Fin 401 Teaching Effectively--tutorialrank.com

•

0 likes•13 views

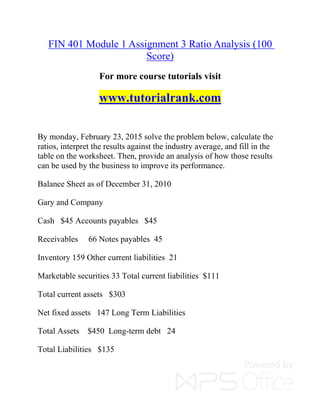

For more course tutorials visit www.tutorialrank.com By monday, February 23, 2015 solve the problem below, calculate the ratios, interpret the results against the industry average, and fill in the table on the worksheet. Then, provide an analysis of how those results can be used by the business to improve its performance. Balance Sheet as of December 31, 2010 Gary and Company

Report

Share

Report

Share

Download to read offline

Recommended

Fin 401 Exceptional Education / snaptutorial.com

For more classes visit

www.snaptutorial.com

By monday, February 23, 2015 solve the problem below, calculate the ratios, interpret the results against the industry average, and fill in the table on the worksheet. Then, provide an analysis of how those results can be used by the business to improve its performance.

Fin 401 Effective Communication / snaptutorial.com

This document contains information about several financial analysis assignments and case studies for a course. It includes details about calculating and interpreting financial ratios for a company, analyzing cash flow management strategies, applying time value of money concepts, calculating a weighted average cost of capital, and evaluating capital budgeting projects. The key information provided includes financial statements, industry averages, calculations, and questions to analyze for each case.

Fin 401 Enhance teaching-snaptutorial.com

For more classes visit

www.snaptutorial.com

By monday, February 23, 2015 solve the problem below, calculate the ratios, interpret the results against the industry average, and fill in the table on the worksheet. Then, provide an analysis of how those results can be used by the business to improve its performance.

Balance Sheet as of December 31, 2010

Gary and Company

Cash $45 Accounts payables $45

FIN 401 Education Organization - snaptutorial.com

For more classes visit

www.snaptutorial.com

By monday, February 23, 2015 solve the problem below, calculate the ratios, interpret the results against the industry average, and fill in the table on the worksheet. Then, provide an analysis of how those results can be used by the business to improve its performance.

Fin 401 Inspiring Innovation--tutorialrank.com

For more course tutorials visit

www.tutorialrank.com

By monday, February 23, 2015 solve the problem below, calculate the ratios, interpret the results against the industry average, and fill in the table on the worksheet. Then, provide an analysis of how those results can be used by the business to improve its performance.

Balance Sheet as of December 31, 2010

Gary and Company

FIN 401 Technology levels--snaptutorial.com

This document contains information for several assignments related to corporate finance. It includes financial statements, calculations, and analysis for ratio analysis, cash management, time value of money, weighted average cost of capital, capital budgeting, and risk adjustment. The assistant is asked to evaluate projects, calculate and interpret various financial ratios and metrics, and provide recommendations for improving business performance and investment decisions.

Fin 401 Enthusiastic Study / snaptutorial.com

By monday, February 23, 2015 solve the problem below, calculate the ratios, interpret the results against the industry average, and fill in the table on the worksheet. Then, provide an analysis of how those results can be used by the business to improve its performance.

Balance Sheet as of December 31, 2010

FIN 401 Effective Communication/tutorialrank.com

For more course tutorials visit

www.tutorialrank.com

By monday, February 23, 2015 solve the problem below, calculate the ratios, interpret the results against the industry average, and fill in the table on the worksheet. Then, provide an analysis of how those results can be used by the business to improve its performance.

Recommended

Fin 401 Exceptional Education / snaptutorial.com

For more classes visit

www.snaptutorial.com

By monday, February 23, 2015 solve the problem below, calculate the ratios, interpret the results against the industry average, and fill in the table on the worksheet. Then, provide an analysis of how those results can be used by the business to improve its performance.

Fin 401 Effective Communication / snaptutorial.com

This document contains information about several financial analysis assignments and case studies for a course. It includes details about calculating and interpreting financial ratios for a company, analyzing cash flow management strategies, applying time value of money concepts, calculating a weighted average cost of capital, and evaluating capital budgeting projects. The key information provided includes financial statements, industry averages, calculations, and questions to analyze for each case.

Fin 401 Enhance teaching-snaptutorial.com

For more classes visit

www.snaptutorial.com

By monday, February 23, 2015 solve the problem below, calculate the ratios, interpret the results against the industry average, and fill in the table on the worksheet. Then, provide an analysis of how those results can be used by the business to improve its performance.

Balance Sheet as of December 31, 2010

Gary and Company

Cash $45 Accounts payables $45

FIN 401 Education Organization - snaptutorial.com

For more classes visit

www.snaptutorial.com

By monday, February 23, 2015 solve the problem below, calculate the ratios, interpret the results against the industry average, and fill in the table on the worksheet. Then, provide an analysis of how those results can be used by the business to improve its performance.

Fin 401 Inspiring Innovation--tutorialrank.com

For more course tutorials visit

www.tutorialrank.com

By monday, February 23, 2015 solve the problem below, calculate the ratios, interpret the results against the industry average, and fill in the table on the worksheet. Then, provide an analysis of how those results can be used by the business to improve its performance.

Balance Sheet as of December 31, 2010

Gary and Company

FIN 401 Technology levels--snaptutorial.com

This document contains information for several assignments related to corporate finance. It includes financial statements, calculations, and analysis for ratio analysis, cash management, time value of money, weighted average cost of capital, capital budgeting, and risk adjustment. The assistant is asked to evaluate projects, calculate and interpret various financial ratios and metrics, and provide recommendations for improving business performance and investment decisions.

Fin 401 Enthusiastic Study / snaptutorial.com

By monday, February 23, 2015 solve the problem below, calculate the ratios, interpret the results against the industry average, and fill in the table on the worksheet. Then, provide an analysis of how those results can be used by the business to improve its performance.

Balance Sheet as of December 31, 2010

FIN 401 Effective Communication/tutorialrank.com

For more course tutorials visit

www.tutorialrank.com

By monday, February 23, 2015 solve the problem below, calculate the ratios, interpret the results against the industry average, and fill in the table on the worksheet. Then, provide an analysis of how those results can be used by the business to improve its performance.

FIN 401 Doing by learn/newtonhelp.com

This document provides information and instructions for several financial analysis assignments. It includes:

1. Instructions to calculate ratios for a company's balance sheet and income statement and compare to industry averages.

2. Questions about implementing a cash management system and calculating potential interest earnings.

3. Multiple questions calculating present and future values of cash flows using time value of money concepts.

4. Questions calculating a company's weighted average cost of capital and evaluating capital budgeting projects.

The document contains detailed information and calculations required to complete various financial analysis assignments on topics like ratio analysis, time value of money, cost of capital, and capital budgeting.

FIN 401 help A Guide to career/Snaptutorial

For more classes visit

www.snaptutorial.com

By monday, February 23, 2015 solve the problem below, calculate the ratios, interpret the results against the industry average, and fill in the table on the worksheet. Then, provide an analysis of how those results can be used by the business to improve its performance.

Balance Sheet as of December 31, 2010

FIN 401 Entire Course NEW

Check this A+ tutorial guideline at

https://www.uopassignments.com/fin-401-argosy

For more classes visit

http://www.uopassignments.com

BUSN 379 Enhance teaching / snaptutorial.com

For more classes visit

www.snaptutorial.com

BUSN 379 Week 1 Case Study Consumer Behavior

BUSN 379 Week 1 Homework

BUSN 379 Week 2 Case Study

BUSN 379 Week 2 Homework Chapter 11; 4, 7, 17, and 29.doc

BUSN 379 Week 2 Homework

BUSN 379 Focus Dreams/newtonhelp.com

For more course tutorials visit

www.newtonhelp.com

BUSN 379 Week 1 Case Study Consumer Behavior

BUSN 379 Week 1 Homework

BUSN 379 Week 2 Case Study

Target Corporation

Target Corporation operates general merchandise stores in the United States and Canada. The author makes corrections to previous valuation models and calculates an updated intrinsic value per share of $99.32, higher than the current stock price. Based on the higher intrinsic value and an upward stock price trend, the author recommends investors buy Target stock. The author also recommends Target maintain its current distribution policy and capital structure.

FIN 515 NERD Education for Service--fin515nerd.com

FOR MORE CLASSES VISIT

www.fin515nerd.com

FIN 515 Week 2 Project Financial Statement Analysis (Nike)

FIN 515 Week 3 Project Financial Statement Analysis (Nike)

FIN 515 Week 6 Project Calculating the Weighted Average Cost of

FIN 515 NERD Redefined Education--fin515nerd.com

This document contains materials for the FIN 515 finance course, including project descriptions, problem sets, quizzes, and exams. It covers topics like financial statement analysis, time value of money, weighted average cost of capital calculation, and capital budgeting. The materials are intended to help students complete the various assignments and assessments for the course.

FIN 515 NERD Introduction Education--fin515nerd.com

This document contains practice questions, exams, assignments, and projects for the FIN 515 financial management course. It includes materials for all weeks of the course as well as three sets of final exam questions. The document is designed to provide students with all the necessary coursework and assessments to complete or prepare for the FIN 515 course from an online education website focused on business and finance classes.

FIN 515 NERD Become Exceptional--fin515nerd.com

This document contains practice questions, exams, assignments, and projects for the FIN 515 financial management course. It includes materials for all weeks of the course as well as three practice final exams. The document is aimed at helping students prepare for and complete the various assessments in the FIN 515 course through practice questions and prior exams. It provides a comprehensive set of practice materials covering the entire course curriculum.

3428 financial management_nov_dec_18

The document is a multi-part exam on financial management. It includes questions on:

1) Calculating the value of a company before and after a recapitalization plan involving debt issuance and share repurchases.

2) Comparing coupon bonds and zero coupon bonds for raising capital.

3) Calculating a company's weighted average cost of capital and cost of equity using different models.

4) Evaluating investment opportunities using net present value and internal rate of return.

The summary provides a high-level overview of the various financial questions covered in the exam without including details on calculations or answers. It focuses on the essential topics and scope covered in the document's questions in 3 sentences.

Fin 401 Massive Success / snaptutorial.com

This document contains information and questions for several finance assignments related to ratio analysis, cash management, time value of money, weighted average cost of capital, and capital budgeting. It provides company financial statements, background information, and specific calculation and analysis questions regarding profitability ratios, cash flows, present and future values, cost of capital components, and project evaluation techniques. The student is asked to calculate various ratios, values, and costs, interpret the results, and recommend acceptance or rejection of potential investment projects based on net present value and internal rate of return.

FIN 401 Perfect Education/newtonhelp.com

For more course tutorials visit

www.newtonhelp.com

By monday, February 23, 2015 solve the problem below, calculate the ratios, interpret the results against the industry average, and fill in the table on the worksheet. Then, provide an analysis of how those results can be used by the business to improve its performance.

Balance Sheet as of December 31, 2010

FIN 401 Become Exceptional/newtonhelp.com

For more course tutorials visit

www.newtonhelp.com

By monday, February 23, 2015 solve the problem below, calculate the ratios, interpret the results against the industry average, and fill in the table on the worksheet. Then, provide an analysis of how those results can be used by the business to improve its performance.

Balance Sheet as of December 31, 2010

Gary and Company

Cash $45 Accounts payables $45

FIN 401 help A Guide to career/Snaptutorial

For more classes visit

www.snaptutorial.com

By monday, February 23, 2015 solve the problem below, calculate the ratios, interpret the results against the industry average, and fill in the table on the worksheet. Then, provide an analysis of how those results can be used by the business to improve its performance.

Balance Sheet as of December 31, 2010

Gary and Company

Cash $45 Accounts payables $45

AssetsLiabilitiesTotal Reserves$50,000Demand Deposits$18.docx

Assets

Liabilities

Total Reserves

$50,000

Demand Deposits

$180,000

U.S. Government Bonds

$110,000

Loans

$20,000

Assume the balance sheet above is for Eastlandia National Bank. The reserve requirement is 20%.

a. Given the current situation, how much money can Eastlandia National Bank lend to borrowers if it wants to keep all of its bonds?

b. Based on your answer in part (a), how much additional money can Eastlandia National Bank create? (Remember, how means how and why.)

c. Explain two reasons why the money supply may not increase by the amount you identified in part (b).

Spring 2013 Due Wed May. 15 by 4pm (my office)

1) Describe (in detail) the three forms of underwriting.

2) You want to set up an education trust for a relative starting in 2014. The trust will pay $25,000 a year starting in year 2022 and ending in year 2025. The stated annual percentage rate is 8% compounded annually.

a. How much will you have to invest in 2010 to achieve your objective?

b. How much will you have to invest each year from 2012 – 2017 to achieve your objective?

3) Samuelson Plastics has 7.5 percent preferred stock outstanding. Currently, this stock has a market value per share of $52 and a book value per share of $38. What is the cost of preferred stock?

4) Tidewater Fishing has a current beta of 1.21. The market risk premium is 8.9 percent and the risk-free rate of return is 3.2 percent. By how much will the cost of equity increase if the company expands its operations such that the company beta rises to 1.50?

5) Penn Corporation does not currently pay dividends. It is expected to begin paying dividends in year three (3) with a $2.50 dividend. This dividend is expected to grow at a rate of 14% for three years and then 6% every year after that forever. The required return on Penn’s stock is 16%. Calculate the price of Penn’s stock today.

6) Suppose Primerica has just paid a dividend of $1.75 per share. Sales and profits for Primerica are expected to grow at a rate of 5% per year. Its dividend is expected to grow by the same amount. If the required return is 12%, what is the value of a share of Primerica in 6 years?

7) IPOs typically experience underpricing. Describe (1) what is underpricing, (2) the evidence that underpricing occurs (be sure to include real world numbers/examples), and (3) why does underpricing occur.

8) Adelson's Electric had beginning long-term debt of $42,511 and ending long-term debt of $48,919. The beginning and ending total debt balances were $84,652 and $78,613, respectively. The interest paid was $4,767. What is the amount of the cash flow to creditors?

9) You arrived at work today to see the CFO, COO and most of the company’s top management team taken away in handcuffs. The only executive who was not arrested was the newly appointed CEO. Before you can even reach your cube, the CEO calls you into his office to explain some incomplete project an ...

FinanceTest ISummer 20191. Using the following data, prepare a .docx

FinanceTest ISummer 2019

1. Using the following data, prepare a three-stage ROE decomposition (DuPont Analysis) for Home Depot.

Return on equity (ROE)

12%

Sales

$5,000

Current ratio

2.29

Dividend payout ratio

25%

Dividends paid

$100

Total liabilities

$4,000

Accounts payable

$600

My work:

1) ROE = Net Income/Sales x Sales/ Equity (or 12%)

2) ROE = Net Income/ Sales x Sales/Assets x Assets/Equity

or …….(400/5,000) (5,000/ Assets) (Assets/Equity)

3) ROE = (Net Profit Margin) (Asset Turnover) (Equity Multiple)

Side notes:

(Accounts Payable) (Current Ratio) = 1,374/ 600 = 2.29

Current assets = 1,374

Current Liability or Accounts payable = 600

Current ratio = 2.29

2. Your task is to update your firm’s long-term financial model (that was originally prepared last year). In financial modeling, a key assumption involves the firm’s dividend policy, as typically specified by the firm’s payout ratio.

You recognize many differences between today and last year.

Last year, the Treasury Yield Curve was upward sloping. Today, the Treasury Yield Curve is inverted. Last year, the Fed was expected to raise interest rates. Today, the Fed is expected to lower interest rates. We also know the following:

TodayLast year

Forward P/E

16

20

Equity Multiplier

2.50

1.95

Based on the differences described above, would you expect the payout ratio in this year’s financial model to be higher or lower than it was last year? Briefly explain.

Based on the differences above, I expect that the payout ratio in this year’s financial model to be lower along with short term headwinds. The earnings per share is going down and the price is taking a hit. Also, assets are leaning towards the heavier side.

3. Glencore will need to have $3,000 on June 20, 2023 (four years from now) to purchase new equipment. To accumulate this money, it will make four equal investments, with the first of the equal investments beginning one year from now.

a. If Glencore can earn an annual interest rate of 10%, how much must it invest per year?

My work:

P1 = 646.41 x 1.10

P2 = 646.41 x 1.10

P3 = 646.41 x 1.10

P4 = 646.41 x 1.10

Invest per year = $646.41

=PMT (10%,4,0,3000,0)

b. After presenting your findings from the above calculation, Glencore’s CFO asks you to consider an alternative scenario. Both changes are to occur today and will continue throughout the four years. You are to consider both changes simultaneously.

1. The interest rate will increase today and remain at that higher level.

2. There will still be four equal investments, but the first investment will occur immediately.

Without doing any calculations, how would these changes (considered simultaneously) affect your answer in part a? Using no more than 50 words, carefully justify your response. Do not write more 50 words.

My response:

With a higher rate (ex: 12%) Glencore’s money is working harder. If less money is put down, then more money will result in t.

Bus 401 week 3 quiz version c

This document contains a 10 question quiz on topics related to corporate finance and capital budgeting. It includes questions about calculating cash flows, investment project evaluation methods like net present value and internal rate of return, and the cost of capital. The quiz also contains questions about capital structure, the time value of money, and depreciation.

Busn 5200 managerial finance complete class

This document provides information and homework assignments for the BUSN 5200 Managerial Finance Complete Class. It includes homework for weeks 1 through 8 covering topics like the field of finance, accounting, ratio analysis, time value of money, capital budgeting, and more. Students are asked to complete assignments involving calculations, preparing financial statements and graphs, and answering conceptual questions. The document also provides information on how to purchase the complete tutorial for this class and contact details for the tutorial provider.

Case Study MarisaName MarisaDemographicsMarisa.docx

Case Study: Marisa

Name: Marisa

Demographics

Marisa is an 11-year-old Hispanic-American female. Marisa is in the 7th grade at a local school. She lives with her biological mother and her stepfather. Marisa has three siblings: one brother and two sisters. Marisa is the oldest child. Marisa’s biological father is inconsistently in her life, and visits with her a couple of times a year. He lives in the same city as Marisa, but doesn’t seem to hold a job long enough for her mother to collect child support. Marisa is the only child from her mother’s first marriage; her siblings were born during her mother’s current marriage.

Treatment History

Marisa has been to therapy “a couple of times” when she was 6 years old. Marisa’s mother reports that she (mother) has always had difficulty “managing Marisa’s behavior.”

Current Treatment

Marisa reports that she visits her school counselor sometimes.

Current Medical

N/A

Current Disposition

Marisa’s mother has brought Marisa into your office seeking counseling for oppositional behavior. Marisa’s mother reports “Marisa is so disrespectful; she talks back, yells at me, and just won’t do what she is told.” While you are talking with Marisa and her mother they describe a recent argument. Marisa reports that her mother “slapped me” during the argument. Marisa’s mother reports, “She hit me; I had to do something.” As you tell Marisa and her mother that you are a mandatory reporter and start describing what that means, Marisa’s mother gets upset and leaves the office, taking Marisa with her.

Notes

Due to the intake paperwork, you have the family’s address and demographic information.

© 2014. Grand Canyon University. All Rights Reserved.

Alternative Assessment

MGMT 2023 – Financial Management

Section 1 - Compulsory (30 marks)

INSTRUCTIONS: Answer all questions in this section.

1. Evaluate the following diagram and explain how the players in the financial market collaborate

to acquire funding and ensure economic efficiency.

(4 marks)

2. Clarksville Printing Company sold 1,500 finance books for $85 each to University of the West

Indies (UWI) in 2019. These books cost Clarkesville $62 each to produce. In the marketing of the

books, the Company paid $4,600 to a marketing firm, and it also borrowed $50,000 on January 1,

2019, on which the Company paid 10 percent interest. Both interest and principal are paid on

December 21, 2019. Depreciation expense for the year was $8,000 and Clarksville’s tax rate is 25

percent.

a. Verify whether Clarksville Printing Company made a profit in 2019, by presenting

an income statement in good form. (3 marks)

b. Explain the impact of the new loan of $50,000 and the depreciation expense on the

cash flows. (2 marks)

c. Determine the Operating Cash Flow for Clarksville Company. What accounts for

the difference in the net income and the operating cash flow? (2 marks)

3. As the Fund Manager for Ba.

!#$&$()#+,(!1. Question Which of the following isar.docx

!"#$%&$'()*#+,(

!

1. Question : Which of the following is/are true?

I. Asset management ratio indicates how effectively a firm

generates profits on sales, assets and stockholder’s equity.

II. Liquidity ratios indicate the firm’s capacity to meet its

short-term financial obligations, but not its long-term

financial obligations.

III. Profitability ratios indicate how efficiently a firm is using

its assets to generate sales.

IV. Financial leverage ratios indicate the firm’s capacity to

meet its financial obligations, both short-term and long-term.

Student Answer:

II and IV

I and II

I, II, and IV

I and III

Question 2. Question : Which of the following is/are true?

I. When a loan is amortized over a five year term, the amount

of interest paid is decreased each year.

II. The effective annual rate of interest will always be equal

to or less than the nominal annual rate of interest.

III. An annuity due is the annuity in which the payments or

receipts occur at the beginning of each period.

IV. If the present value of a given sum is equal to its future

value, then the discount rate must be zero.

Student Answer:

IV only

III & IV

II, III & IV

I, III & IV

Question 3. Question : If a firm’s current ratio is 3.0,

Student Answer:

it is possible for its quick ratio to be larger than 3.0.

its current liabilities exceed its current assets.

it is possible for its quick ratio to be smaller than 3.0.

its current liabilities equal its current assets.

Ch 3

Ch 5

Ch 3

Question 4. Question : Which of the following is/are true?

I. The shareholder wealth maximization goal states that

management should seek to maximize the present value of

the expected future returns to the owners of the firm.

II. The primary reason for the agency problem between the

stockholders and managers is because of the separation of

ownership and management.

III. Protective covenants in a company's bond indentures are

used in agency relationships involving stockholders and

creditors.

IV. The fact that no investor can expect to earn excess

returns based on an investment strategy using only historical

stock price or return information is an example of

semistrong-form market efficiency.

Student Answer:

I and IV

I, II and IV

I, II and III

All of the above

Question 5. Question : If you’re a financial manager of a MNC (U.S. based) and you

anticipate that your company will need to pay C$2 million 6

months later. If you would like to make use of either forward

or futures or options contracts to fix your exchange rate

today, what is your strategy?

Student Answer:

BUY forward/futures contracts for C$2 million or BUY

call options for C$2 million.

SELL forward/futures contracts for C$2 million or BUY

call options for C$2 million.

BUY forward/futures contracts for C$2 million or ...

Uop fin 370 final exam guide

fin 370,uop fin 370,uop fin 370 complete course,uop fin 370 entire course, uop fin 370 week 1,uop fin 370 week 2,uop fin 370 week 3,uop fin 370 week 4,uop fin 370 week 5,fin 370 final exam guide new,fin 370 tutorials,fin 370 assignments,fin 370 help

More Related Content

What's hot

FIN 401 Doing by learn/newtonhelp.com

This document provides information and instructions for several financial analysis assignments. It includes:

1. Instructions to calculate ratios for a company's balance sheet and income statement and compare to industry averages.

2. Questions about implementing a cash management system and calculating potential interest earnings.

3. Multiple questions calculating present and future values of cash flows using time value of money concepts.

4. Questions calculating a company's weighted average cost of capital and evaluating capital budgeting projects.

The document contains detailed information and calculations required to complete various financial analysis assignments on topics like ratio analysis, time value of money, cost of capital, and capital budgeting.

FIN 401 help A Guide to career/Snaptutorial

For more classes visit

www.snaptutorial.com

By monday, February 23, 2015 solve the problem below, calculate the ratios, interpret the results against the industry average, and fill in the table on the worksheet. Then, provide an analysis of how those results can be used by the business to improve its performance.

Balance Sheet as of December 31, 2010

FIN 401 Entire Course NEW

Check this A+ tutorial guideline at

https://www.uopassignments.com/fin-401-argosy

For more classes visit

http://www.uopassignments.com

BUSN 379 Enhance teaching / snaptutorial.com

For more classes visit

www.snaptutorial.com

BUSN 379 Week 1 Case Study Consumer Behavior

BUSN 379 Week 1 Homework

BUSN 379 Week 2 Case Study

BUSN 379 Week 2 Homework Chapter 11; 4, 7, 17, and 29.doc

BUSN 379 Week 2 Homework

BUSN 379 Focus Dreams/newtonhelp.com

For more course tutorials visit

www.newtonhelp.com

BUSN 379 Week 1 Case Study Consumer Behavior

BUSN 379 Week 1 Homework

BUSN 379 Week 2 Case Study

Target Corporation

Target Corporation operates general merchandise stores in the United States and Canada. The author makes corrections to previous valuation models and calculates an updated intrinsic value per share of $99.32, higher than the current stock price. Based on the higher intrinsic value and an upward stock price trend, the author recommends investors buy Target stock. The author also recommends Target maintain its current distribution policy and capital structure.

FIN 515 NERD Education for Service--fin515nerd.com

FOR MORE CLASSES VISIT

www.fin515nerd.com

FIN 515 Week 2 Project Financial Statement Analysis (Nike)

FIN 515 Week 3 Project Financial Statement Analysis (Nike)

FIN 515 Week 6 Project Calculating the Weighted Average Cost of

FIN 515 NERD Redefined Education--fin515nerd.com

This document contains materials for the FIN 515 finance course, including project descriptions, problem sets, quizzes, and exams. It covers topics like financial statement analysis, time value of money, weighted average cost of capital calculation, and capital budgeting. The materials are intended to help students complete the various assignments and assessments for the course.

FIN 515 NERD Introduction Education--fin515nerd.com

This document contains practice questions, exams, assignments, and projects for the FIN 515 financial management course. It includes materials for all weeks of the course as well as three sets of final exam questions. The document is designed to provide students with all the necessary coursework and assessments to complete or prepare for the FIN 515 course from an online education website focused on business and finance classes.

FIN 515 NERD Become Exceptional--fin515nerd.com

This document contains practice questions, exams, assignments, and projects for the FIN 515 financial management course. It includes materials for all weeks of the course as well as three practice final exams. The document is aimed at helping students prepare for and complete the various assessments in the FIN 515 course through practice questions and prior exams. It provides a comprehensive set of practice materials covering the entire course curriculum.

3428 financial management_nov_dec_18

The document is a multi-part exam on financial management. It includes questions on:

1) Calculating the value of a company before and after a recapitalization plan involving debt issuance and share repurchases.

2) Comparing coupon bonds and zero coupon bonds for raising capital.

3) Calculating a company's weighted average cost of capital and cost of equity using different models.

4) Evaluating investment opportunities using net present value and internal rate of return.

The summary provides a high-level overview of the various financial questions covered in the exam without including details on calculations or answers. It focuses on the essential topics and scope covered in the document's questions in 3 sentences.

What's hot (11)

FIN 515 NERD Education for Service--fin515nerd.com

FIN 515 NERD Education for Service--fin515nerd.com

FIN 515 NERD Introduction Education--fin515nerd.com

FIN 515 NERD Introduction Education--fin515nerd.com

Similar to Fin 401 Teaching Effectively--tutorialrank.com

Fin 401 Massive Success / snaptutorial.com

This document contains information and questions for several finance assignments related to ratio analysis, cash management, time value of money, weighted average cost of capital, and capital budgeting. It provides company financial statements, background information, and specific calculation and analysis questions regarding profitability ratios, cash flows, present and future values, cost of capital components, and project evaluation techniques. The student is asked to calculate various ratios, values, and costs, interpret the results, and recommend acceptance or rejection of potential investment projects based on net present value and internal rate of return.

FIN 401 Perfect Education/newtonhelp.com

For more course tutorials visit

www.newtonhelp.com

By monday, February 23, 2015 solve the problem below, calculate the ratios, interpret the results against the industry average, and fill in the table on the worksheet. Then, provide an analysis of how those results can be used by the business to improve its performance.

Balance Sheet as of December 31, 2010

FIN 401 Become Exceptional/newtonhelp.com

For more course tutorials visit

www.newtonhelp.com

By monday, February 23, 2015 solve the problem below, calculate the ratios, interpret the results against the industry average, and fill in the table on the worksheet. Then, provide an analysis of how those results can be used by the business to improve its performance.

Balance Sheet as of December 31, 2010

Gary and Company

Cash $45 Accounts payables $45

FIN 401 help A Guide to career/Snaptutorial

For more classes visit

www.snaptutorial.com

By monday, February 23, 2015 solve the problem below, calculate the ratios, interpret the results against the industry average, and fill in the table on the worksheet. Then, provide an analysis of how those results can be used by the business to improve its performance.

Balance Sheet as of December 31, 2010

Gary and Company

Cash $45 Accounts payables $45

AssetsLiabilitiesTotal Reserves$50,000Demand Deposits$18.docx

Assets

Liabilities

Total Reserves

$50,000

Demand Deposits

$180,000

U.S. Government Bonds

$110,000

Loans

$20,000

Assume the balance sheet above is for Eastlandia National Bank. The reserve requirement is 20%.

a. Given the current situation, how much money can Eastlandia National Bank lend to borrowers if it wants to keep all of its bonds?

b. Based on your answer in part (a), how much additional money can Eastlandia National Bank create? (Remember, how means how and why.)

c. Explain two reasons why the money supply may not increase by the amount you identified in part (b).

Spring 2013 Due Wed May. 15 by 4pm (my office)

1) Describe (in detail) the three forms of underwriting.

2) You want to set up an education trust for a relative starting in 2014. The trust will pay $25,000 a year starting in year 2022 and ending in year 2025. The stated annual percentage rate is 8% compounded annually.

a. How much will you have to invest in 2010 to achieve your objective?

b. How much will you have to invest each year from 2012 – 2017 to achieve your objective?

3) Samuelson Plastics has 7.5 percent preferred stock outstanding. Currently, this stock has a market value per share of $52 and a book value per share of $38. What is the cost of preferred stock?

4) Tidewater Fishing has a current beta of 1.21. The market risk premium is 8.9 percent and the risk-free rate of return is 3.2 percent. By how much will the cost of equity increase if the company expands its operations such that the company beta rises to 1.50?

5) Penn Corporation does not currently pay dividends. It is expected to begin paying dividends in year three (3) with a $2.50 dividend. This dividend is expected to grow at a rate of 14% for three years and then 6% every year after that forever. The required return on Penn’s stock is 16%. Calculate the price of Penn’s stock today.

6) Suppose Primerica has just paid a dividend of $1.75 per share. Sales and profits for Primerica are expected to grow at a rate of 5% per year. Its dividend is expected to grow by the same amount. If the required return is 12%, what is the value of a share of Primerica in 6 years?

7) IPOs typically experience underpricing. Describe (1) what is underpricing, (2) the evidence that underpricing occurs (be sure to include real world numbers/examples), and (3) why does underpricing occur.

8) Adelson's Electric had beginning long-term debt of $42,511 and ending long-term debt of $48,919. The beginning and ending total debt balances were $84,652 and $78,613, respectively. The interest paid was $4,767. What is the amount of the cash flow to creditors?

9) You arrived at work today to see the CFO, COO and most of the company’s top management team taken away in handcuffs. The only executive who was not arrested was the newly appointed CEO. Before you can even reach your cube, the CEO calls you into his office to explain some incomplete project an ...

FinanceTest ISummer 20191. Using the following data, prepare a .docx

FinanceTest ISummer 2019

1. Using the following data, prepare a three-stage ROE decomposition (DuPont Analysis) for Home Depot.

Return on equity (ROE)

12%

Sales

$5,000

Current ratio

2.29

Dividend payout ratio

25%

Dividends paid

$100

Total liabilities

$4,000

Accounts payable

$600

My work:

1) ROE = Net Income/Sales x Sales/ Equity (or 12%)

2) ROE = Net Income/ Sales x Sales/Assets x Assets/Equity

or …….(400/5,000) (5,000/ Assets) (Assets/Equity)

3) ROE = (Net Profit Margin) (Asset Turnover) (Equity Multiple)

Side notes:

(Accounts Payable) (Current Ratio) = 1,374/ 600 = 2.29

Current assets = 1,374

Current Liability or Accounts payable = 600

Current ratio = 2.29

2. Your task is to update your firm’s long-term financial model (that was originally prepared last year). In financial modeling, a key assumption involves the firm’s dividend policy, as typically specified by the firm’s payout ratio.

You recognize many differences between today and last year.

Last year, the Treasury Yield Curve was upward sloping. Today, the Treasury Yield Curve is inverted. Last year, the Fed was expected to raise interest rates. Today, the Fed is expected to lower interest rates. We also know the following:

TodayLast year

Forward P/E

16

20

Equity Multiplier

2.50

1.95

Based on the differences described above, would you expect the payout ratio in this year’s financial model to be higher or lower than it was last year? Briefly explain.

Based on the differences above, I expect that the payout ratio in this year’s financial model to be lower along with short term headwinds. The earnings per share is going down and the price is taking a hit. Also, assets are leaning towards the heavier side.

3. Glencore will need to have $3,000 on June 20, 2023 (four years from now) to purchase new equipment. To accumulate this money, it will make four equal investments, with the first of the equal investments beginning one year from now.

a. If Glencore can earn an annual interest rate of 10%, how much must it invest per year?

My work:

P1 = 646.41 x 1.10

P2 = 646.41 x 1.10

P3 = 646.41 x 1.10

P4 = 646.41 x 1.10

Invest per year = $646.41

=PMT (10%,4,0,3000,0)

b. After presenting your findings from the above calculation, Glencore’s CFO asks you to consider an alternative scenario. Both changes are to occur today and will continue throughout the four years. You are to consider both changes simultaneously.

1. The interest rate will increase today and remain at that higher level.

2. There will still be four equal investments, but the first investment will occur immediately.

Without doing any calculations, how would these changes (considered simultaneously) affect your answer in part a? Using no more than 50 words, carefully justify your response. Do not write more 50 words.

My response:

With a higher rate (ex: 12%) Glencore’s money is working harder. If less money is put down, then more money will result in t.

Bus 401 week 3 quiz version c

This document contains a 10 question quiz on topics related to corporate finance and capital budgeting. It includes questions about calculating cash flows, investment project evaluation methods like net present value and internal rate of return, and the cost of capital. The quiz also contains questions about capital structure, the time value of money, and depreciation.

Busn 5200 managerial finance complete class

This document provides information and homework assignments for the BUSN 5200 Managerial Finance Complete Class. It includes homework for weeks 1 through 8 covering topics like the field of finance, accounting, ratio analysis, time value of money, capital budgeting, and more. Students are asked to complete assignments involving calculations, preparing financial statements and graphs, and answering conceptual questions. The document also provides information on how to purchase the complete tutorial for this class and contact details for the tutorial provider.

Case Study MarisaName MarisaDemographicsMarisa.docx

Case Study: Marisa

Name: Marisa

Demographics

Marisa is an 11-year-old Hispanic-American female. Marisa is in the 7th grade at a local school. She lives with her biological mother and her stepfather. Marisa has three siblings: one brother and two sisters. Marisa is the oldest child. Marisa’s biological father is inconsistently in her life, and visits with her a couple of times a year. He lives in the same city as Marisa, but doesn’t seem to hold a job long enough for her mother to collect child support. Marisa is the only child from her mother’s first marriage; her siblings were born during her mother’s current marriage.

Treatment History

Marisa has been to therapy “a couple of times” when she was 6 years old. Marisa’s mother reports that she (mother) has always had difficulty “managing Marisa’s behavior.”

Current Treatment

Marisa reports that she visits her school counselor sometimes.

Current Medical

N/A

Current Disposition

Marisa’s mother has brought Marisa into your office seeking counseling for oppositional behavior. Marisa’s mother reports “Marisa is so disrespectful; she talks back, yells at me, and just won’t do what she is told.” While you are talking with Marisa and her mother they describe a recent argument. Marisa reports that her mother “slapped me” during the argument. Marisa’s mother reports, “She hit me; I had to do something.” As you tell Marisa and her mother that you are a mandatory reporter and start describing what that means, Marisa’s mother gets upset and leaves the office, taking Marisa with her.

Notes

Due to the intake paperwork, you have the family’s address and demographic information.

© 2014. Grand Canyon University. All Rights Reserved.

Alternative Assessment

MGMT 2023 – Financial Management

Section 1 - Compulsory (30 marks)

INSTRUCTIONS: Answer all questions in this section.

1. Evaluate the following diagram and explain how the players in the financial market collaborate

to acquire funding and ensure economic efficiency.

(4 marks)

2. Clarksville Printing Company sold 1,500 finance books for $85 each to University of the West

Indies (UWI) in 2019. These books cost Clarkesville $62 each to produce. In the marketing of the

books, the Company paid $4,600 to a marketing firm, and it also borrowed $50,000 on January 1,

2019, on which the Company paid 10 percent interest. Both interest and principal are paid on

December 21, 2019. Depreciation expense for the year was $8,000 and Clarksville’s tax rate is 25

percent.

a. Verify whether Clarksville Printing Company made a profit in 2019, by presenting

an income statement in good form. (3 marks)

b. Explain the impact of the new loan of $50,000 and the depreciation expense on the

cash flows. (2 marks)

c. Determine the Operating Cash Flow for Clarksville Company. What accounts for

the difference in the net income and the operating cash flow? (2 marks)

3. As the Fund Manager for Ba.

!#$&$()#+,(!1. Question Which of the following isar.docx

!"#$%&$'()*#+,(

!

1. Question : Which of the following is/are true?

I. Asset management ratio indicates how effectively a firm

generates profits on sales, assets and stockholder’s equity.

II. Liquidity ratios indicate the firm’s capacity to meet its

short-term financial obligations, but not its long-term

financial obligations.

III. Profitability ratios indicate how efficiently a firm is using

its assets to generate sales.

IV. Financial leverage ratios indicate the firm’s capacity to

meet its financial obligations, both short-term and long-term.

Student Answer:

II and IV

I and II

I, II, and IV

I and III

Question 2. Question : Which of the following is/are true?

I. When a loan is amortized over a five year term, the amount

of interest paid is decreased each year.

II. The effective annual rate of interest will always be equal

to or less than the nominal annual rate of interest.

III. An annuity due is the annuity in which the payments or

receipts occur at the beginning of each period.

IV. If the present value of a given sum is equal to its future

value, then the discount rate must be zero.

Student Answer:

IV only

III & IV

II, III & IV

I, III & IV

Question 3. Question : If a firm’s current ratio is 3.0,

Student Answer:

it is possible for its quick ratio to be larger than 3.0.

its current liabilities exceed its current assets.

it is possible for its quick ratio to be smaller than 3.0.

its current liabilities equal its current assets.

Ch 3

Ch 5

Ch 3

Question 4. Question : Which of the following is/are true?

I. The shareholder wealth maximization goal states that

management should seek to maximize the present value of

the expected future returns to the owners of the firm.

II. The primary reason for the agency problem between the

stockholders and managers is because of the separation of

ownership and management.

III. Protective covenants in a company's bond indentures are

used in agency relationships involving stockholders and

creditors.

IV. The fact that no investor can expect to earn excess

returns based on an investment strategy using only historical

stock price or return information is an example of

semistrong-form market efficiency.

Student Answer:

I and IV

I, II and IV

I, II and III

All of the above

Question 5. Question : If you’re a financial manager of a MNC (U.S. based) and you

anticipate that your company will need to pay C$2 million 6

months later. If you would like to make use of either forward

or futures or options contracts to fix your exchange rate

today, what is your strategy?

Student Answer:

BUY forward/futures contracts for C$2 million or BUY

call options for C$2 million.

SELL forward/futures contracts for C$2 million or BUY

call options for C$2 million.

BUY forward/futures contracts for C$2 million or ...

Uop fin 370 final exam guide

fin 370,uop fin 370,uop fin 370 complete course,uop fin 370 entire course, uop fin 370 week 1,uop fin 370 week 2,uop fin 370 week 3,uop fin 370 week 4,uop fin 370 week 5,fin 370 final exam guide new,fin 370 tutorials,fin 370 assignments,fin 370 help

Uop fin 370 final exam guide

This document contains a practice exam for the UOP FIN 370 course with 60 multiple choice questions covering topics like the cash cycle, time value of money, capital budgeting, cost of capital, and financial statement analysis. An online resource is provided for additional practice exams.

Uop fin 370 final exam guide

fin 370,uop fin 370,uop fin 370 complete course,uop fin 370 entire course, uop fin 370 week 1,uop fin 370 week 2,uop fin 370 week 3,uop fin 370 week 4,uop fin 370 week 5,fin 370 final exam guide new,fin 370 tutorials,fin 370 assignments,fin 370 help, fin 370 cash flow problem sets new,fin 370 final exam guide new,fin 370 final exam guide new,

Uop fin 370 final exam guide

fin 370,uop fin 370,uop fin 370 entire course,uop fin 370 entire class,uop fin 370 week 1,uop fin 370 week 2,uop fin 370 week 3,uop fin 370 week 4,uop fin 370 week 5,uop fin 370 tutorials,fin 370 assignments,fin 370 help,uop fin 370 learning team lowes,uop fin 370 strategic initiative paper lowe's,uop fin 370 final exam guide

Which of the following is considered a hybrid organizational form.docx

Which of the following is considered a hybrid organizational form?

limited liability partnership

corporation

sole proprietorship

partnership

Which of the following is a principal within the agency relationship?

the board of directors

the CEO of the firm

a shareholder

a company engineer

Teakap, Inc., has current assets of $ 1,456,312 and total assets of $4,812,369 for the year ending September 30, 2006. It also has current liabilities of $1,041,012, common equity of $1,500,000, and retained earnings of $1,468,347. How much long-term debt does the firm have?

Which of the following presents a summary of the changes in a firm’s balance sheet from the beginning of an accounting period to the end of that accounting period?

The statement of net worth.

The statement of retained earnings.

The statement of working capital.

The statement of cash flows.

Efficiency ratio: Gateway Corp. has an inventory turnover ratio of 5.6. What is the firm's days's sales in inventory?

61.7 days

57.9 days

65.2 days

64.3 days

IE

Leverage ratio: Your firm has an equity multiplier of 2.47. What is its debt-to-equity ratio?

0

1.74

0.60

1.47

Which of the following is not a method of “benchmarking”?

Evaluating a single firm’s performance over time.

Conduct an industry group analysis.

Identify a group of firms that compete with the company being analyzed.

Utilize the DuPont system to analyze a firm’s performance.

Present value: Jack Robbins is saving for a new car. He needs to have $ 21,000 for the car in three years. How much will he have to invest today in an account paying 8 percent annually to achieve his target? (Round to nearest dollar.)

$26,454

$16,670

$19,444

$22,680

IE

PV of multiple cash flows: Ferris, Inc., has borrowed from their bank at a rate of 8 percent and will repay the loan with interest over the next five years. Their scheduled payments, starting at the end of the year are as follows—$450,000, $560,000, $750,000, $875,000, and

$1,000,000. What is the present value of these payments? (Round to the nearest

dollar.)

$2,815,885

$2,735,200

$2,431,224

$2,615,432

PV of multiple cash flows: Ajax Corp. is expecting the following cash flows—

$79,000, $112,000, $164,000, $84,000, and $242,000—over the next five years.

If the company's opportunity cost is 15 percent, what is the present value of these

cash flows? (Round to the nearest dollar.)

$477,235

$429,560

$414,322

$480,906

IE

Future value of an annuity: Jayadev Athreya has started on his first job.

He plans to start saving for retirement early. He will invest $5,000 at the end

of each year for the next 45 years in a fund that will earn a return of 10 percent.

How much will Jayadev have at the end of 45 years? (Round to the nearest dollar.)

$2,667,904

$5,233,442

$1,745,600

$3,594,524

Serox stock was selling for $20 two years ago. The stock sold for

$25 one year ago, and it is currently selling for $28. Serox pays a $1.10 dividend

per.

Description Instructions Complete final exam.Ques.docx

Description / Instructions: Complete final exam.

Question 1

Which of the following is considered a hybrid organizational form?

sole proprietorship

partnership

corporation

limited liability partnership

Question 2

Which of the following is a principal within the agency relationship?

a company engineer

the CEO of the firm

a shareholder

the board of directors

Question 3

Teakap, Inc., has current assets of $ 1,456,312 and total assets of $4,812,369 for the year ending September 30, 2006. It also has current liabilities of $1,041,012, common equity of $1,500,000, and retained earnings of $1,468,347. How much long-term debt does the firm have?

$803,010

$2,303,010

$2,123,612

$1,844,022

Question 4

Which of the following presents a summary of the changes in a firm’s balance sheet from the beginning of an accounting period to the end of that accounting period?

The statement of cash flows.

The statement of net worth.

The statement of retained earnings.

The statement of working capital.

Question 5

Efficiency ratio: Gateway Corp. has an inventory turnover ratio of 5.6. What is the firm's days's sales in inventory?

61.7 days

57.9 days

65.2 days

64.3 days

Question 6

Leverage ratio: Your firm has an equity multiplier of 2.47. What is its debt-to-equity ratio?

0

0.60

1.47

1.74

Question 7

Which of the following is not a method of “benchmarking”?

Utilize the DuPont system to analyze a firm’s performance.

Conduct an industry group analysis.

Evaluating a single firm’s performance over time.

Identify a group of firms that compete with the company being analyzed.

Question 8

Present value: Jack Robbins is saving for a new car. He needs to have $ 21,000 for the car in three years. How much will he have to invest today in an account paying 8 percent annually to achieve his target? (Round to nearest dollar.)

$26,454

$19,444

$22,680

$16,670

Question 9

PV of multiple cash flows: Ferris, Inc., has borrowed from their bank at a rate of 8 percent and will repay the loan with interest over the next five years. Their scheduled payments, starting at the end of the year are as follows—$450,000, $560,000, $750,000, $875,000, and $1,000,000. What is the present value of these payments? (Round to the nearest dollar.)

$2,815,885

$2,615,432

$2,735,200

$2,431,224

Question 10

PV of multiple cash flows: Ajax Corp. is expecting the following cash flows—$79,000, $112,000, $164,000, $84,000, and $242,000—over the next five years. If the company's opportunity cost is 15 percent, what is the present value of these cash flows? (Round to the nearest dollar.)

$429,560

$414,322

$480,906

$477,235

Question 11

Future value of an annuity: Jayadev At.

Finance homework help

This document provides information about online finance homework help and solutions to finance questions and exams. It includes links to purchase solutions to entire courses, exams, and homework assignments for prices ranging from $3-$11 per question. The questions cover topics like corporate bond analysis, cash budgets, inventory lists, accounting principles, and insurance. Clicking the provided links would allow users to access full solutions and explanations to the questions and exams.

Finance homework help

This document provides information about online finance homework help and solutions to finance questions and exams. It includes links to purchase solutions to entire courses, exams, and homework assignments for prices ranging from $3-$11 per question. The questions cover topics like corporate bond analysis, cash budgets, inventory lists, accounting audits, and capital budgeting. Clicking the links provided would allow users to access the full solutions to finance problems and exams.

Similar to Fin 401 Teaching Effectively--tutorialrank.com (18)

AssetsLiabilitiesTotal Reserves$50,000Demand Deposits$18.docx

AssetsLiabilitiesTotal Reserves$50,000Demand Deposits$18.docx

FinanceTest ISummer 20191. Using the following data, prepare a .docx

FinanceTest ISummer 20191. Using the following data, prepare a .docx

Case Study MarisaName MarisaDemographicsMarisa.docx

Case Study MarisaName MarisaDemographicsMarisa.docx

!#$&$()#+,(!1. Question Which of the following isar.docx

!#$&$()#+,(!1. Question Which of the following isar.docx

Which of the following is considered a hybrid organizational form.docx

Which of the following is considered a hybrid organizational form.docx

Description Instructions Complete final exam.Ques.docx

Description Instructions Complete final exam.Ques.docx

Recently uploaded

The simplified electron and muon model, Oscillating Spacetime: The Foundation...

Discover the Simplified Electron and Muon Model: A New Wave-Based Approach to Understanding Particles delves into a groundbreaking theory that presents electrons and muons as rotating soliton waves within oscillating spacetime. Geared towards students, researchers, and science buffs, this book breaks down complex ideas into simple explanations. It covers topics such as electron waves, temporal dynamics, and the implications of this model on particle physics. With clear illustrations and easy-to-follow explanations, readers will gain a new outlook on the universe's fundamental nature.

How to Manage Your Lost Opportunities in Odoo 17 CRM

Odoo 17 CRM allows us to track why we lose sales opportunities with "Lost Reasons." This helps analyze our sales process and identify areas for improvement. Here's how to configure lost reasons in Odoo 17 CRM

ISO/IEC 27001, ISO/IEC 42001, and GDPR: Best Practices for Implementation and...

Denis is a dynamic and results-driven Chief Information Officer (CIO) with a distinguished career spanning information systems analysis and technical project management. With a proven track record of spearheading the design and delivery of cutting-edge Information Management solutions, he has consistently elevated business operations, streamlined reporting functions, and maximized process efficiency.

Certified as an ISO/IEC 27001: Information Security Management Systems (ISMS) Lead Implementer, Data Protection Officer, and Cyber Risks Analyst, Denis brings a heightened focus on data security, privacy, and cyber resilience to every endeavor.

His expertise extends across a diverse spectrum of reporting, database, and web development applications, underpinned by an exceptional grasp of data storage and virtualization technologies. His proficiency in application testing, database administration, and data cleansing ensures seamless execution of complex projects.

What sets Denis apart is his comprehensive understanding of Business and Systems Analysis technologies, honed through involvement in all phases of the Software Development Lifecycle (SDLC). From meticulous requirements gathering to precise analysis, innovative design, rigorous development, thorough testing, and successful implementation, he has consistently delivered exceptional results.

Throughout his career, he has taken on multifaceted roles, from leading technical project management teams to owning solutions that drive operational excellence. His conscientious and proactive approach is unwavering, whether he is working independently or collaboratively within a team. His ability to connect with colleagues on a personal level underscores his commitment to fostering a harmonious and productive workplace environment.

Date: May 29, 2024

Tags: Information Security, ISO/IEC 27001, ISO/IEC 42001, Artificial Intelligence, GDPR

-------------------------------------------------------------------------------

Find out more about ISO training and certification services

Training: ISO/IEC 27001 Information Security Management System - EN | PECB

ISO/IEC 42001 Artificial Intelligence Management System - EN | PECB

General Data Protection Regulation (GDPR) - Training Courses - EN | PECB

Webinars: https://pecb.com/webinars

Article: https://pecb.com/article

-------------------------------------------------------------------------------

For more information about PECB:

Website: https://pecb.com/

LinkedIn: https://www.linkedin.com/company/pecb/

Facebook: https://www.facebook.com/PECBInternational/

Slideshare: http://www.slideshare.net/PECBCERTIFICATION

Exploiting Artificial Intelligence for Empowering Researchers and Faculty, In...

Exploiting Artificial Intelligence for Empowering Researchers and Faculty, In...Dr. Vinod Kumar Kanvaria

Exploiting Artificial Intelligence for Empowering Researchers and Faculty,

International FDP on Fundamentals of Research in Social Sciences

at Integral University, Lucknow, 06.06.2024

By Dr. Vinod Kumar KanvariaA Survey of Techniques for Maximizing LLM Performance.pptx

A Survey of Techniques for Maximizing LLM Performance

BÀI TẬP BỔ TRỢ TIẾNG ANH 8 CẢ NĂM - GLOBAL SUCCESS - NĂM HỌC 2023-2024 (CÓ FI...

BÀI TẬP BỔ TRỢ TIẾNG ANH 8 CẢ NĂM - GLOBAL SUCCESS - NĂM HỌC 2023-2024 (CÓ FI...Nguyen Thanh Tu Collection

https://app.box.com/s/y977uz6bpd3af4qsebv7r9b7s21935vdclinical examination of hip joint (1).pdf

described clinical examination all orthopeadic conditions .

Chapter 4 - Islamic Financial Institutions in Malaysia.pptx

Chapter 4 - Islamic Financial Institutions in Malaysia.pptxMohd Adib Abd Muin, Senior Lecturer at Universiti Utara Malaysia

This slide is special for master students (MIBS & MIFB) in UUM. Also useful for readers who are interested in the topic of contemporary Islamic banking.

Introduction to AI for Nonprofits with Tapp Network

Dive into the world of AI! Experts Jon Hill and Tareq Monaur will guide you through AI's role in enhancing nonprofit websites and basic marketing strategies, making it easy to understand and apply.

Digital Artifact 1 - 10VCD Environments Unit

Digital Artifact 1 - 10VCD Environments Unit - NGV Pavilion Concept Design

A Strategic Approach: GenAI in Education

Artificial Intelligence (AI) technologies such as Generative AI, Image Generators and Large Language Models have had a dramatic impact on teaching, learning and assessment over the past 18 months. The most immediate threat AI posed was to Academic Integrity with Higher Education Institutes (HEIs) focusing their efforts on combating the use of GenAI in assessment. Guidelines were developed for staff and students, policies put in place too. Innovative educators have forged paths in the use of Generative AI for teaching, learning and assessments leading to pockets of transformation springing up across HEIs, often with little or no top-down guidance, support or direction.

This Gasta posits a strategic approach to integrating AI into HEIs to prepare staff, students and the curriculum for an evolving world and workplace. We will highlight the advantages of working with these technologies beyond the realm of teaching, learning and assessment by considering prompt engineering skills, industry impact, curriculum changes, and the need for staff upskilling. In contrast, not engaging strategically with Generative AI poses risks, including falling behind peers, missed opportunities and failing to ensure our graduates remain employable. The rapid evolution of AI technologies necessitates a proactive and strategic approach if we are to remain relevant.

Assessment and Planning in Educational technology.pptx

In an education system, it is understood that assessment is only for the students, but on the other hand, the Assessment of teachers is also an important aspect of the education system that ensures teachers are providing high-quality instruction to students. The assessment process can be used to provide feedback and support for professional development, to inform decisions about teacher retention or promotion, or to evaluate teacher effectiveness for accountability purposes.

Recently uploaded (20)

Pride Month Slides 2024 David Douglas School District

Pride Month Slides 2024 David Douglas School District

The simplified electron and muon model, Oscillating Spacetime: The Foundation...

The simplified electron and muon model, Oscillating Spacetime: The Foundation...

Liberal Approach to the Study of Indian Politics.pdf

Liberal Approach to the Study of Indian Politics.pdf

How to Manage Your Lost Opportunities in Odoo 17 CRM

How to Manage Your Lost Opportunities in Odoo 17 CRM

Digital Artefact 1 - Tiny Home Environmental Design

Digital Artefact 1 - Tiny Home Environmental Design

ISO/IEC 27001, ISO/IEC 42001, and GDPR: Best Practices for Implementation and...

ISO/IEC 27001, ISO/IEC 42001, and GDPR: Best Practices for Implementation and...

Exploiting Artificial Intelligence for Empowering Researchers and Faculty, In...

Exploiting Artificial Intelligence for Empowering Researchers and Faculty, In...

A Survey of Techniques for Maximizing LLM Performance.pptx

A Survey of Techniques for Maximizing LLM Performance.pptx

BÀI TẬP BỔ TRỢ TIẾNG ANH 8 CẢ NĂM - GLOBAL SUCCESS - NĂM HỌC 2023-2024 (CÓ FI...

BÀI TẬP BỔ TRỢ TIẾNG ANH 8 CẢ NĂM - GLOBAL SUCCESS - NĂM HỌC 2023-2024 (CÓ FI...

Chapter 4 - Islamic Financial Institutions in Malaysia.pptx

Chapter 4 - Islamic Financial Institutions in Malaysia.pptx

Introduction to AI for Nonprofits with Tapp Network

Introduction to AI for Nonprofits with Tapp Network

Film vocab for eal 3 students: Australia the movie

Film vocab for eal 3 students: Australia the movie

Assessment and Planning in Educational technology.pptx

Assessment and Planning in Educational technology.pptx

Fin 401 Teaching Effectively--tutorialrank.com

- 1. FIN 401 Module 1 Assignment 3 Ratio Analysis (100 Score) For more course tutorials visit www.tutorialrank.com By monday, February 23, 2015 solve the problem below, calculate the ratios, interpret the results against the industry average, and fill in the table on the worksheet. Then, provide an analysis of how those results can be used by the business to improve its performance. Balance Sheet as of December 31, 2010 Gary and Company Cash $45 Accounts payables $45 Receivables 66 Notes payables 45 Inventory 159 Other current liabilities 21 Marketable securities 33 Total current liabilities $111 Total current assets $303 Net fixed assets 147 Long Term Liabilities Total Assets $450 Long-term debt 24 Total Liabilities $135

- 2. Owners Equity Common stock $114 Retained earnings 201 Total stockholders’ equity 315 Total liabilities and equity $450 Income Statement Year 2010 Net sales $795 Cost of goods sold 660 Gross profit 135 Selling expenses 73.5 Depreciation 12 EBIT 49.5 Interest expense 4.5 EBT 45 Taxes (40%) 18 Net income 27

- 3. 1. Calculate the following ratios AND interpret the result against the industry average: Ratio Your Answer Industry Average Your Interpretation (Good-Fair-Low-Poor) Profit margin on sales 3% Return on assets 9% Receivable turnover 16X Inventory turnover 10X Fixed asset turnover 2X Total asset turnover 3X Current ratio 2X Quick ratio 1.5X Times interest earned 7X 2. Analysis: Give your interpretation of what the ratios calculations show and how the business can use this information to improve its performance. Justify all answers.

- 4. Highlight your answers. Receivable turnover requires the use of credit sales. Since you are not given this number please use the sales figure of 795. I am pasting the required form for you to complete, as a reminder. Remember to show me your work. You can put the calculations at the end of your paper. If these are not included I will have to count the answer wrong. Ratio Your Answer Industry Average Your Interpretation (Good-Fair-Low-Poor) Profit margin on sales 3% Return on assets 9% Receivable turnover 1.6X Inventory turnover 10X Fixed asset turnover 2X Total asset turnover 3X Current ratio 2X Quick ratio 1.5X ********************************************************* FIN 401 Module 2 Assignment 2 Cash Management (100 Score)

- 5. For more course tutorials visit www.tutorialrank.com Norma’s Cat Food of Shell Knob ships cat food throughout the country. Norma has determined that through the establishment of local collection centers around the country, she can speed up the collection of payments by two and one-half days. Furthermore, the cash management department of her bank has indicated to her that she can defer her payments on her accounts by one-half day without affecting suppliers. The bank has a remote disbursement center in Iowa. a.If the company has $5 million per day in collections and $3 million per day in disbursements, how many dollars will the cash management system free up? Justify your answers. b.If the company can earn 8 percent per annum on freed-up funds, how much will the income be? Justify your answers. c.If the annual cost of the new system is $800,000, should it be implemented? Explain why or why not. *********************************************************

- 6. FIN 401 Module 3 Assignment 2 LASA 1 The Time Value of Money (100 Score) For more course tutorials visit www.tutorialrank.com Mary has been working for a university for almost 25 years and is now approaching retirement. She wants to address several financial issues before her retirement and has asked you to help her resolve the situations below. Her assignment to you is to provide a 4-5 page report, addressing each of the following issues separately. You are to show all your calculations and provide a detailed explanation for each issue. Issue A: For the last 19 years, Mary has been depositing $500 in her savings account , which has earned 5% per year, compounded annually and is expected to continue paying that amount. Mary will make one more $500 deposit one year from today. If Mary closes the account right after she makes the last deposit, how much will this account be worth at that time? Issue B: Mary has been working at the university for 25 years, with an excellent record of service. As a result, the board wants to reward her with a bonus to her retirement package. They are offering her $75,000 a year

- 7. for 20 years, starting one year from her retirement date and each year for 19 years after that date. Mary would prefer a one-time payment the day after she retires. What would this amount be if the appropriate interest rate is 7%? Issue C: Mary’sreplacement is unexpectedly hired away by another school, and Mary is asked to stay in her position for another three years. The board assumes the bonus should stay the same, but Mary knows the present value of her bonus will change. What would be the present value of her deferred annuity? Issue D: Mary wants to help pay for her granddaughter Beth’s education. She has decided to pay for half of the tuition costs at State University, which are now $11,000 per year. Tuition is expected to increase at a rate of 7% per year into the foreseeable future. Beth just had her 12th birthday. Beth plans to start college on her 18th birthday and finish in four years. Mary will make a deposit today and continue making deposits each year until Beth starts college. The account will earn 4% interest, compounded annually. How much must Mary’s deposits be each year in order to pay half of Beth’s tuition at the beginning of each school each year? *********************************************************

- 8. FIN 401 Module 4 Assignment 2 The Weighted Average Cost of Capital (100 Score) For more course tutorials visit www.tutorialrank.com Coogly Company is attempting to identify its weighted average cost of capital for the coming year and has hired you to answer some questions they have about the process. They have asked you to present this information in a PowerPoint presentation to the company’s management team. The company would like for you to keep your presentation to approximately 10 slides and use the notes section in PowerPoint to clarify your point. Your presentation should address the following questions and offer a final recommendation to Coogly. Make sure you support your answers and clearly explain the advantages and disadvantages of utilizing the weighted average cost of capital methodology. Include at least one graph or chart in your presentation. Company Information The capital structure for the firm will be maintained and is now 10% preferred stock, 30% debt, and 60% new common stock. No retained earnings are available. The marginal tax rate for the firm is 40%. 1. Coogly has outstanding preferred stock That pays a dividend of $4 per share and sells for $82 per share, with a floatation cost of $6 per share. What is the component cost for Coogly's preferred stock? What are the advantages and disadvantages of using preferred stock in the capital structure?

- 9. 2. If the company issues new common stock, it will sell for $50 per share with a floatation cost of $9 per share. The last dividend paid was $3.80 and this dividend is expected to grow at a rate of 7% for the foreseeable future. What is the cost of new equity to the firm? What are the advantages and disadvantages of issuing new equity in the capital structure? 3. The company will use new bonds for any capital project, according to the capital structure. These bonds will have a market and par value of $1000, with a coupon rate of 6% and a floatation cost of 7%. The bonds will mature in 20 years and no other debt will be used for any new investments. What is the cost of new debt? What are the advantages and disadvantages of issuing new debt in the capital structure? 4. Given the component costs identified above and the capital structure for the firm, what is the weighted average cost of capital for Coogly? What are the advantages and disadvantages of using this method in the capital budgeting process? ********************************************************* FIN 401 Module 5 Assignment 1 LASA 2 The Capital Budgeting Decision (100 Score) For more course tutorials visit www.tutorialrank.com As a financial consultant, you have contracted with Wheel Industries to evaluate their procedures involving the evaluation of long term

- 10. investment opportunities. You have agreed to provide a detailed report illustrating the use of several techniques for evaluating capital projects including the weighted average cost of capital to the firm, the anticipated cash flows for the projects, and the methods used for project selection. In addition, you have been asked to evaluate two projects, incorporating risk into the calculations. You have also agreed to provide an 8-10 page report, in good form, with detailed explanation of your methodology, findings, and recommendations. Company Information Wheel Industries is considering a three-year expansion project, Project A. The project requires an initial investment of $1.5 million. The project will use the straight-line depreciation method. The project has no salvage value. It is estimated that the project will generate additional revenues of $1.2 million per year before tax and has additional annual costs of $600,000. The Marginal Tax rate is 35%. Required: 1. Wheel has just paid a dividend of $2.50 per share. The dividends are expected to grow at a constant rate of six percent per year forever. If the stock is currently selling for $50 per share with a 10% flotation cost, what is the cost of new equity for the firm? What are the advantages and disadvantages of using this type of financing for the firm? 2. The firm is considering using debt in its capital structure. If the market rate of 5% is appropriate for debt of this kind, what is the after tax cost of debt for the company? What are the advantages and disadvantages of using this type of financing for the firm?