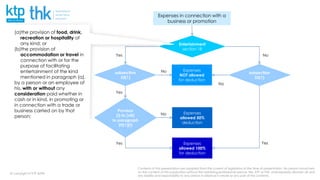

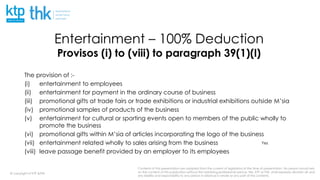

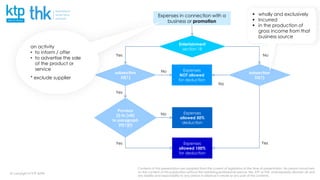

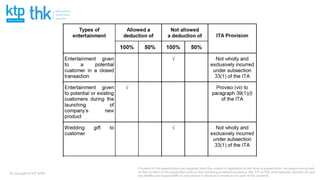

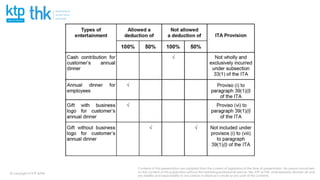

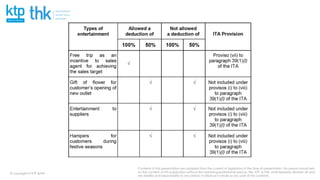

The document discusses entertainment expense deductions under Malaysian tax law. It outlines that entertainment expenses can be deducted at 50% or 100% depending on the type of expense. Expenses are fully deductible if they fall under certain provisos, including expenses for employees, expenses incurred in the ordinary course of business, or expenses related to sales. The objective is to explain the tax treatment of entertainment expenses and how to determine the deductible amount.