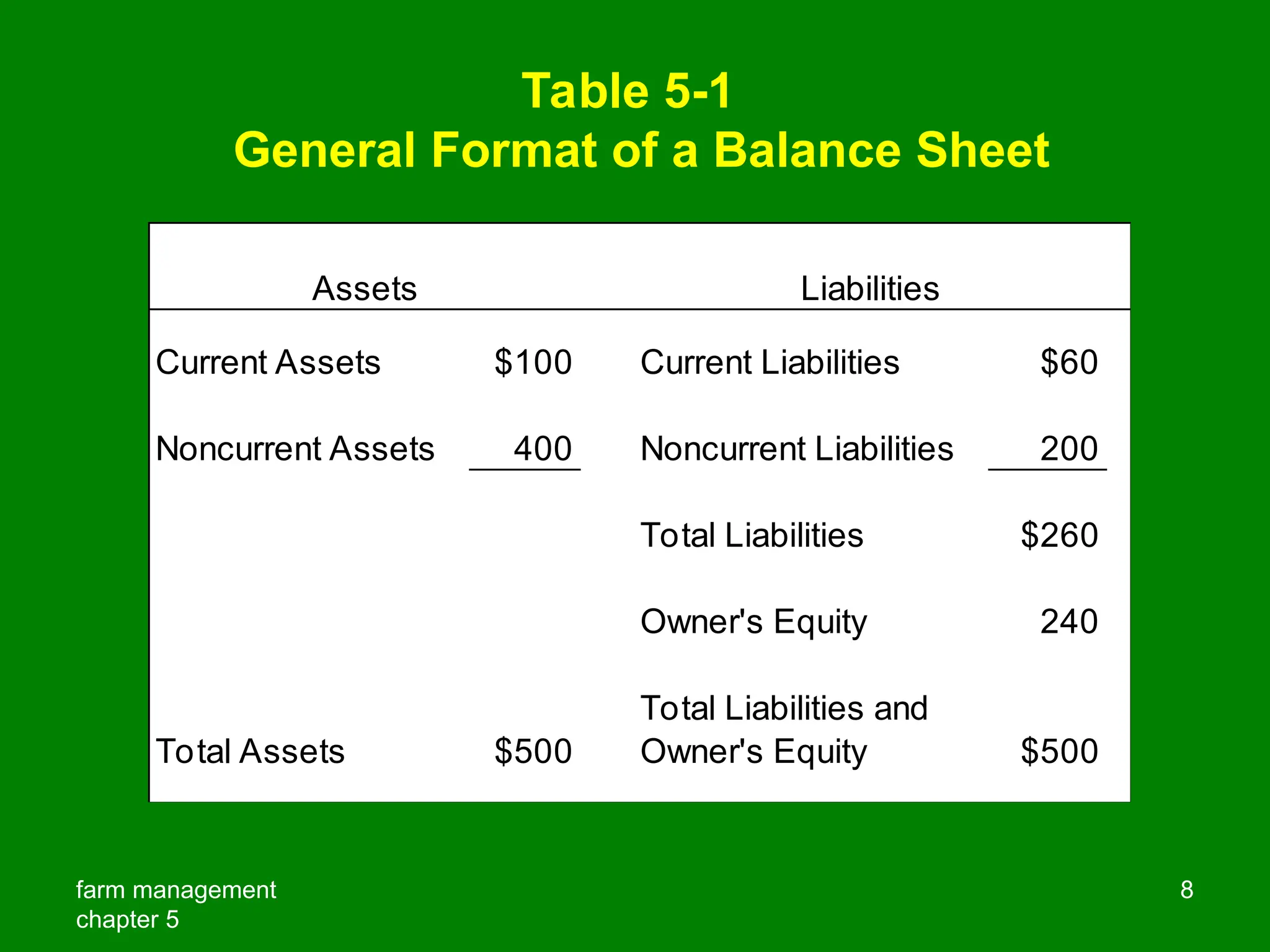

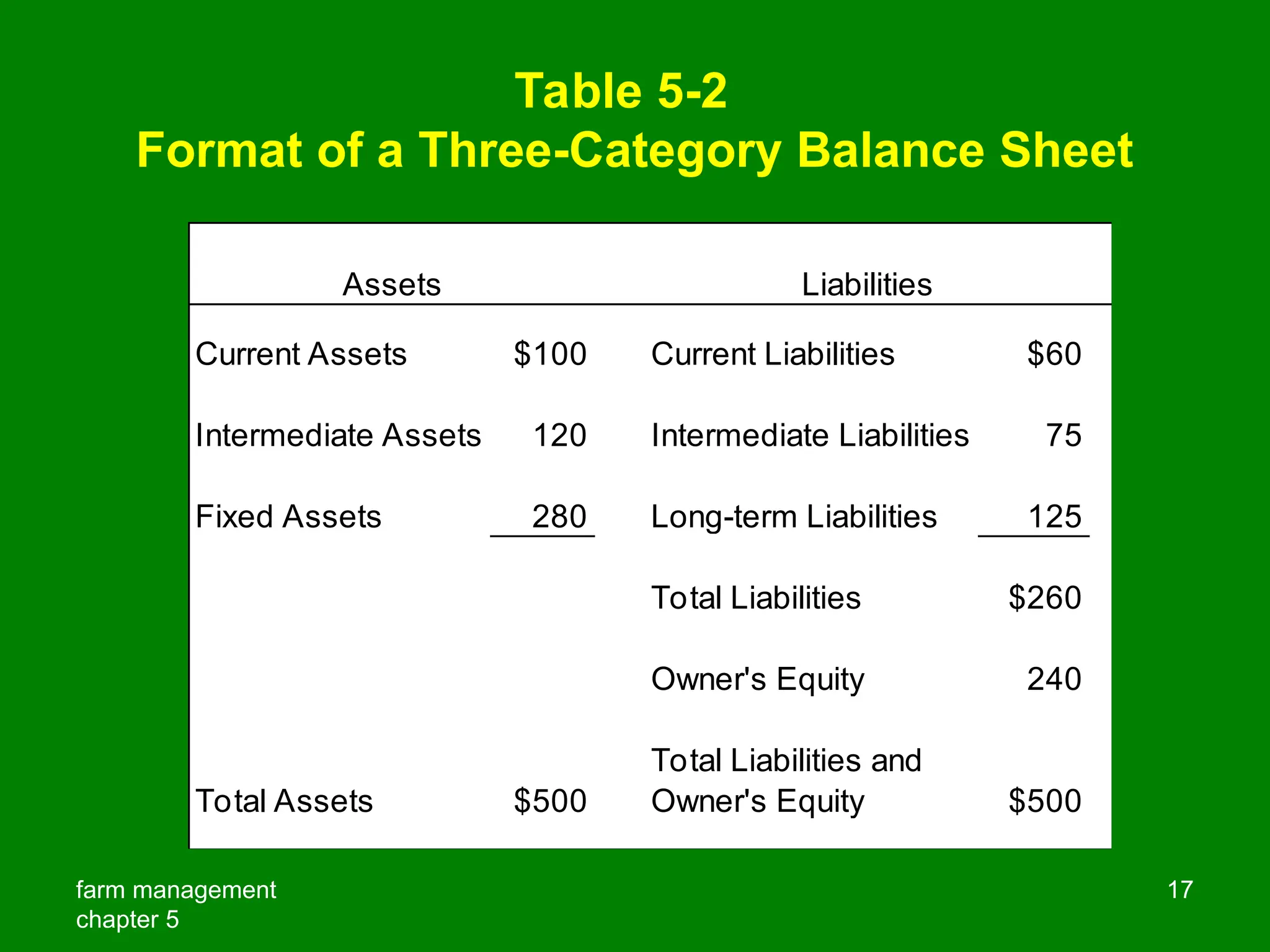

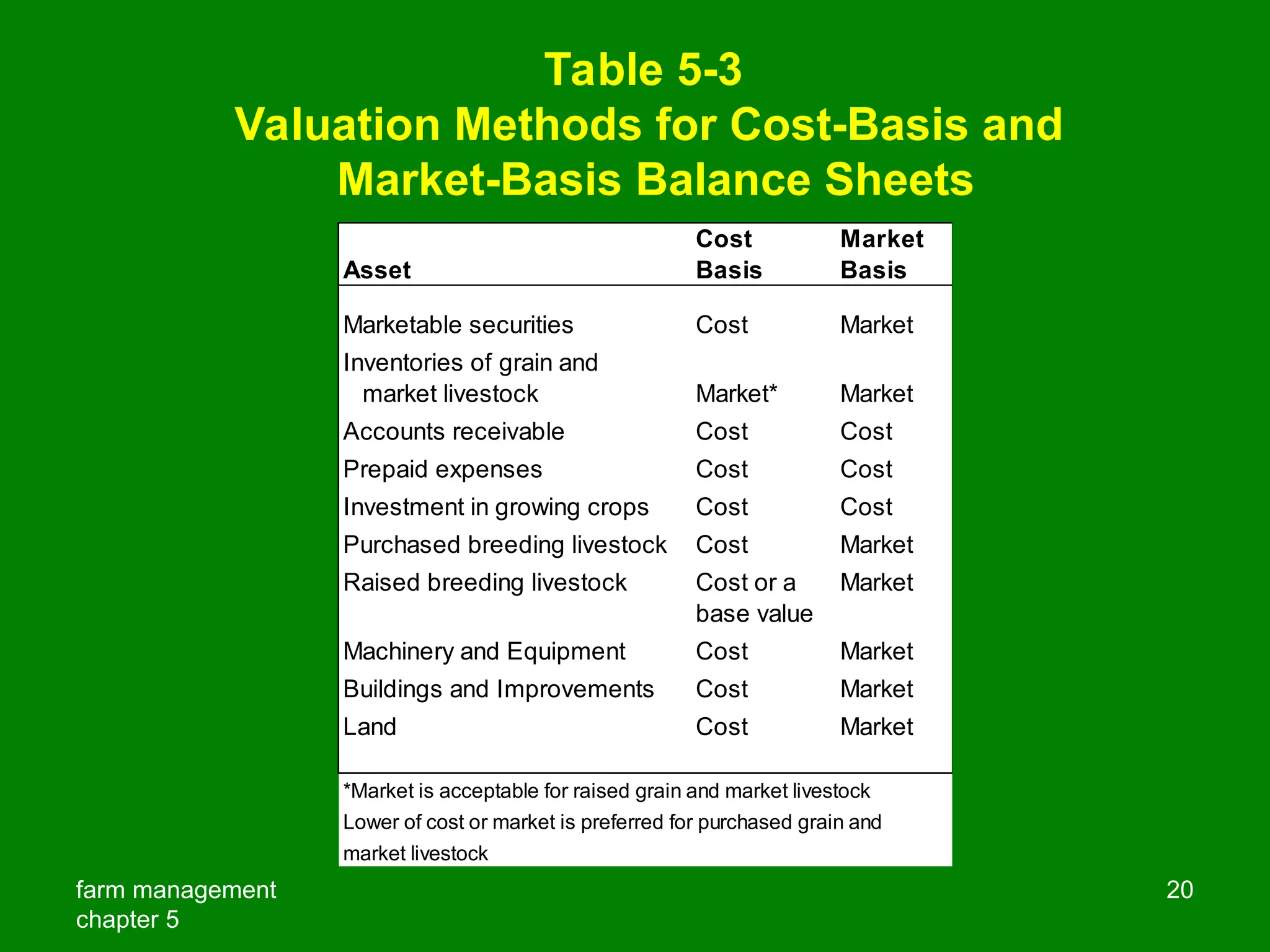

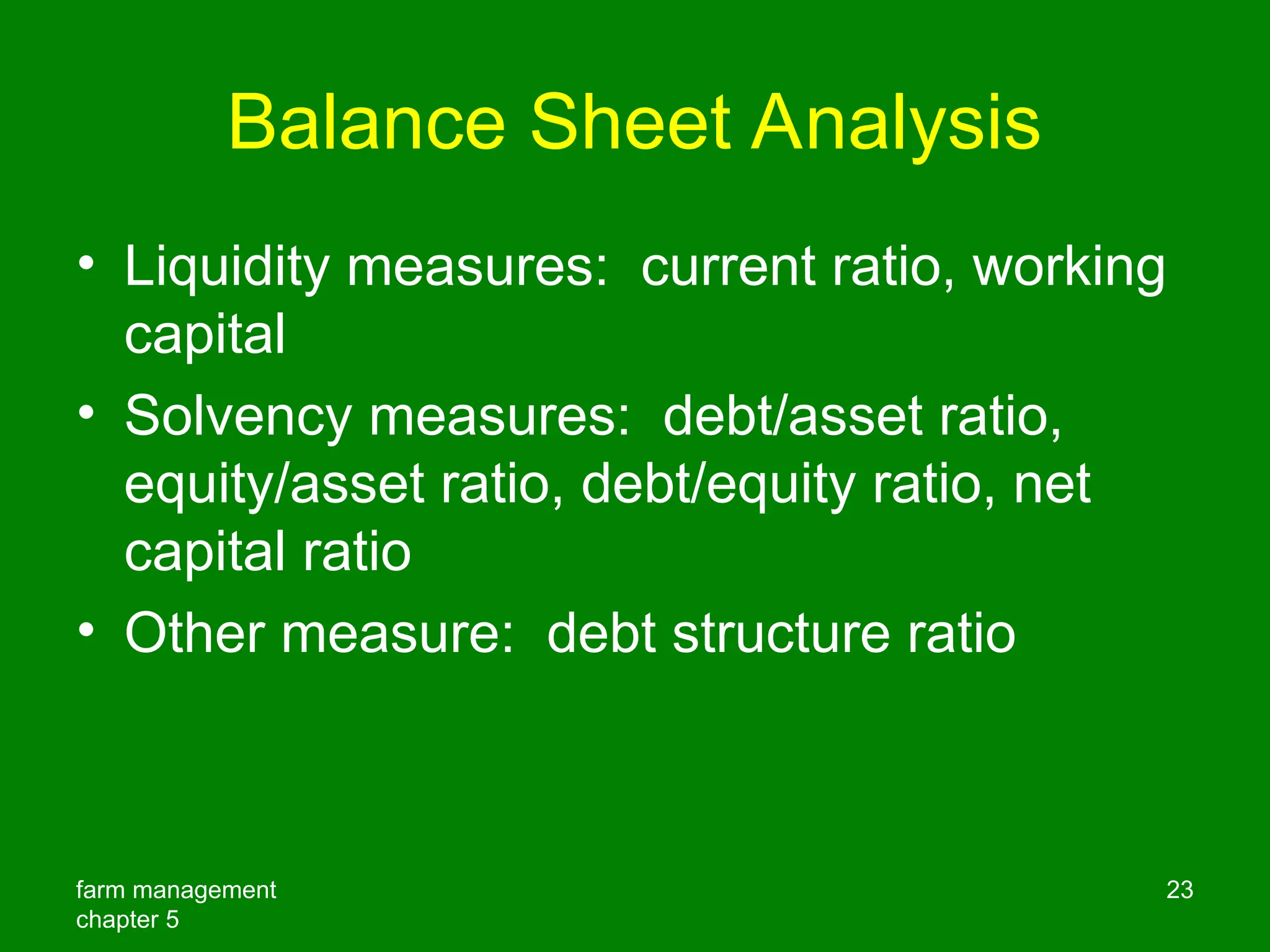

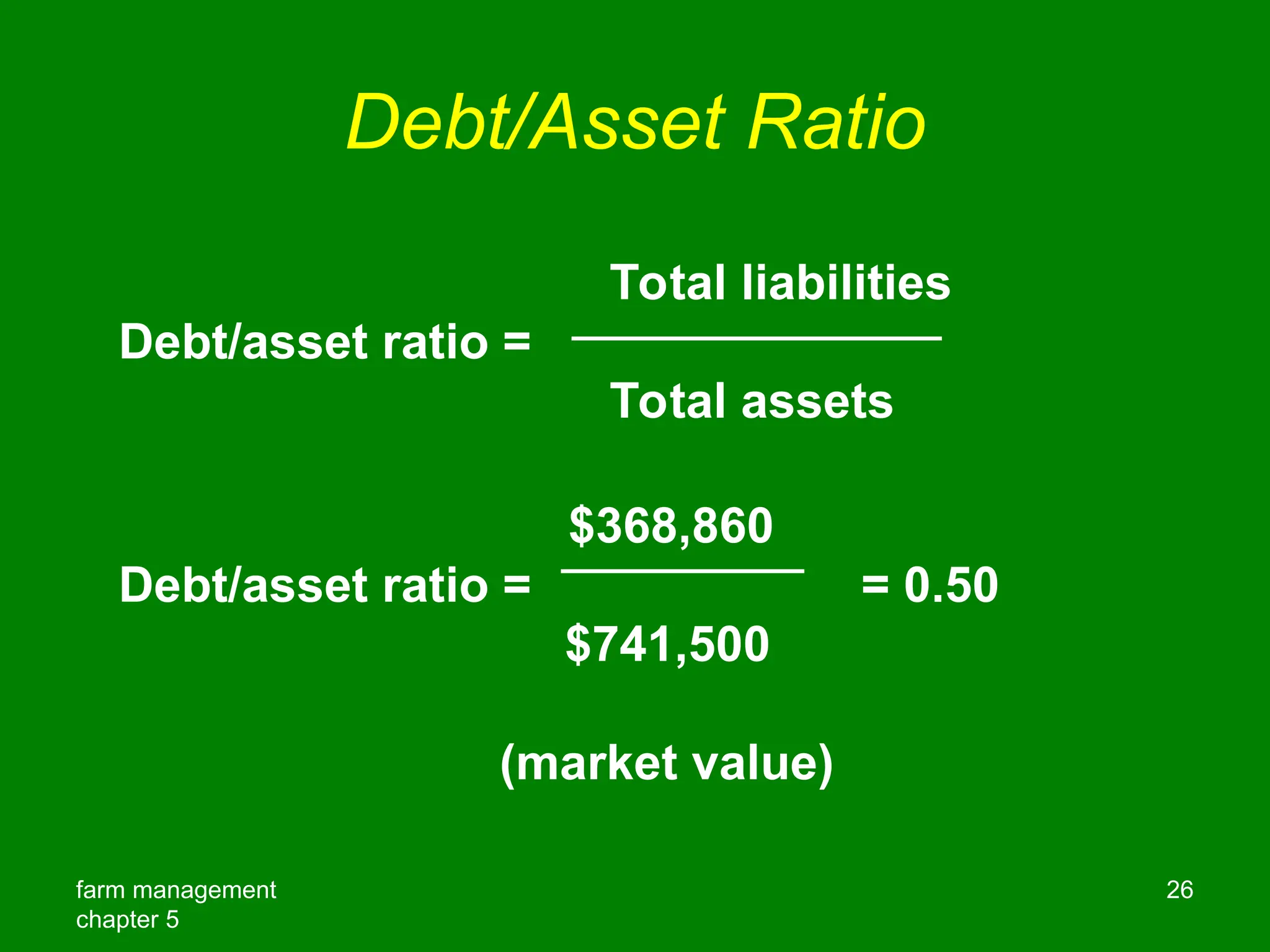

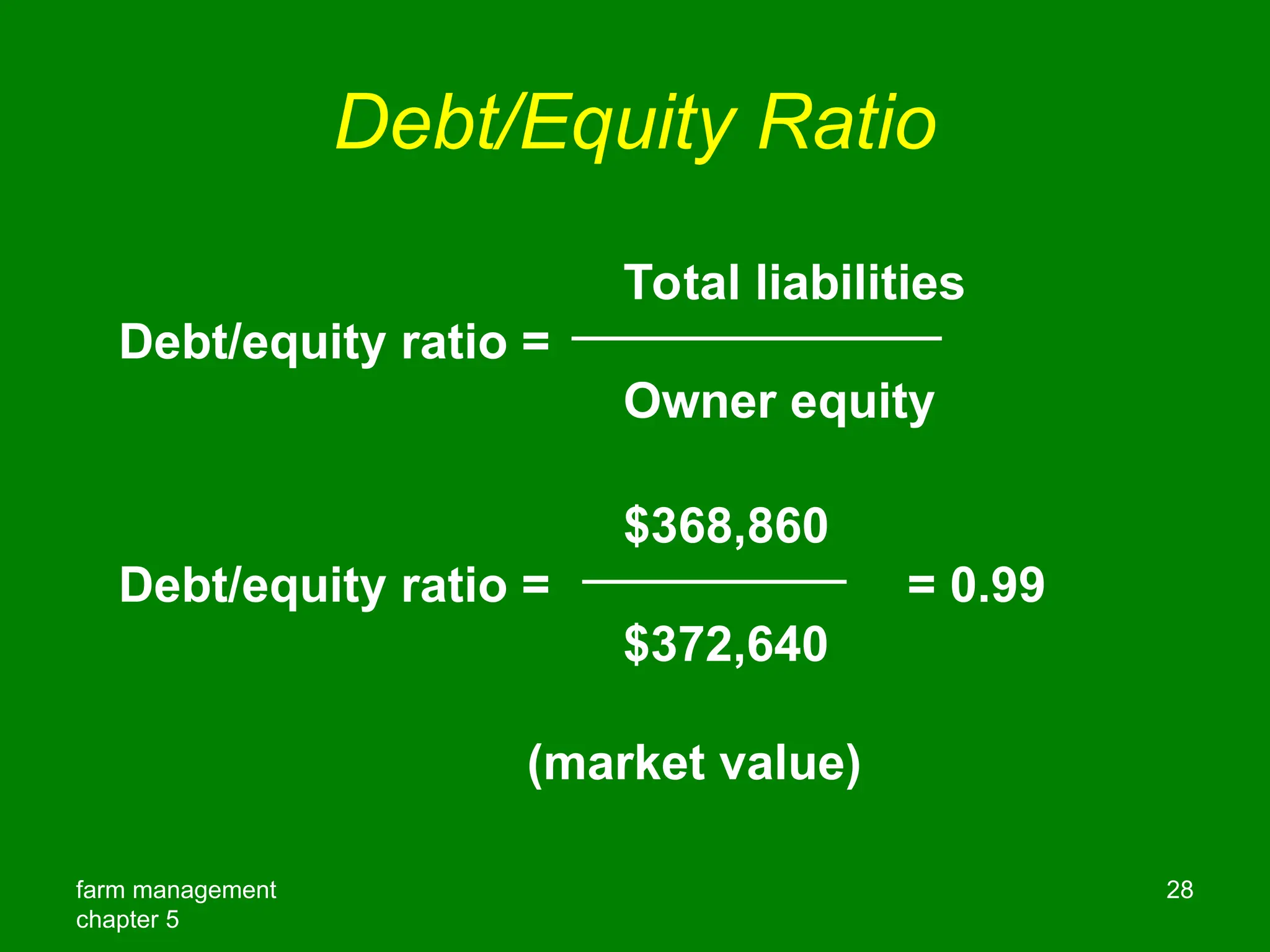

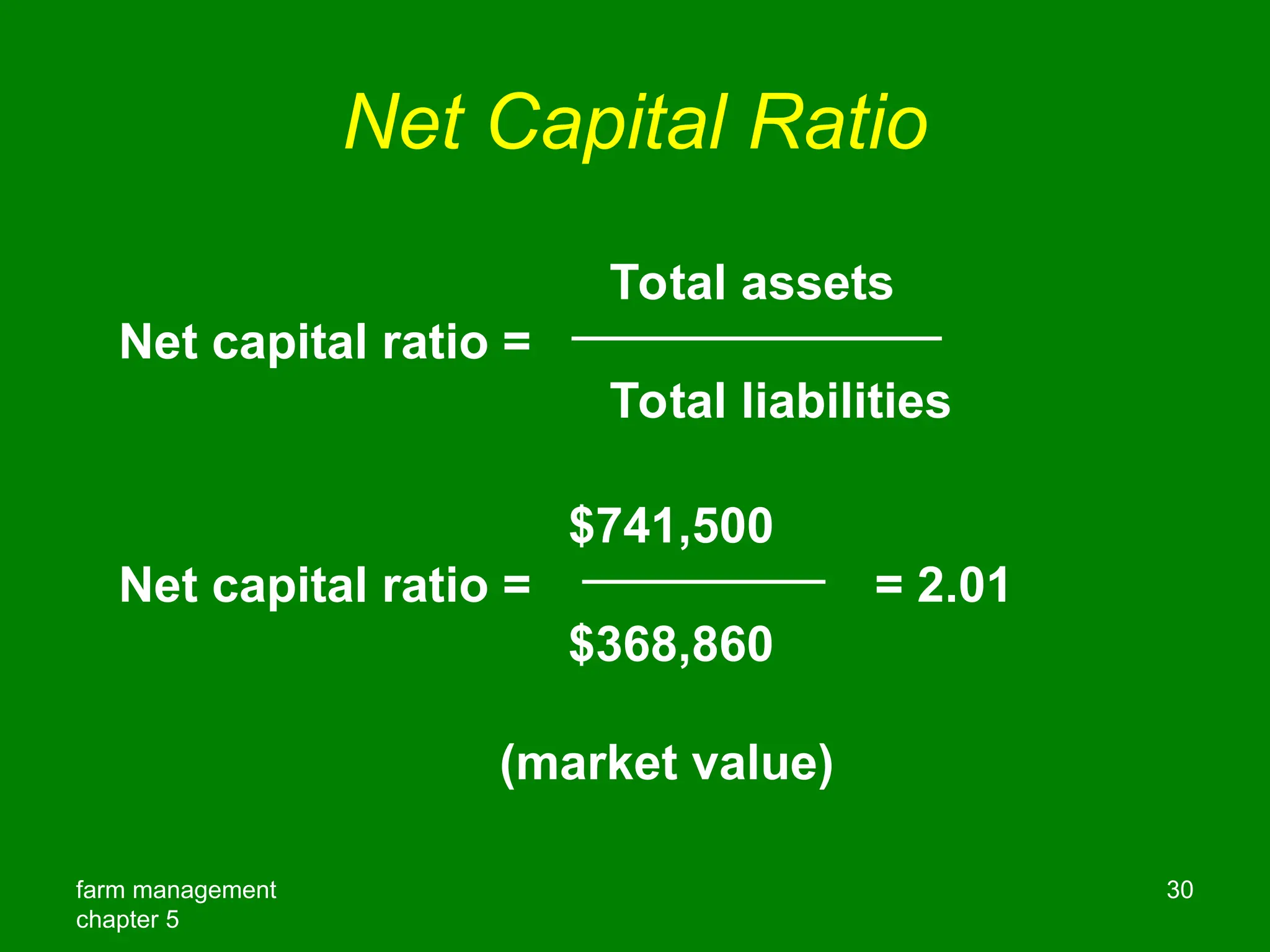

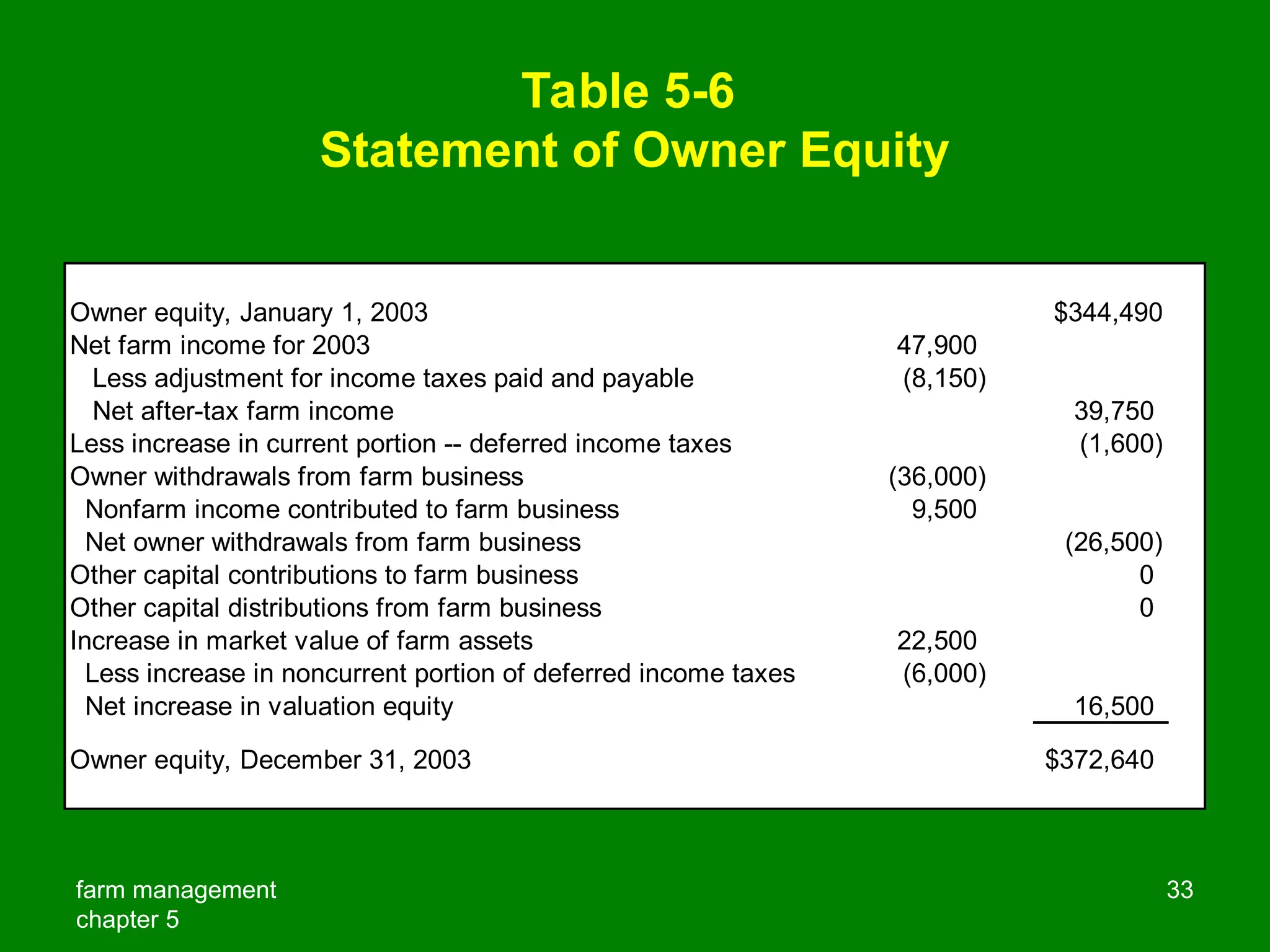

The document details the purpose, structure, and analysis of a balance sheet in farm management, highlighting the importance of asset valuation and the distinction between cost and market basis. It outlines the significance of owner equity, liquidity, and solvency measures, alongside examples of balance sheet formats and asset classifications. Additionally, it emphasizes the necessity of including a statement of owner equity in financial records to track changes over time.