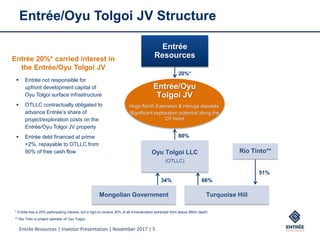

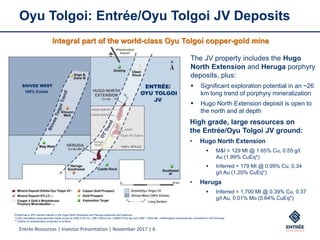

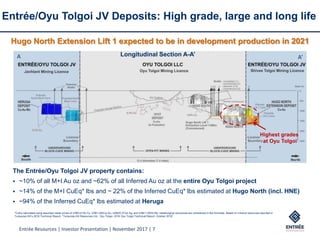

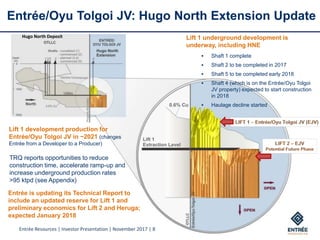

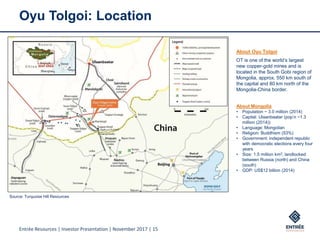

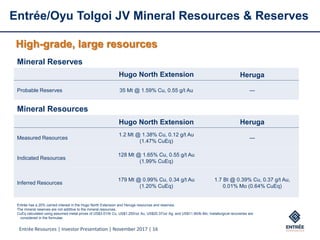

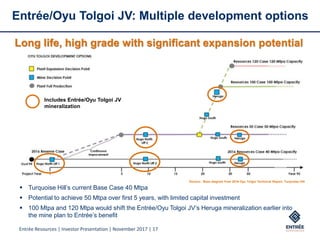

Entrée Resources Ltd. holds a 20% carried interest in the world-class Oyu Tolgoi underground copper-gold mine in Mongolia through a joint venture with Oyu Tolgoi LLC. The presentation provides an overview of Entrée's assets and low-risk profile. It notes that Oyu Tolgoi LLC is responsible for financing Entrée's share of project costs and that Entrée will not be responsible for any upfront development capital. Shaft 4 construction is expected to begin in 2018, with production from Lift 1 of the Hugo North Extension deposit anticipated in 2021, making Entrée a future producer. An updated technical report is expected in January 2018.