Embed presentation

Download to read offline

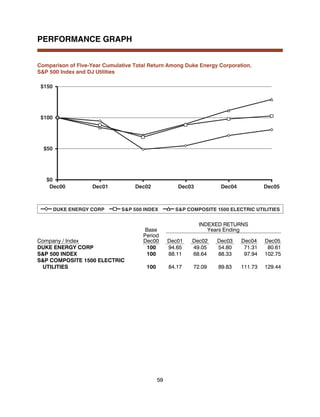

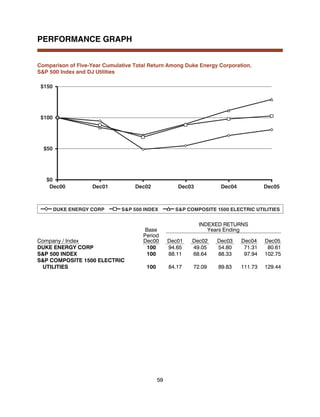

The document is a proxy statement and notice of annual meeting for Duke Energy Corporation shareholders. It announces the annual meeting to be held on October 24, 2006 and provides details on voting for election of directors, approval of a long-term incentive plan, and ratification of the independent auditor. The CEO's letter encourages shareholders to vote and participate in the meeting.