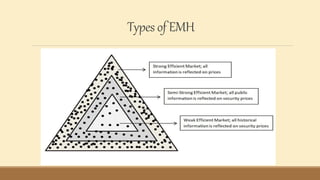

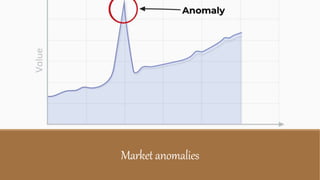

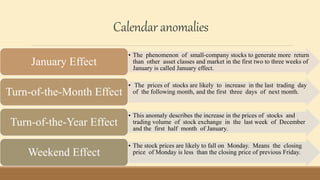

The Efficient Market Hypothesis states that stock prices always reflect all available information and that it is impossible for investors to outperform the market. It has three main assumptions: stocks are traded at fair value, market prices reflect all information, and investors cannot beat the market. There are three types of market efficiency - weak, semi-strong, and strong. The EMH is limited by market crashes, anomalies, and evidence some investors can beat the market. Several anomalies exist, including calendar anomalies like the January effect and turn-of-the-month effect. Fundamental anomalies include the value and size effects. Technical anomalies use techniques like moving averages and trading range breaks.