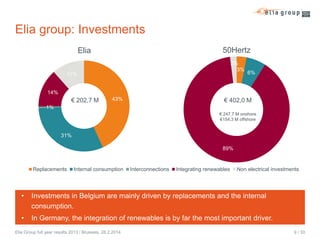

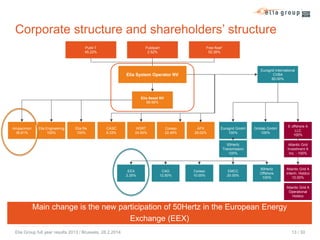

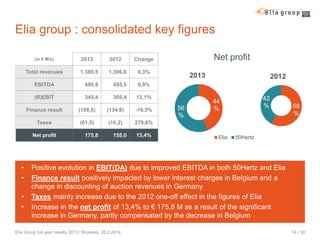

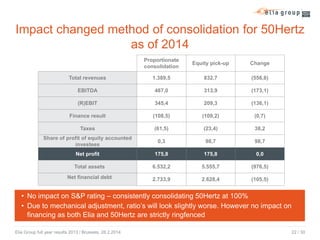

The document provides an overview of Elia Group's full year 2013 results. Key highlights include good financial results for the Group, with increased EBITDA in both the 50Hertz and Elia transmission businesses. Net profit increased 13.4% to €175.8 million. Operational highlights note nearly full realization of investment plans and continuity of supply maintained in both Belgium and Germany. The outlook discusses plans to establish a new entity to pursue asset and share deals and regulatory developments.

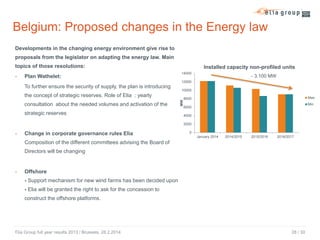

![Germany: Main outline of the proposed amendment

of the Renewable Energies Act (EEG)

-

RES share of electricity consumption to be between 40%

and 45% by 2025 and between 55% and 60% by 2035

(previously minimum targets were set: 2020 35%; 2030

50%)

A binding corridor for the deployment of renewables

energies

-

Offshore wind target: 6.5 GW by 2020 (previously 10

GW by 2020)

-

20,36

20

13,53

15

10

5

8,33

3,530

3,592

2011

2012

6,240

14,11

5,277

2,047

0

2010

2013

2014

Feed-in tariffs remain method of choice, mechanisms

for quantitative expansion control to be introduced by

2018 (tenders to be tested for large solar power systems

by 2016)

-

23,58

Mandatory “market premium” with sliding premium for

new RES plants

Costs

EEG surcharge

Line of attack of the Energiewende remains unchanged.

Elia Group full year results 2013 / Brussels, 28.2.2014

29 / 30

EEG surcharge [ct/kWh]

-

25

Costs [Bn. €]

Until now only key parameters have been established.

The legislative process has not yet started. Entry into

force is foreseen for August 2014.](https://image.slidesharecdn.com/eliagroupfullyearresults2013-140303031433-phpapp01/85/Elia-group-full-year-results-2013-29-320.jpg)