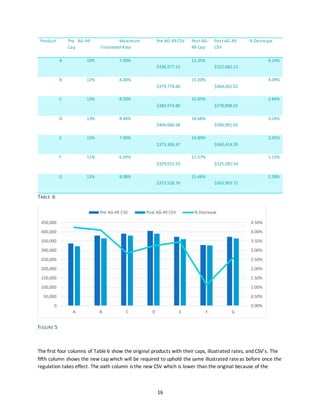

This document discusses the impact of a new regulation (AG-49) on illustrated universal life insurance products (IULs). AG-49 establishes a standardized methodology for calculating illustrated rates to increase comparability between products and manage consumer expectations. The objectives of the project are to understand, estimate, and predict how the regulation may influence IUL product design and performance. Various assumptions, tools, and analyses are used to illustrate sample cases and simulate economic scenarios to assess the cash values and returns of IULs under the new regulation.

![23

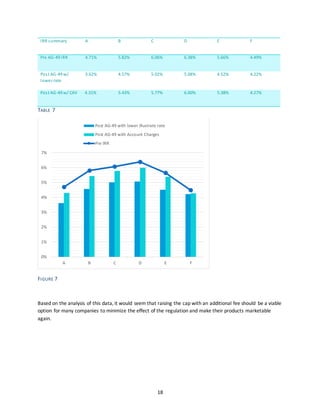

From perspectives of both insurance company and policyholder, a new chargeis unrecommendable.

Prediction

Based on all the analyses above, we suggest that companies may redesign the products with some new costs

rather than simply adjust parameters.

Probable tactics may include: increase monthly cost, increase premium load, and adjust the cost of

insurance while keeping a high cap rate

Not suggestive tactics: increase participation rate alone, increase cap rateand chargemore

Project Milestones

Statement of Intent

Project Charter

Excel Calculator for:

o Historical Illustrate Rate

o Cap RateConverter

o Economic Simulation Generator

Analysis on:

o Illustration Perspective

o Economic Simulation Perspective

Summary and Prediction

References

Actuarial Guideline [YY] The application of the life illustrations model regulation to polices with index-based

interest, adopted by the Life Actuarial (A) Task Force, 4/16/2015

Wink’s Sales & Market Report 1st Quarter, 2015

Summary of Indexed UL Illustrations Model Regulation (Actuarial Guideline YY), Lion Street, 2015](https://image.slidesharecdn.com/b5b77bef-e7cd-4d3a-bab7-434fec1d0241-151002034942-lva1-app6892/85/final-written-presentation-23-320.jpg)