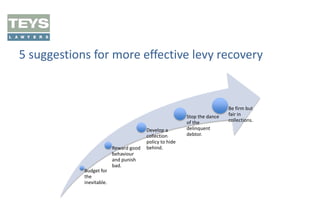

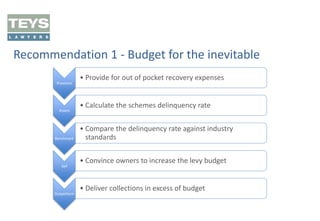

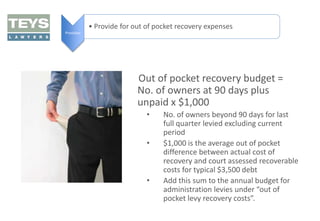

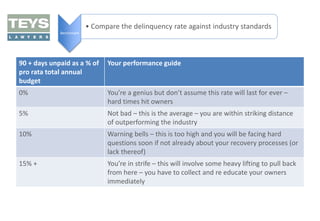

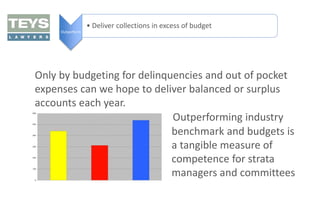

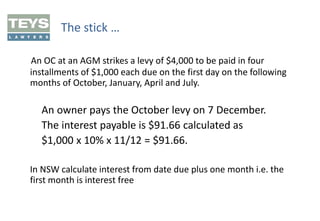

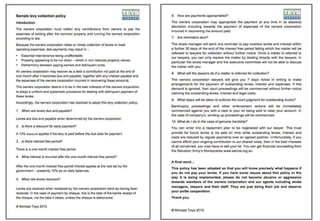

The document discusses effective strategies for levy recovery in strata management, emphasizing the importance of budgeting for expected delinquencies and developing structured collection policies. It outlines five key recommendations, including rewarding timely payments, being consistent in enforcing policies, and moving swiftly in legal proceedings when necessary. The insights are aimed at improving financial health for strata communities amid rising delinquency rates and legal challenges.