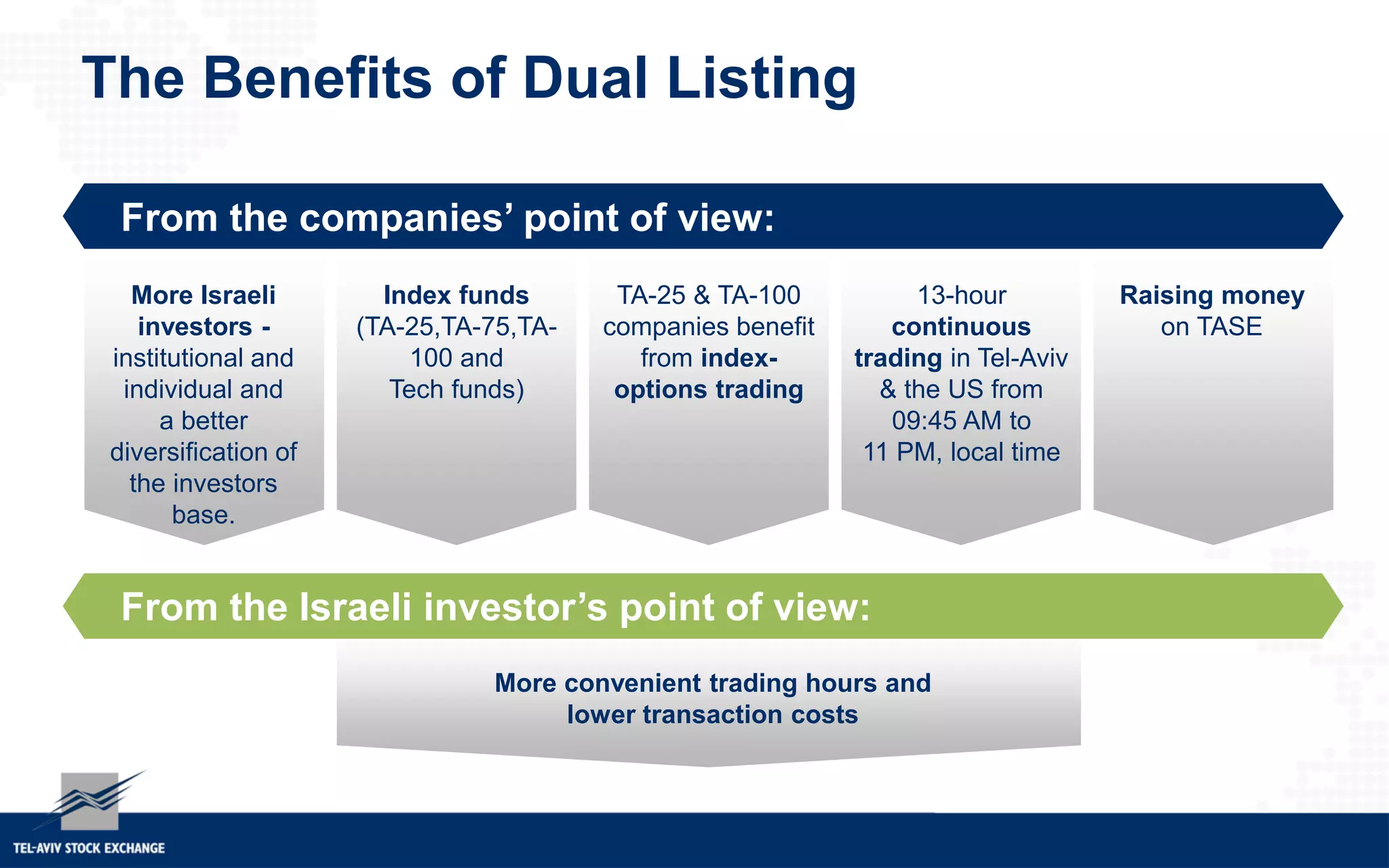

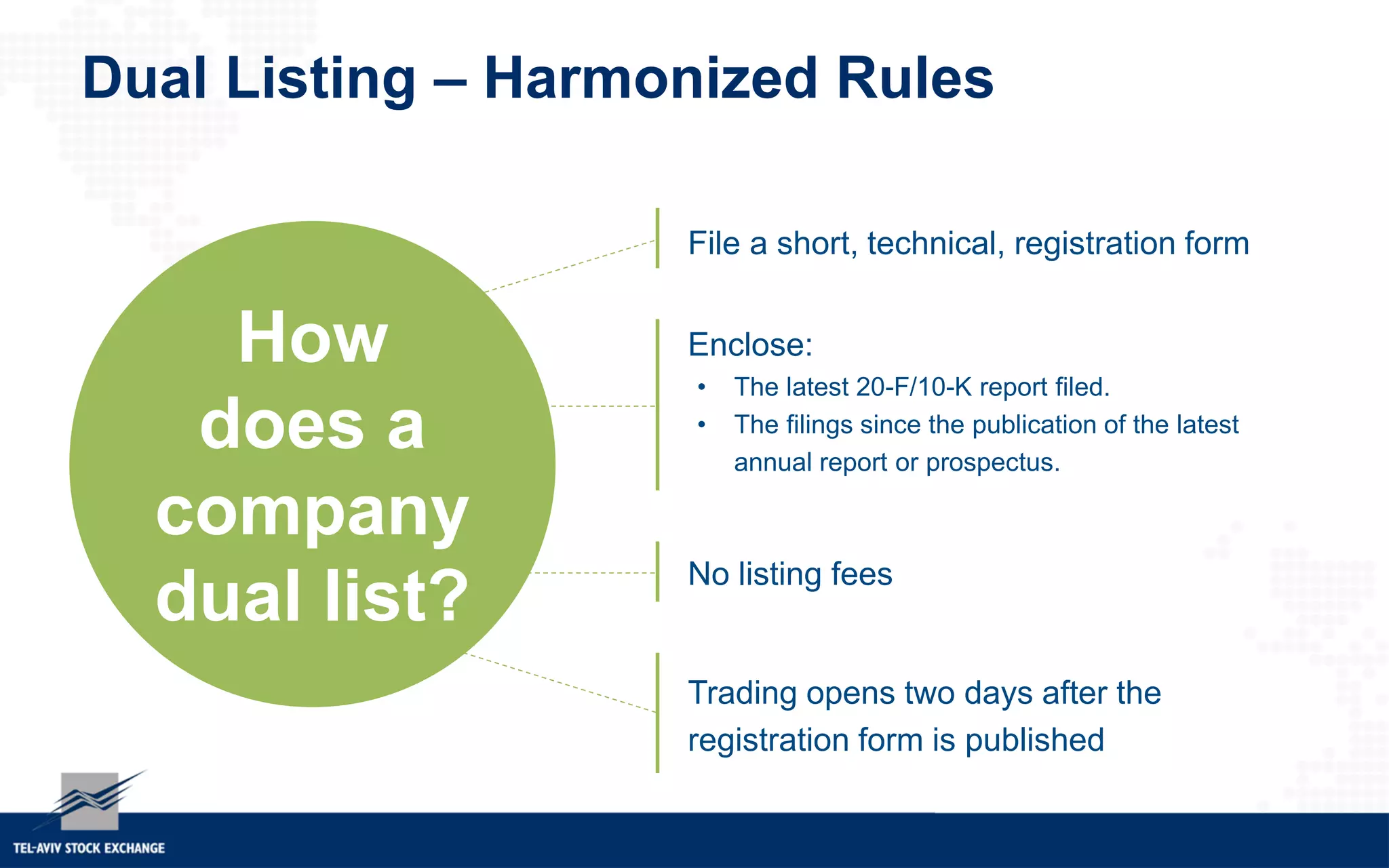

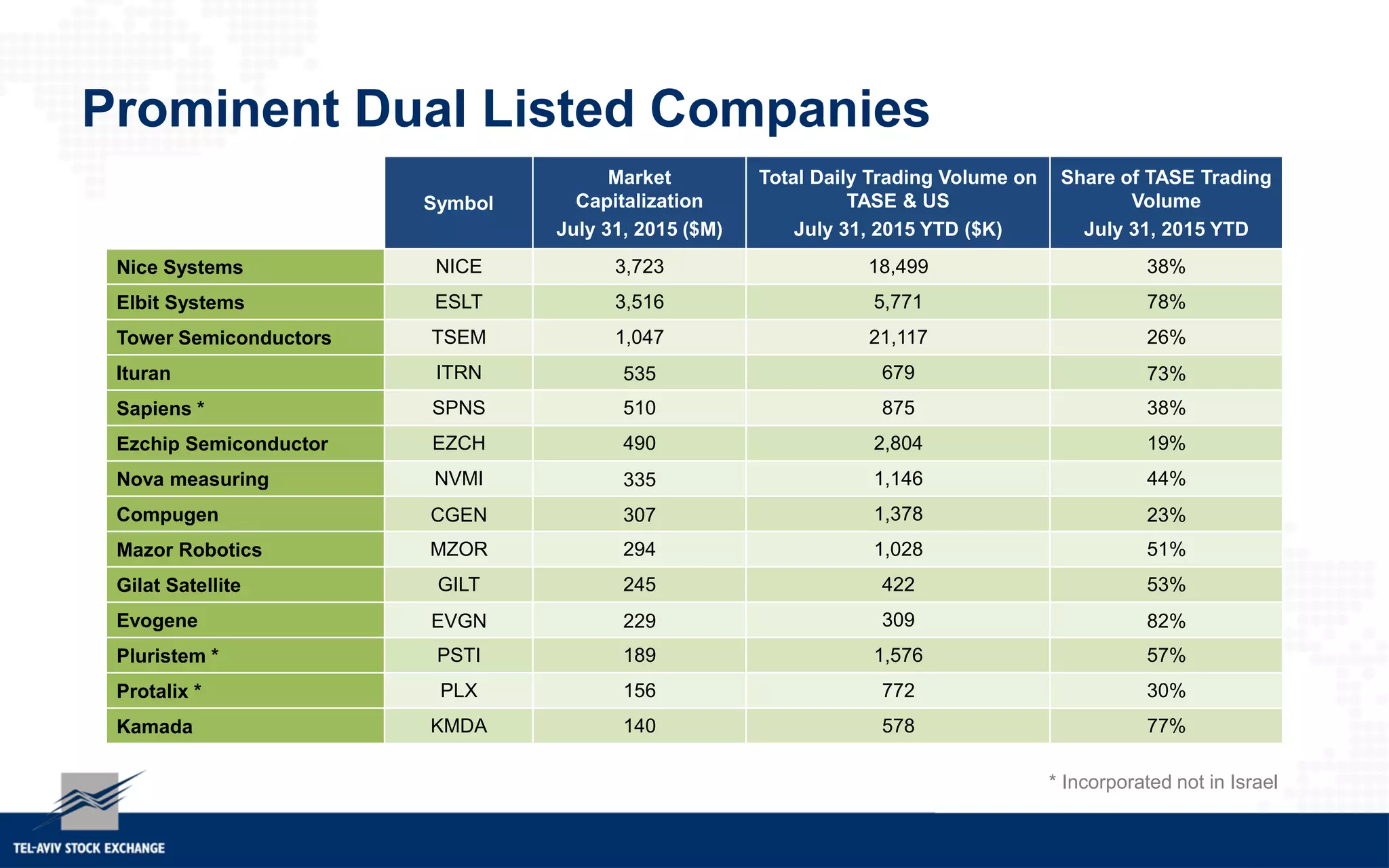

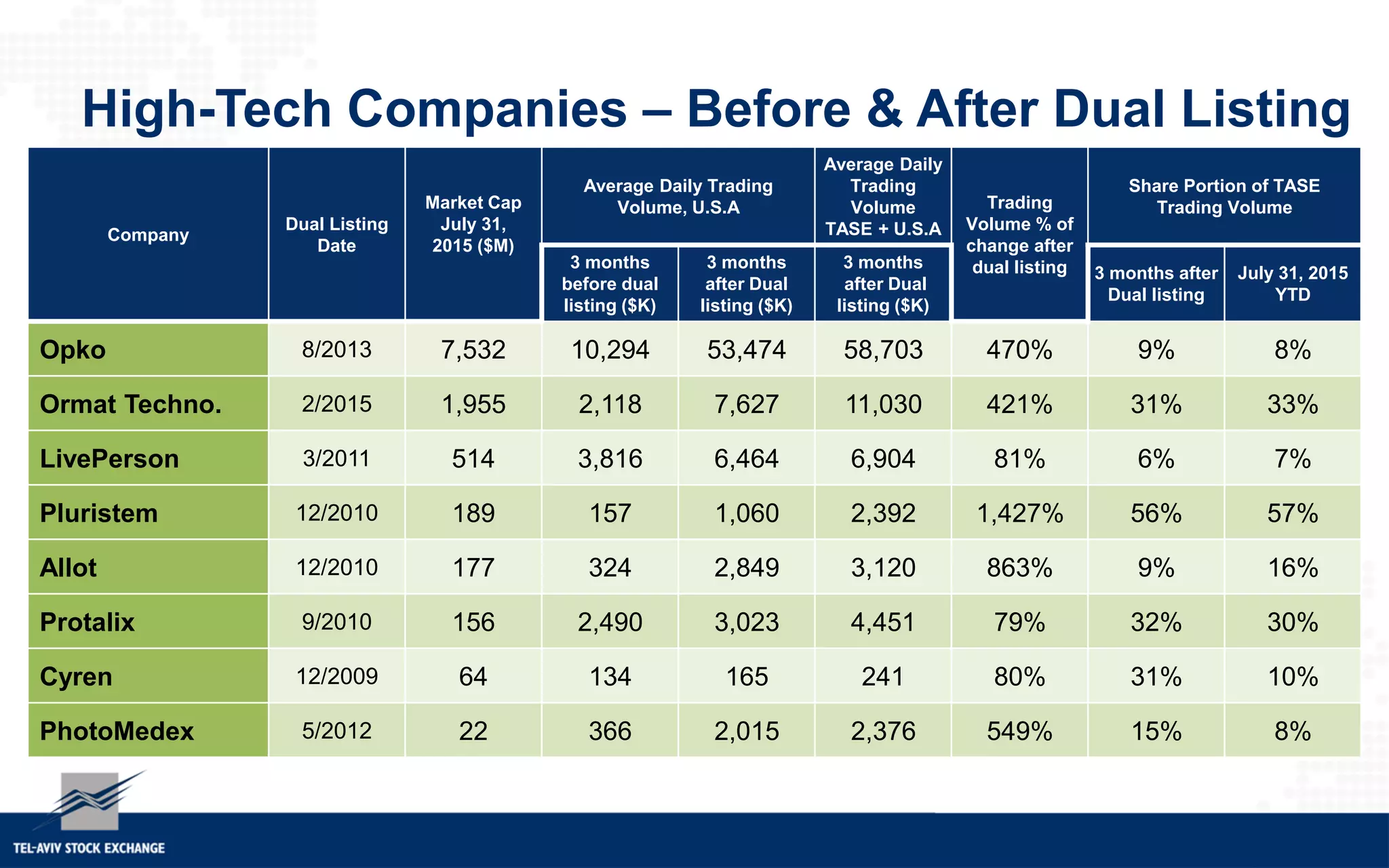

Dual listing companies on the Tel Aviv Stock Exchange (TASE) and a major foreign exchange like NYSE or NASDAQ can benefit both the companies and Israeli investors. For companies, it provides access to a wider investor base and more convenient trading hours. For Israeli investors, it allows more opportunities to invest in Israeli companies and provides lower transaction costs and a better diversification of their investment portfolio. There are now 46 companies dually listed, and they see increased trading volumes on both exchanges after becoming dual listed. The process of dual listing is also designed to be simple, requiring only a short registration form and no translation of financial statements.