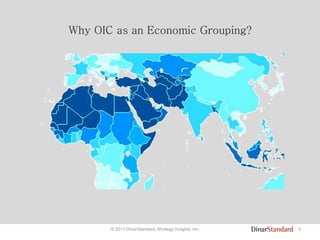

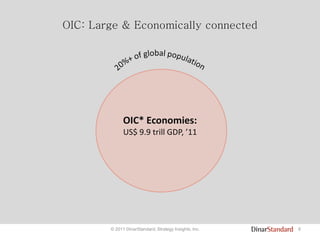

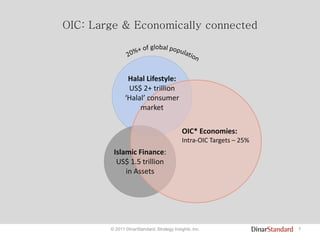

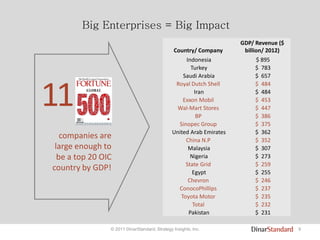

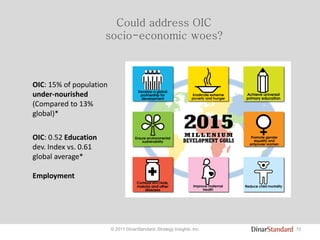

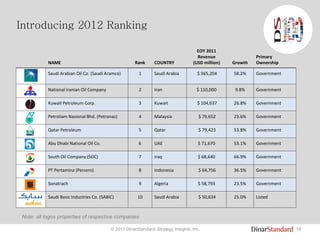

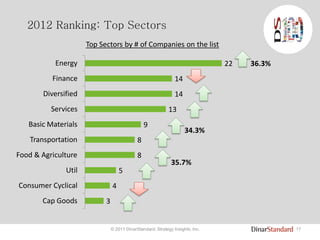

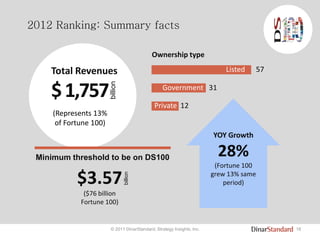

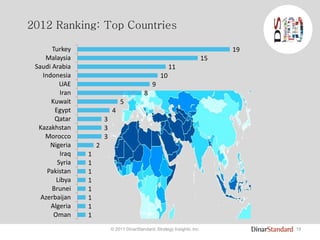

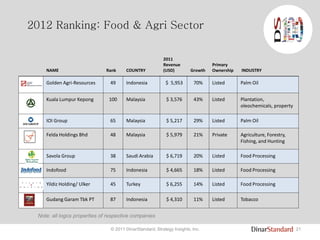

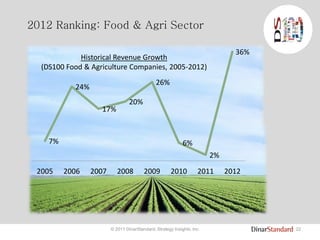

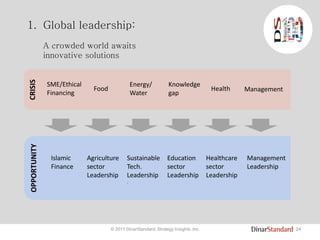

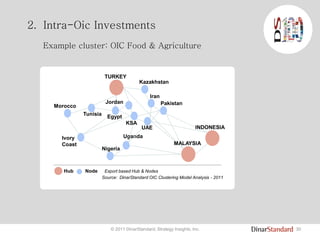

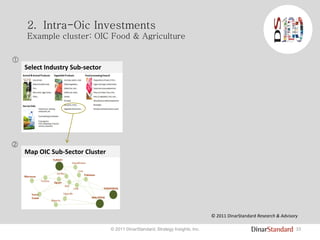

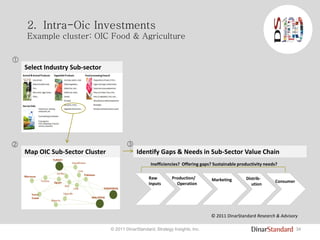

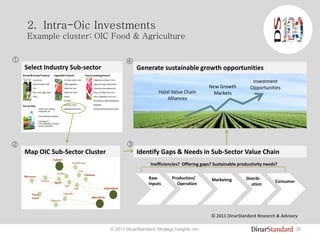

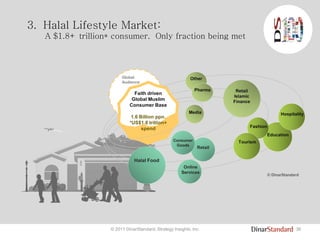

The document presents the 9th annual DS100 ranking of the top 100 companies from OIC member countries, emphasizing their economic impact and leadership opportunities. Key highlights include the large GDP of OIC member economies, the rapid growth of these companies, and their significant role in addressing socio-economic challenges. The ranking showcases various industries, particularly energy and food/agriculture, while calling for intra-OIC investments and innovation to enhance the global presence of these companies.