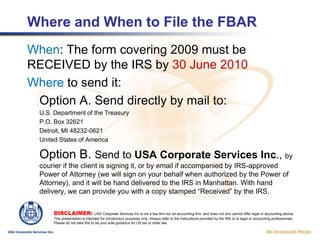

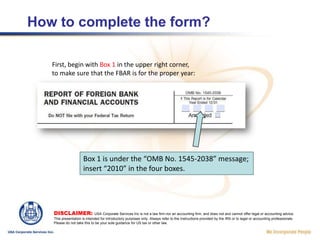

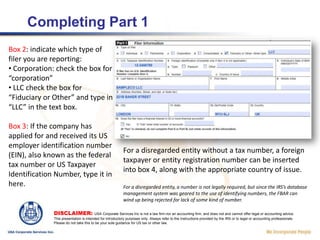

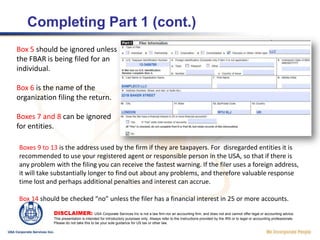

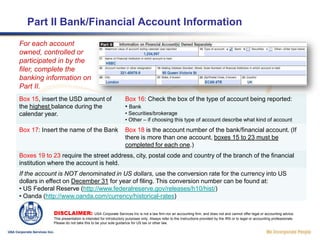

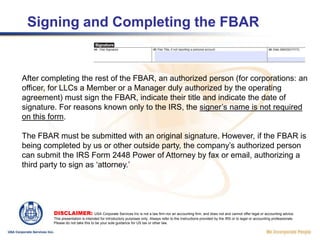

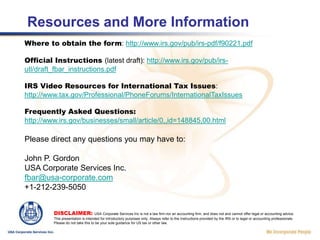

The FBAR is an annual report that must be filed by US entities and individuals to disclose foreign bank accounts over $10,000. It is due by June 30th and must be filed with the US Department of Treasury. The presentation reviews how to complete the FBAR form, including providing identifying information in Part 1, listing foreign bank account details in Part 2, signing the form, and available resources for filing.