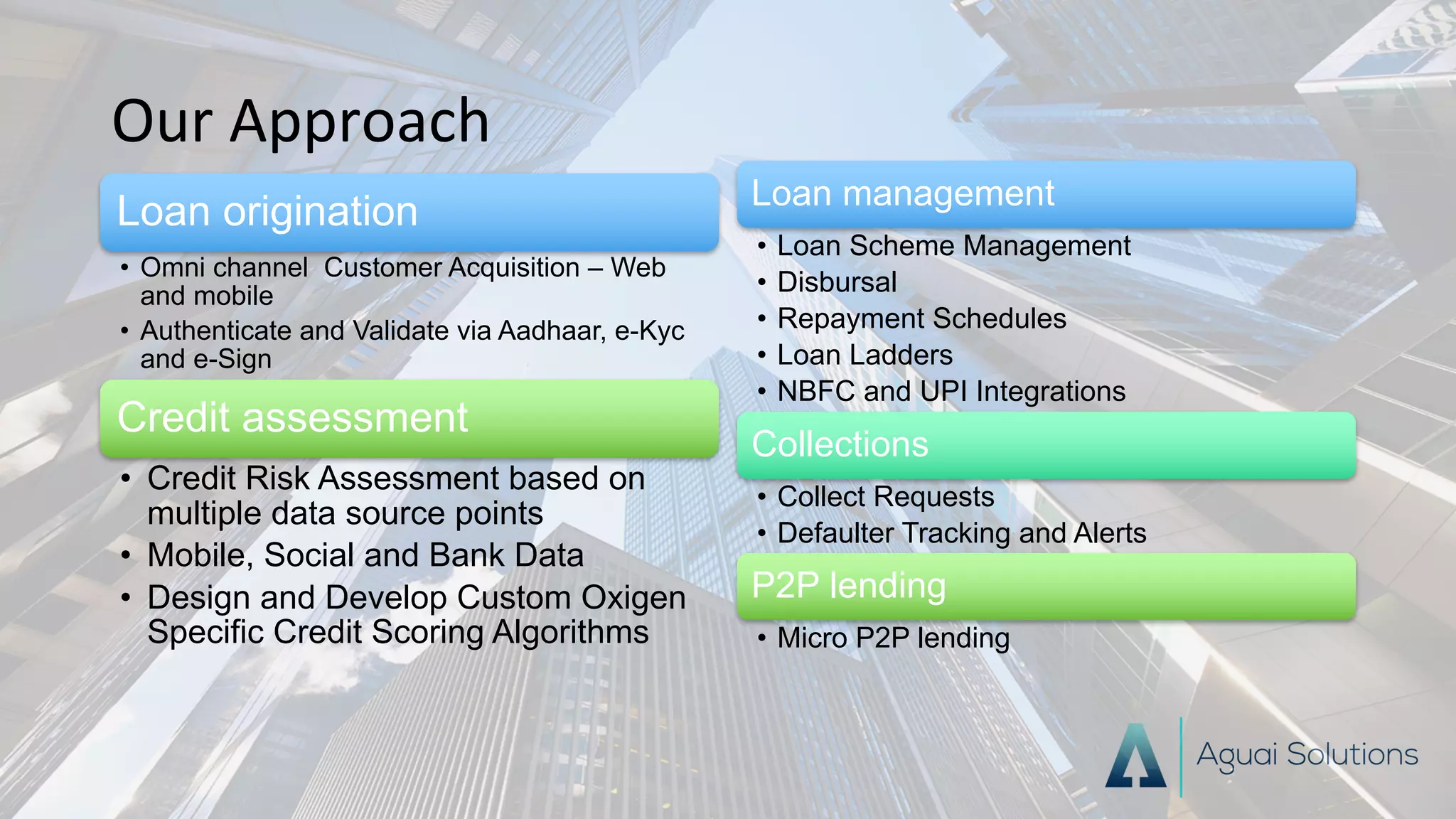

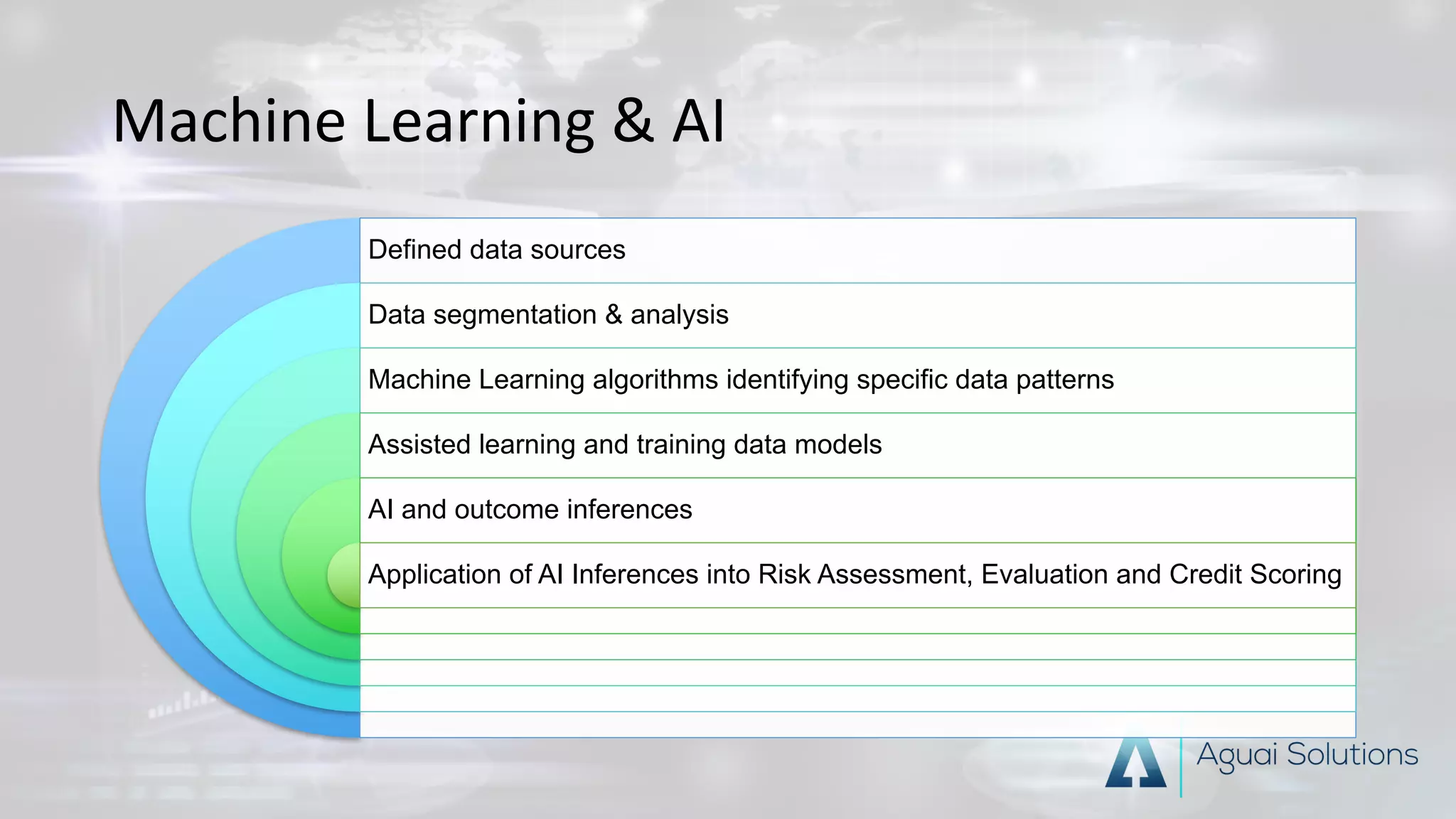

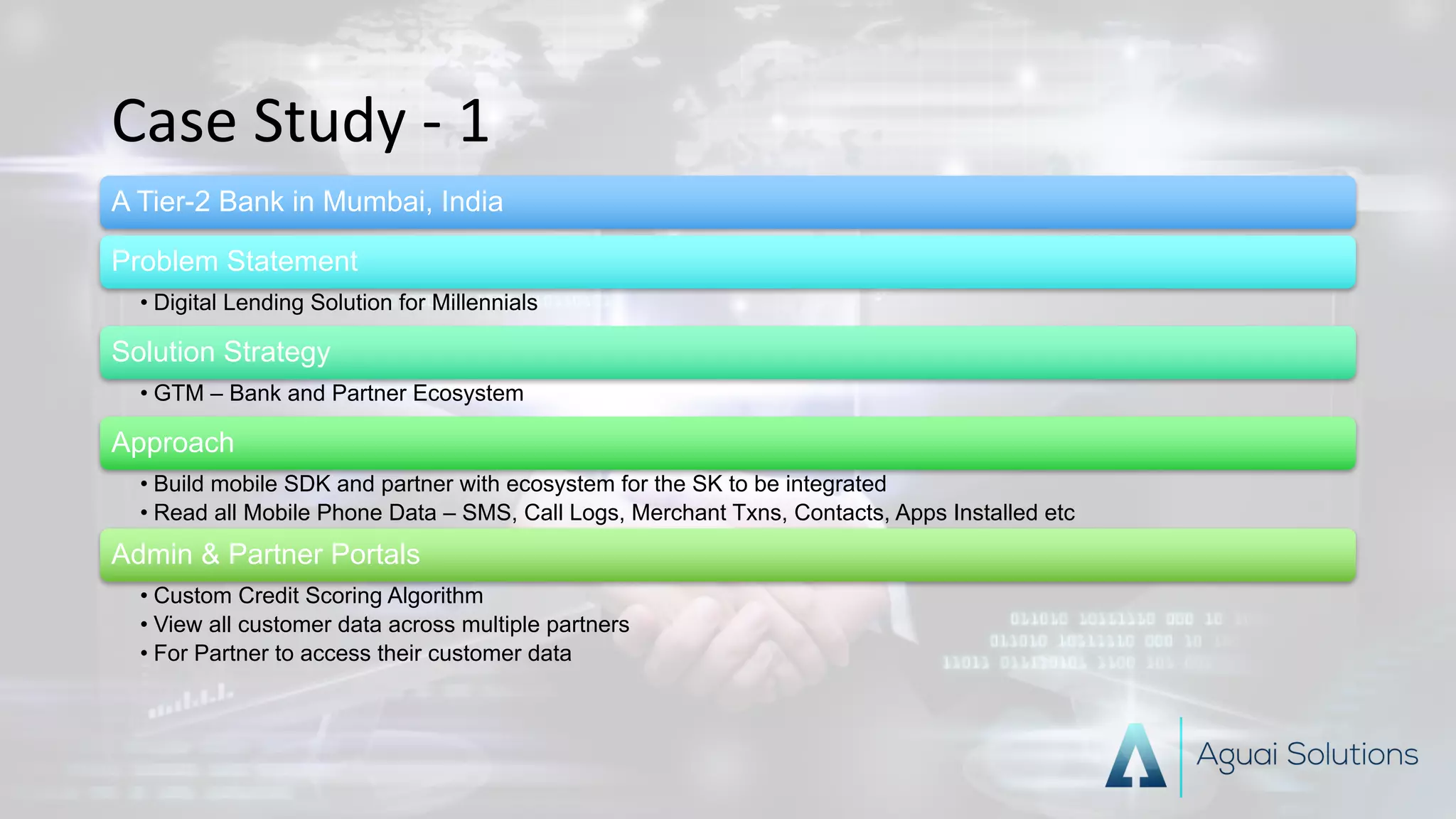

Aguai specializes in digital lending solutions for BFSI enterprises, focusing on new-age banks and NBFCs to enhance customer experiences while reducing operational costs. Their offerings include loan origination, credit assessment, loan management, and collections, utilizing AI and machine learning for credit scoring and risk assessment. With over 100 years of combined industry experience, Aguai has successfully served 13 fintech clients and garnered several awards for its innovative approach.