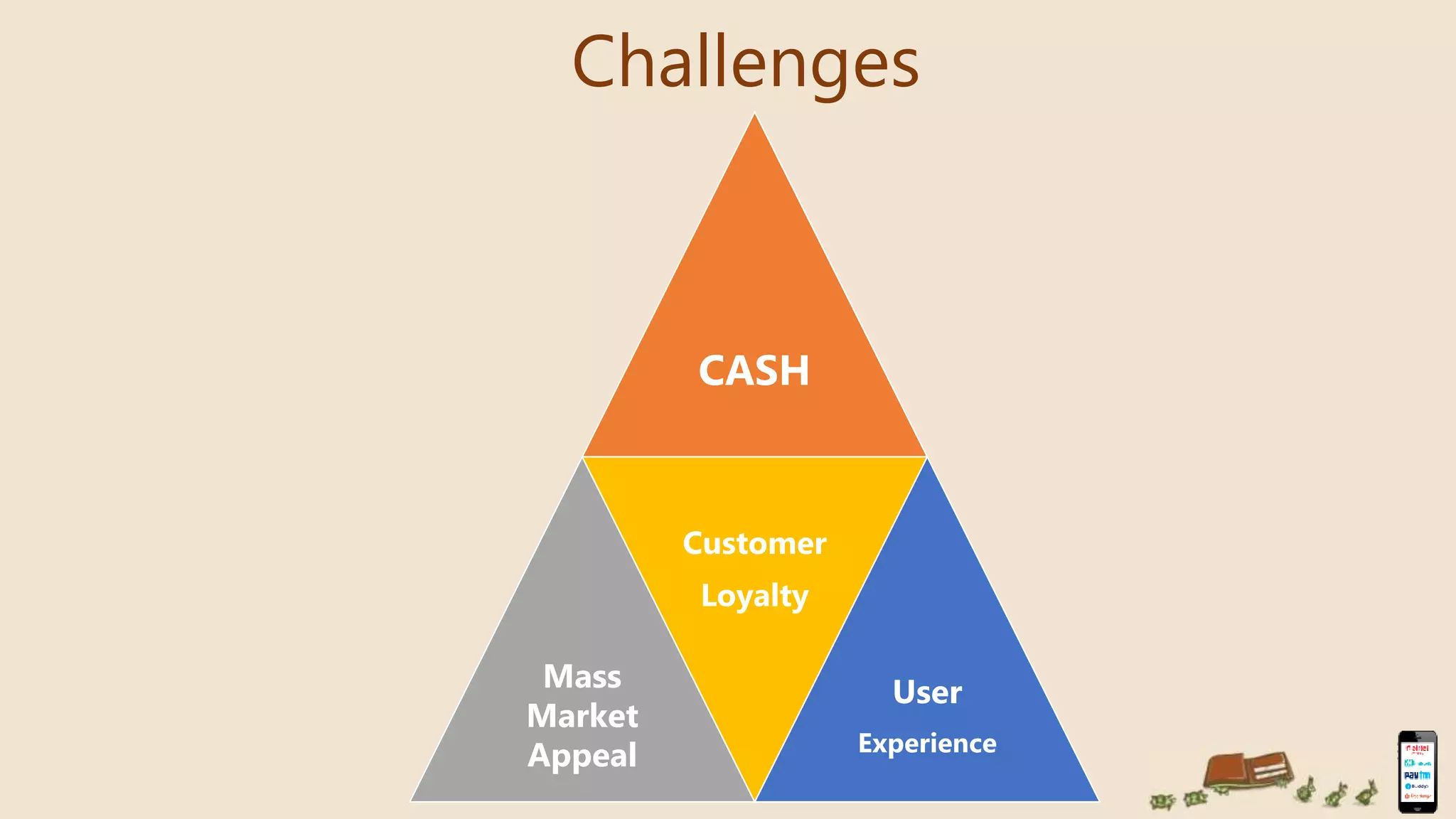

The document discusses various e-wallets, highlighting their features, types, and significance in facilitating cashless transactions. It covers specific e-wallets such as SBI Buddy, Mobikwik, and Paytm, including their launch dates, founders, and functions like bill payments and mobile recharges. Additionally, it mentions market trends, revenue models, and challenges faced by these services.