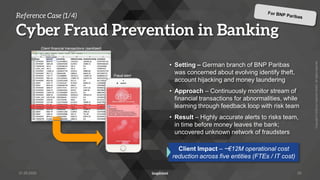

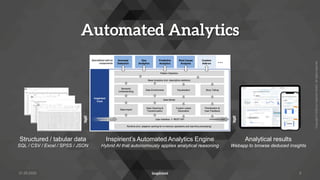

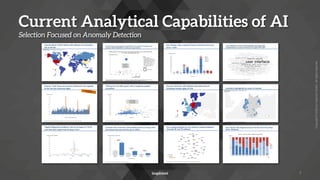

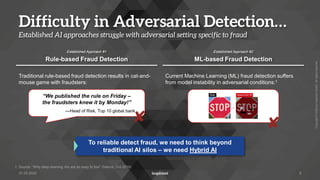

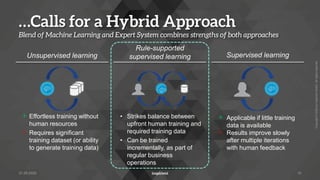

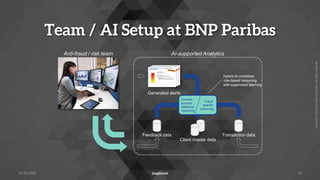

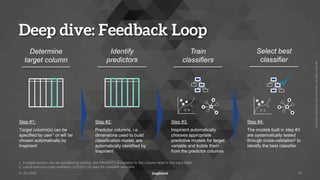

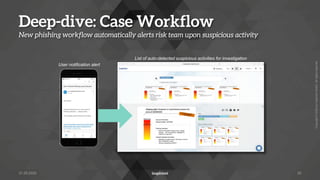

The document discusses Inspirient GmbH's hybrid AI system for fraud detection and prevention, highlighting its capabilities in automated data analysis, anomaly detection, and real-time response. It outlines the challenges of traditional fraud detection methods and emphasizes the need for a hybrid approach that combines rule-based and machine learning techniques. Additionally, it presents real-world applications and success stories demonstrating the effectiveness of their solutions in various sectors, particularly in banking.

![Copyright

©

2022

by

Inspirient

GmbH.

All

rights

reserved.

Sample Results (1/2)

Money Laundering

21

29.08.2017 30.08.2017

28.08.2017

Transactions to [x] on 29 August

2017 stand out against typical

daily distribution](https://image.slidesharecdn.com/inspirient-digitalcsi-vf-gw-220531110107-78d61435/85/Digital-Crime-Scene-Investigation-22-320.jpg)