This document provides information to help students study for the ACCA F9 Financial Management exam. It outlines what the exam covers, the skills required, and how to improve exam chances. The F9 exam tests knowledge of investment, financing and dividend policy decisions. Students must be able to perform calculations, interpret data, explain techniques, and apply skills to practical contexts. Practicing varied questions under timed conditions is emphasized as essential exam preparation. Answering Section C questions requires focused, organization-specific responses based on provided scenarios.

![176 8: Investment appraisal using DCF methods Part D Investment appraisal

Answers to Quick Quiz

1 FV = PV (1 + r)n

2 PV = FV n

r)

(1

1

3 (a) A cash outlay to be incurred at the beginning of an investment project occurs in year 0.

(b) A cash outlay, saving or inflow which occurs during the course of a time period is assumed to

occur all at once at the end of the time period.

(c) A cash outlay or receipt that occurs at the beginning of a time period is taken to occur at the end of

the time period.

4 Annual cash flow/discount rate

5 (a) It takes account of the time value of money.

(b) It uses all cash flows relating to a project.

(c) It allows for the timing of cash flows.

6 D 15% + {(3,670/[3,670 + 1,390]) 3%} = 17.2%

7 (a) Included

(b) Not included (non-cash)

(c) Not included (past cost)

(d) Not included (included in the discount rate)

Now try the questions below from the Practice Question Bank

Number Level Marks Approximate time

Section A Q18 Examination 2 4 mins

Section C Q6 Introductory N/A 39 mins

Section C Q7 Examination 20 39 mins

Section C Q8 Introductory N/A 39 mins

www.facebook.com/ng-books

ng-books.blogspot.com

n

g

-

b

o

o

k

s

.

b

l

o

g

s

p

o

t

.

c

o

m](https://image.slidesharecdn.com/f9financialmanagement-studytext2016-2017-220618221639-e43e6ffa/85/F9-Financial-Management-Study-Text-2016-2017-pdf-201-320.jpg)

![Part D Investment appraisal 10: Project appraisal and risk 199

A computer would calculate the NPV many times over using the values established in this way with more

random numbers, and the results would be analysed to provide the following.

(a) An expected NPV for the project

(b) A statistical distribution pattern for the possible variation in the NPV above or below this average

The decision whether to go ahead with the project would then be made on the basis of expected return

and risk.

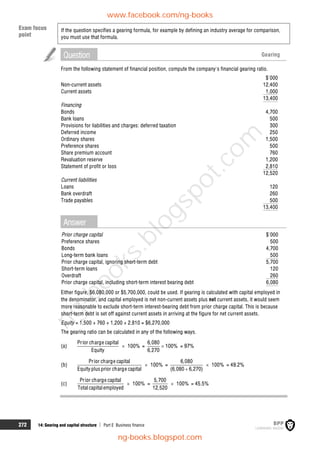

4.3 Discounted payback (adjusted payback)

The discounted payback period (DPP) is the time it will take before a project's cumulative NPV turns from

being negative to being positive.

The payback method of investment appraisal, discussed in Chapter 7, recognises uncertainty in

investment decisions by focusing on the near future. Short-term projects are preferred to long-term

projects and liquidity is emphasised.

The discounted payback period is the length of time before the cumulative PV of cash inflows from the

projects begins to exceed the initial outflow. It is similar to the payback method, but uses discounted cash

flows rather than non-discounted cash flows to measure the payback period.

Discounted payback uses discounted cash flows. This is also known as adjusted payback.

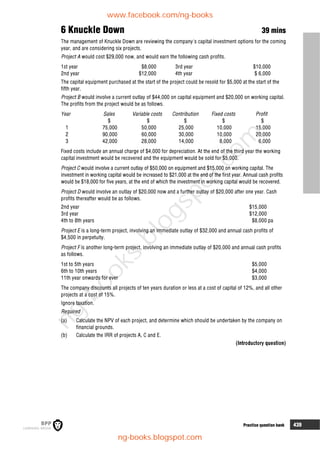

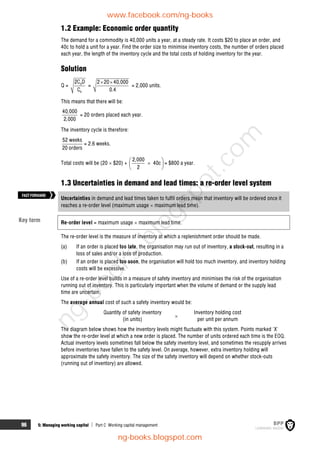

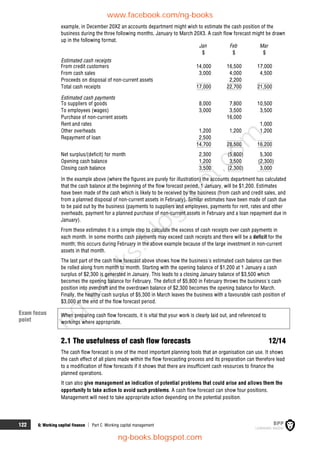

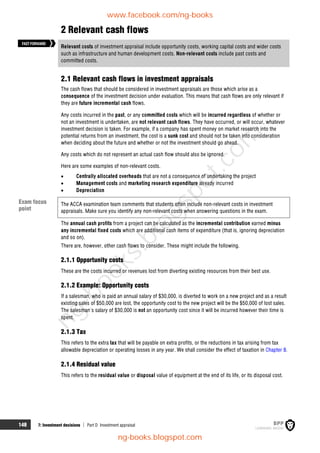

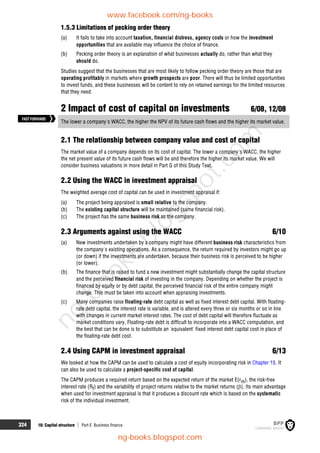

For example, if we have a cost of capital of 10% and a project with the cash flows shown below, we can

calculate a discounted payback period.

Discount Present Cumulative

Year Cash flow factor value NPV

$ 10% $ $

0 (100,000) 1.000 (100,000) (100,000)

1 30,000 0.909 27,270 (72,730)

2 50,000 0.826 41,300 (31,430)

3 40,000 0.751 30,040 (1,390)

4 30,000 0.683 20,490 19,100

5 20,000 0.621 12,420 31,520

NPV = 31,520

The DPP is early in year 4.

It may be approximated as 3 years + [1,390/(1,390 + 19,100)] × 12 months

= 3 years 0.8 months, say 3 years 1 month.

A company can set a target DPP, and choose not to undertake any projects with a DPP in excess of a

certain number of years, say, five years.

4.4 Advantages and disadvantages of discounted payback period

The approach has all the perceived advantages of the payback period method of investment appraisal: it

is easy to understand and calculate, and it provides a focus on liquidity where this is relevant. In addition,

however, it also takes into account the time value of money. It therefore bridges the gap between the

theoretically superior NPV method and the regular payback period method.

However, it does differ from NPV in that the discount rate used is the unadjusted cost of capital whereas

NPV often uses an adjusted rate to reflect project risk and uncertainty.

Because the DPP approach takes the time value of money into consideration, it produces a longer

payback period than the non-discounted payback approach, and takes into account more of the project's

cash flows.

FASTFORWARD

www.facebook.com/ng-books

ng-books.blogspot.com

n

g

-

b

o

o

k

s

.

b

l

o

g

s

p

o

t

.

c

o

m](https://image.slidesharecdn.com/f9financialmanagement-studytext2016-2017-220618221639-e43e6ffa/85/F9-Financial-Management-Study-Text-2016-2017-pdf-224-320.jpg)

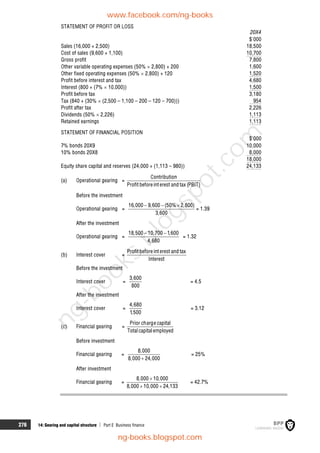

![Part E Business finance 16: Capital structure 329

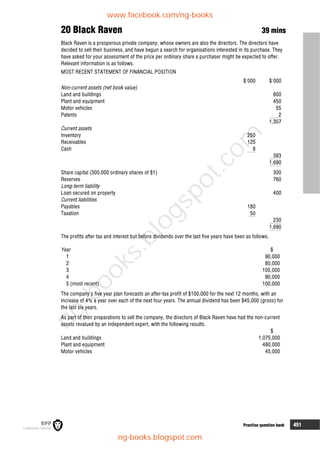

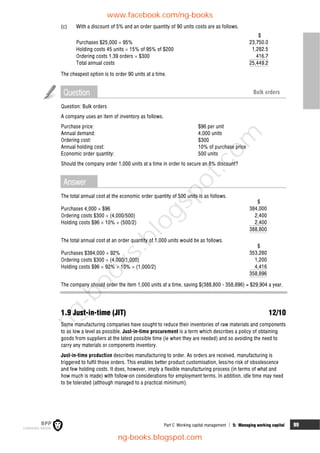

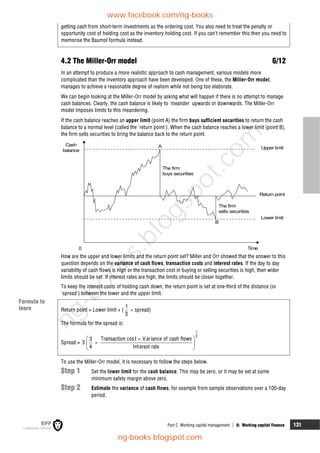

The beta value for the industry is 1.59.

Step 1 Convert the geared beta value for the industry to an ungeared beta (asset beta) for the

industry.

a = 1.59

2

2 (1(1 0.30))

= 1.18

Step 2 Convert this ungeared industry beta back into a geared beta, which reflects the company's

own gearing level of 2:5.

e = 1.18

5 (2(1 0.30))

5

= 1.51

Step 3 (a) This is a project-specific beta for the firm's equity capital and so, using the CAPM,

we can estimate the project-specific cost of equity as:

keg = 11% + (16% – 11%) 1.51 = 18.55%

(b) The project will presumably be financed in a gearing ratio of 2:5 debt to equity, and

so the project-specific cost of capital ought to be:

[5/7 18.55%] + [2/7 70% 11%] = 15.45%

Question Ungeared and geared betas

Two companies are identical in every respect except for their capital structure. XY has a debt:equity ratio

of 1:3, and its equity has a value of 1.20. PQ has a debt:equity ratio of 2:3. Corporation tax is at 30%.

Estimate a value for PQ's equity.

Answer

Estimate an ungeared beta from XY data.

a = 1.20

3

3 (1(1 0.30))

= 0.973

Estimate a geared beta for PQ using this ungeared beta.

e = 0.973

3 (2(1– 0.30))

3

= 1.427

2.7.6 Weaknesses in the formula

The problems with using the geared and ungeared beta formula for calculating a firm's equity beta from

data about other firms are as follows.

(a) It is difficult to identify other firms with identical operating characteristics.

(b) Estimates of beta values from share price information are not wholly accurate. They are based

on statistical analysis of historical data and, as the previous example shows, estimates using one

firm's data will differ from estimates using another firm's data.

(c) There may be differences in beta values between firms caused by:

(i) Different cost structures (eg the ratio of fixed costs to variable costs)

(ii) Size differences between firms

(iii) Debt capital not being risk free

www.facebook.com/ng-books

ng-books.blogspot.com

n

g

-

b

o

o

k

s

.

b

l

o

g

s

p

o

t

.

c

o

m](https://image.slidesharecdn.com/f9financialmanagement-studytext2016-2017-220618221639-e43e6ffa/85/F9-Financial-Management-Study-Text-2016-2017-pdf-354-320.jpg)

![382 19: Foreign currency risk Part G Risk management

For example, in July 2015, the price of a Big Mac in America was $4.79. At market exchange rates, the

price of a Big Mac in China was $2.74. So the Big Mac index suggests that the yuan was undervalued by

43% at the time.

3.5 The Fisher effect

The term Fisher effect is sometimes used in looking at the relationship between interest rates and

expected rates of inflation (see Chapter 9, Section 1).

The rate of interest is seen as being made up of two parts: the real required rate of return (real interest

rate) plus a premium for inflation. Then:

[1 + nominal (money) rate] = [1 + real interest rate] [1 + inflation rate]

(1 + i) = (1 + r)(1 + h)

Countries with relatively high rates of inflation will generally have high nominal rates of interest, partly

because high interest rates are a mechanism for reducing inflation, and partly because of the Fisher effect:

higher nominal interest rates serve to allow investors to obtain a high enough real rate of return where

inflation is relatively high.

According to the international Fisher effect, nominal interest rate differentials between countries provide

an unbiased predictor of future changes in spot exchange rates. The currency of countries with relatively

high interest rates is expected to depreciate against currencies with lower interest rates, because the

higher interest rates are considered necessary to compensate for the anticipated currency depreciation.

Given free movement of capital internationally, this idea suggests that the real rate of return in different

countries will equalise as a result of adjustments to spot exchange rates.

The international Fisher effect can be expressed as:

a a

b b

1 i 1 h

1 i 1 h

Where ia is the nominal interest rate in country a

ib is the nominal interest rate in country b

ha is the inflation rate in country a

hb is the inflation rate in country b

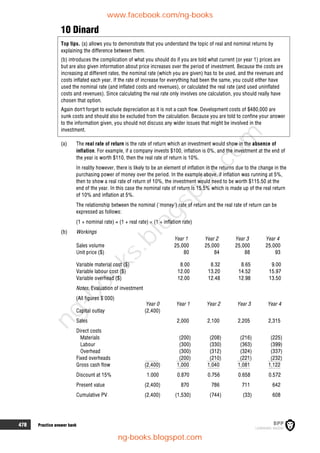

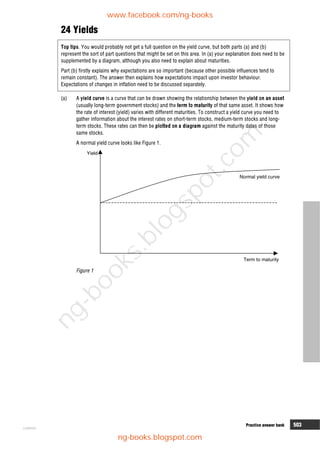

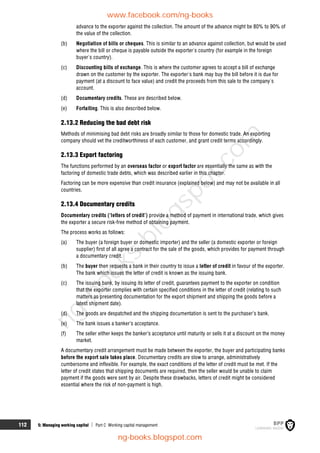

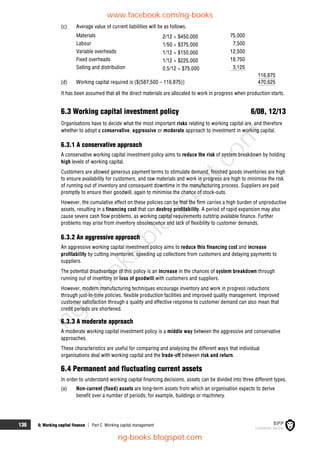

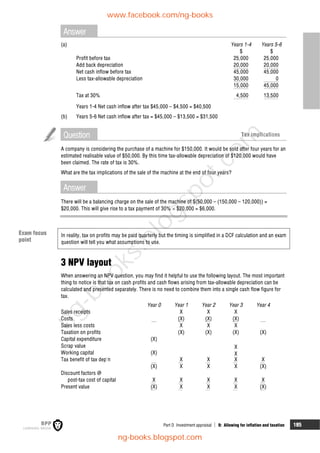

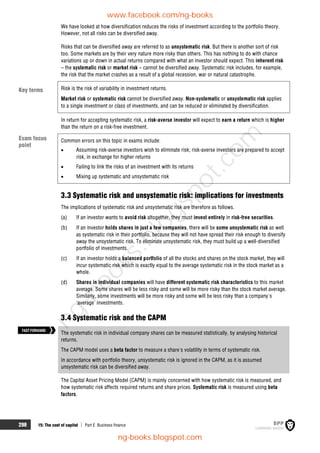

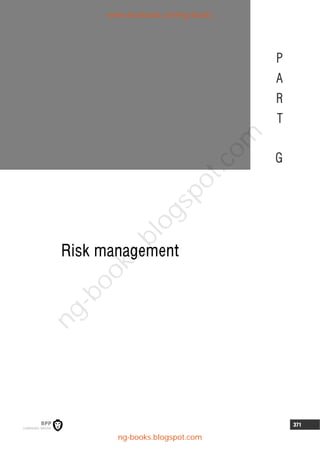

3.6 Four-way equivalence

The four-way equivalence model states that in equilibrium, differences between forward and spot rates,

differences in interest rates, expected differences in inflation rates and expected changes in spot rates are

equal to one another.

(equals)

Expectation

theory

(equals)

Fisher effects

Difference in interest rates Expected differences in

inflation rates

Expected change in spot

rate

Difference between forward

and spot

(equals)

Interest rate parity

(equals)

International

Fisher effects

(equals)

Purchasing power

parity

Exam

formula

www.facebook.com/ng-books

ng-books.blogspot.com

n

g

-

b

o

o

k

s

.

b

l

o

g

s

p

o

t

.

c

o

m](https://image.slidesharecdn.com/f9financialmanagement-studytext2016-2017-220618221639-e43e6ffa/85/F9-Financial-Management-Study-Text-2016-2017-pdf-407-320.jpg)