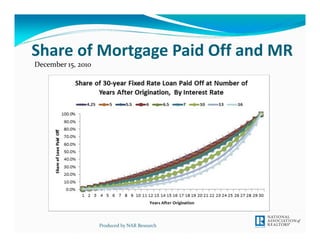

This document discusses how the share of a mortgage that is paid off varies based on interest rates over the life of a 30-year loan. It shows that lower interest rates allow borrowers to pay off a greater share of the loan faster. For example, at a 4.25% rate, one-quarter of the loan is paid off after 12 years, while at a 10% rate it takes 18 years to reach the same point. The document also notes that 91% of home buyers in 2010 financed their purchase, so current low mortgage rates are beneficial in allowing buyers to pay down more of the loan early on.