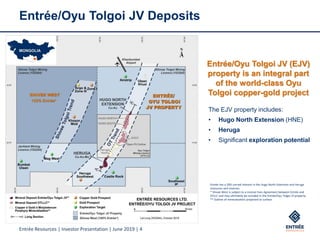

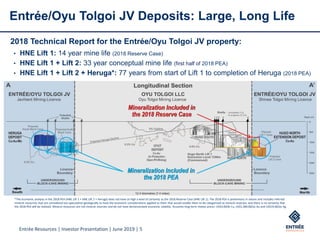

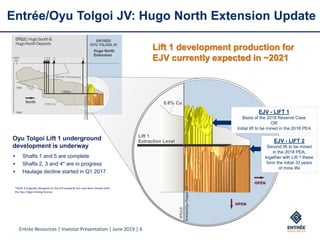

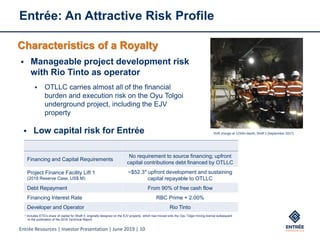

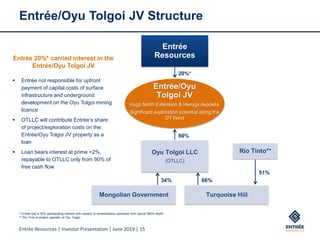

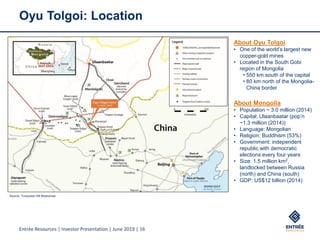

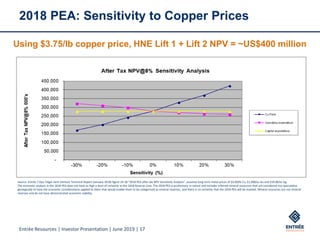

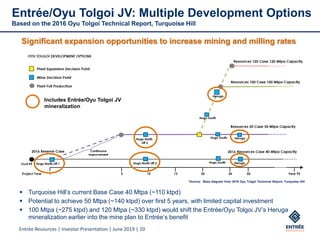

This presentation provides an overview of Entrée Resources and the Oyu Tolgoi project in Mongolia. It discusses plans to continue advancing the project towards production. However, it cautions that forward-looking statements involve risks and uncertainties, as numerous assumptions regarding costs, production schedules, commodity prices, and other factors may change. It also notes that inferred resources are uncertain and may not be upgraded to indicated or measured resources. The presentation was prepared by a qualified person as defined by Canadian regulations.