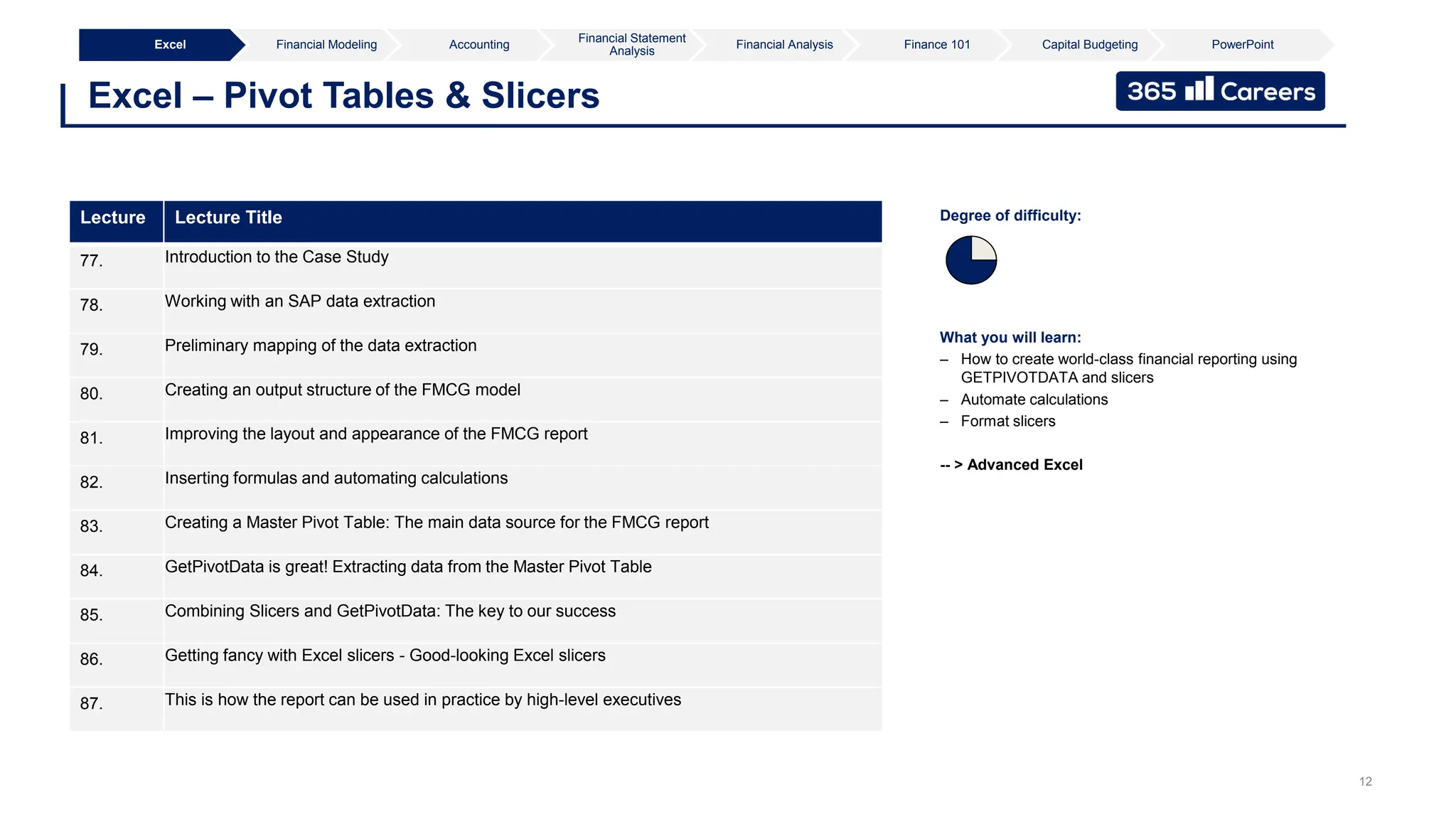

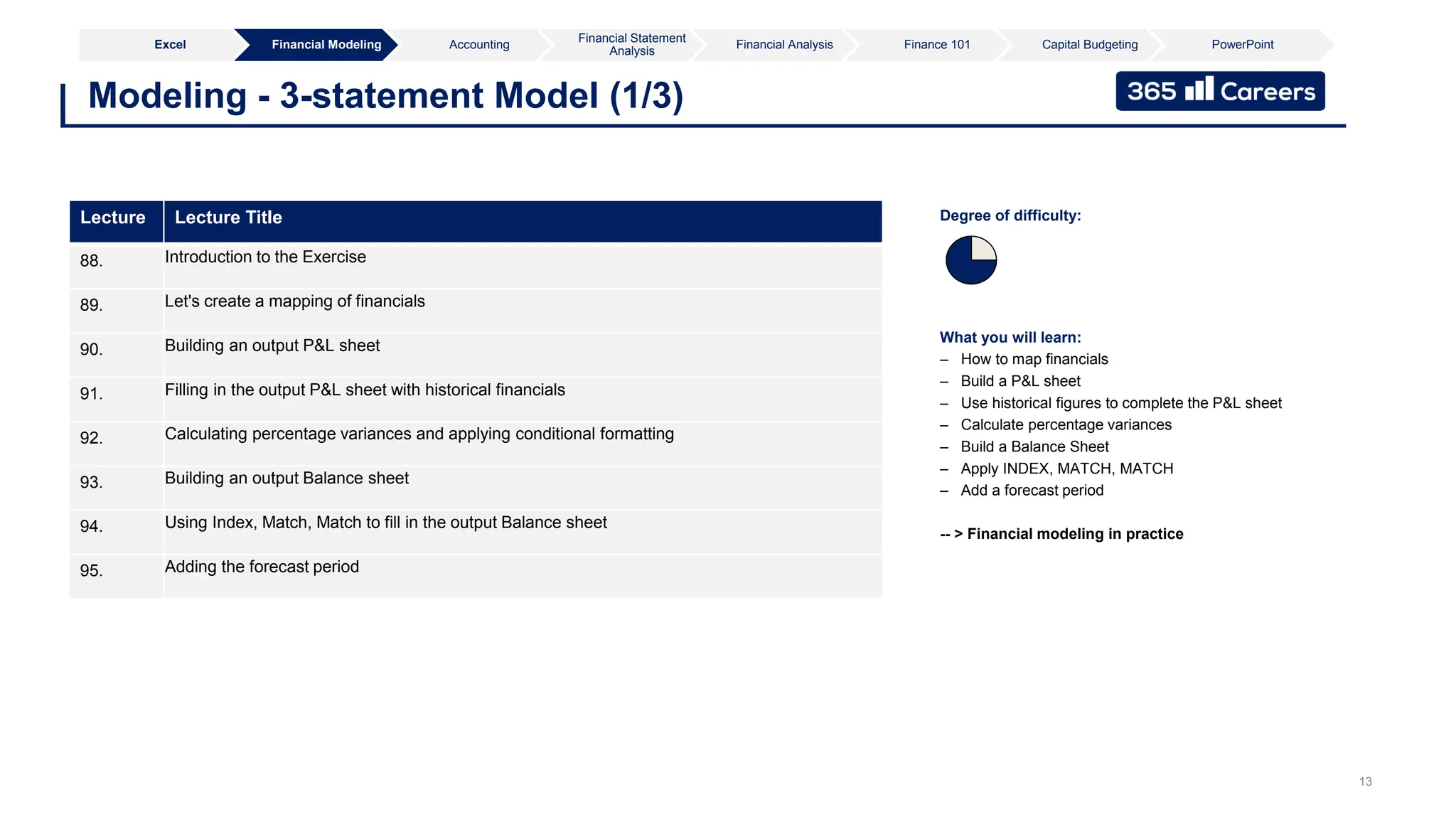

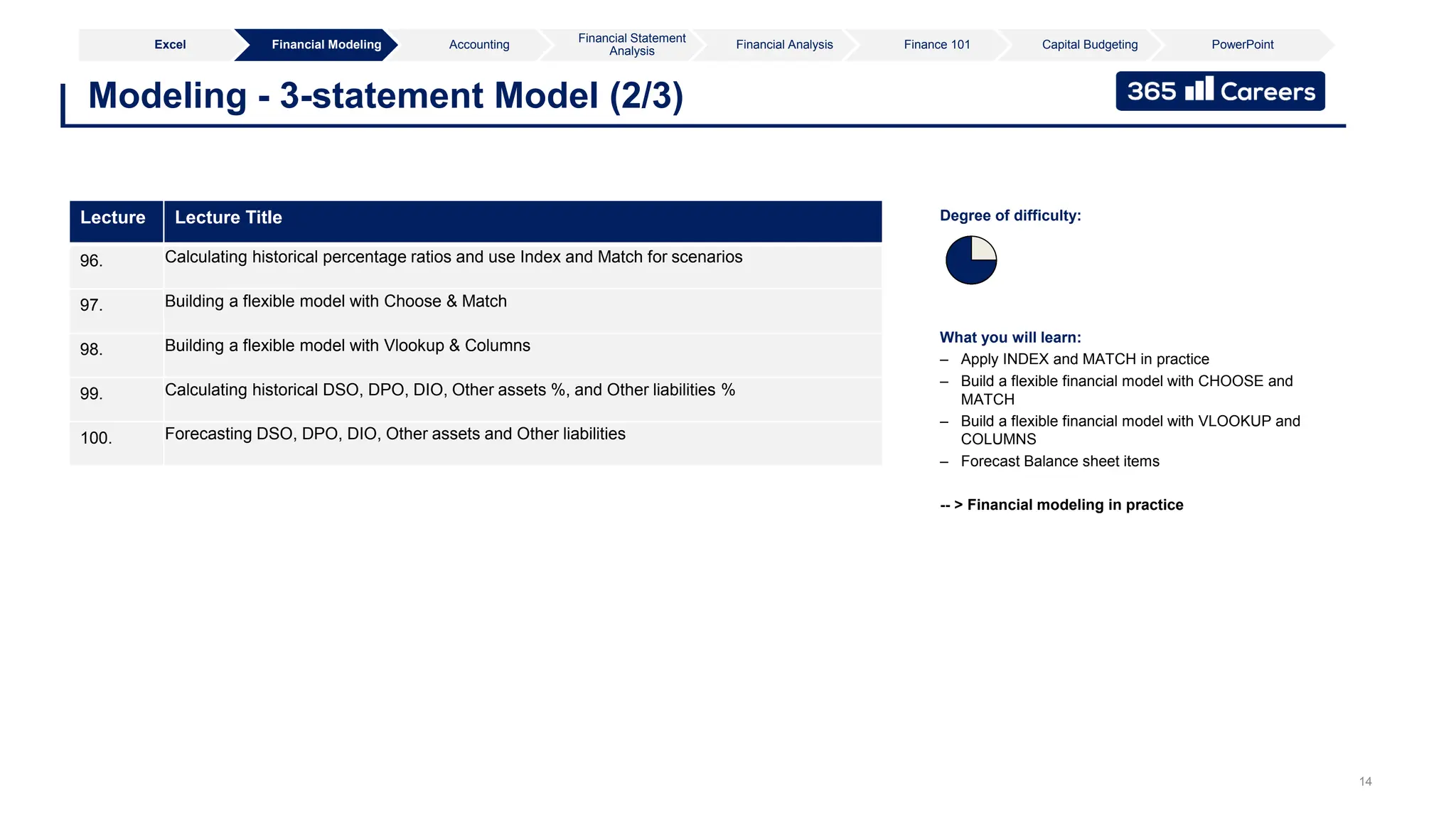

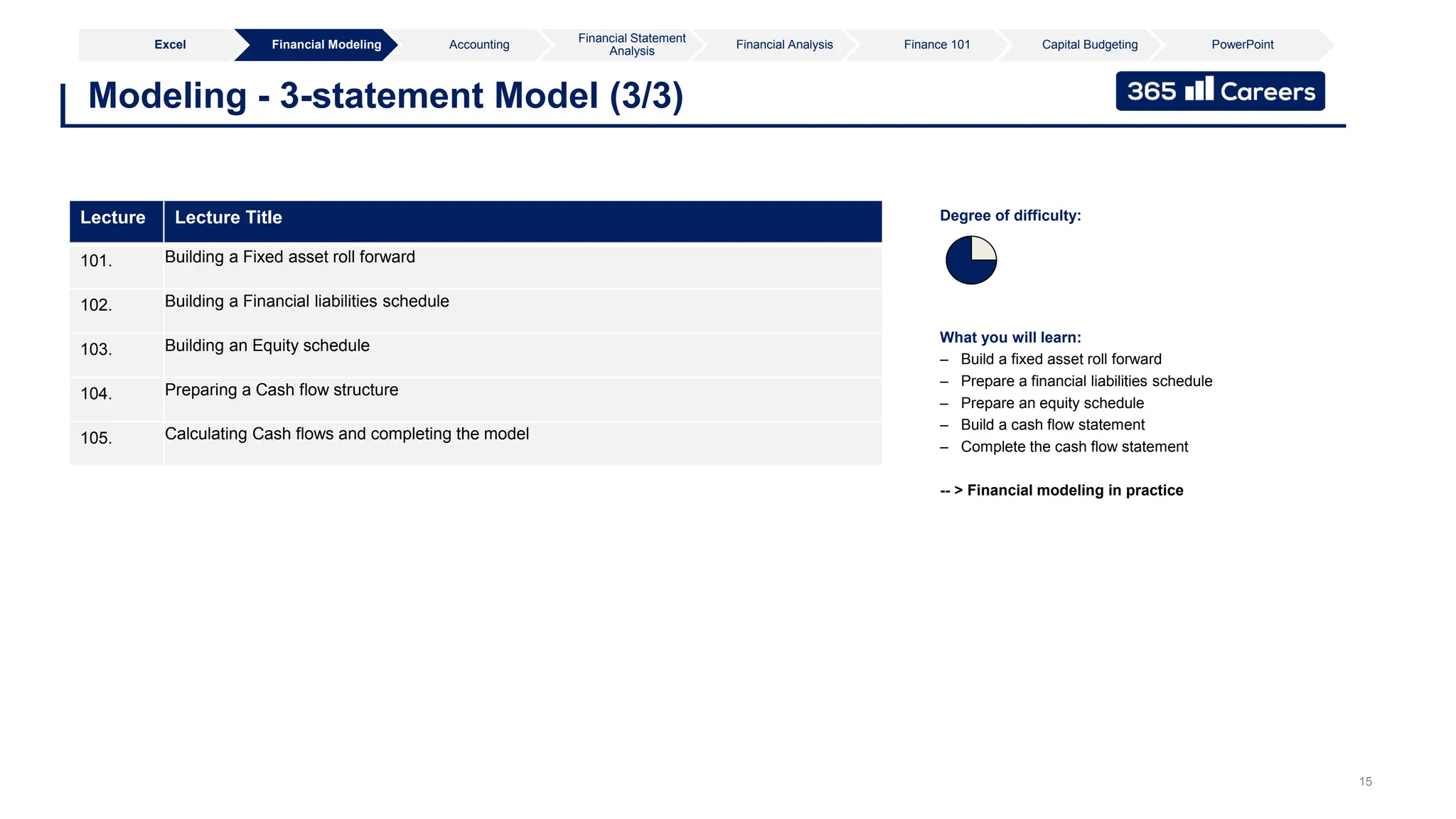

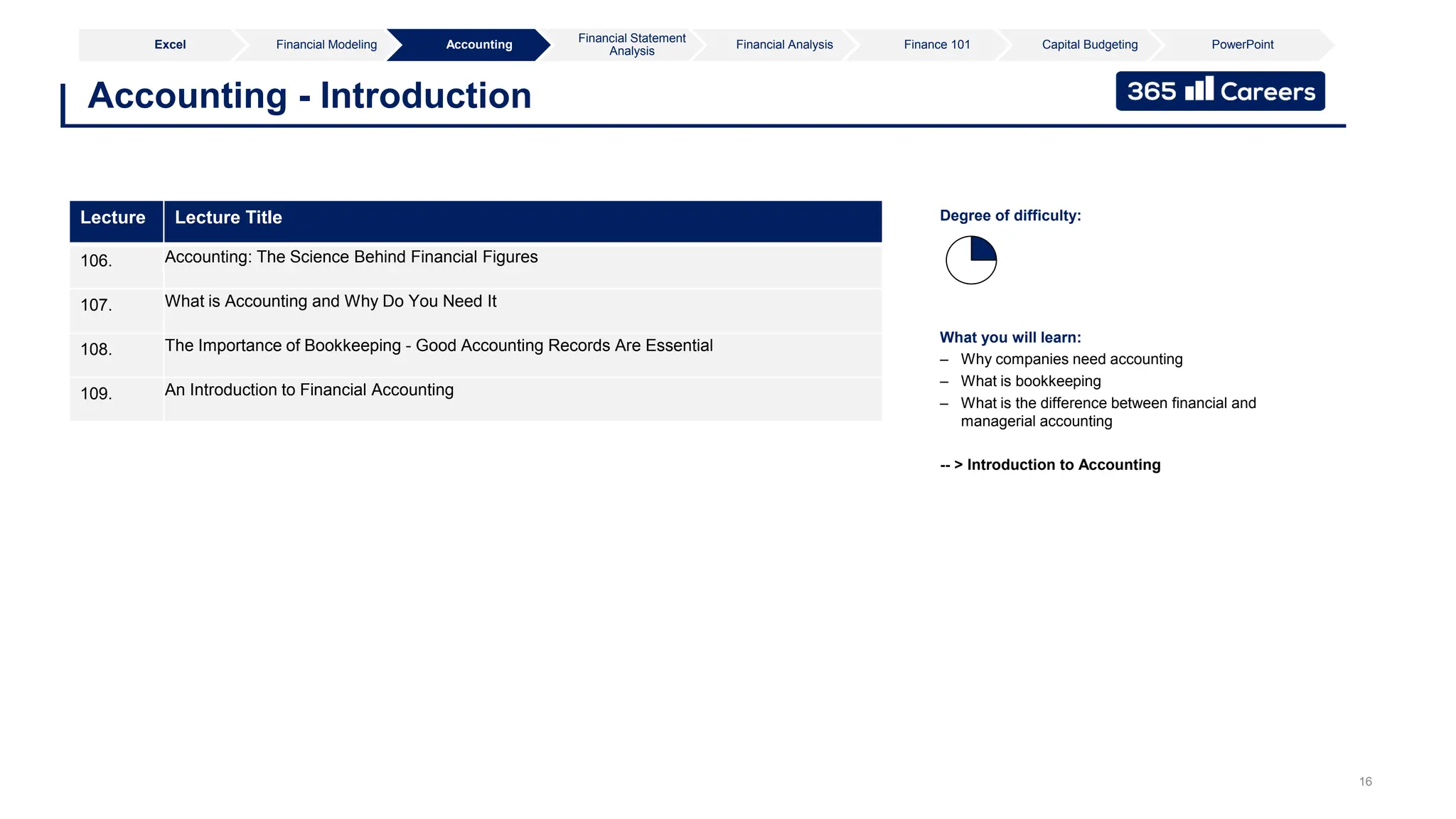

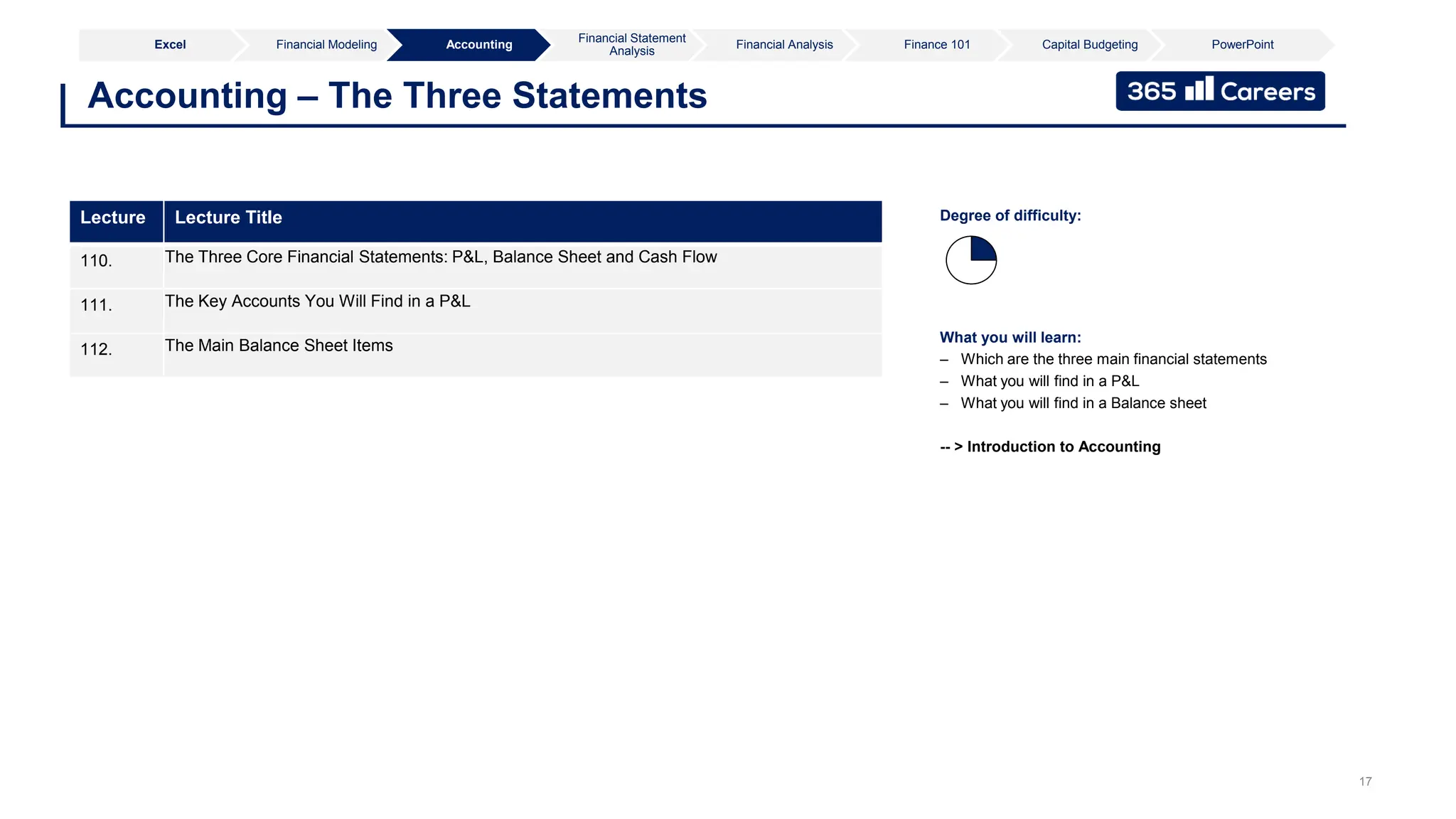

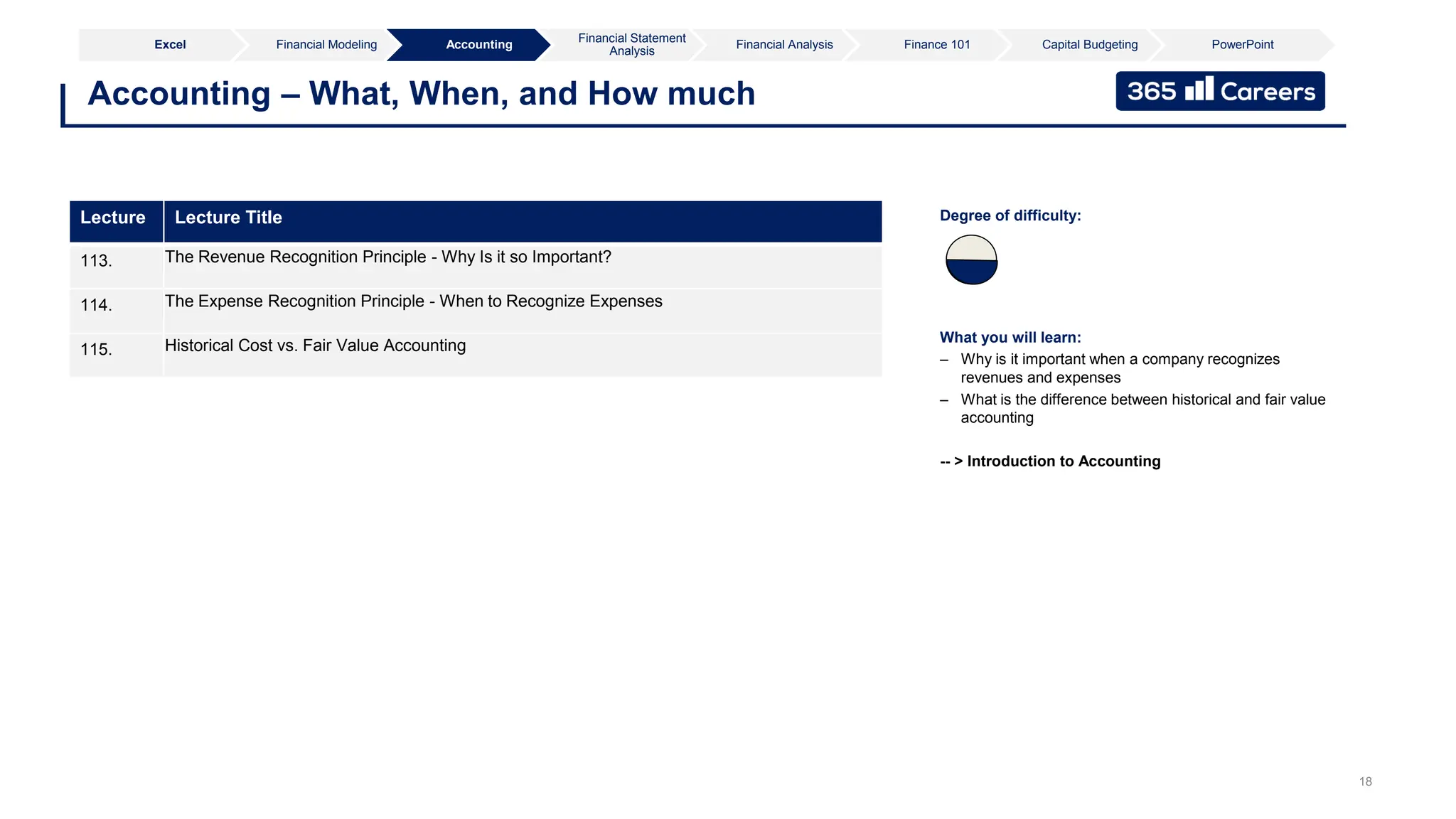

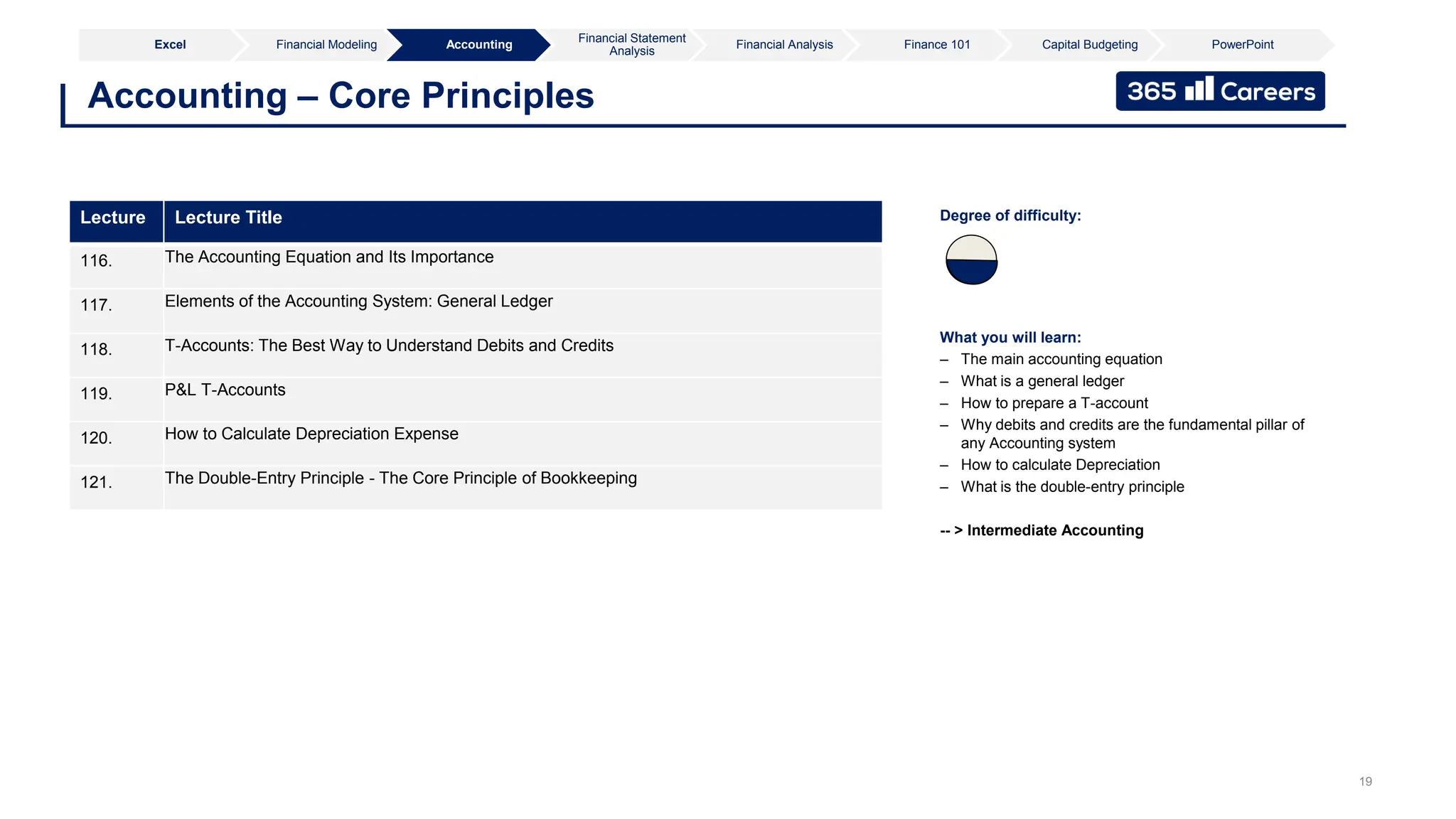

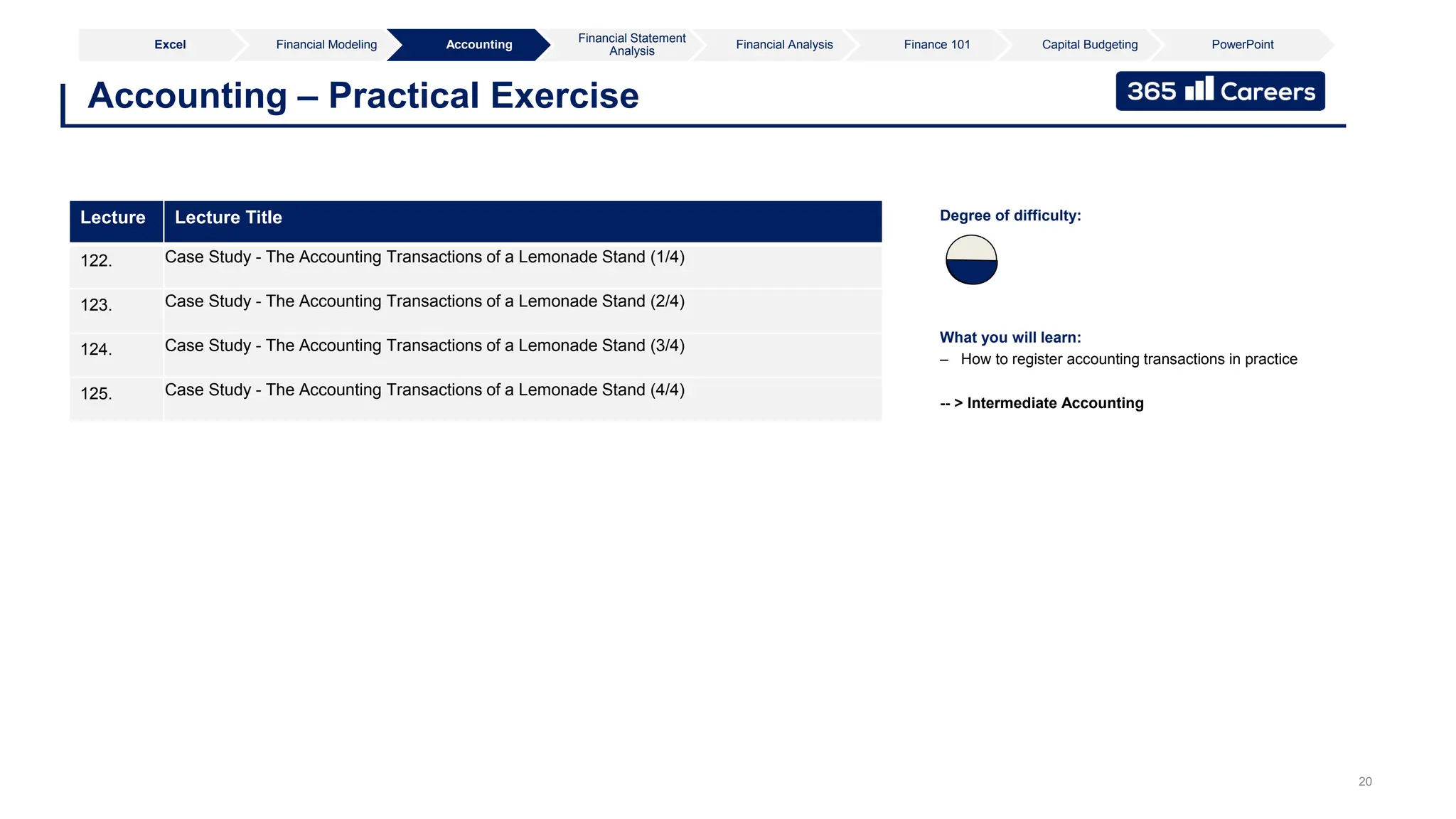

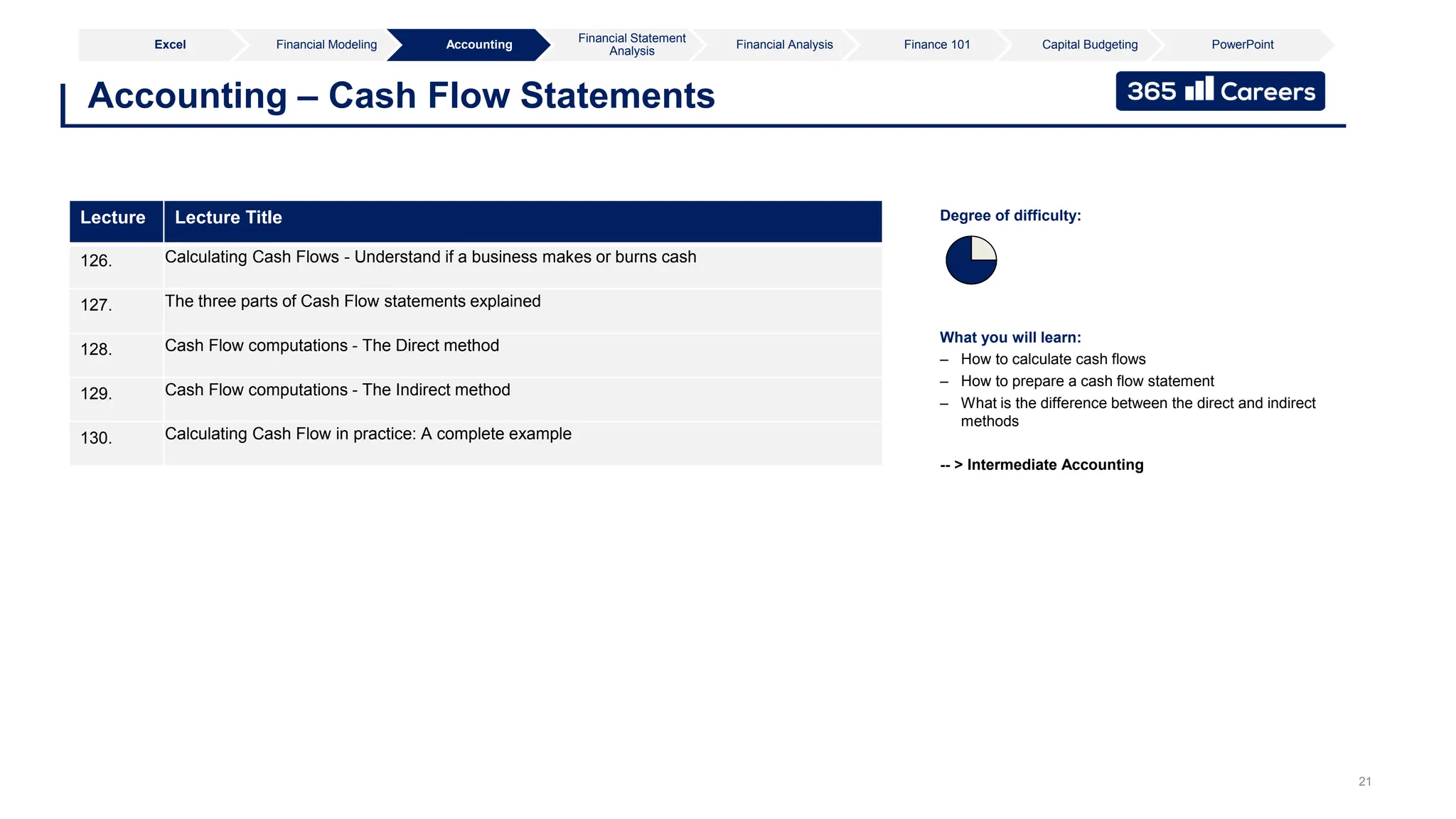

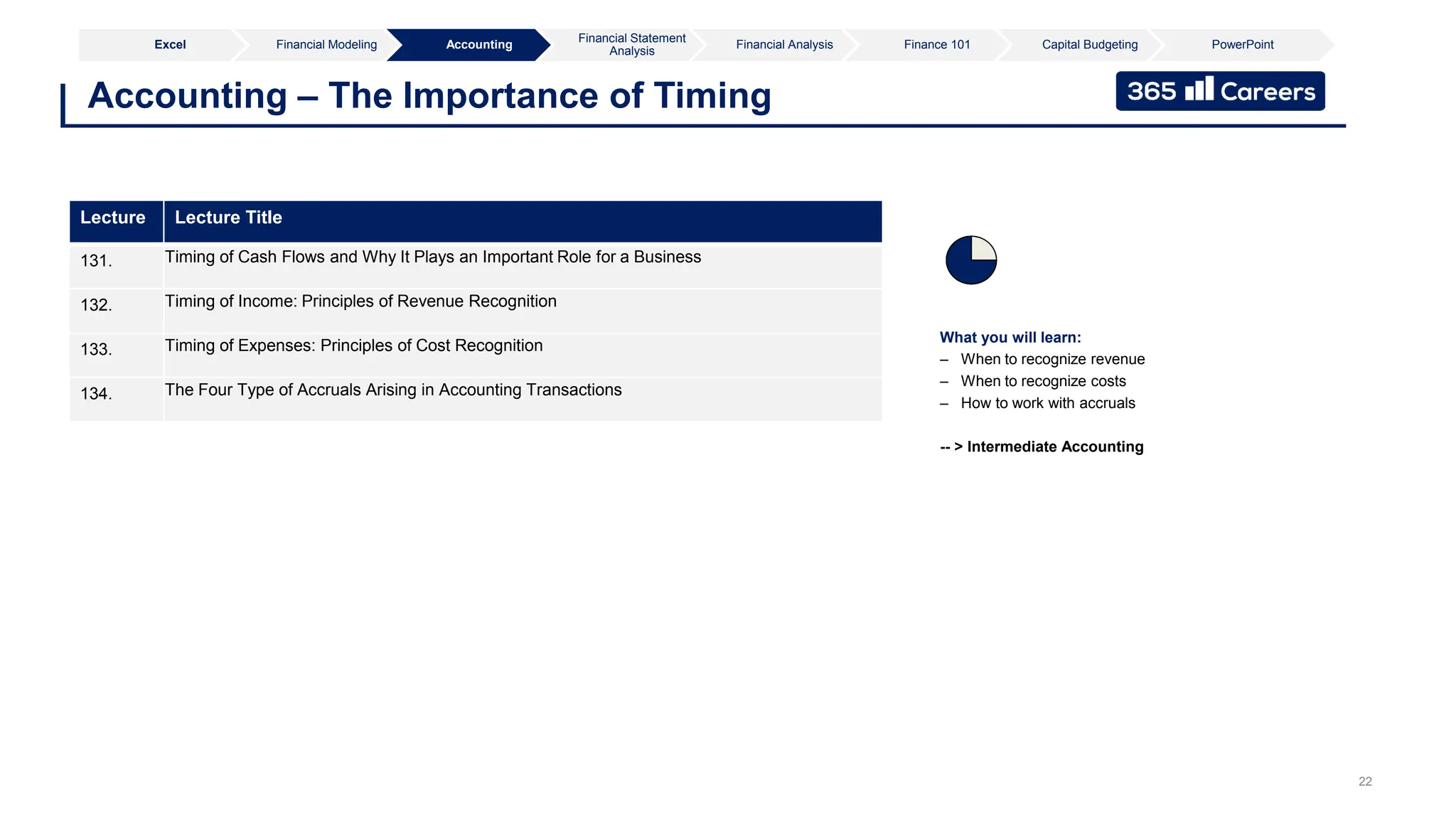

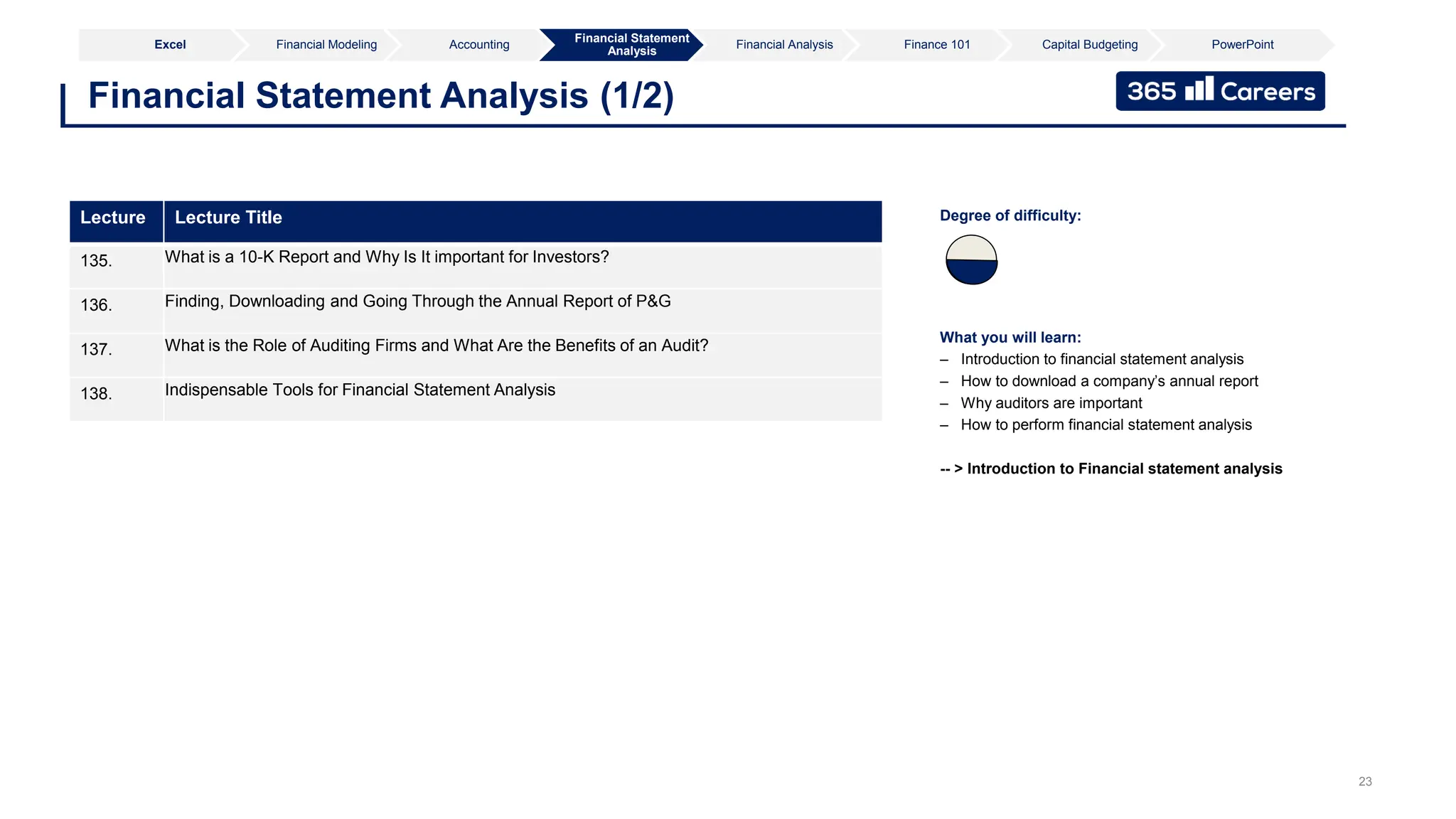

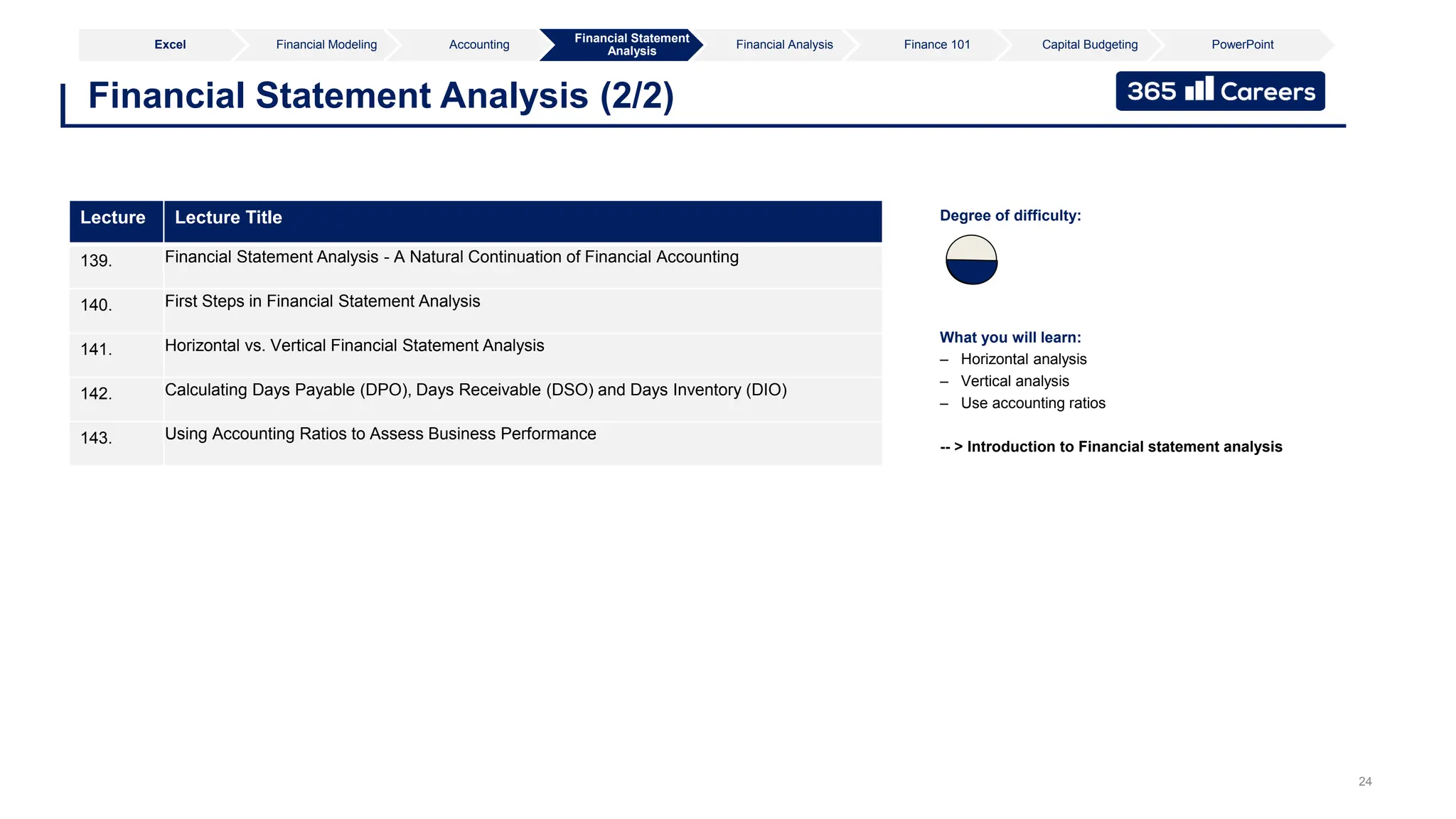

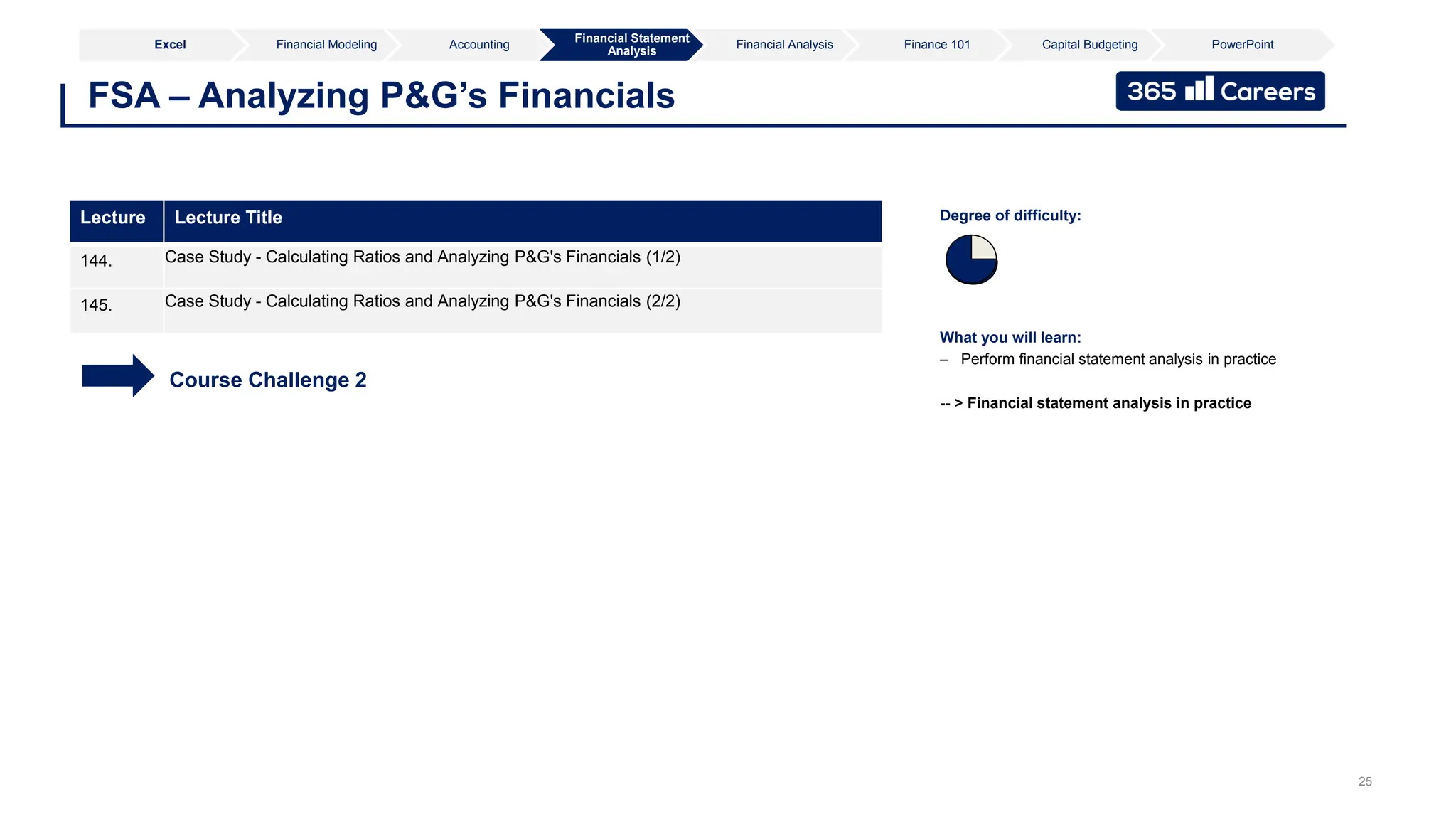

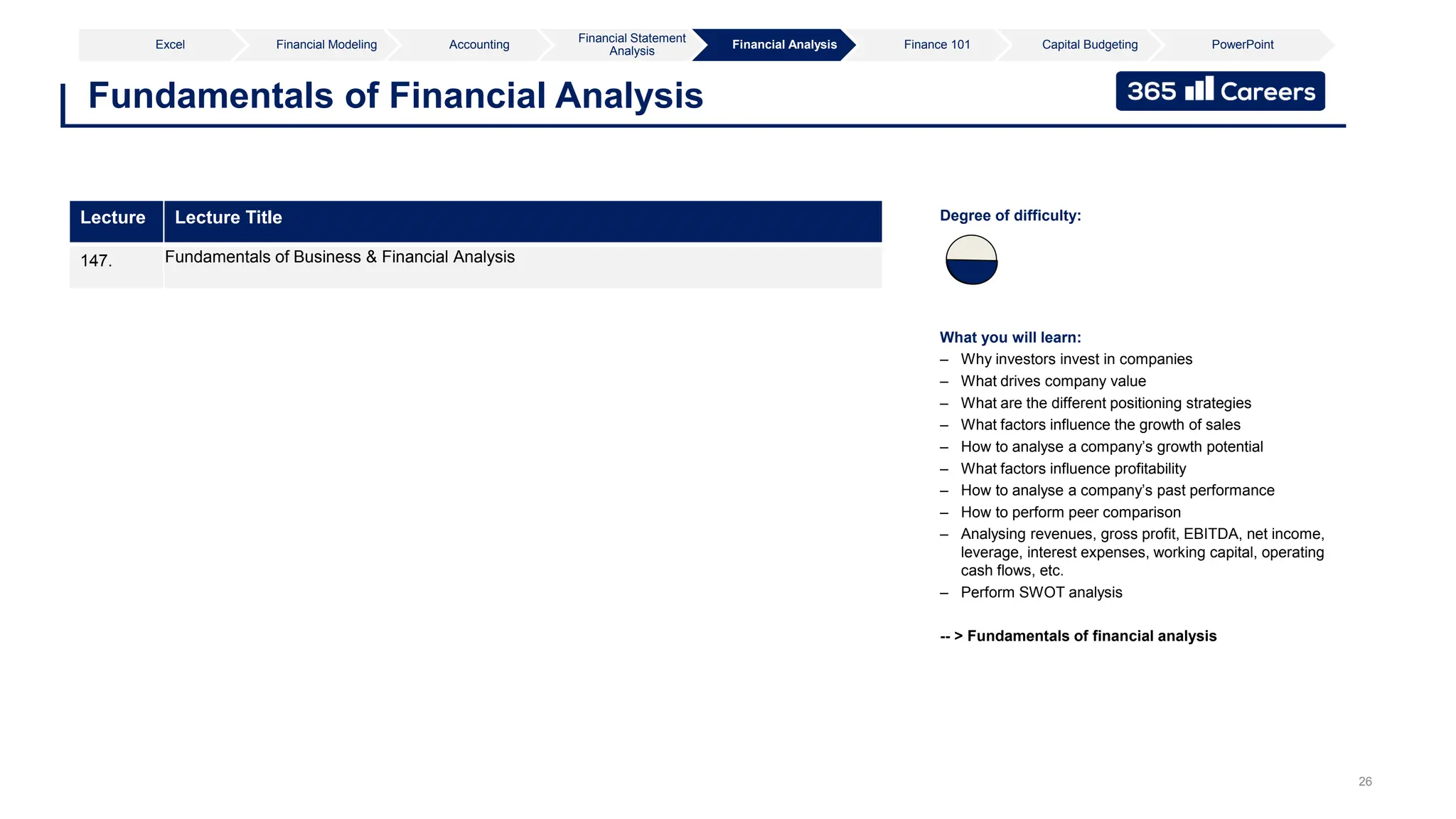

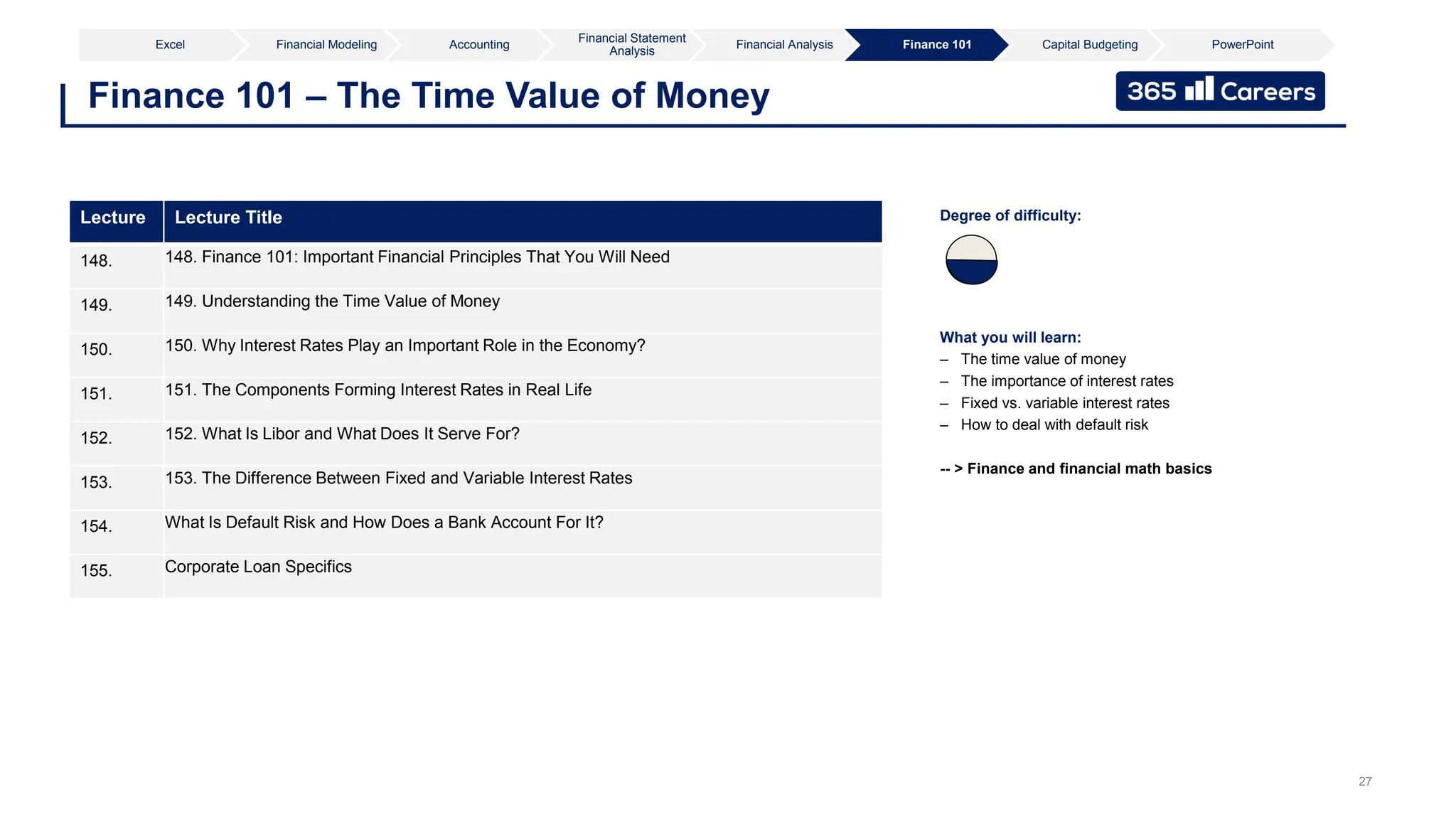

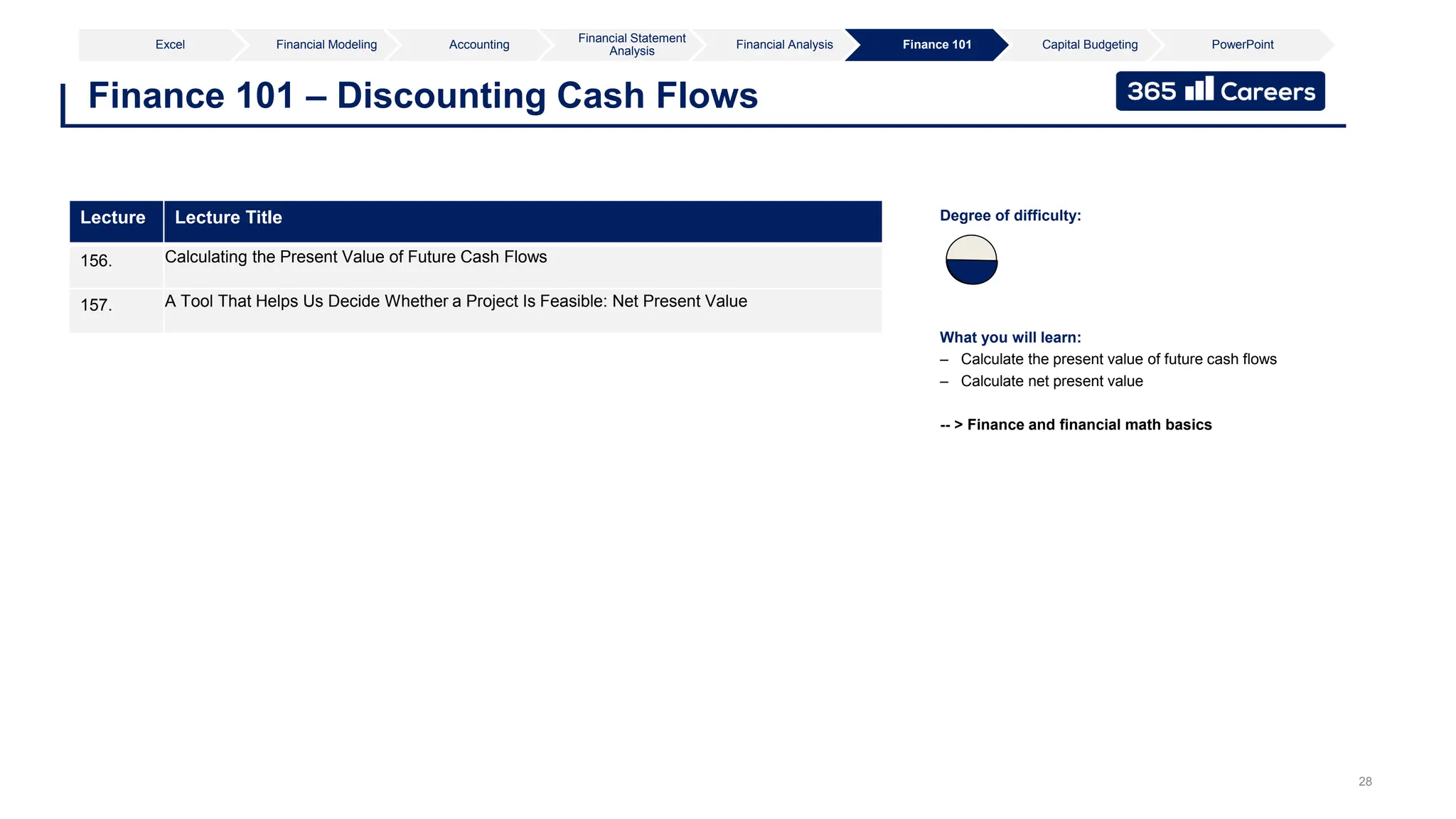

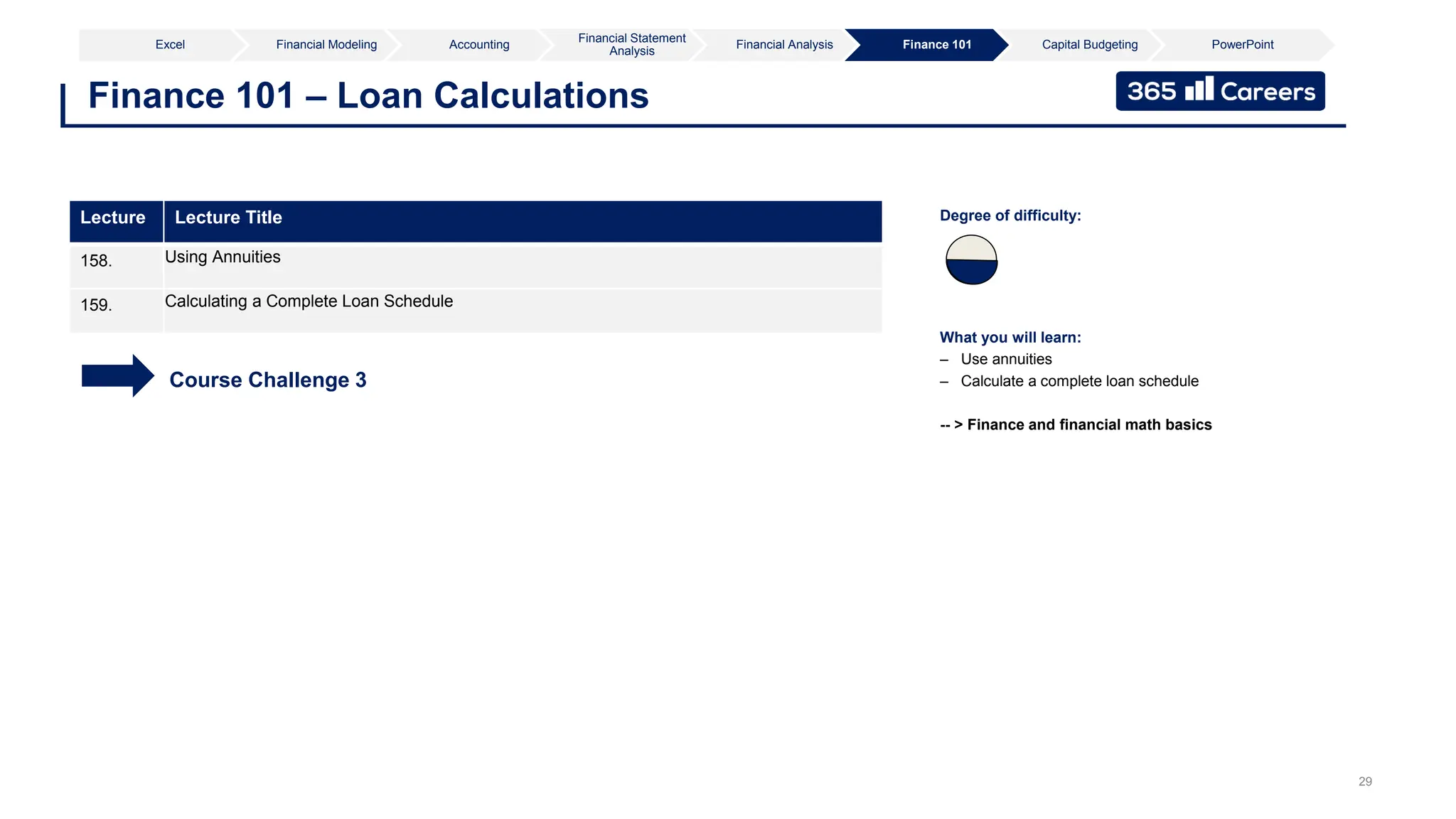

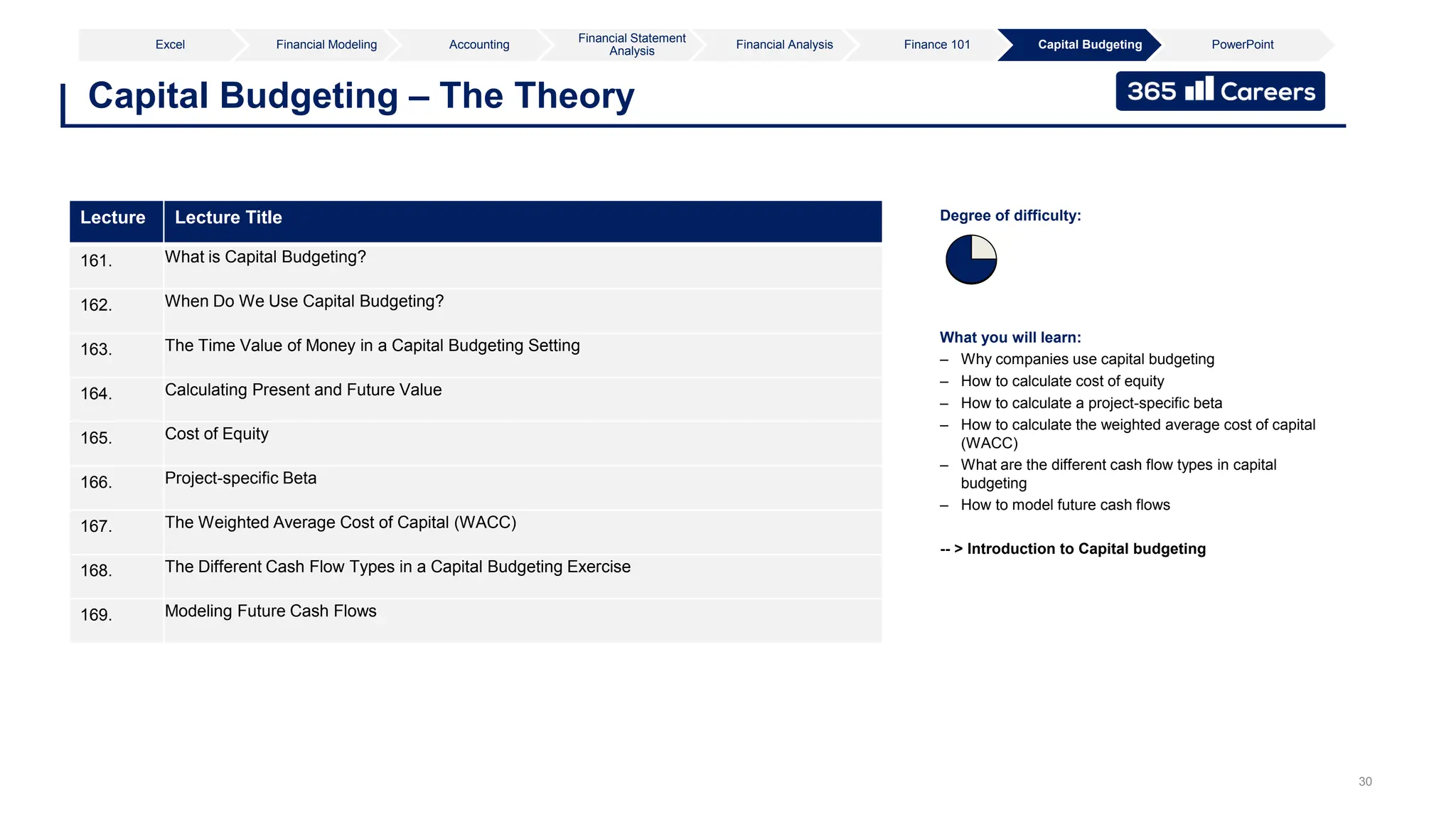

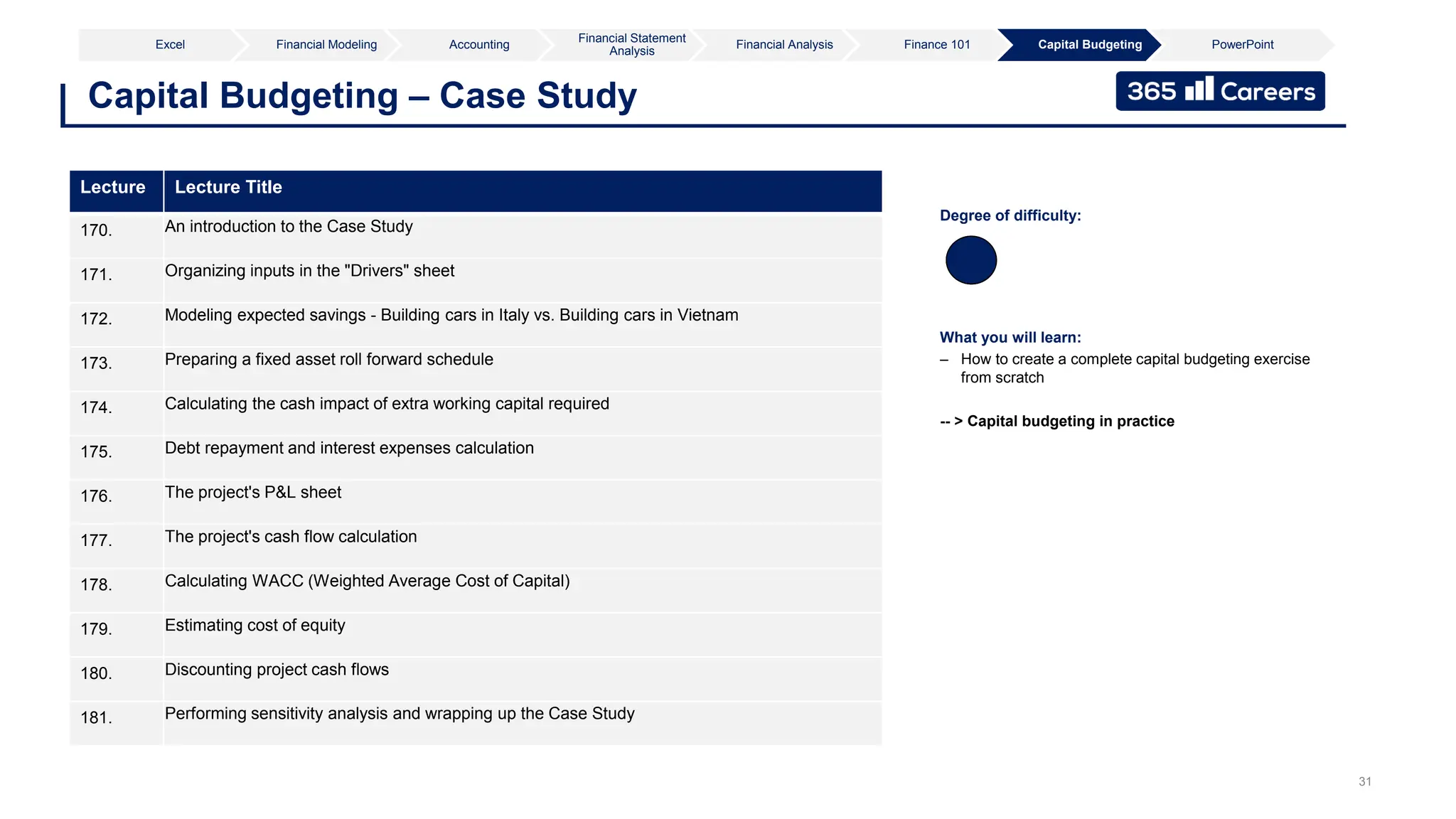

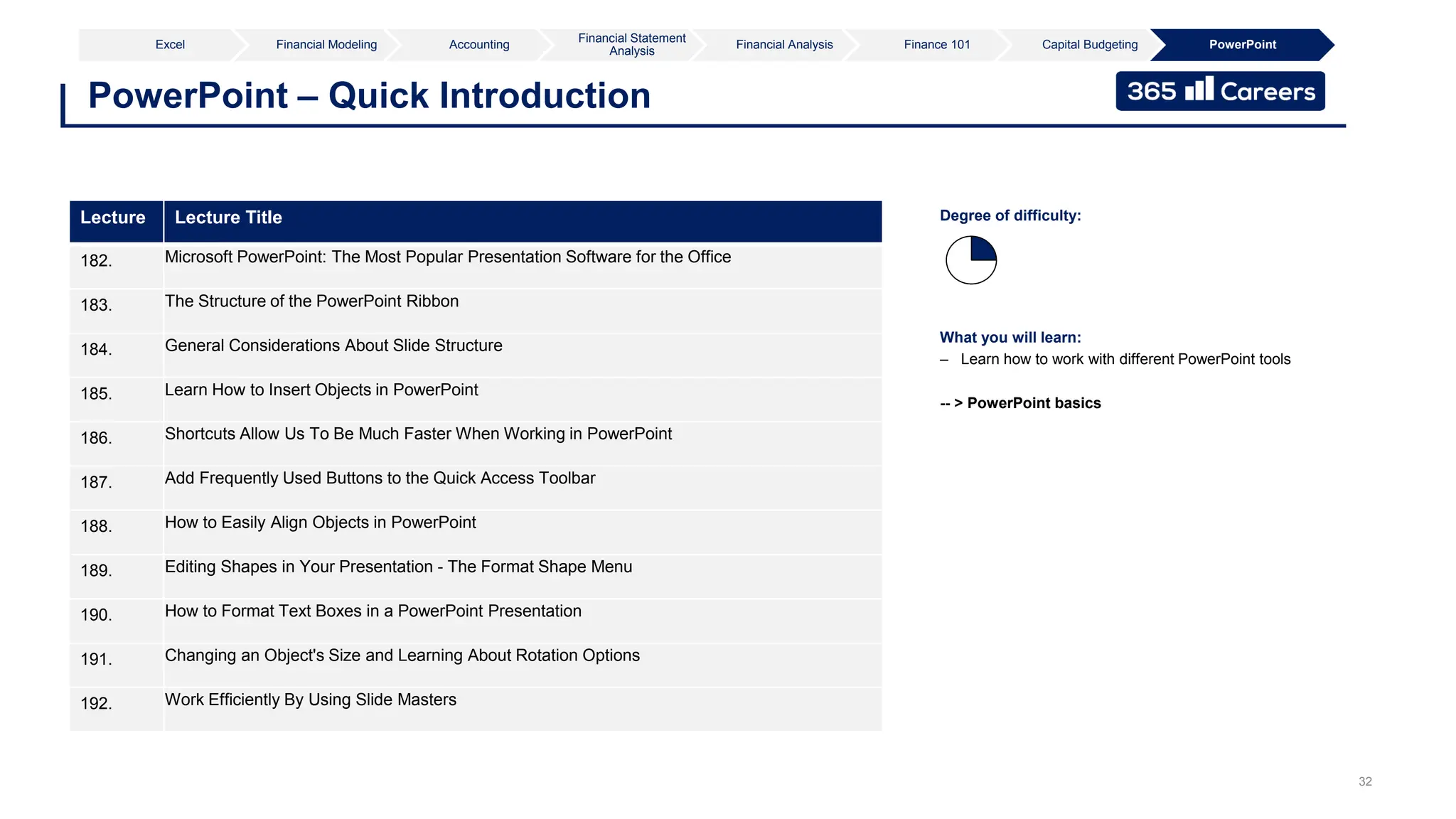

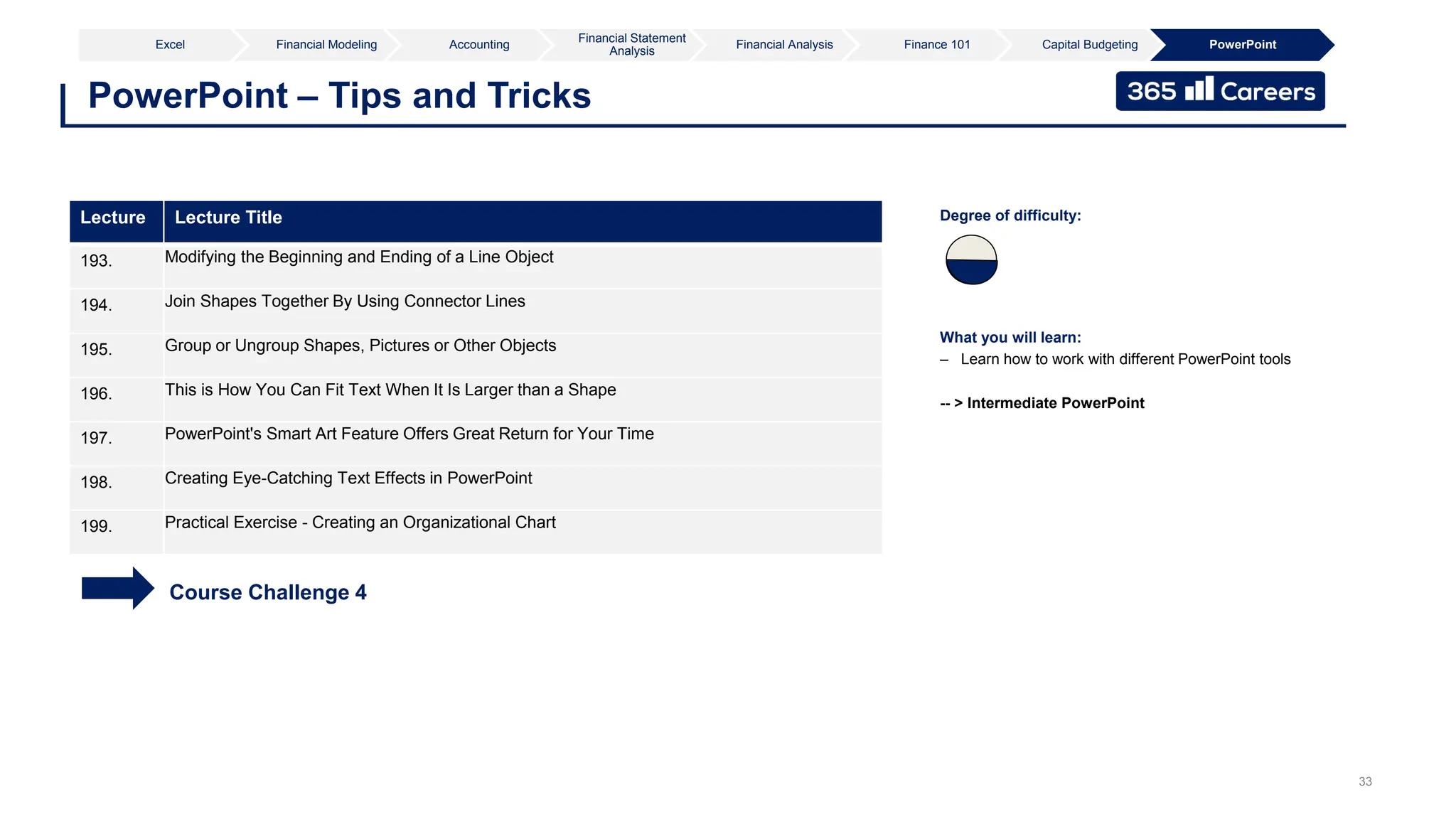

The document outlines a comprehensive financial analysis course curriculum focused on Excel skills, financial modeling, accounting principles, and financial statement analysis. It includes modules on loan calculations, capital budgeting, and the three financial statements, with detailed sections on Excel functions, modeling, and practical applications. Learners will gain proficiency in essential financial analysis tools and techniques, supported by practical exercises and case studies.