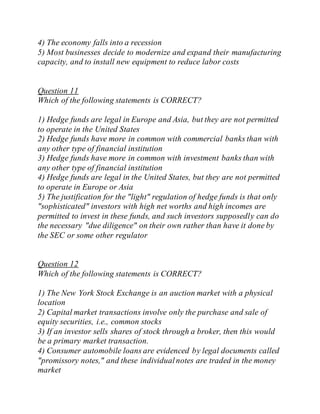

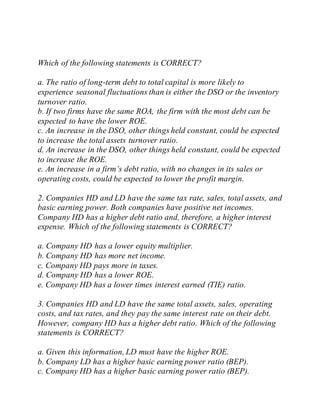

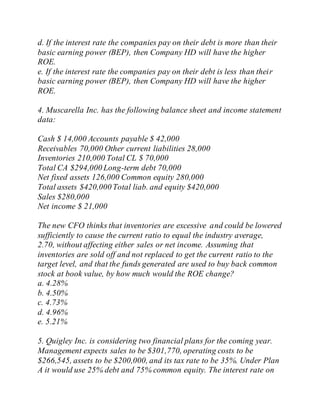

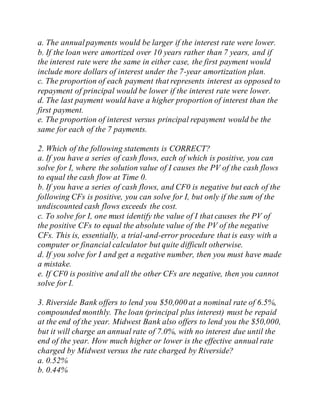

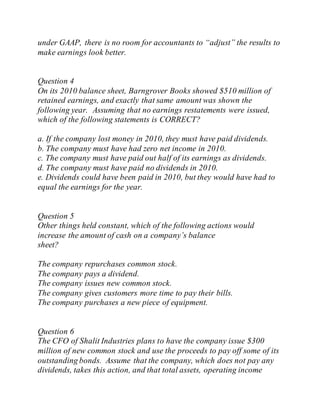

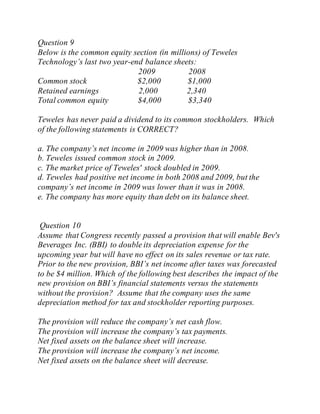

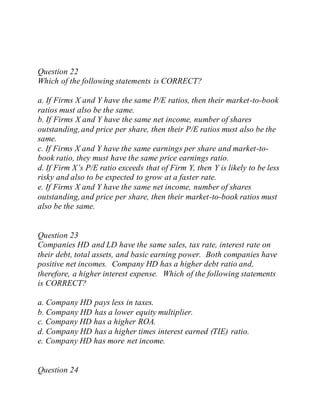

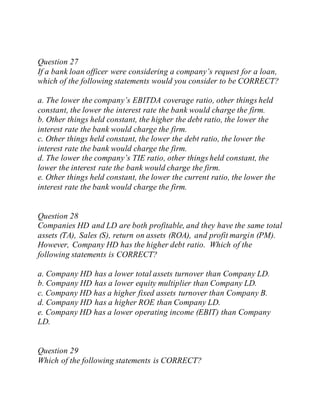

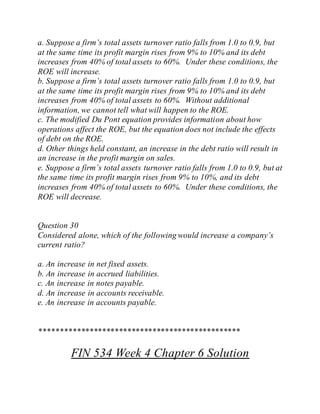

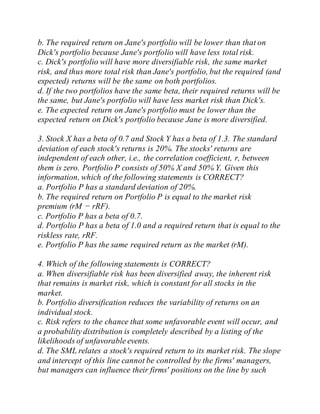

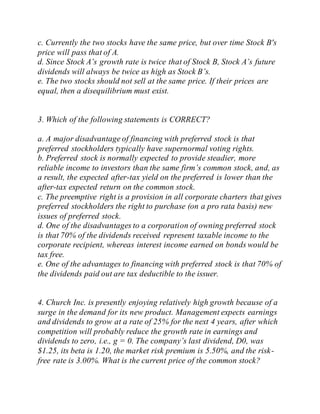

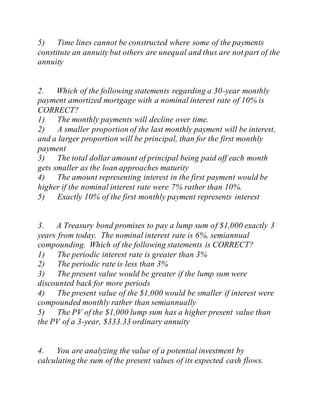

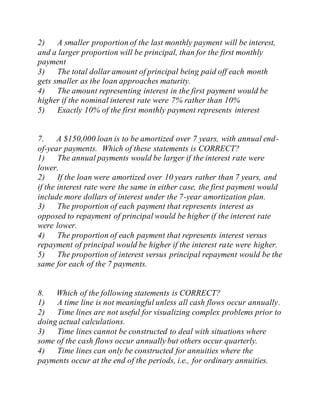

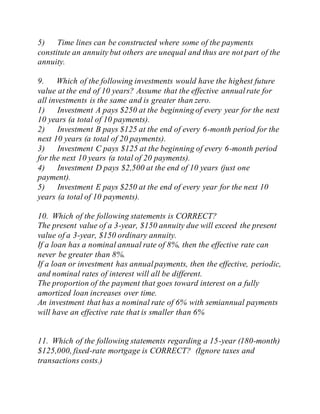

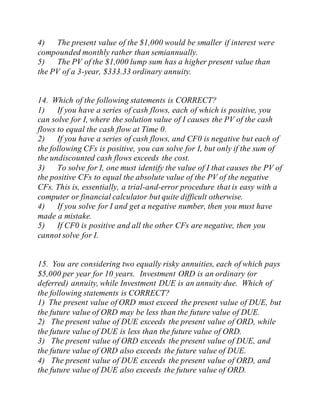

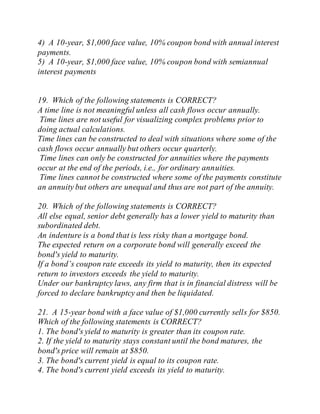

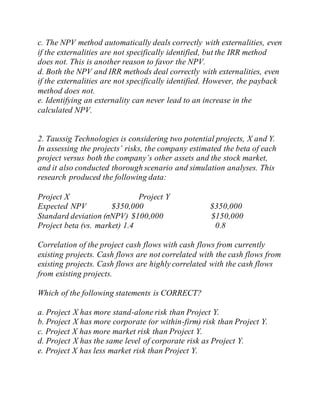

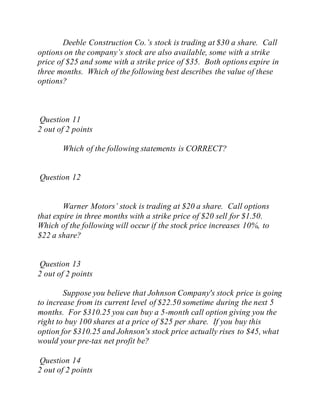

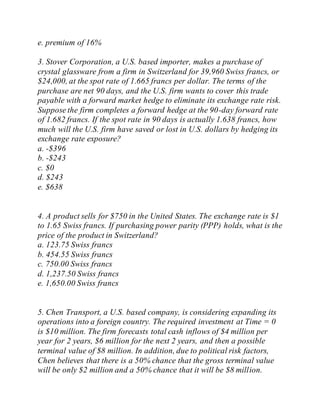

The document provides a comprehensive collection of solutions, quizzes, and discussion questions related to the FIN 534 course, covering various financial theories and concepts. It includes a series of exam questions that test understanding of financial decision-making, capital budgeting, dividends, and options pricing. Additionally, there are examples illustrating scenarios and calculations regarding cost of capital and project evaluations.