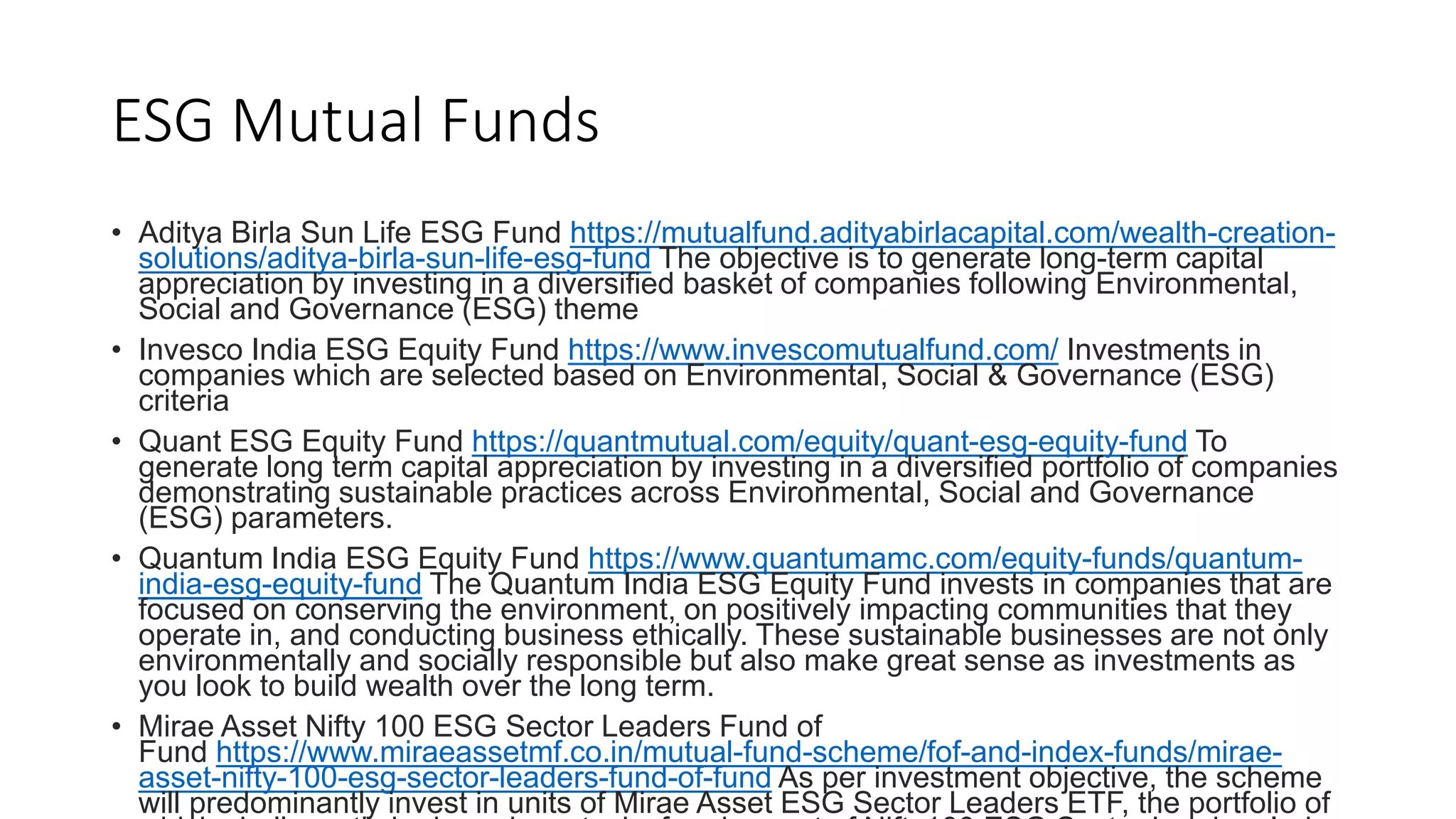

Ethical investing in India involves investing in companies and causes that have minimal ethical harm and generate financial returns, with a focus on environmental, social, and governance (ESG) factors, as well as aligning with the United Nations Sustainable Development Goals (SDGs). Various forms of ethical investments, including shariah-compliant options, are available through mutual funds and other investment vehicles that prioritize sustainability and social responsibility. The document outlines several ethical mutual funds and examples of companies engaged in ethical practices, aiming to provide investors with viable options that reflect their values.