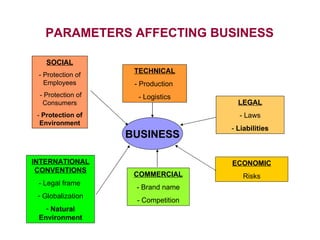

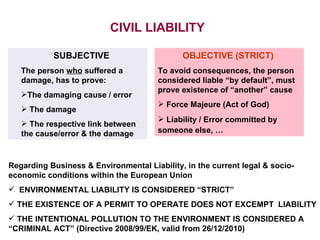

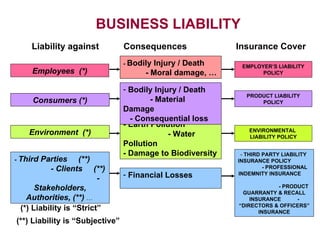

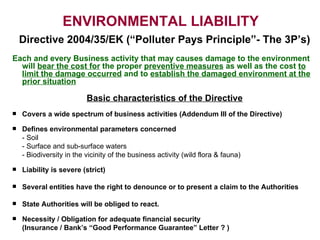

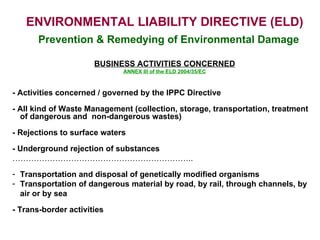

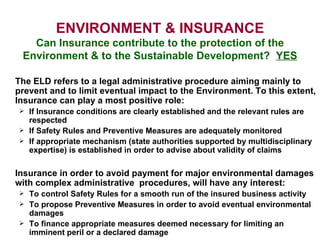

The document discusses environmental liability and European Directive 2004/35/EK. It provides an overview of the parameters affecting business liability, including technical, social, international, commercial, economic, and legal factors. It explains that environmental liability under the directive is considered "strict" and that having an operating permit does not exempt one from liability. The directive establishes the "polluter pays principle" and requires adequate financial security like insurance to cover environmental damage from business activities.

![HELLENIC COMMITTEE OF LLOYD’S BROKERS’ ASSOCIATES “70 years of Presence in the Greek Insurance Market” 30 TH September 2009, Yacht Club of Greece Environmental Liability & European Directive 2004/35/EK George Koutinas Engineer NTUA & Ε NSPM Specialist Insurance Broker [email_address]](https://image.slidesharecdn.com/090930environmentalliabilityinsuranceeventbrokerslloydsingreece1-12969377270033-phpapp02/75/Environmental-Liability-Insurance-EU-Directive-2004-35-EU-1-2048.jpg)