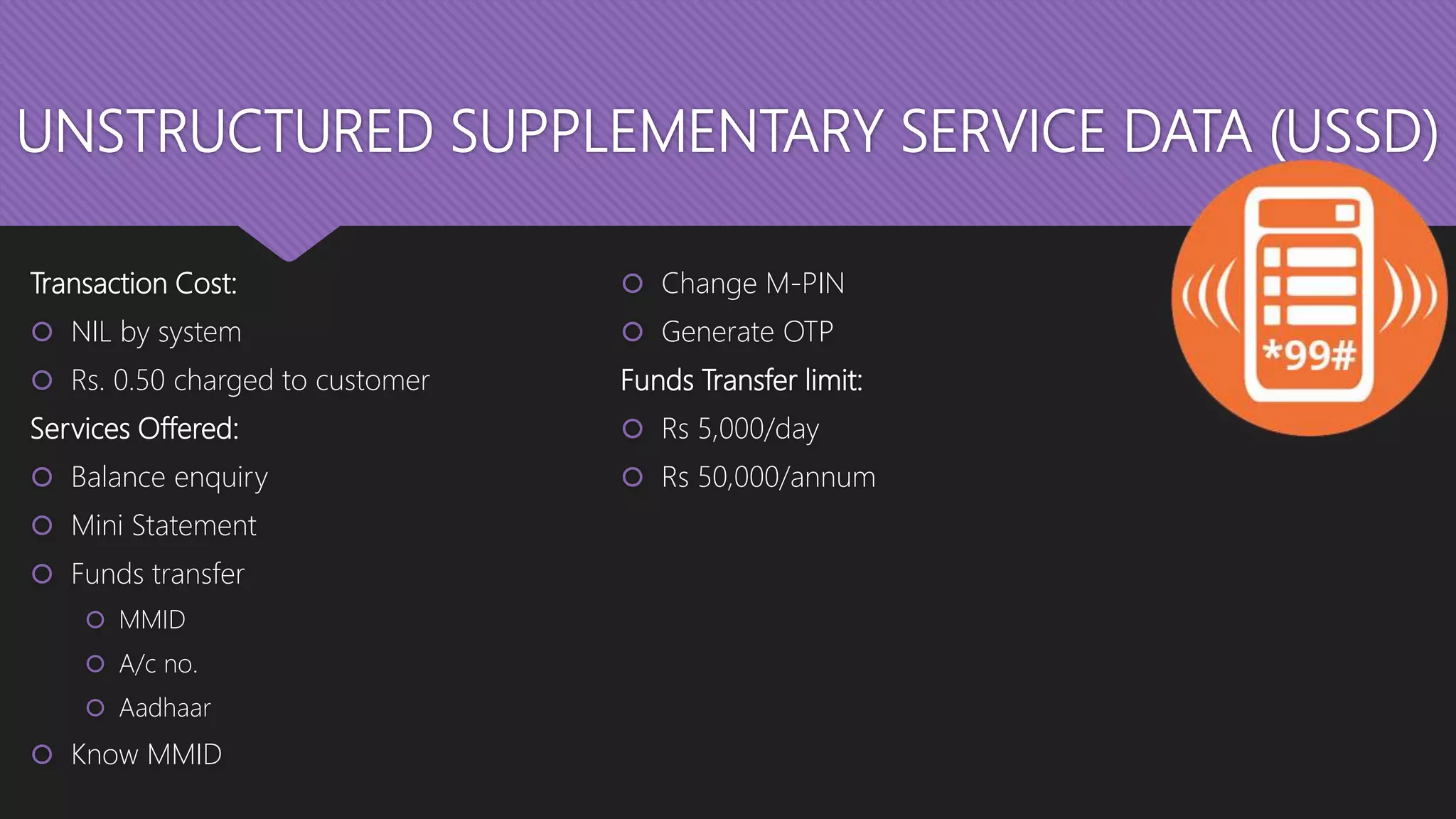

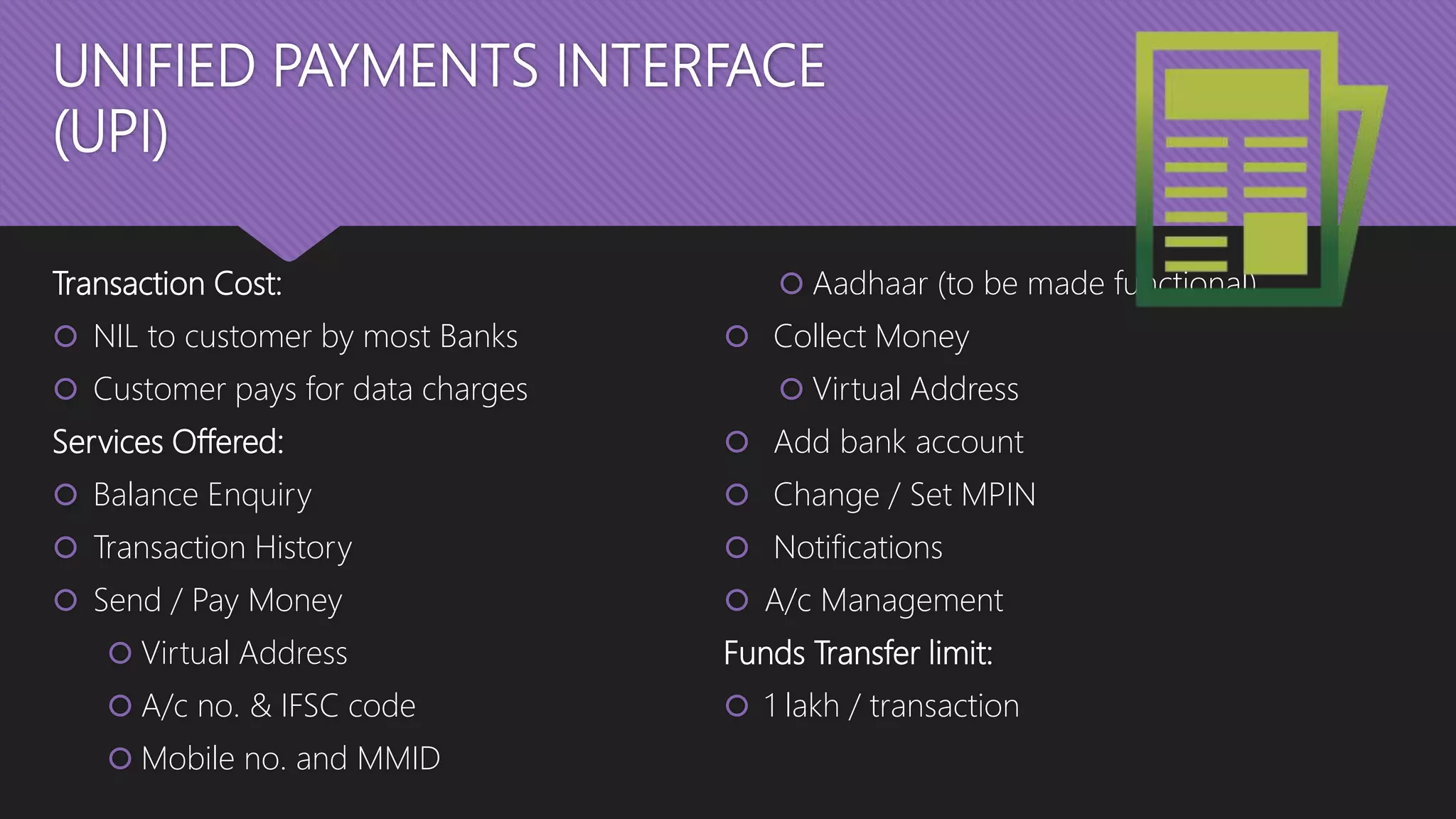

The document discusses various electronic payment systems in India such as internet banking, NEFT, RTGS, ECS, IMPS, banking cards, USSD and AEPS. It provides details on how to activate and use these payment methods, transaction costs and limits, and services offered. Key points covered are that NEFT and RTGS facilitate funds transfer between bank accounts, while ECS, IMPS and USSD allow for utility payments, instant bank transfers using mobile phones, and basic mobile banking respectively.