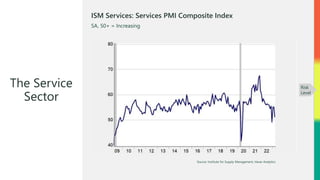

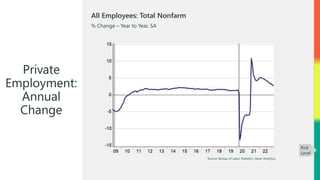

In March 2023, the service sector confidence index fell to 51.2, indicating modest expansion but recent volatility kept the risk level at yellow. Job growth continued with 236,000 jobs added, showing strength in the labor market despite inflation concerns, while the unemployment rate dropped to 3.5%. Consumer confidence saw a slight increase to 104.2, yet it marked a 13-month decline year-over-year, underlining ongoing economic risks despite signs of growth.