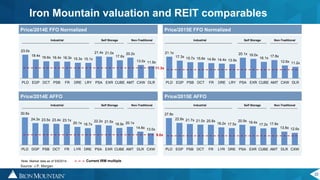

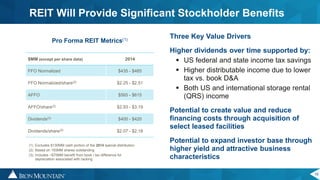

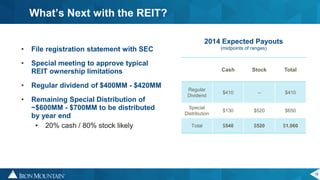

Iron Mountain plans to convert to a REIT to enhance stockholder returns. As a REIT, it will be able to acquire leased facilities, broaden its investor base, and increase valuations. It expects to significantly increase its annual dividend for stockholders. The conversion is on track for 2014 and Iron Mountain will be able to execute its strategy within the REIT framework using its global real estate footprint.

![17

(1) Adjusted to reflect planned conversion to a REIT in 2014

(2) Includes 0% - 2% internal revenue growth

(3) Excludes approximately $6 million of charges related to the company’s organizational realignment and includes on-going REIT compliance costs of approximately $15 million

(4) Assumes 193 million shares outstanding

(5) Includes ~$6 million for the relocation of the Boston headquarters and $5 million of REIT conversion CapEx

(6) Includes ~$40MM associated with the expansion of our data center capacity

($MM)) Initial Guidance C$ Growth Adjusted Guidance(1) C$ Growth

Revenues $3,090 - $3,170 2% - 4%(2) $3,090 - $3,170 2% - 4%(2)

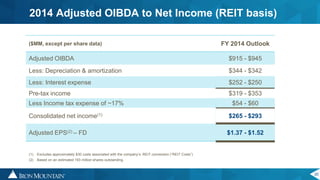

Adjusted OIBDA(3)

$930 - $960 2% - 5% $915- $945 0% - 3%

Adjusted EPS(3) – FD $1.03 - $1.14 $1.37 – $1.52(4)

Investments:

Capex (ex RE)(5)

~$245 ~$250

Real Estate(6)

~$90 ~$90

Free Cash Flow (ex: RE) $300 - $340 $350 - $390

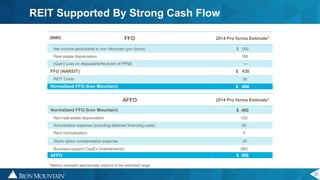

FFO [Normalized] $435 - $485

AFFO $565 - $615

Dividends ~$207 $400 - $420

2014 – Adjustments to Guidance](https://image.slidesharecdn.com/favorableoutcomepresentation062514final-nonotes-140626045627-phpapp01/85/Favorable-Outcome-Presentation-06-25-14-final-17-320.jpg)