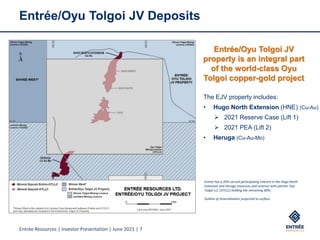

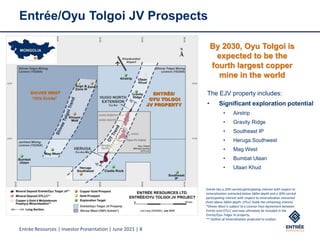

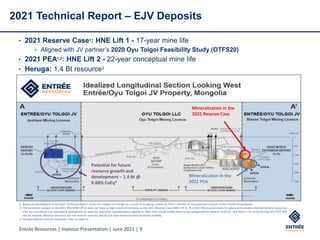

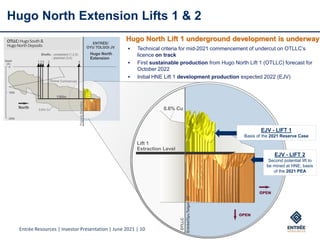

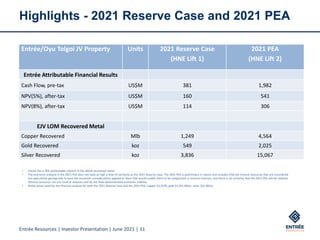

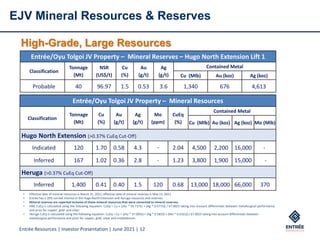

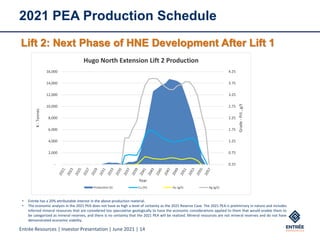

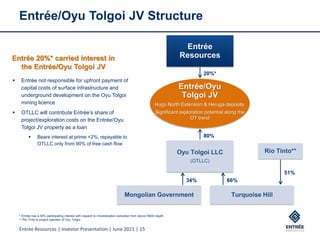

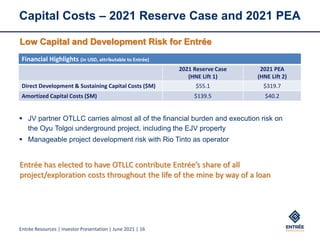

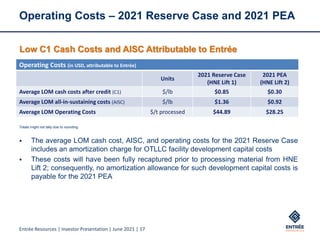

Entrée Resources presented their investor overview for June 2021, highlighting their joint venture in the Oyu Tolgoi underground copper-gold mine. The report details the development and projected production timelines, significant mineral reserves, and the financial implications, with a notable focus on the risks and uncertainties that could affect outcomes. The company emphasizes its strategic position, partnership dynamics, and future exploration potential within the high-profile mining project in Mongolia.