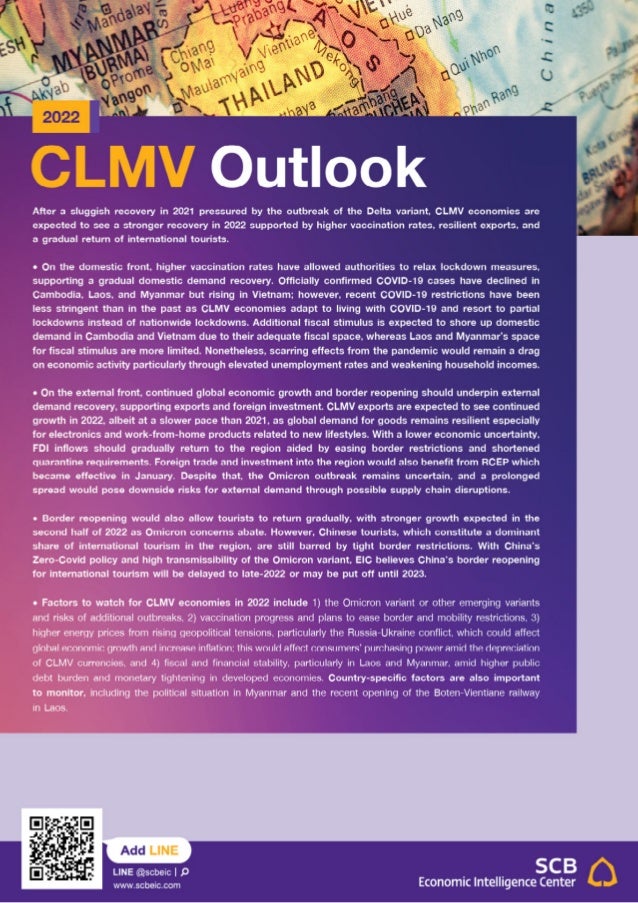

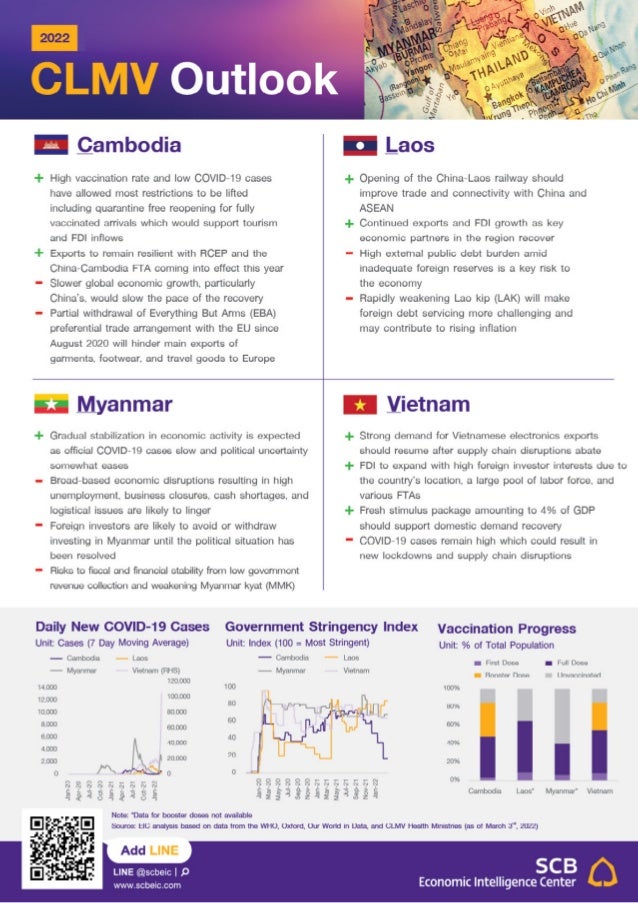

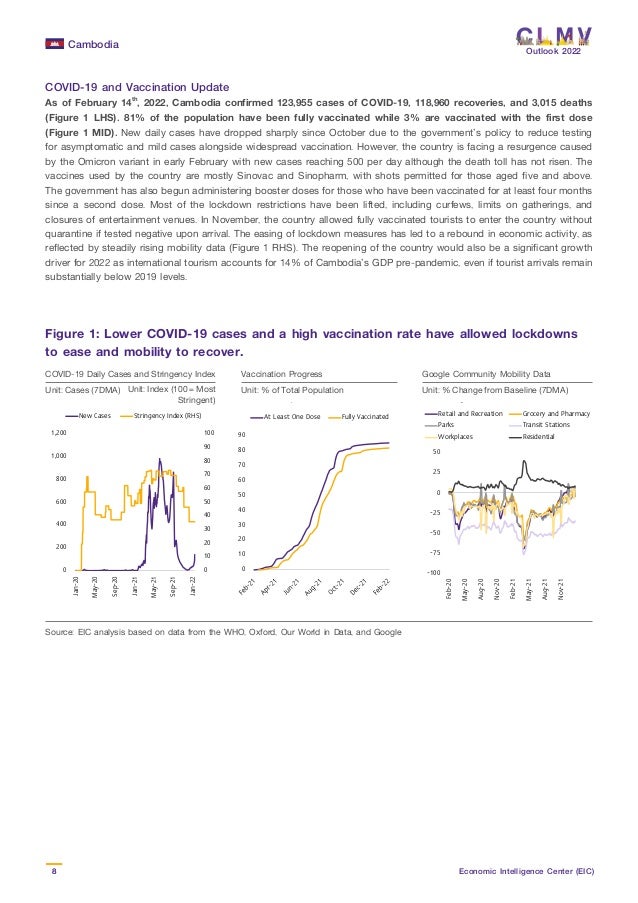

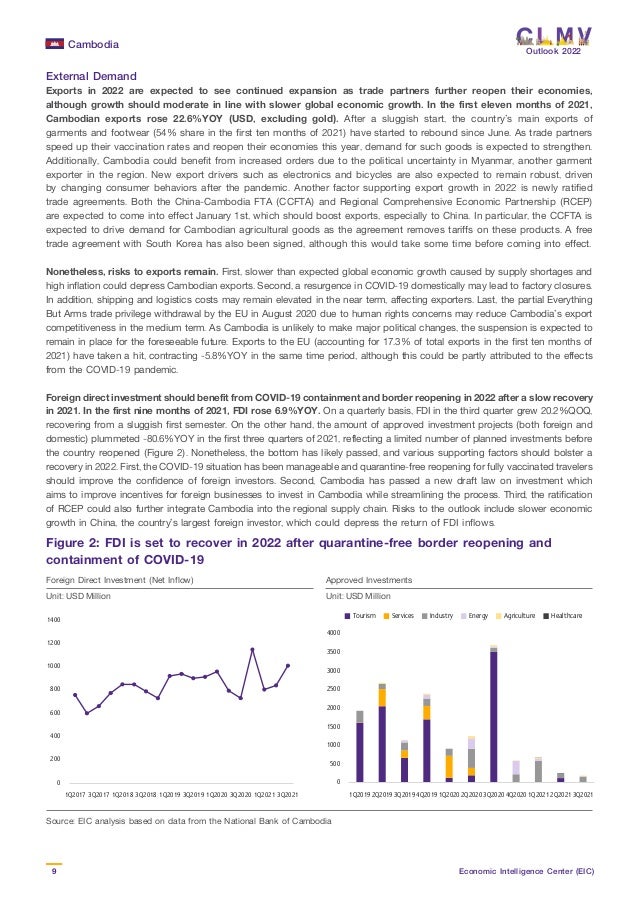

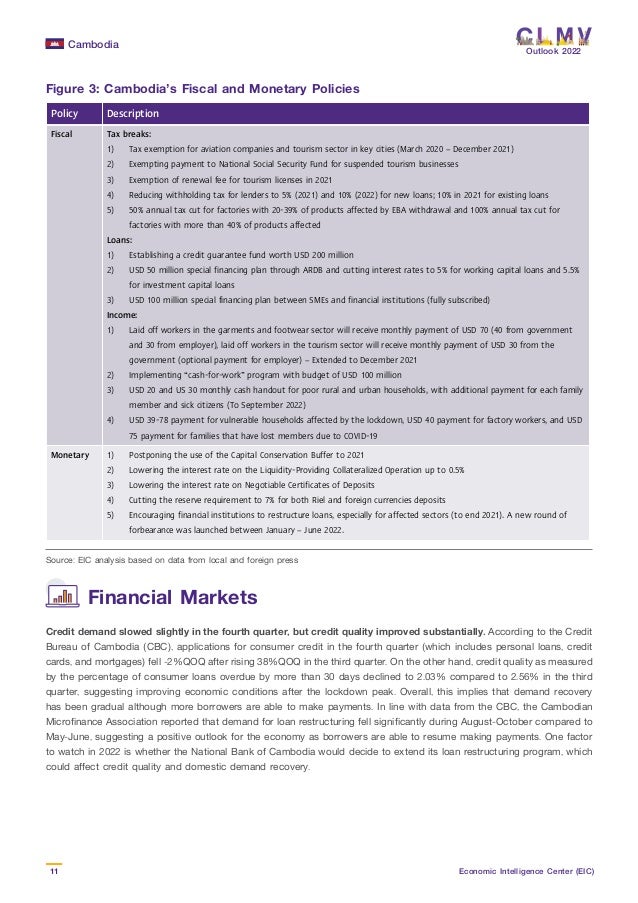

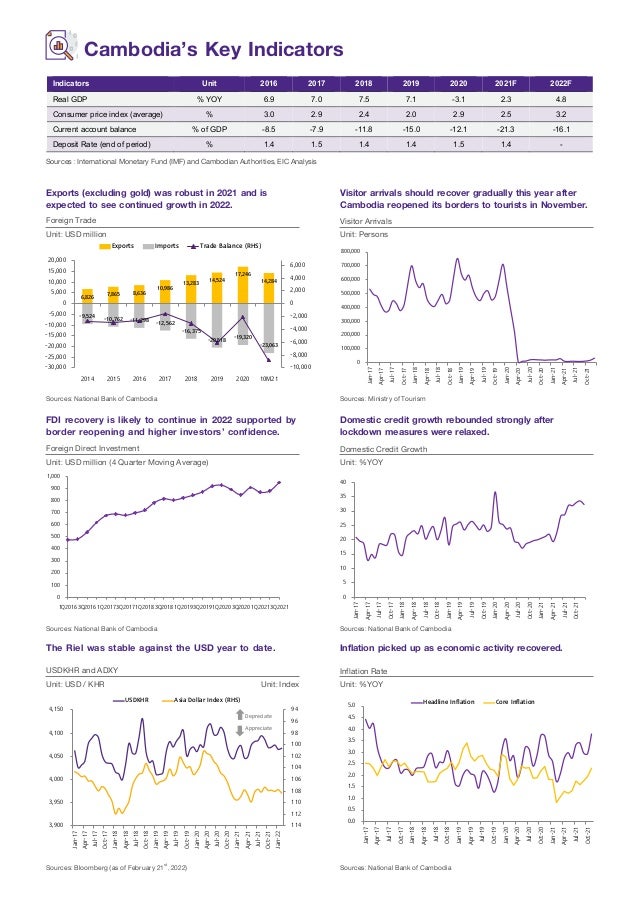

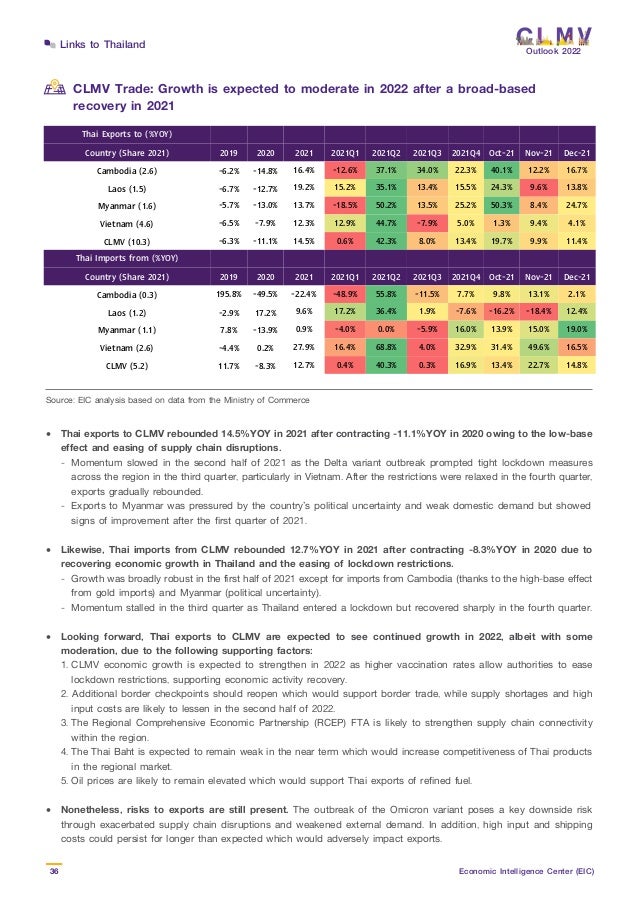

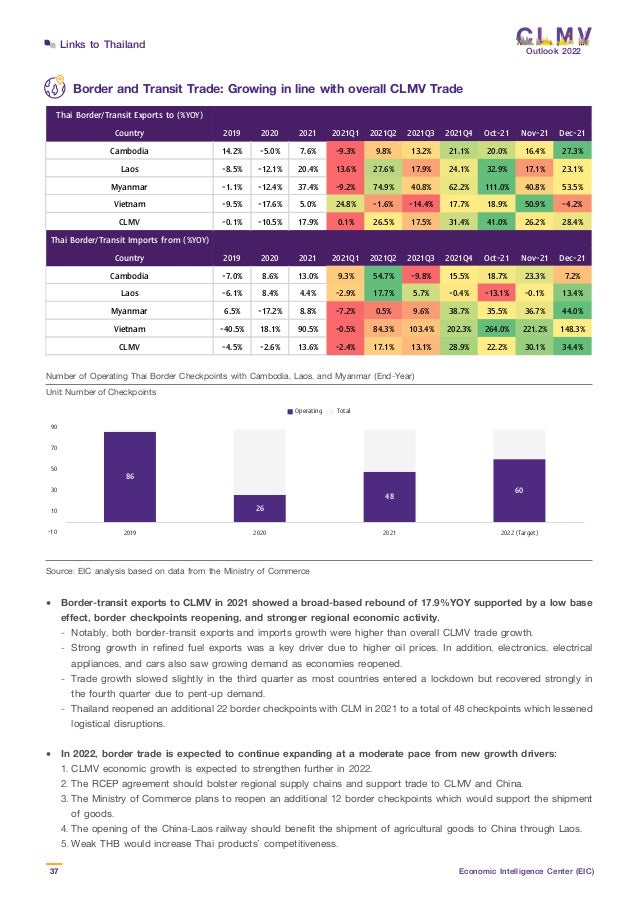

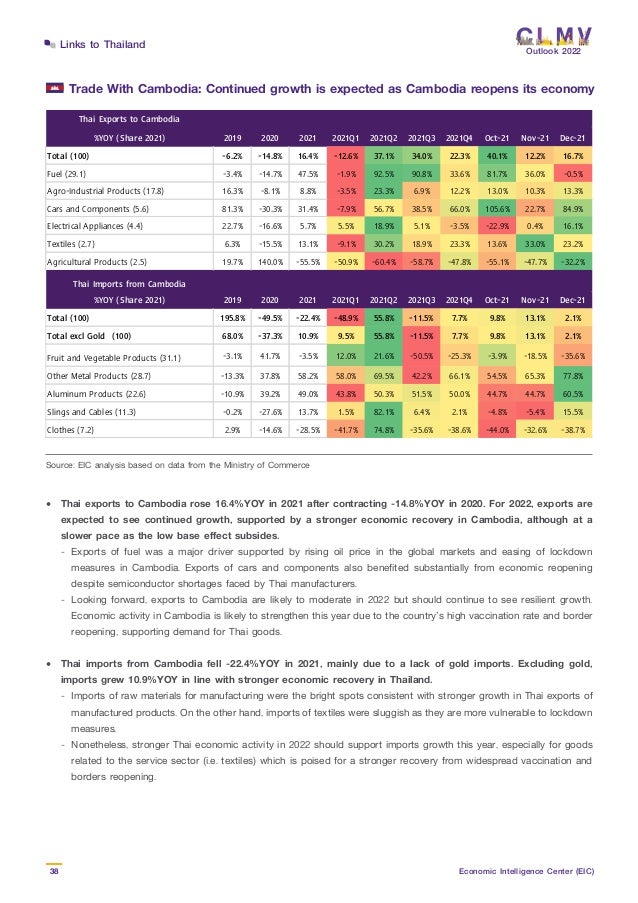

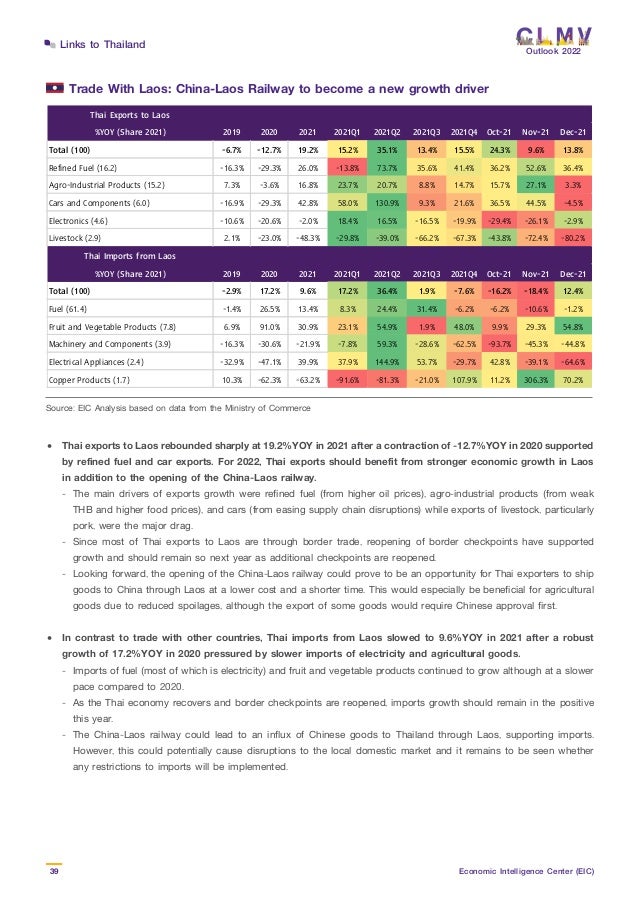

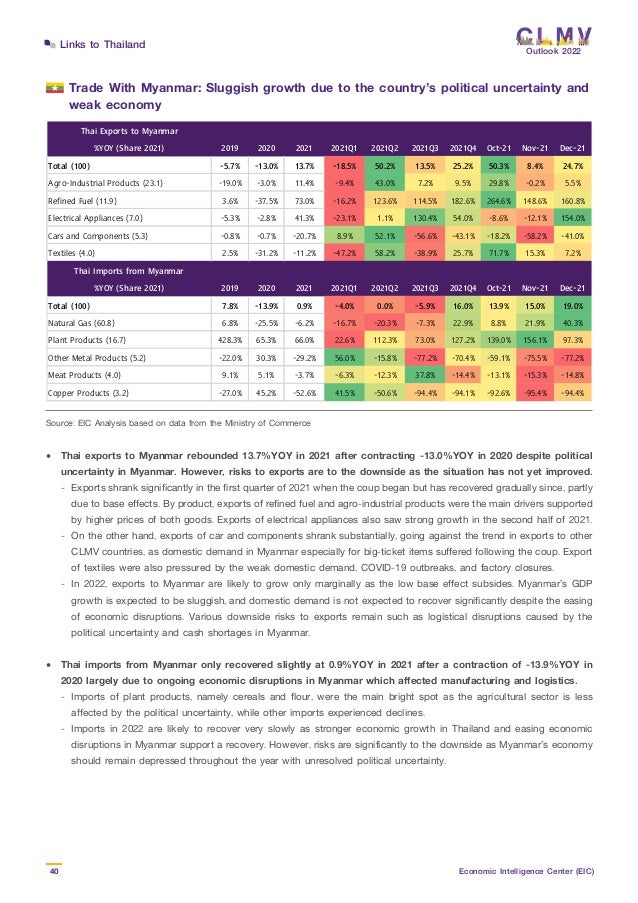

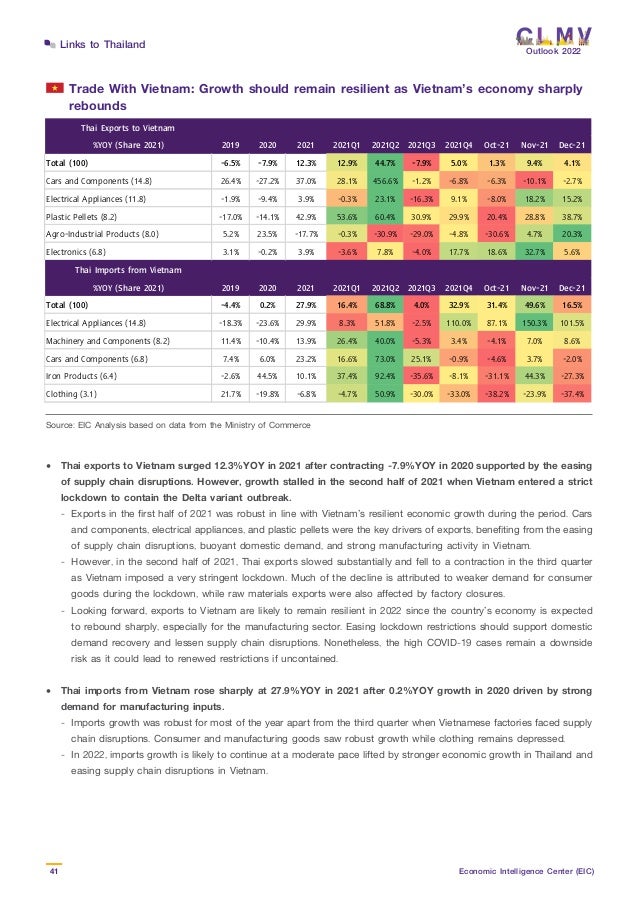

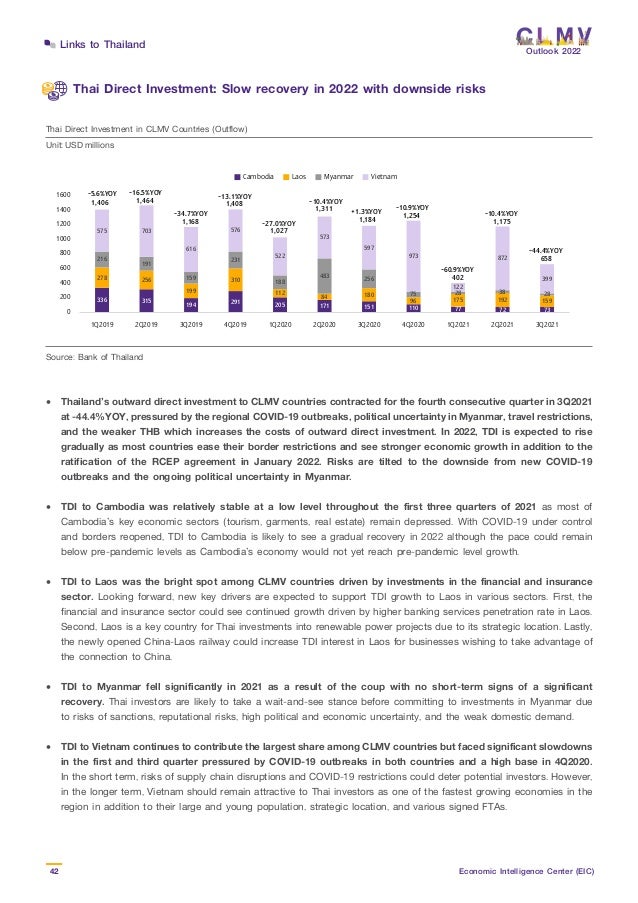

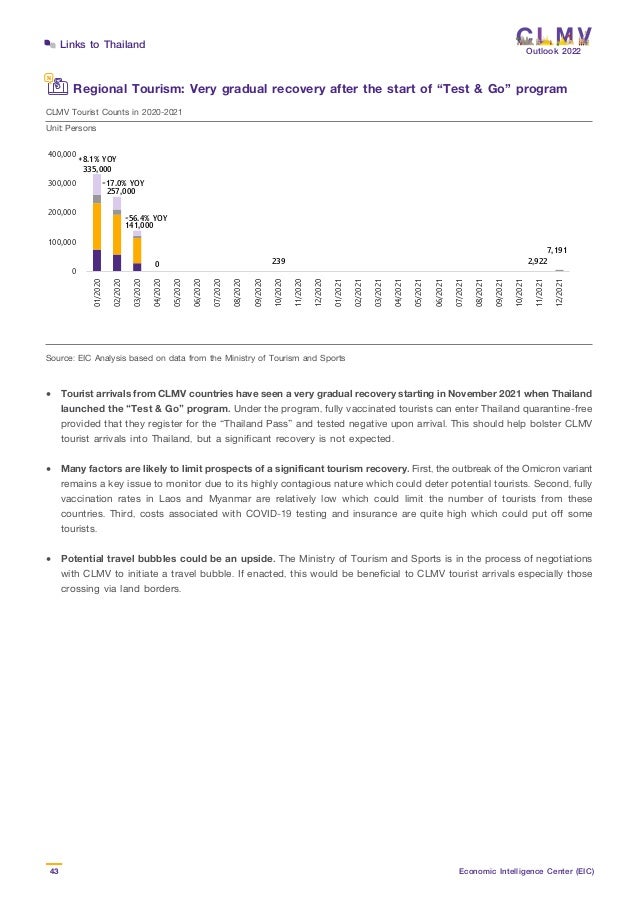

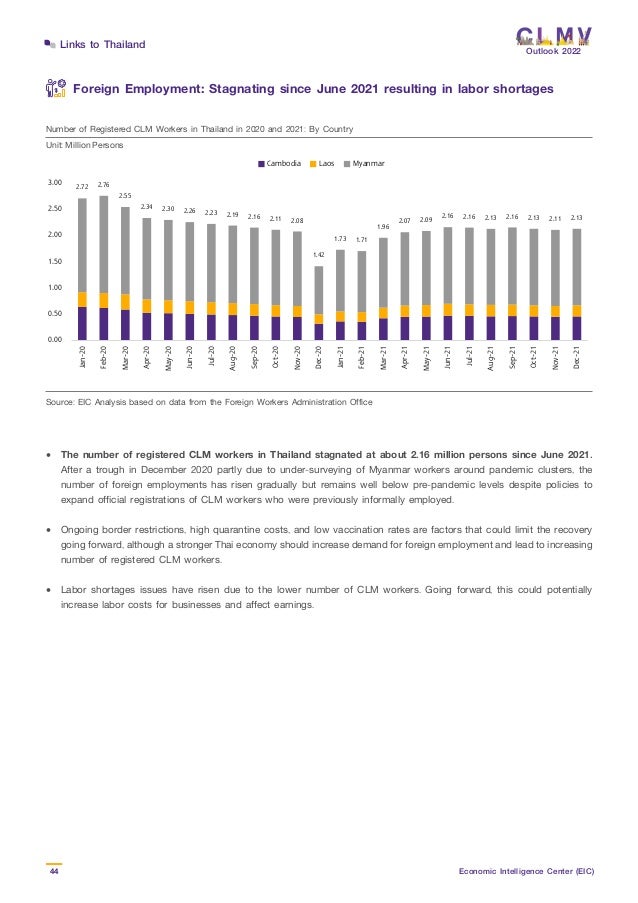

The report provides an economic outlook for Cambodia in 2022, projecting a GDP growth of 4.8%, supported by easing lockdowns, a high vaccination rate, and fiscal stimulus measures. It highlights risks including potential COVID-19 resurgences, reliance on external demand, and disruptions in supply chains. The tourism sector is set to recover gradually with the reopening to vaccinated travelers, although arrivals will remain below pre-pandemic levels.