This document analyzes the relationship between consumption and price using statistical analysis and regression models. It finds:

1. There is a strong negative correlation between consumption and price, meaning as price increases consumption decreases.

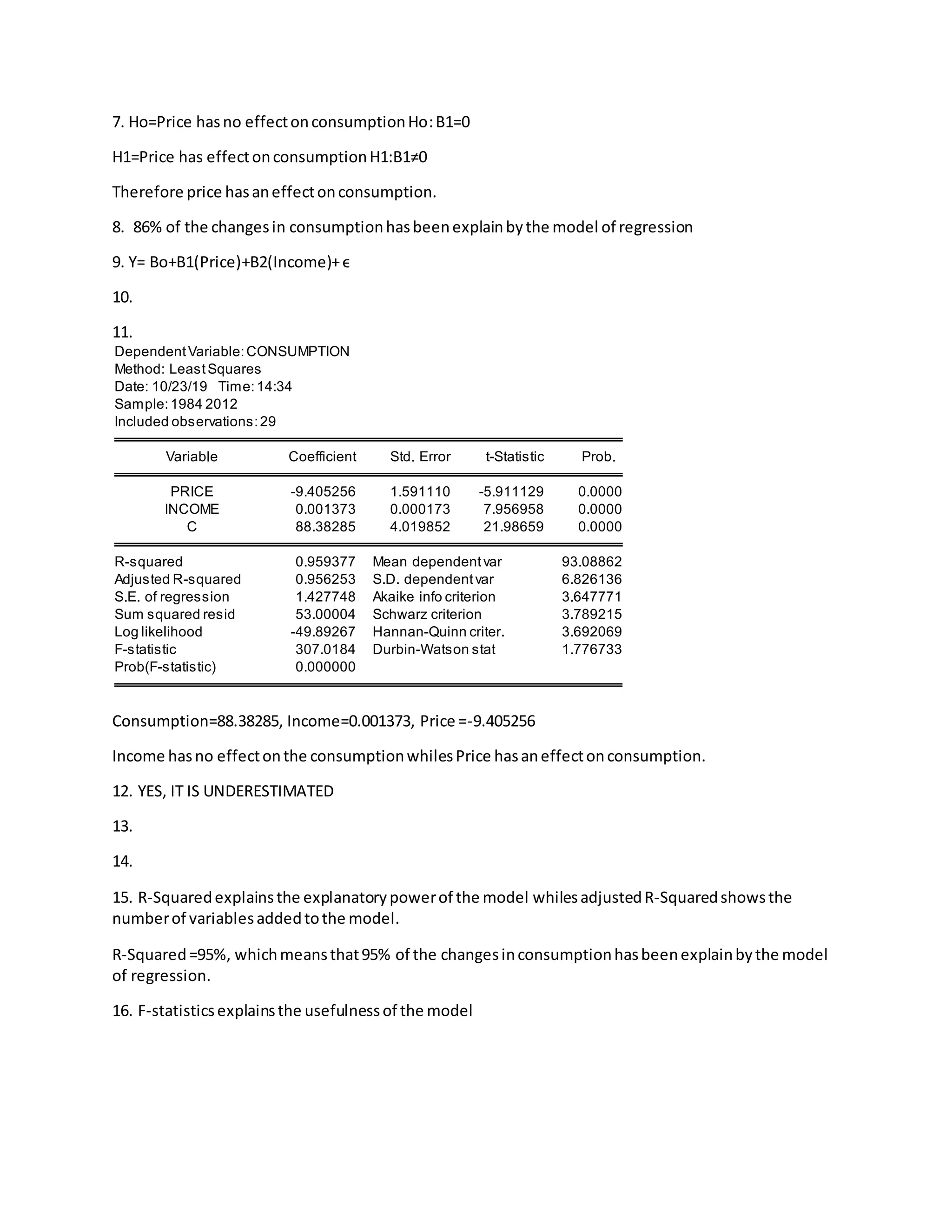

2. A regression model with price as the independent variable explains 86% of the changes in consumption.

3. Adding income as a second independent variable improves the model fit, with price and income both having a statistically significant impact on consumption.