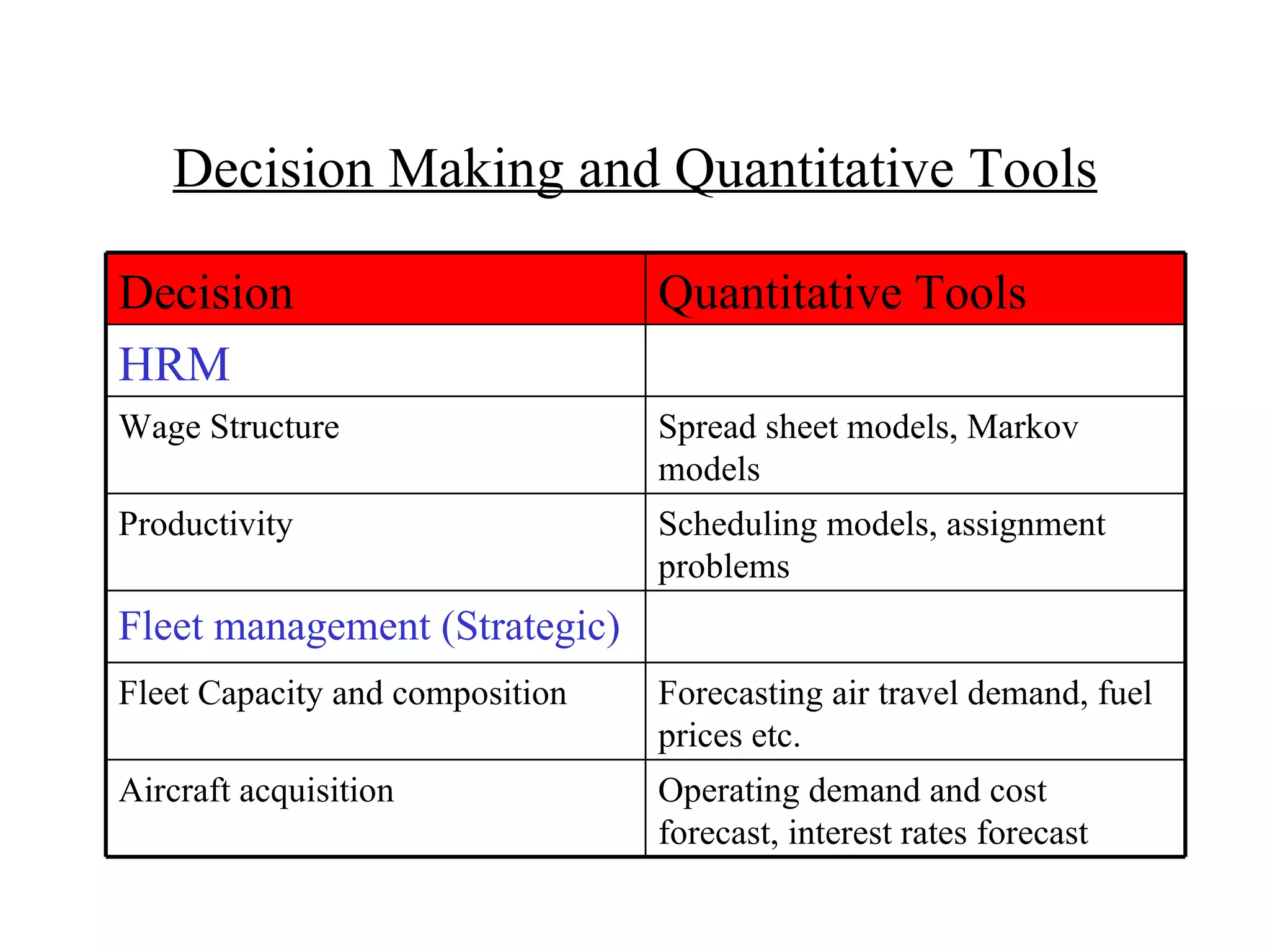

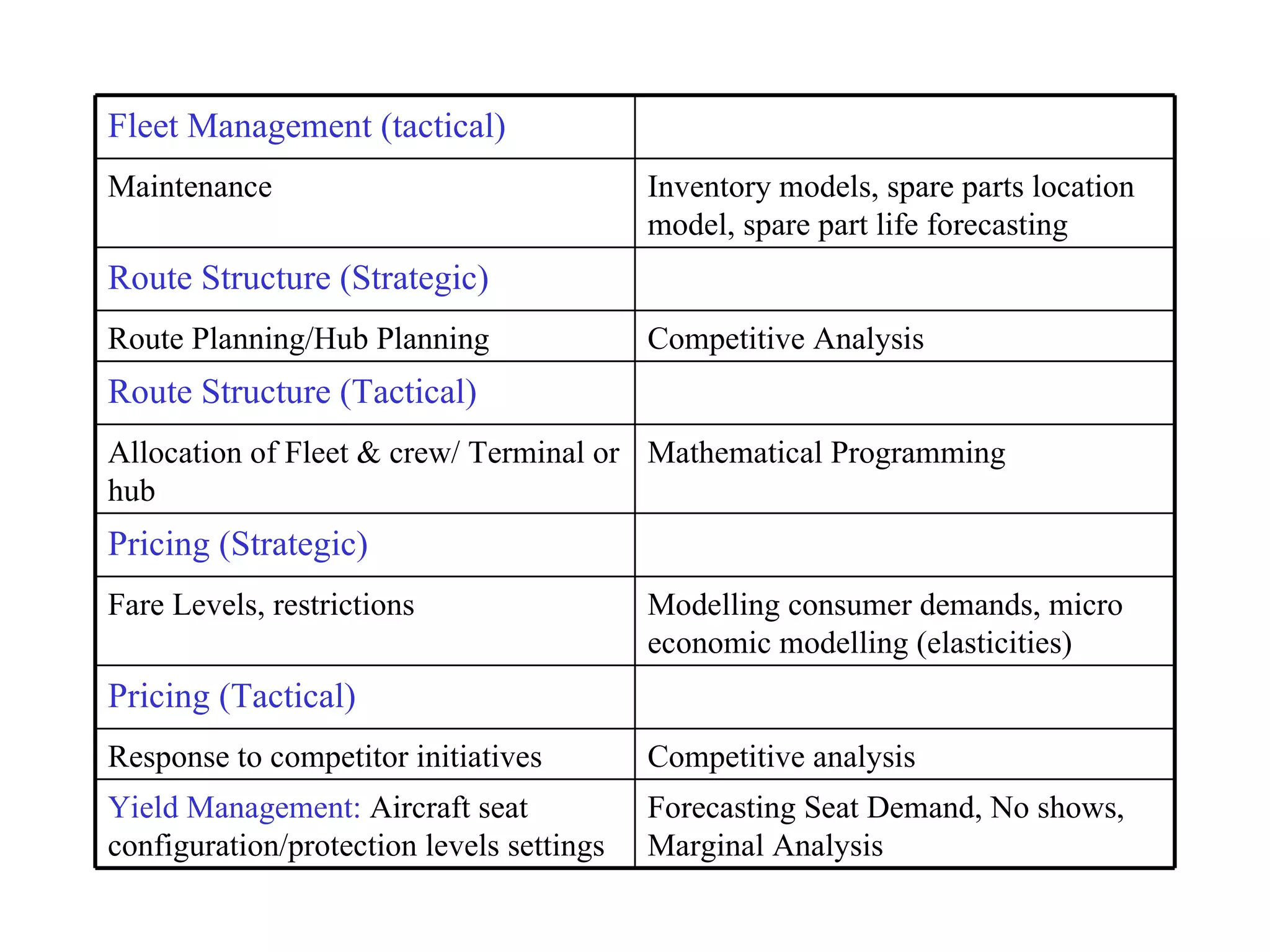

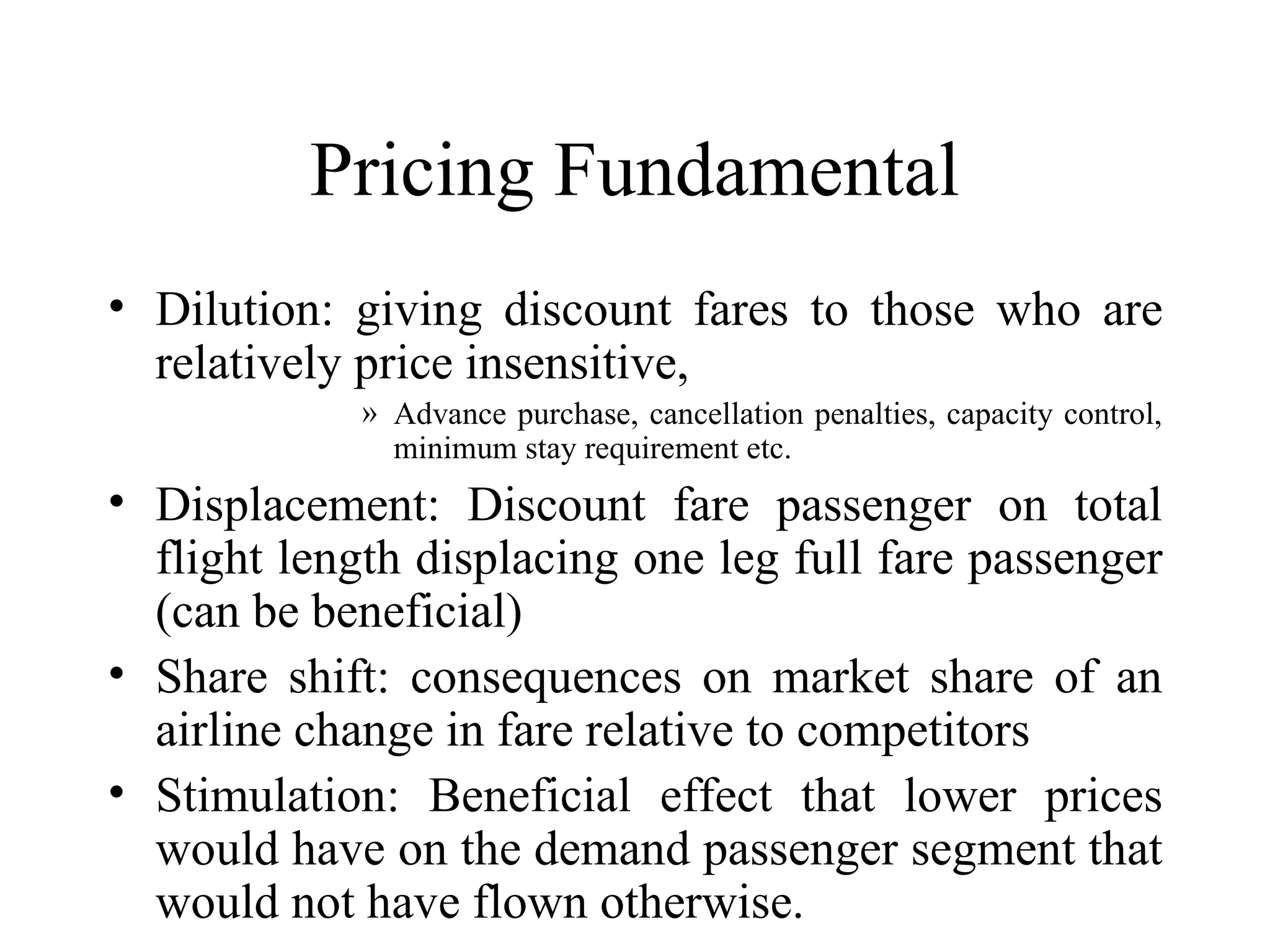

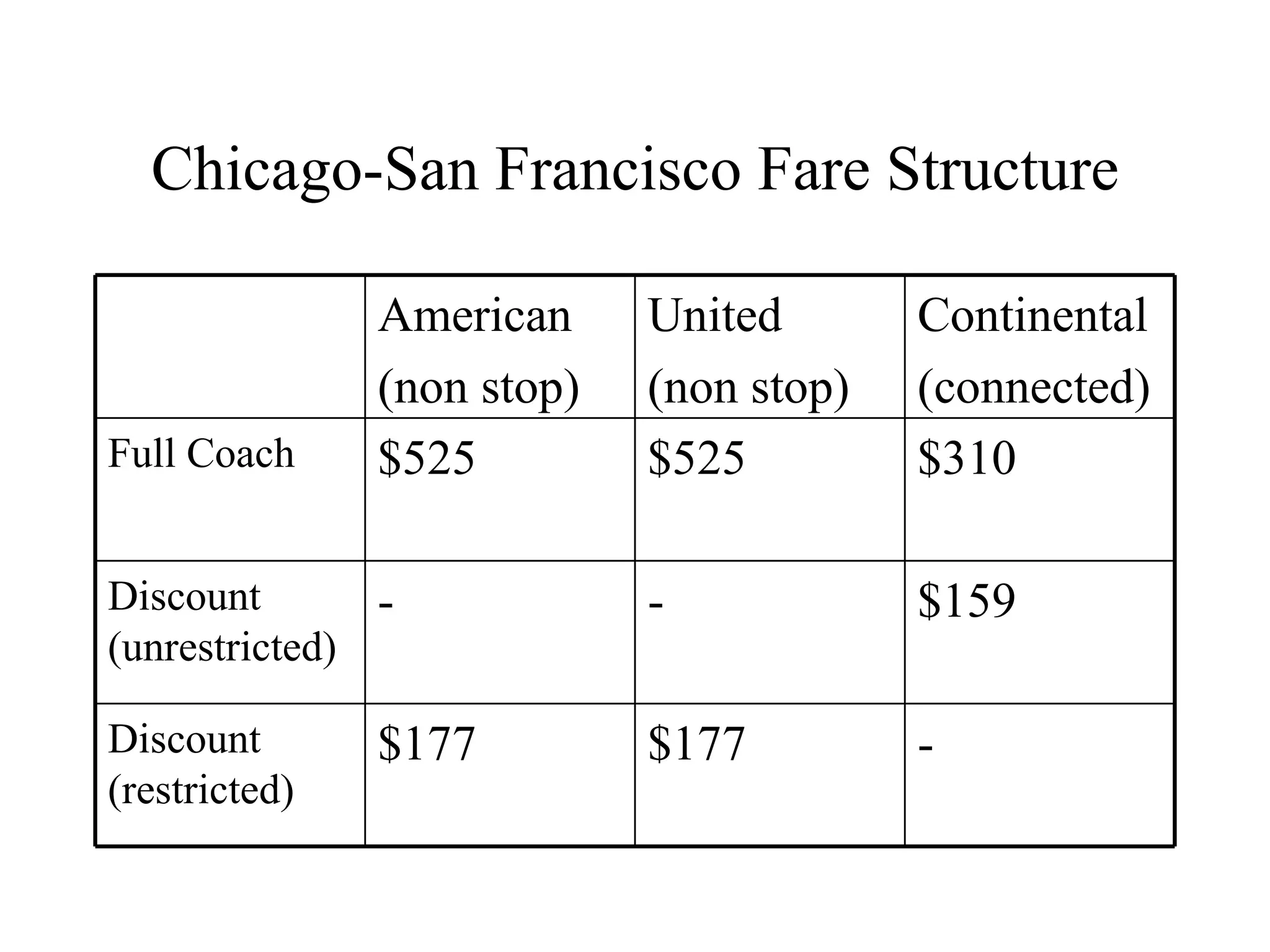

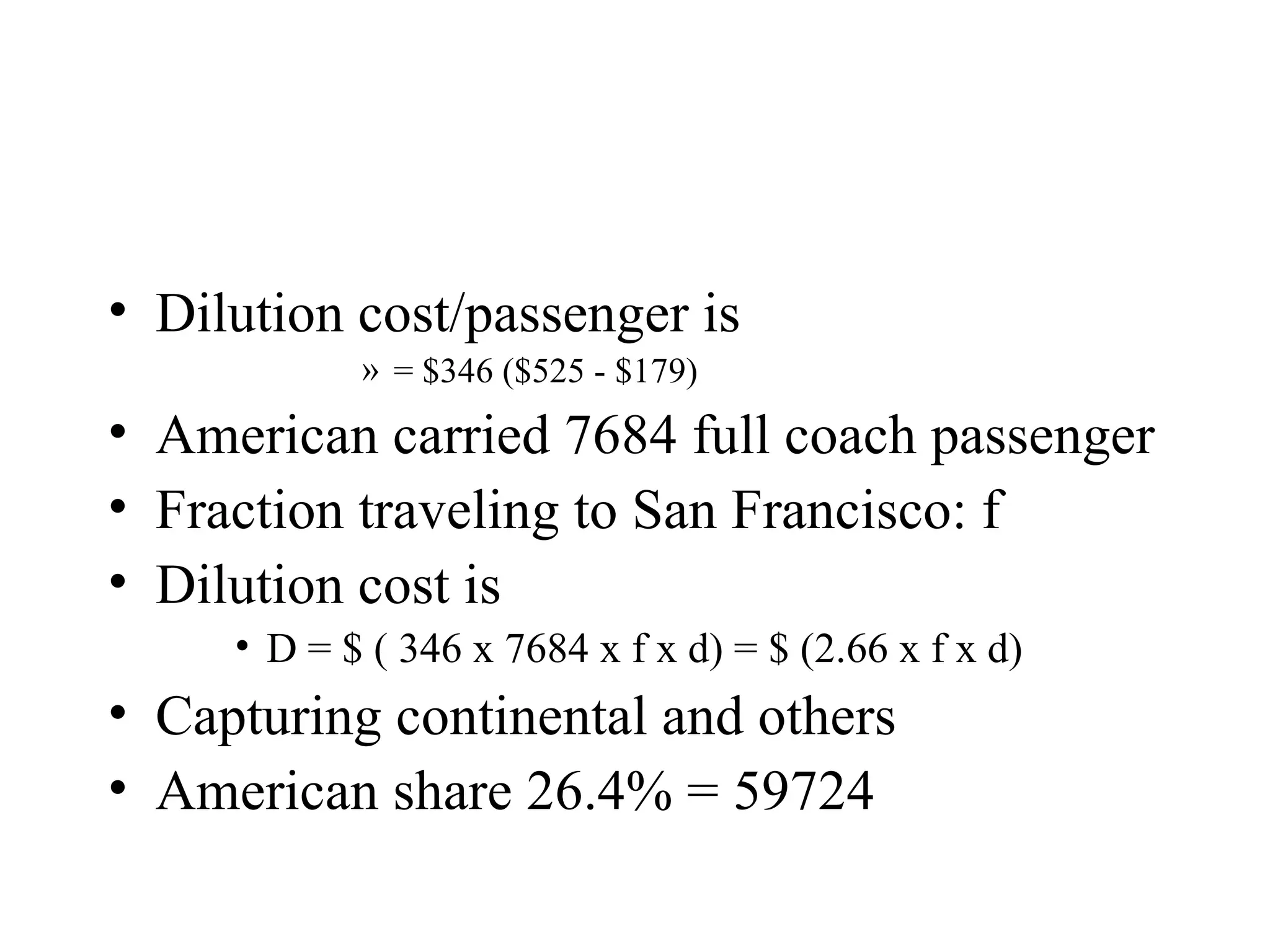

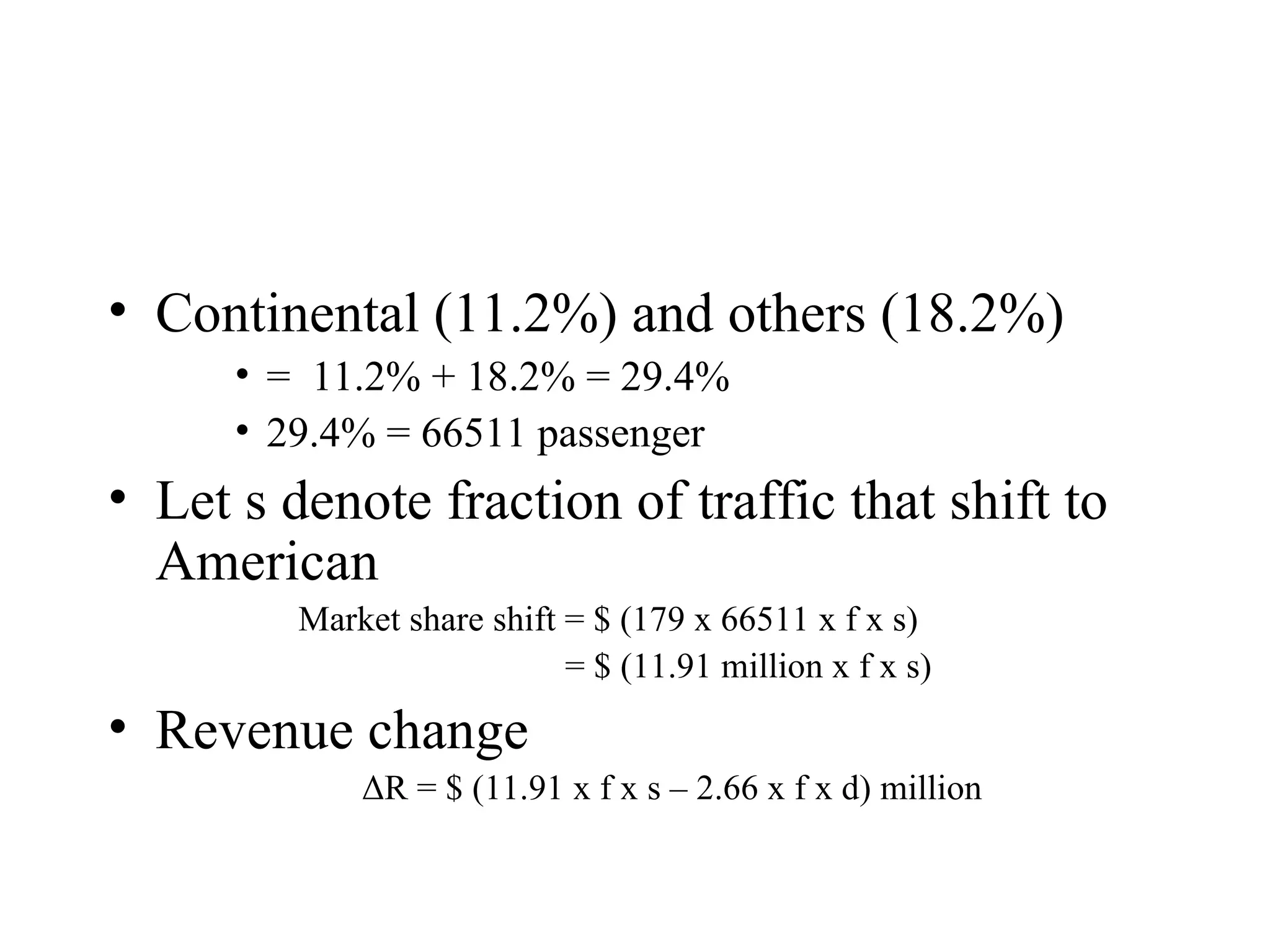

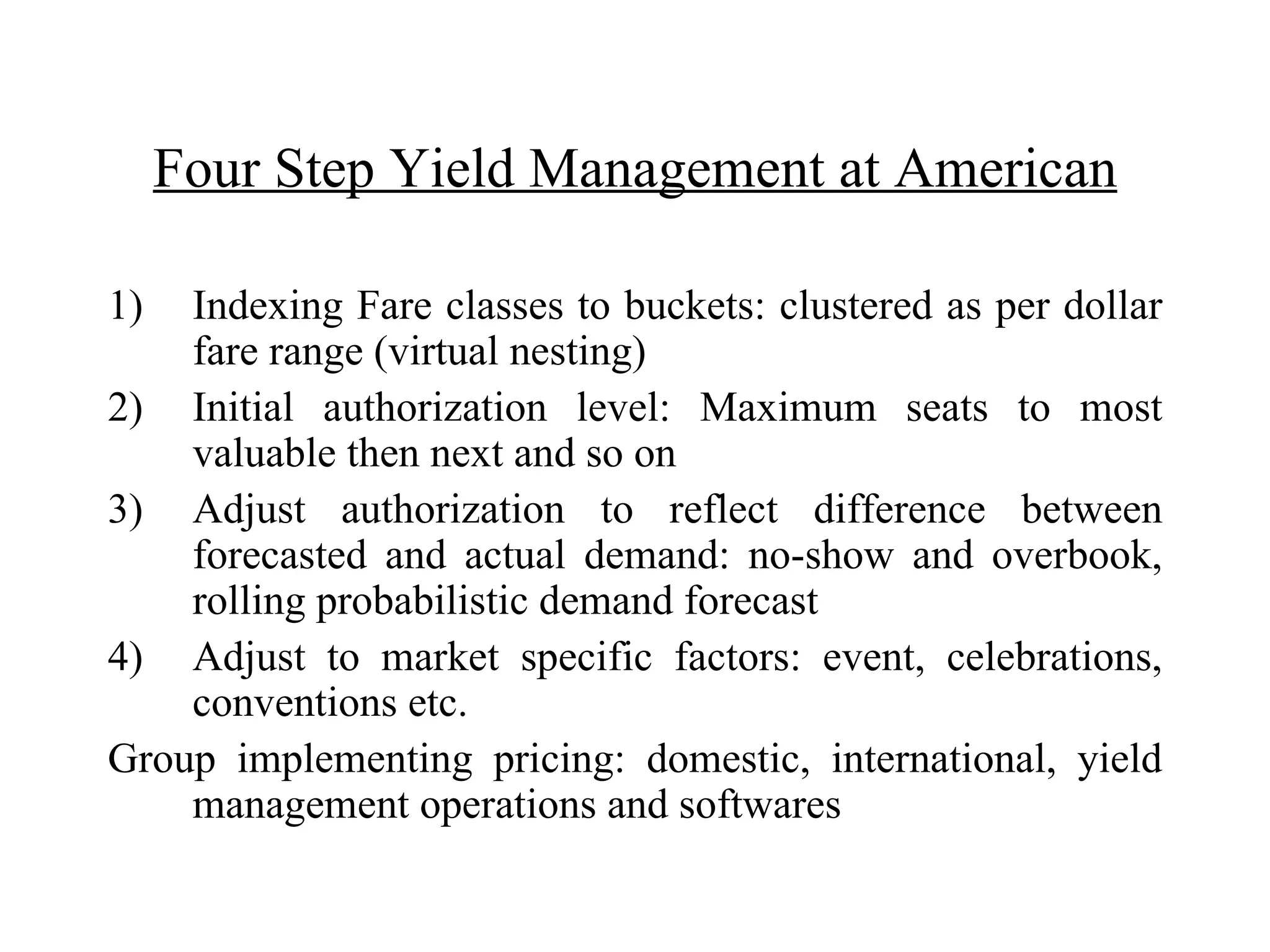

The document discusses various quantitative tools used in airline revenue management and decision making. It covers topics like demand forecasting, fleet management, scheduling models, pricing concepts, yield management, and competitive analysis. Yield management involves clustering fare classes into buckets based on price and adjusting authorized seat levels for different fare classes based on forecasted versus actual demand trends. Key factors considered in airline yield management calculations include fare levels, restrictions, passenger demand elasticities, and market-specific conditions.