The document analyzes the relationship between stock market performance and economic growth in the U.S. from 1980-2011. It finds a strong positive correlation between changes in the Dow Jones Industrial Average and nominal GDP. Regression analysis shows stock market fluctuations explained about 87% of the variation in GDP. The results suggest stock prices can influence economic activity by affecting business confidence, financing, and household wealth. Therefore, large declines in stock prices may precede and prolong economic downturns.

![7

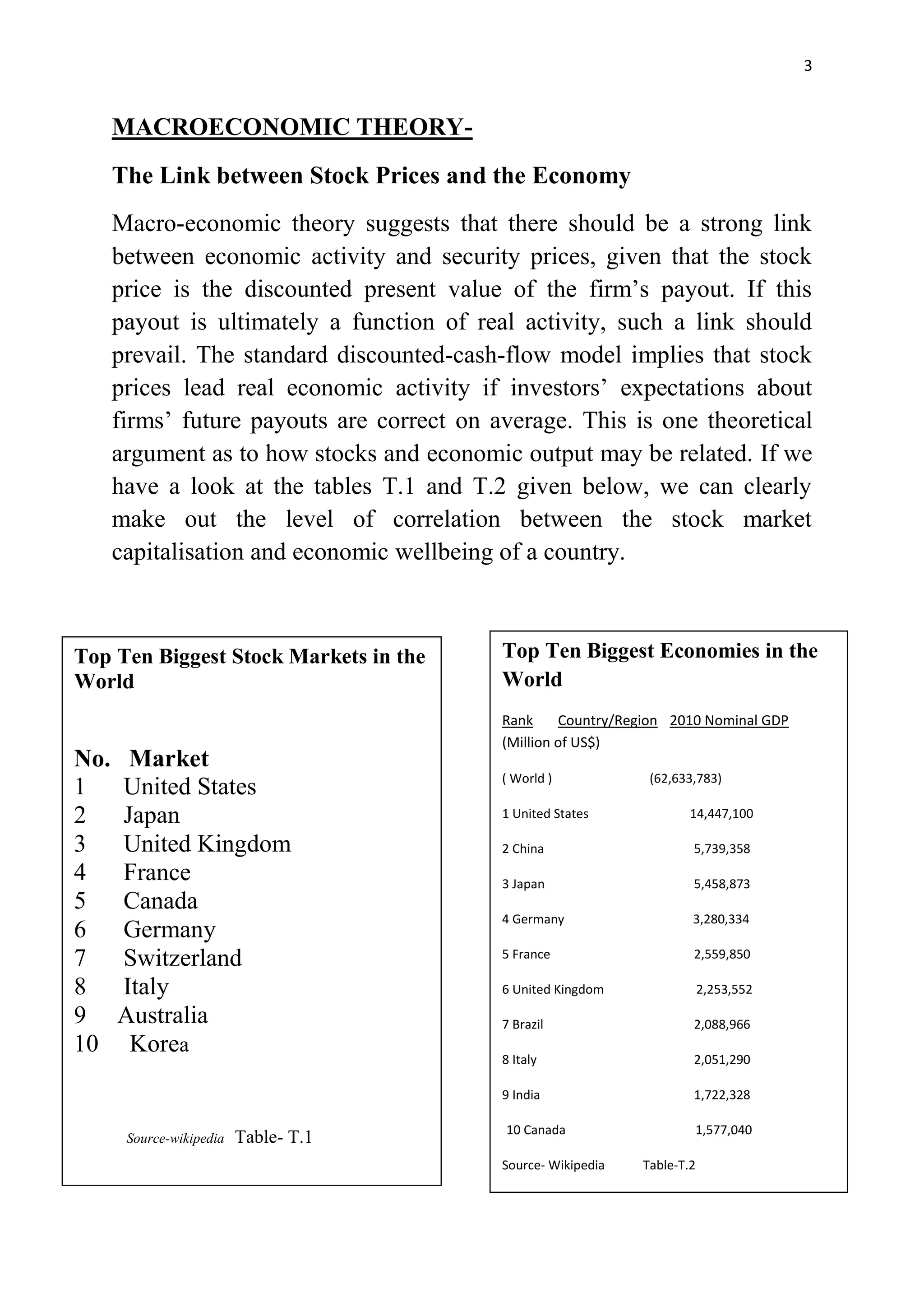

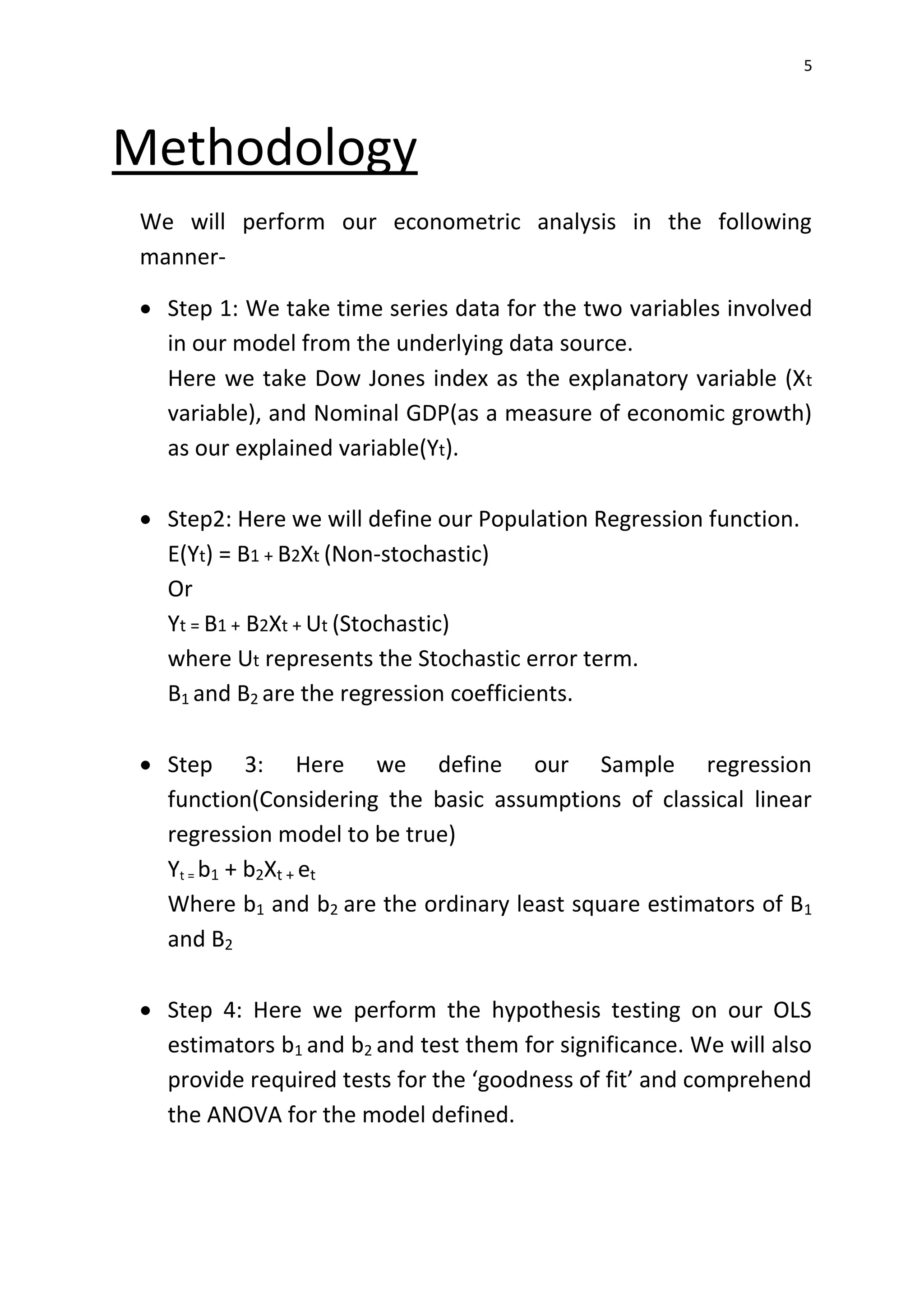

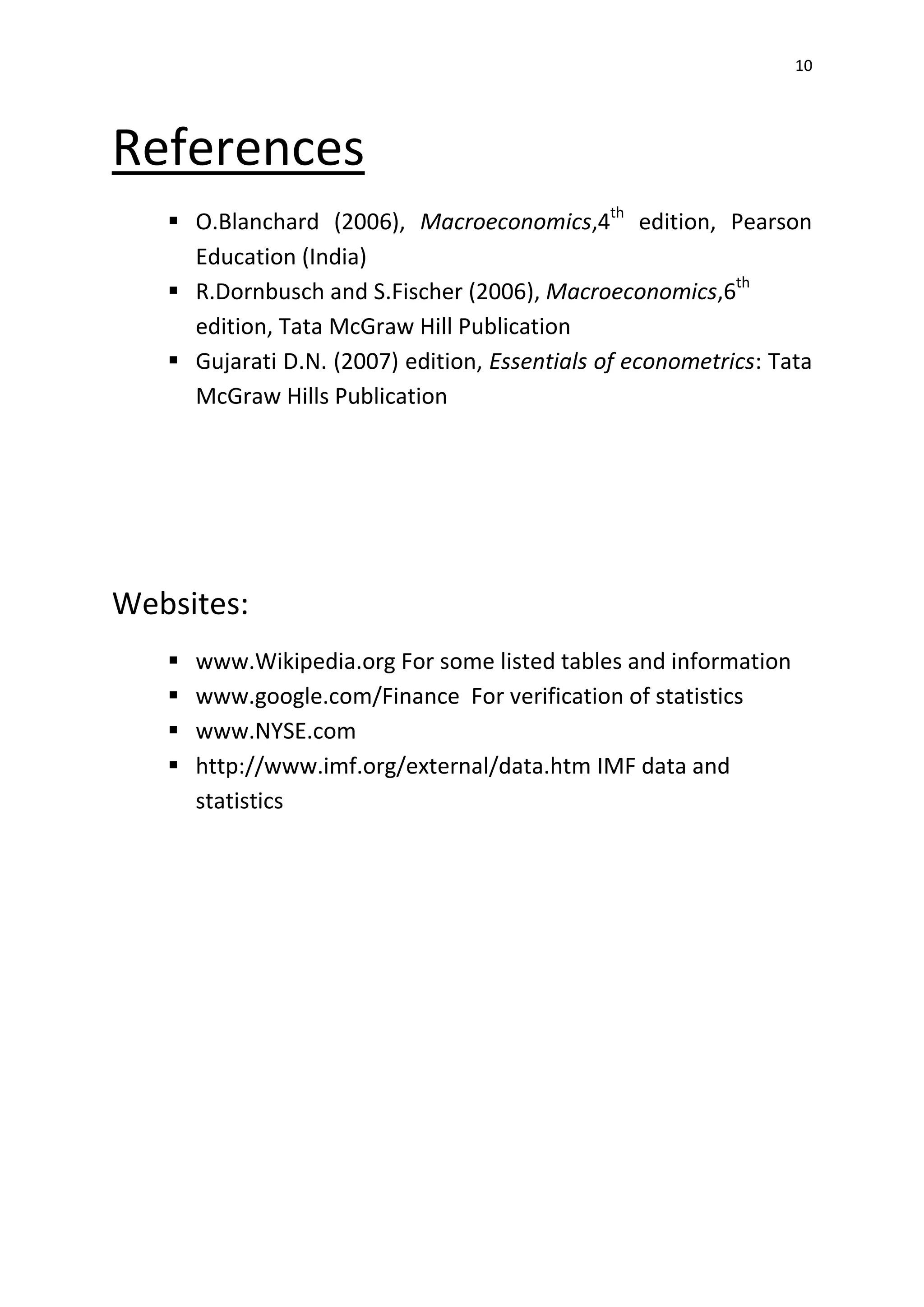

Figure: This figure depicts the changes in the two variables w.r.t. time

The scatter plot shows a strong Correlation between the two

variables.

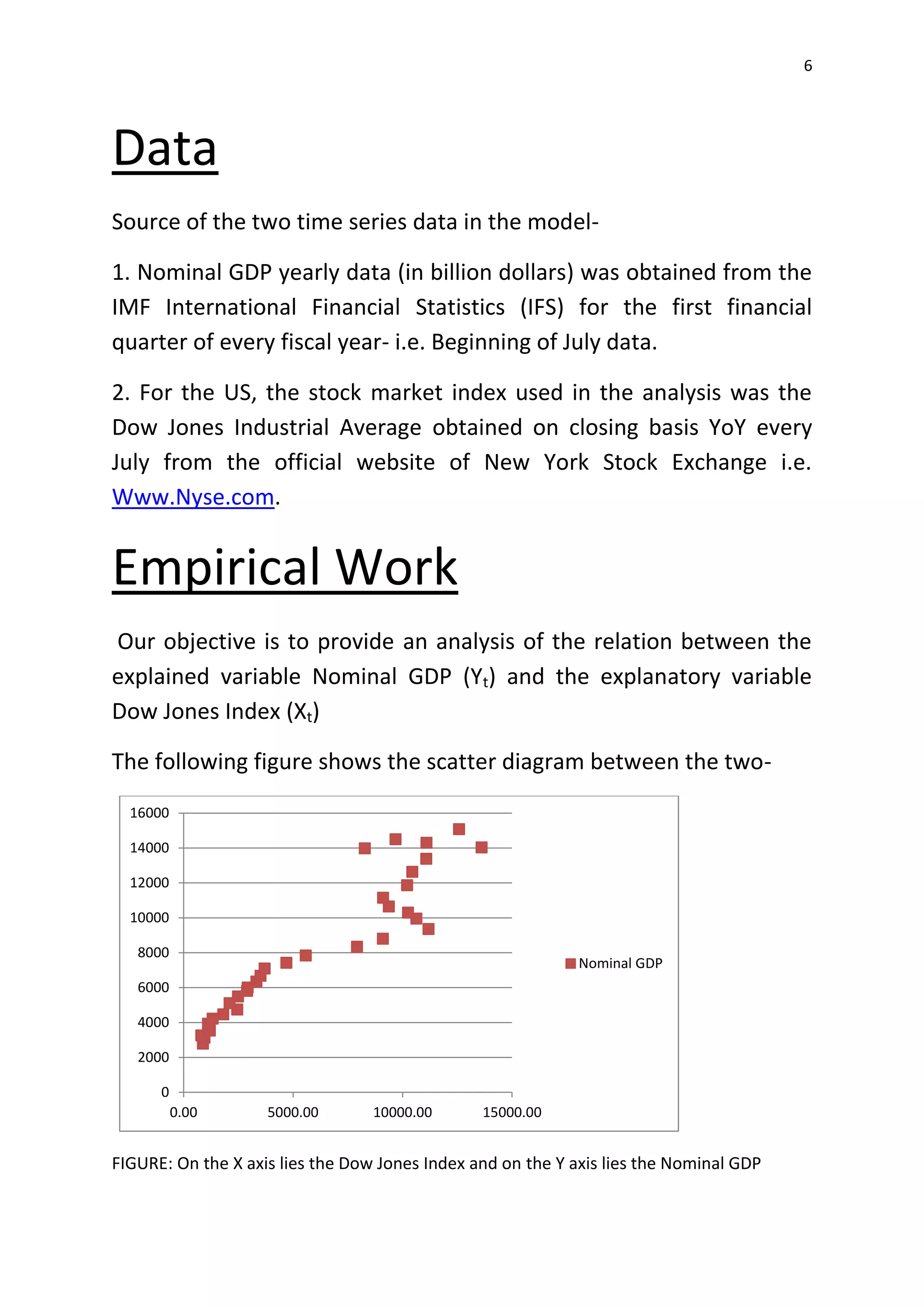

Considering the Sample regression function-

Yt = b1 + b2Xt + et

Analysis of our data gives us the following result [See Appendix] -

Hence, Y(cap) = 3018.81 + 0.86Xt

{Y(cap) denotes the Estimator of Yt } Standard error (444.52) Standard error (0.059)

t-statistic (6.79) t- statistic

(14.38)

P-value (1.5*10-7

) P-value (5.32*10-

15

)

0.00

5000.00

10000.00

15000.00

20000.00

25000.00

30000.00

Nominal GDP

Dow Jones](https://image.slidesharecdn.com/a256e568-0634-4b39-b2e7-ddabe1162319-170209220223/75/Econometrics-project-7-2048.jpg)

![12

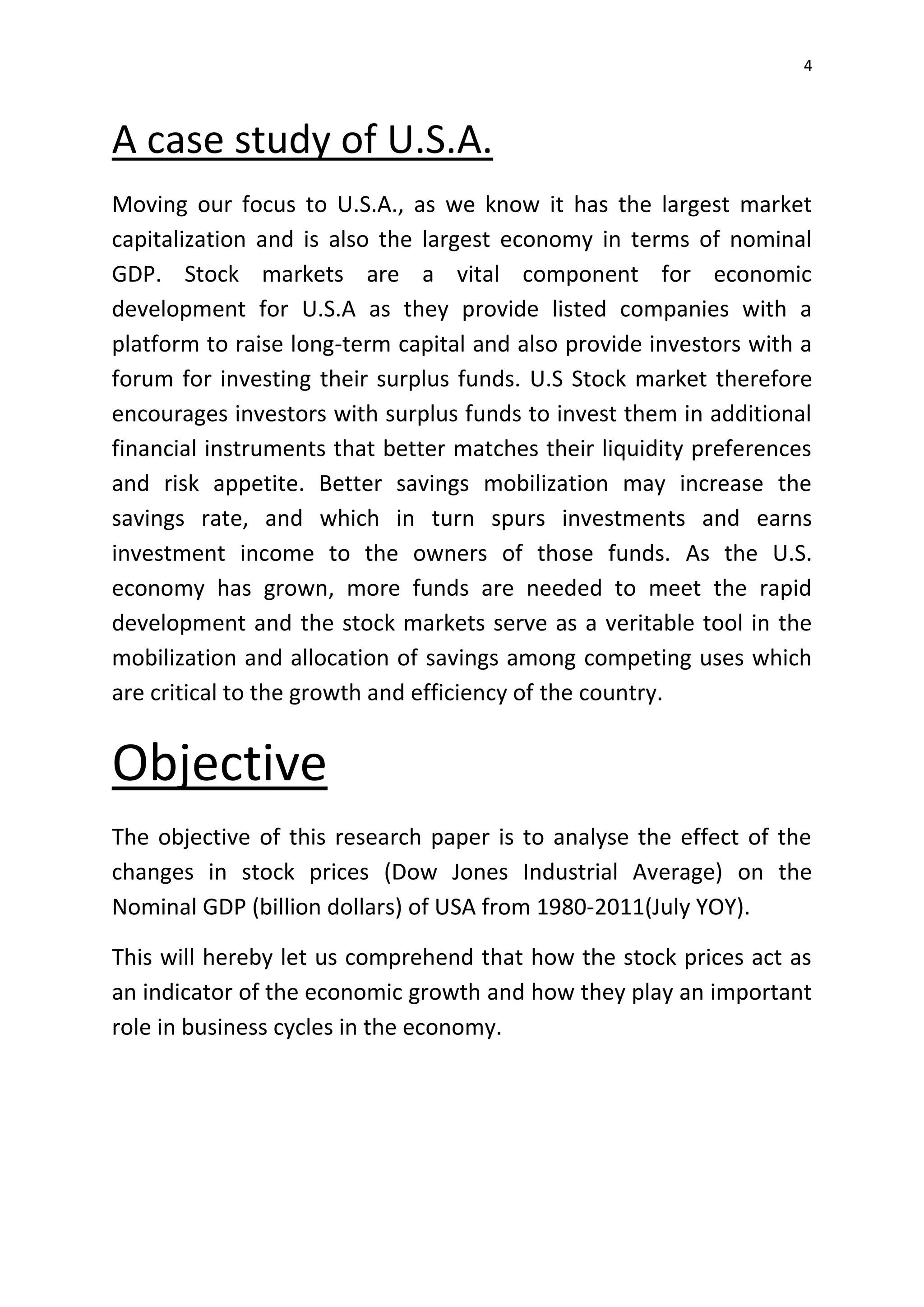

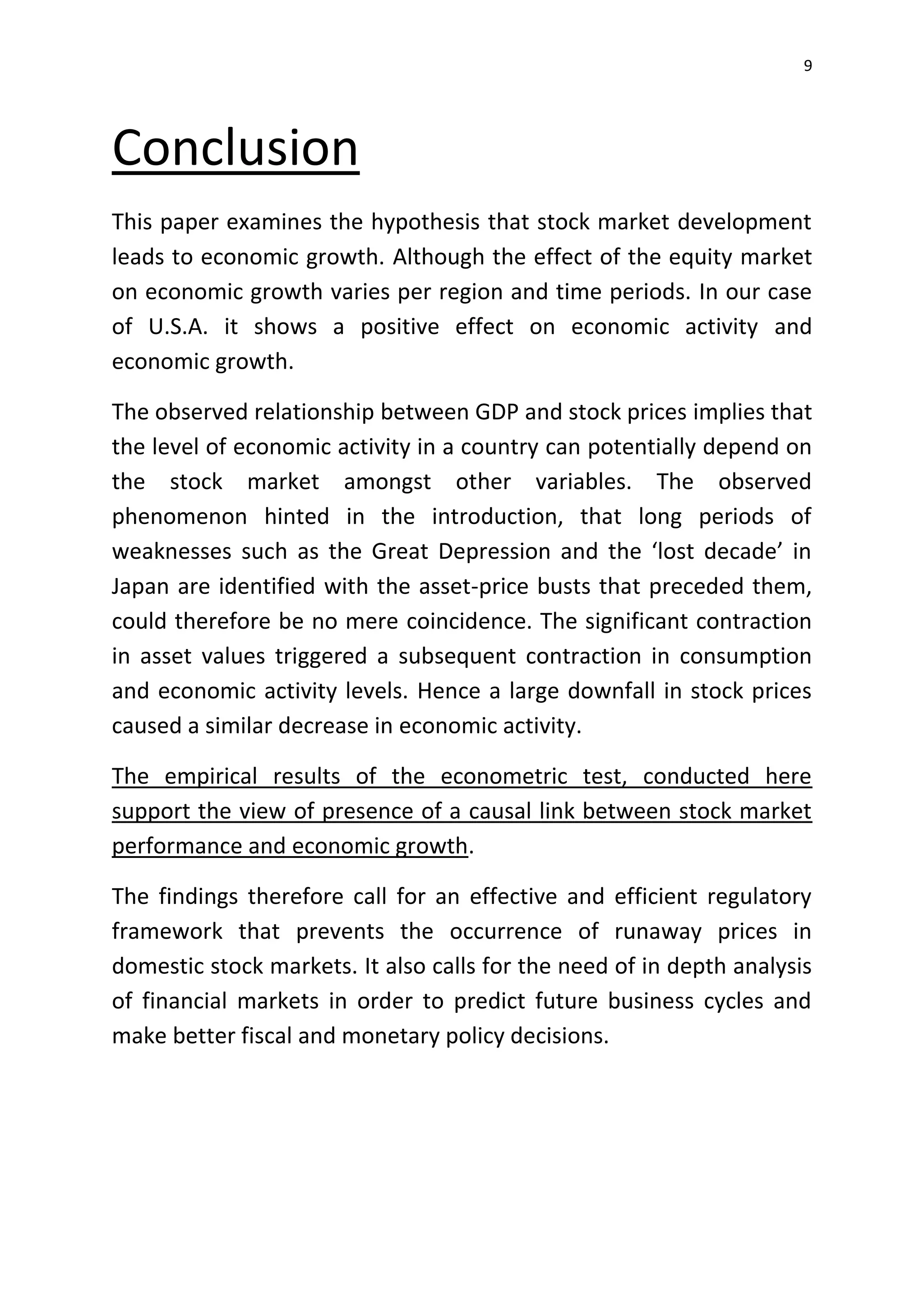

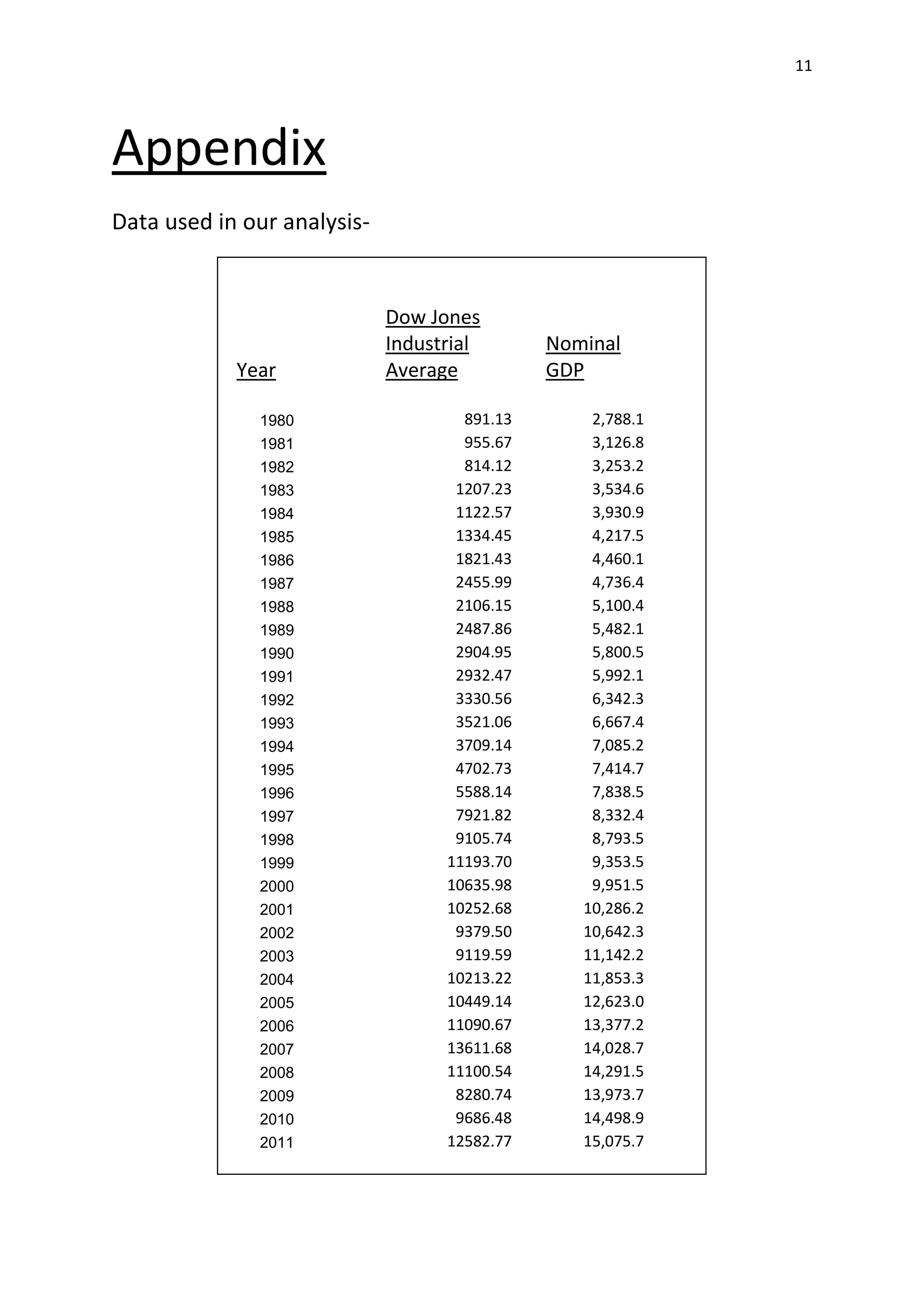

Basic formulae used in the calculation, and hypothesis of our

variables.

b1= E(Y) – b2E(X)

b2= [∑XiYi – nE(X)E(Y)]/ ∑Xi

2

- n E(Y)2

R2

= ESS/ TSS

Adjusted R2

= {1- (1- R2

) (n-1)}/(n-k)

Where, k is the total number of variables

F= {R2

/(k-1)}/{(1- R2

)/(n-k)}

The following table shows the results of our calculations:

SUMMARY OUTPUT

Regression Statistics

Multiple R 0.934535046

R Square 0.873355752

Adjusted R Square 0.869134277

Standard Error 1410.325629

Observations 32

ANOVA

df SS MS F

Significance

F

Regression 1 411496141.7 4.11E+08 206.884 5.32E-15

Residual 30 59670551.41 1989018

Total 31 471166693.1

Coefficients

Standard

Error t Stat P-value Lower 95%

Upper

95%

Lower

95.0%

Upper

95.0%

Intercept 3018.812666 444.5235344 6.79112

1.57E-

07 2110.974 3926.651 2110.974 3926.651

X Variable 1 0.862004381 0.059930236 14.38346

5.32E-

15 0.739611 0.984398 0.739611 0.984398](https://image.slidesharecdn.com/a256e568-0634-4b39-b2e7-ddabe1162319-170209220223/75/Econometrics-project-12-2048.jpg)