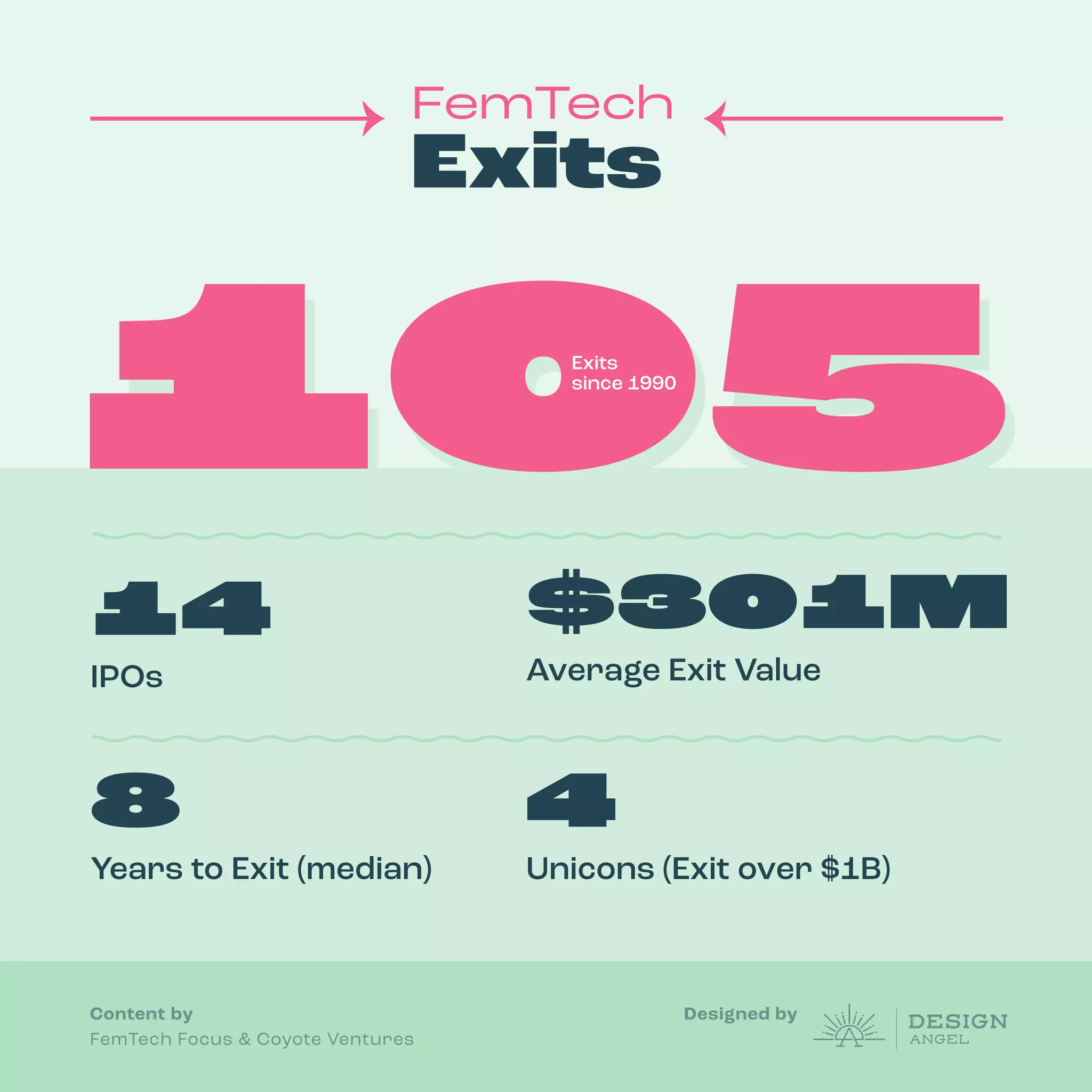

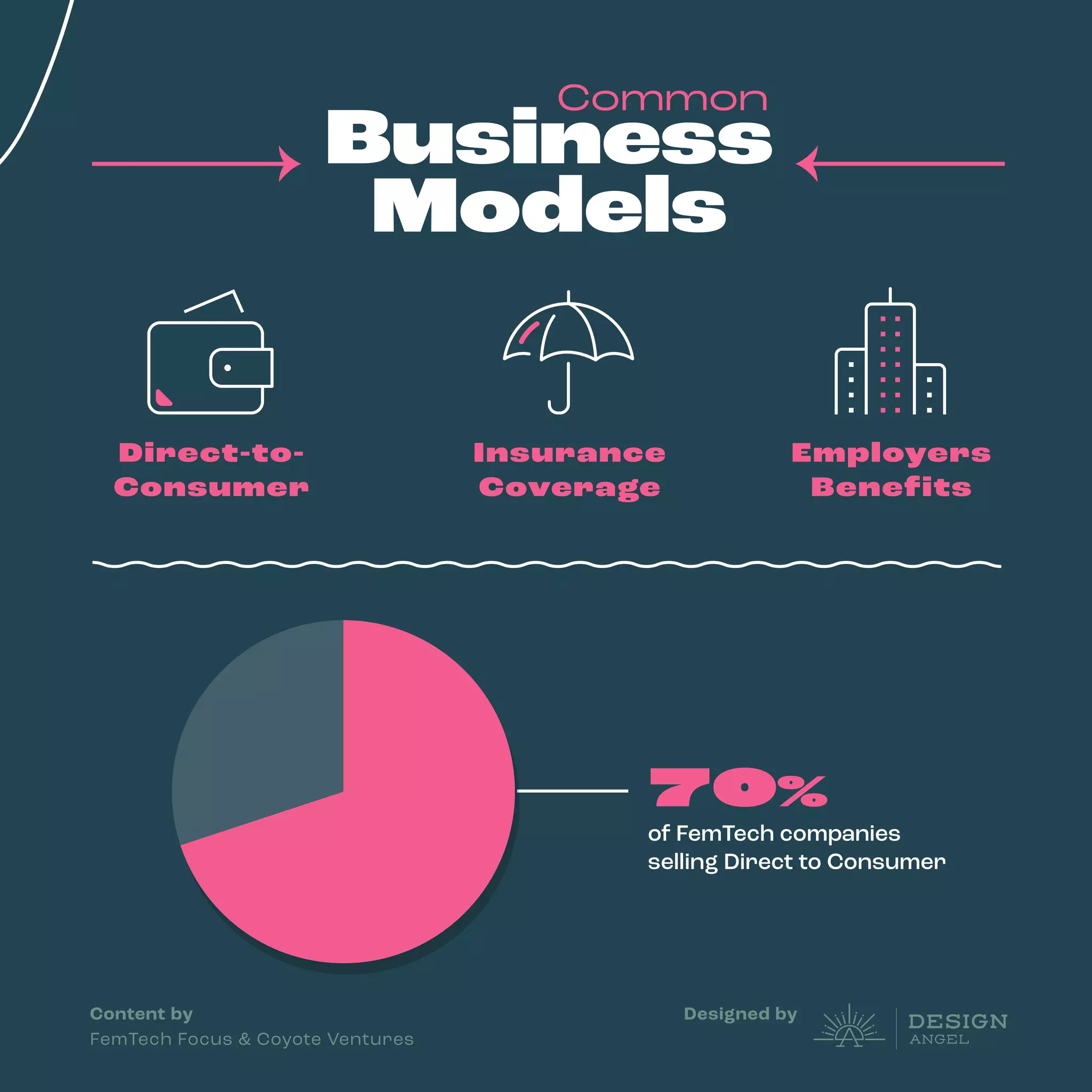

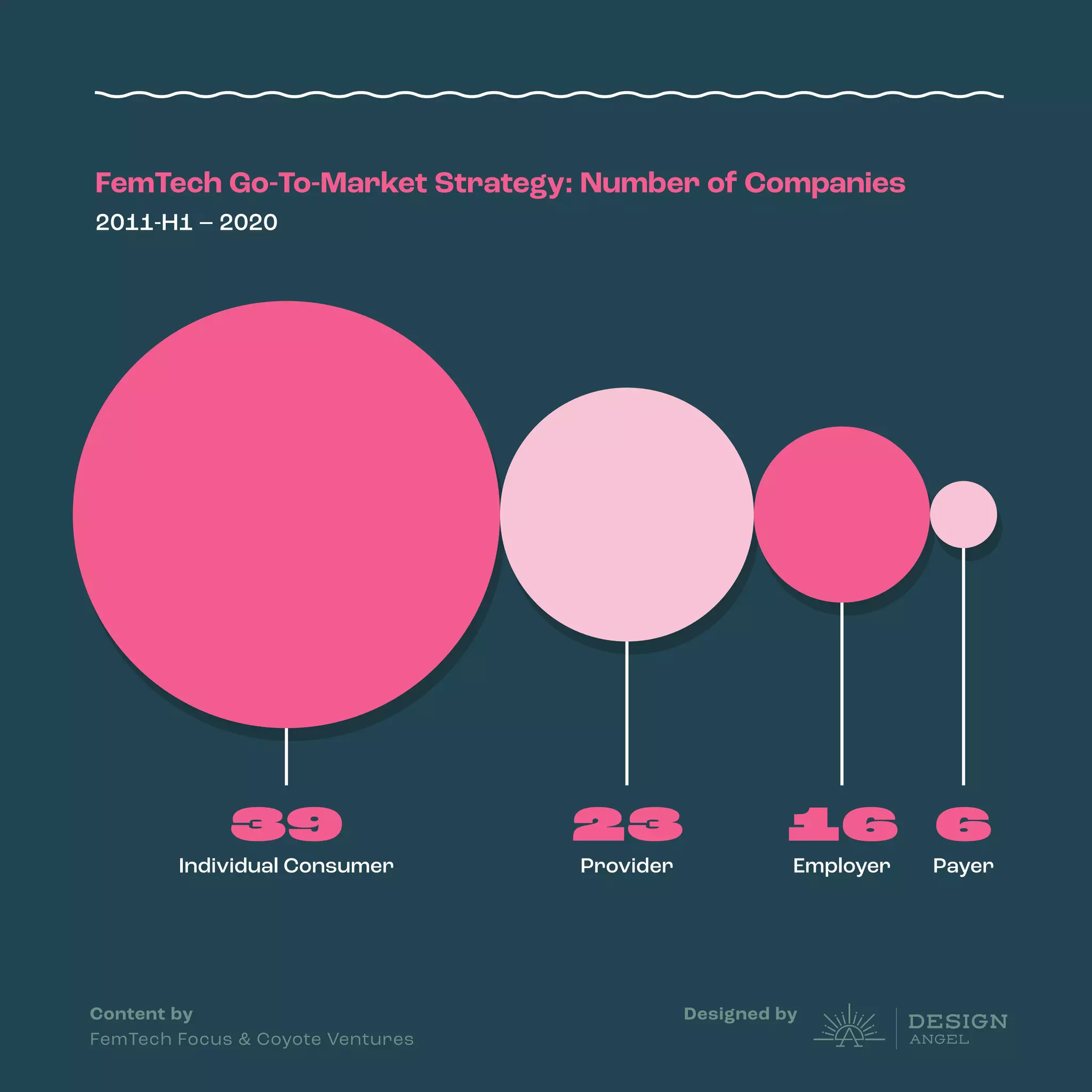

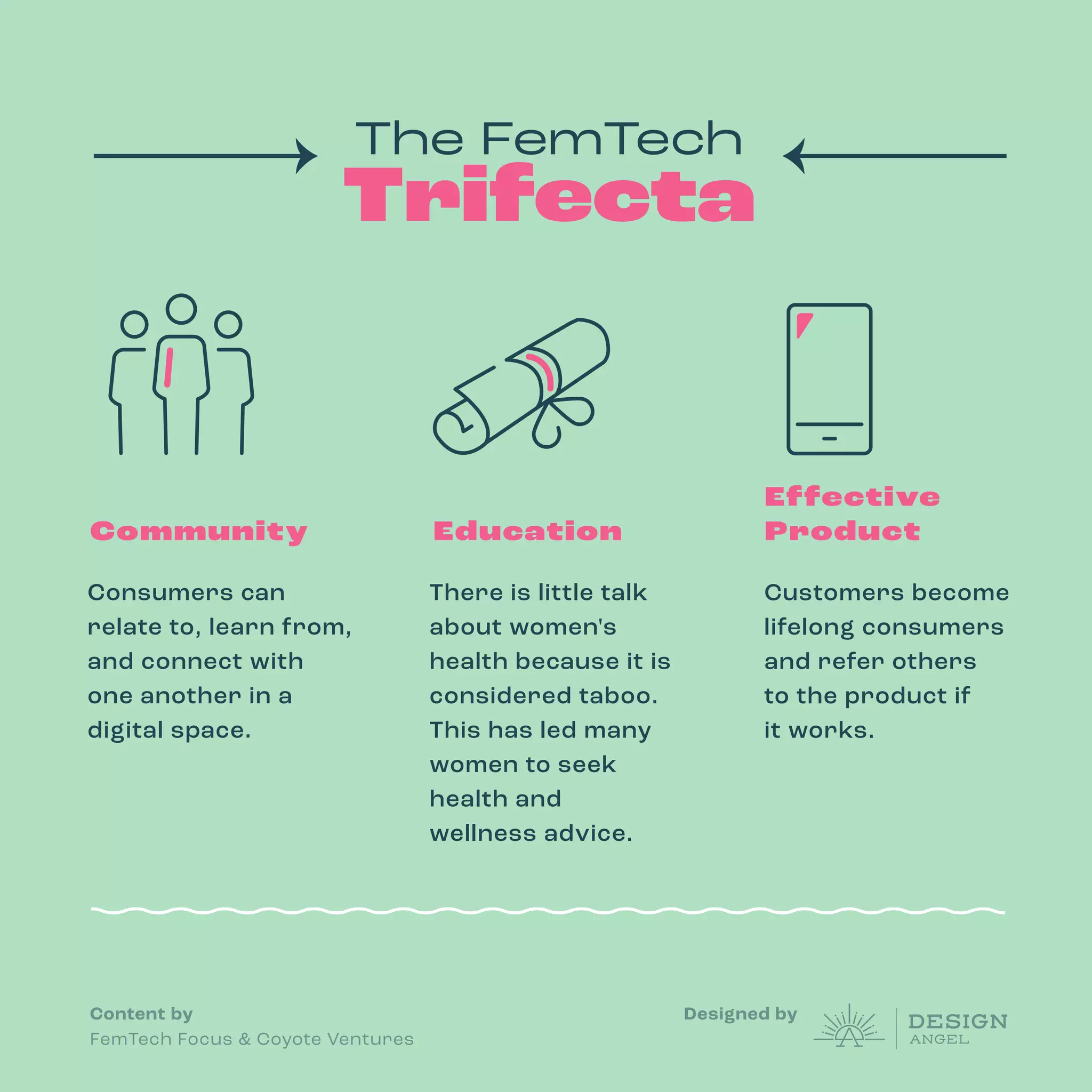

This document summarizes the FemTech landscape and market opportunities. It notes that there have been 105 FemTech exits since 1990, with an average exit value of $301 million. Most FemTech companies (70%) sell directly to consumers. The document also discusses opportunities in the FemTech space around access, education, and product effectiveness if barriers like limited insurance coverage, censorship, and high customer acquisition costs can be addressed.