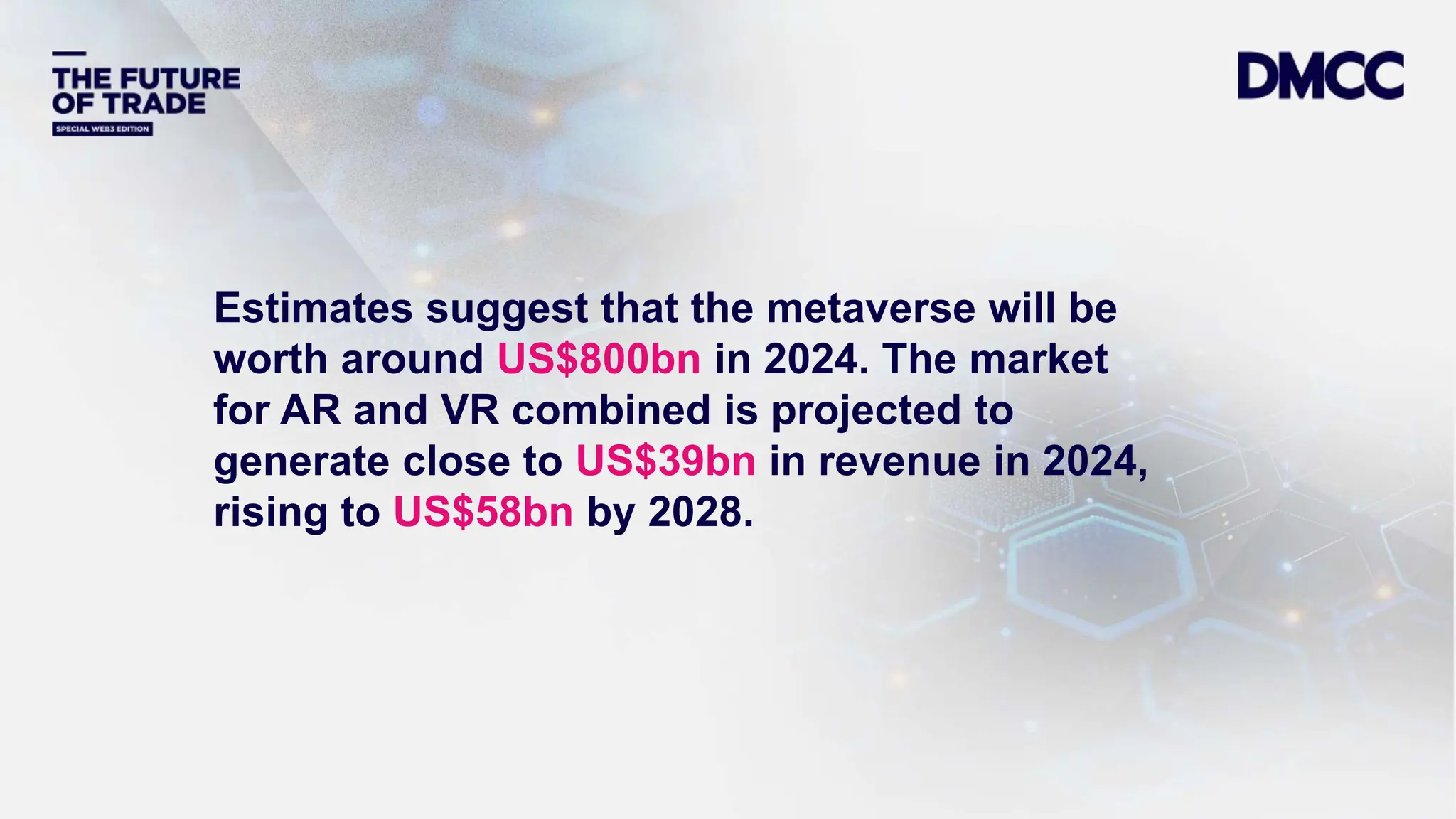

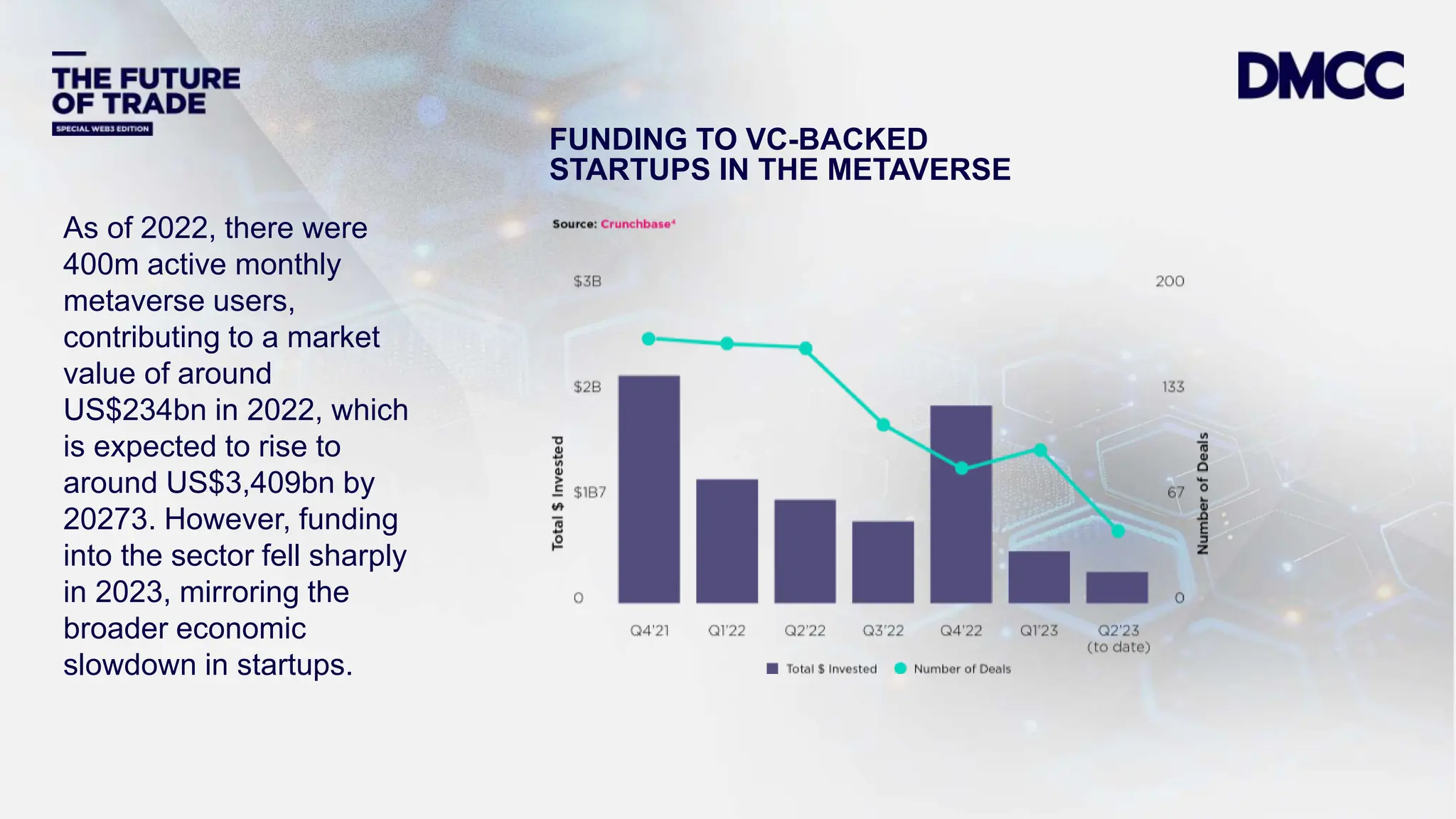

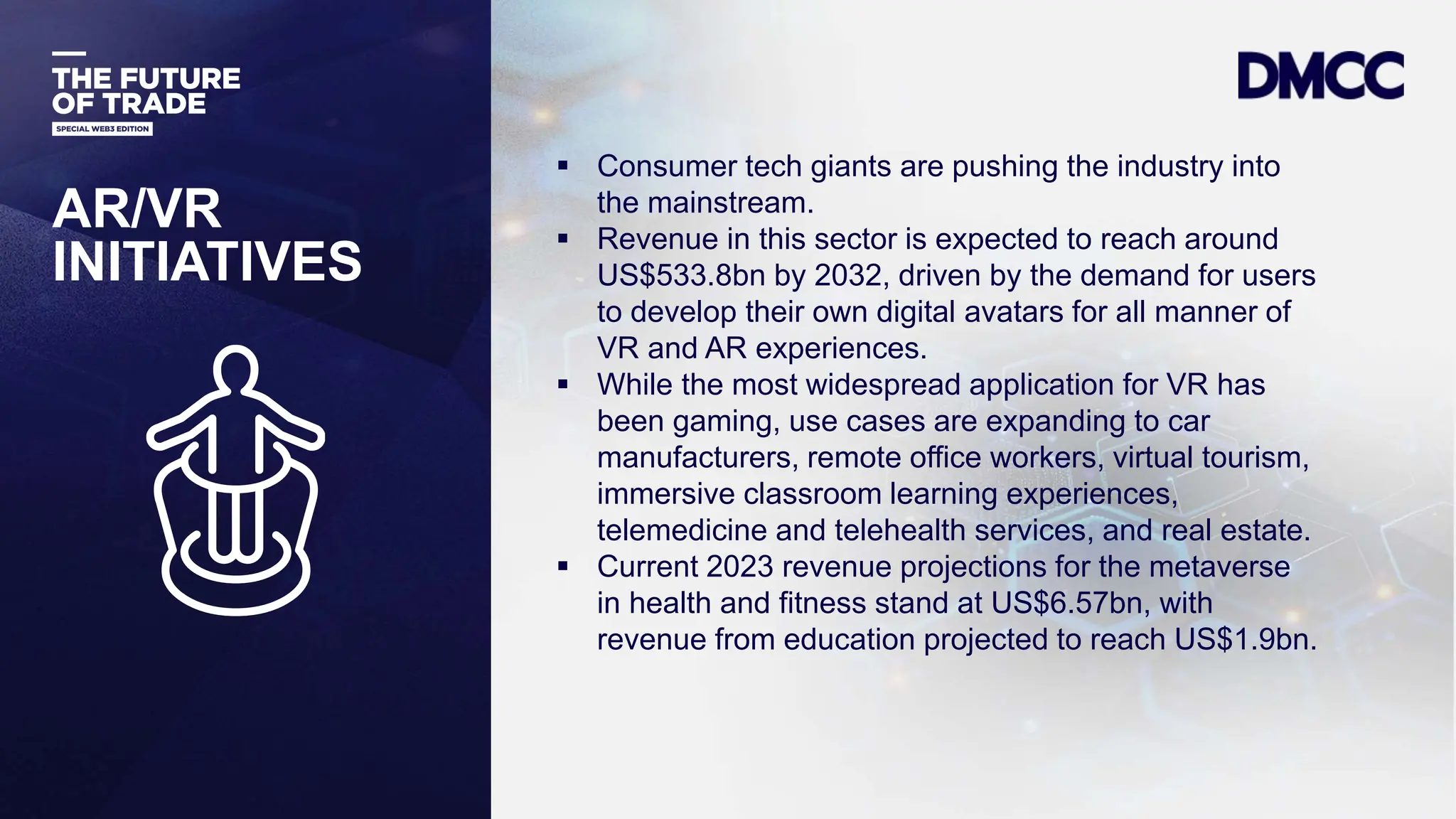

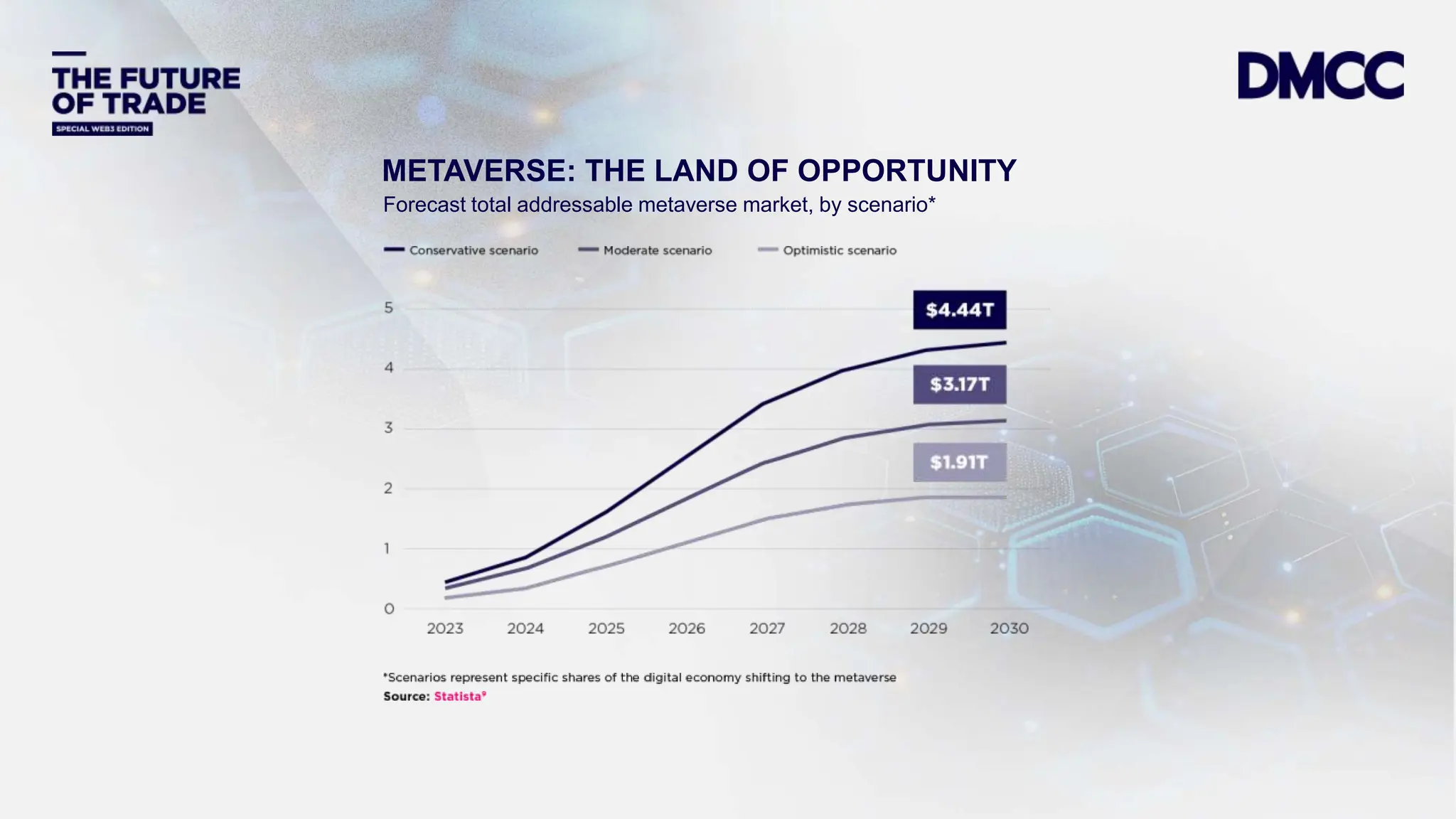

The document discusses the evolution of the web3 era, driven by technology trends such as blockchain, cryptocurrencies, and the metaverse, promising decentralization and innovation. It highlights the resilience of the market post-2022 'crypto winter', the potential growth of decentralized finance (DeFi), and the challenges faced in the metaverse and cryptocurrency regulation. The UAE emerges as a leader in crypto regulation, fostering an environment conducive to investment and innovation while emphasizing the importance of clear regulatory frameworks.