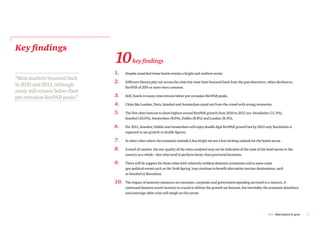

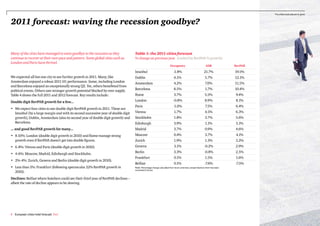

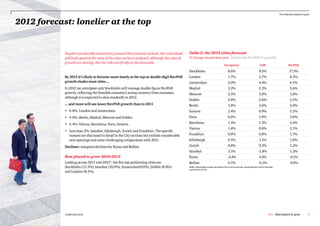

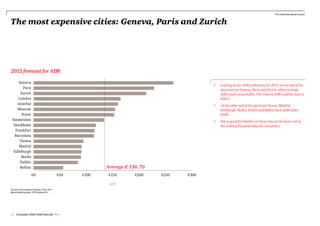

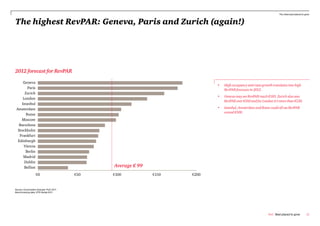

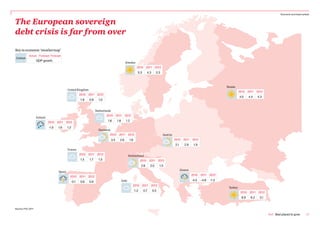

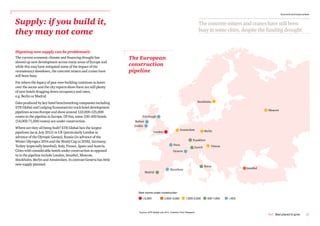

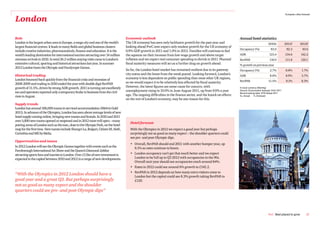

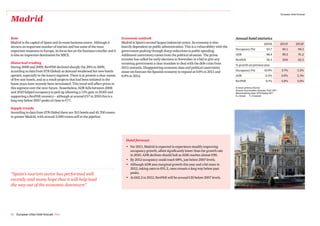

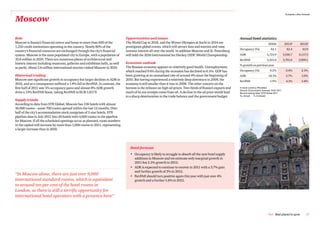

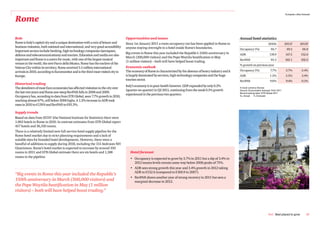

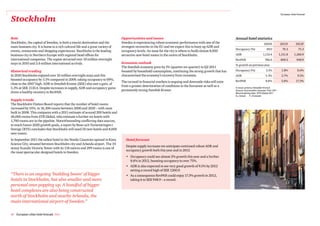

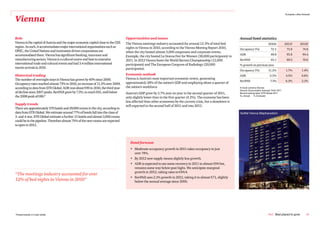

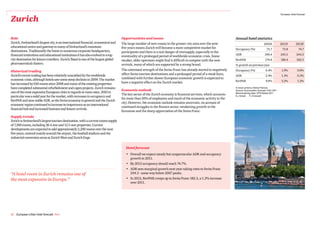

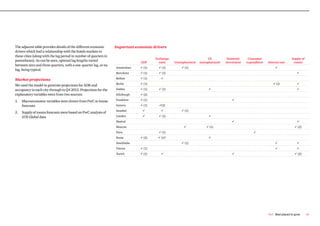

The document presents PwC's hotel forecast for 17 European cities, highlighting the resilience of the hotel sector despite economic challenges. Key findings indicate that cities like Istanbul, London, and Amsterdam show promising recovery with substantial revenue per available room (RevPAR) growth, while others may struggle due to economic downturns and oversupply. The analysis emphasizes the varying maturity and profitability of each city's hotel market, with different macroeconomic drivers impacting overall performance.