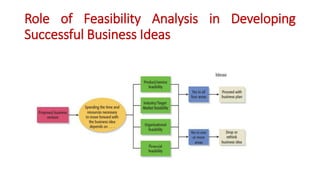

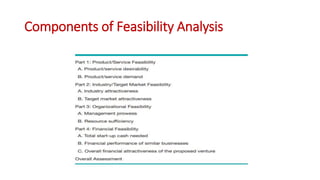

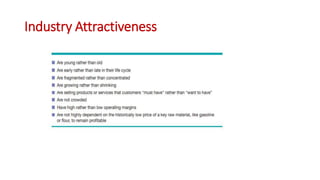

Feasibility analysis is a critical process for assessing the viability of a business idea, involving product/service feasibility, industry/target market feasibility, organizational feasibility, and financial feasibility. Each component evaluates aspects such as market demand, management capabilities, resource availability, and financial requirements necessary for the proposed business. Skipping feasibility analysis can lead to pursuing nonviable business ideas, making it essential for entrepreneurs to conduct thorough assessments before development.