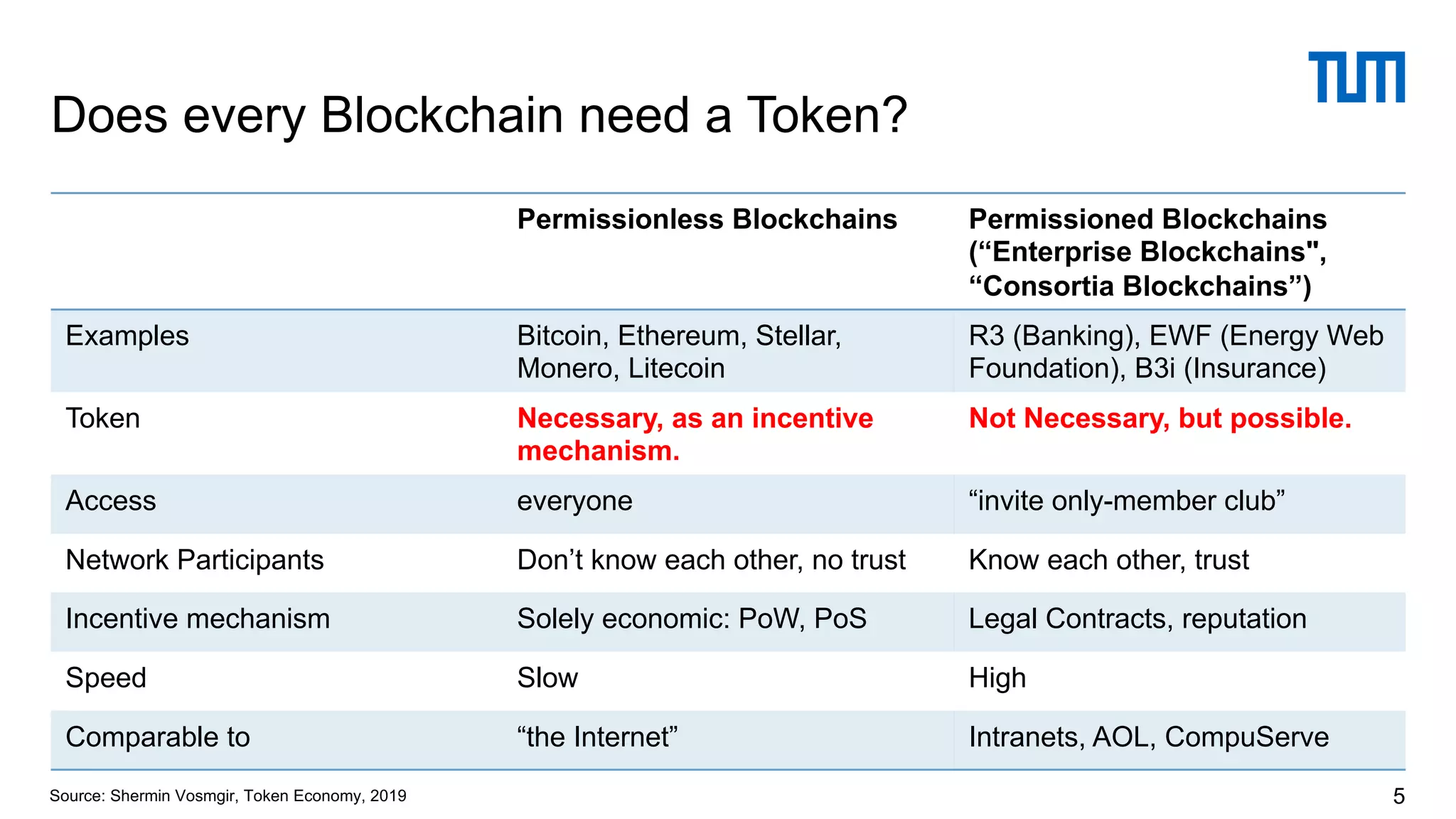

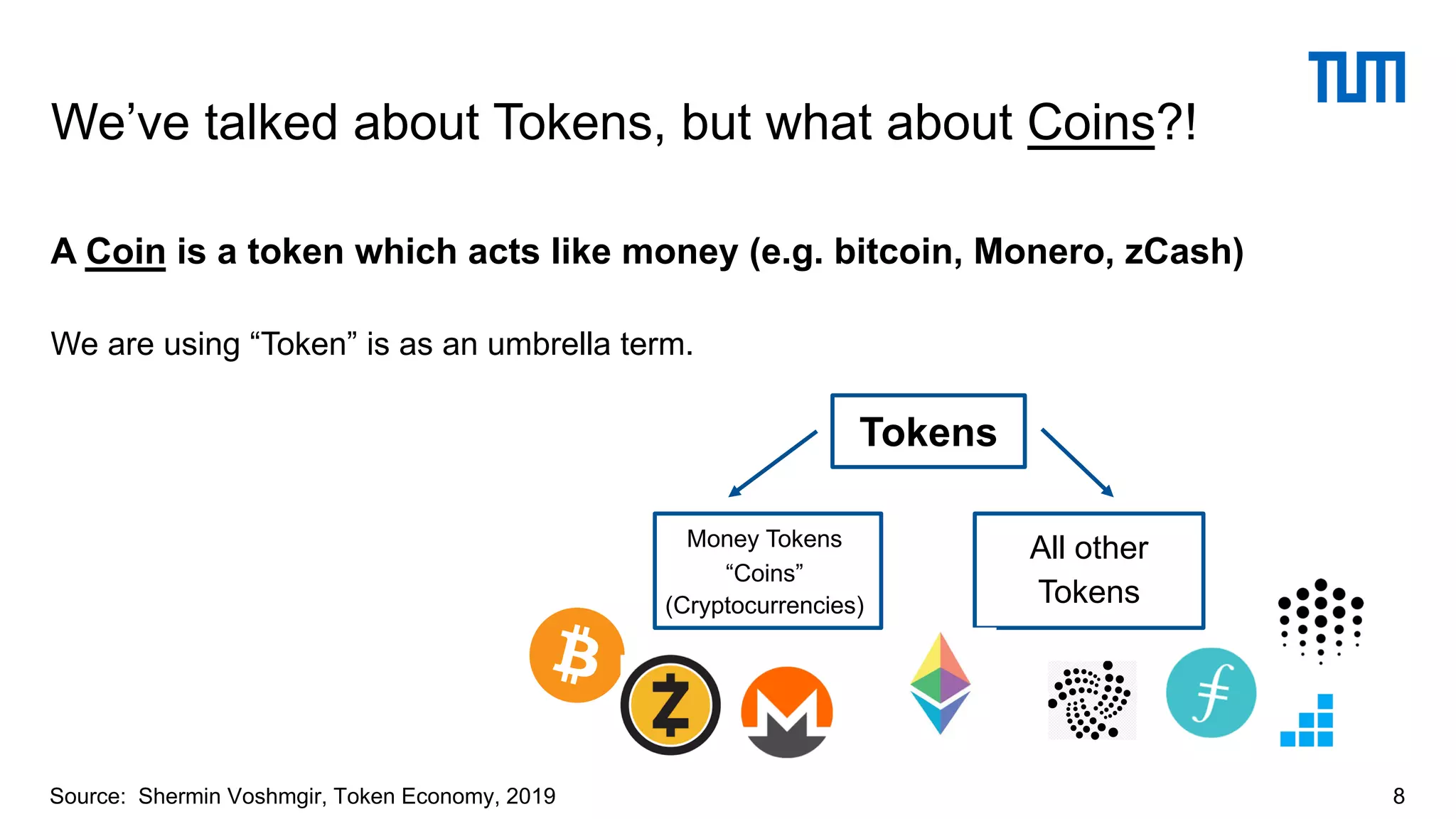

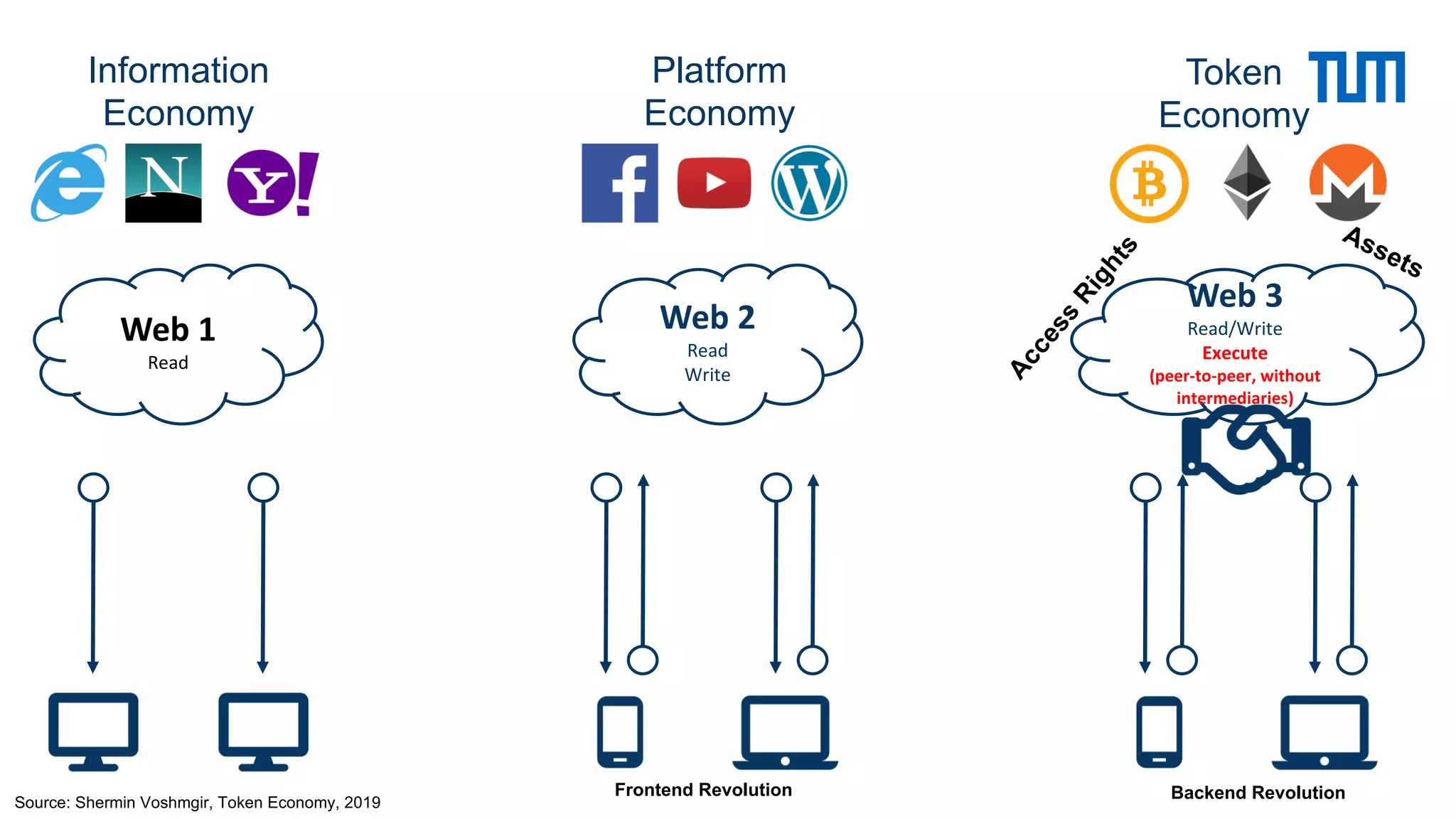

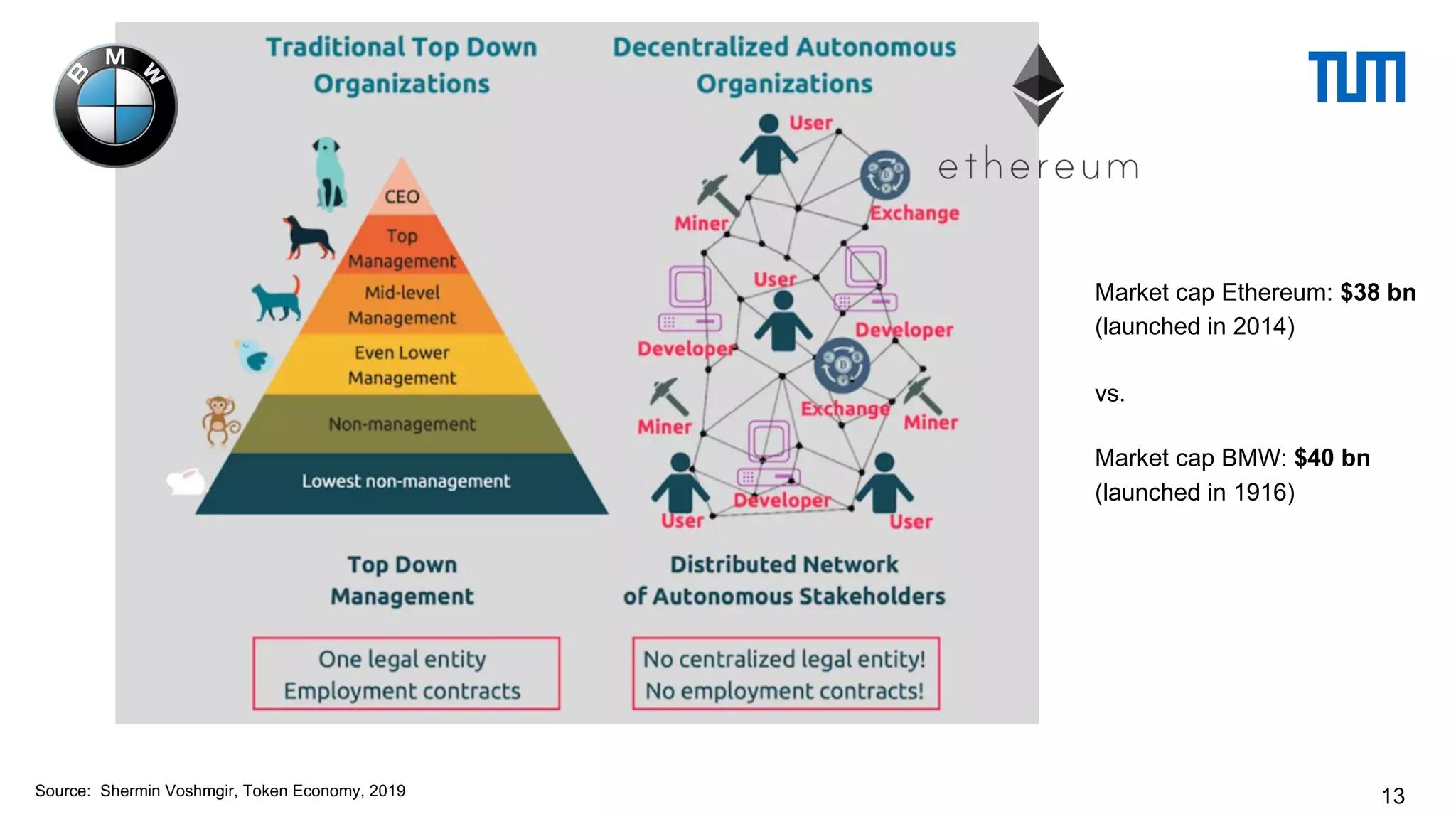

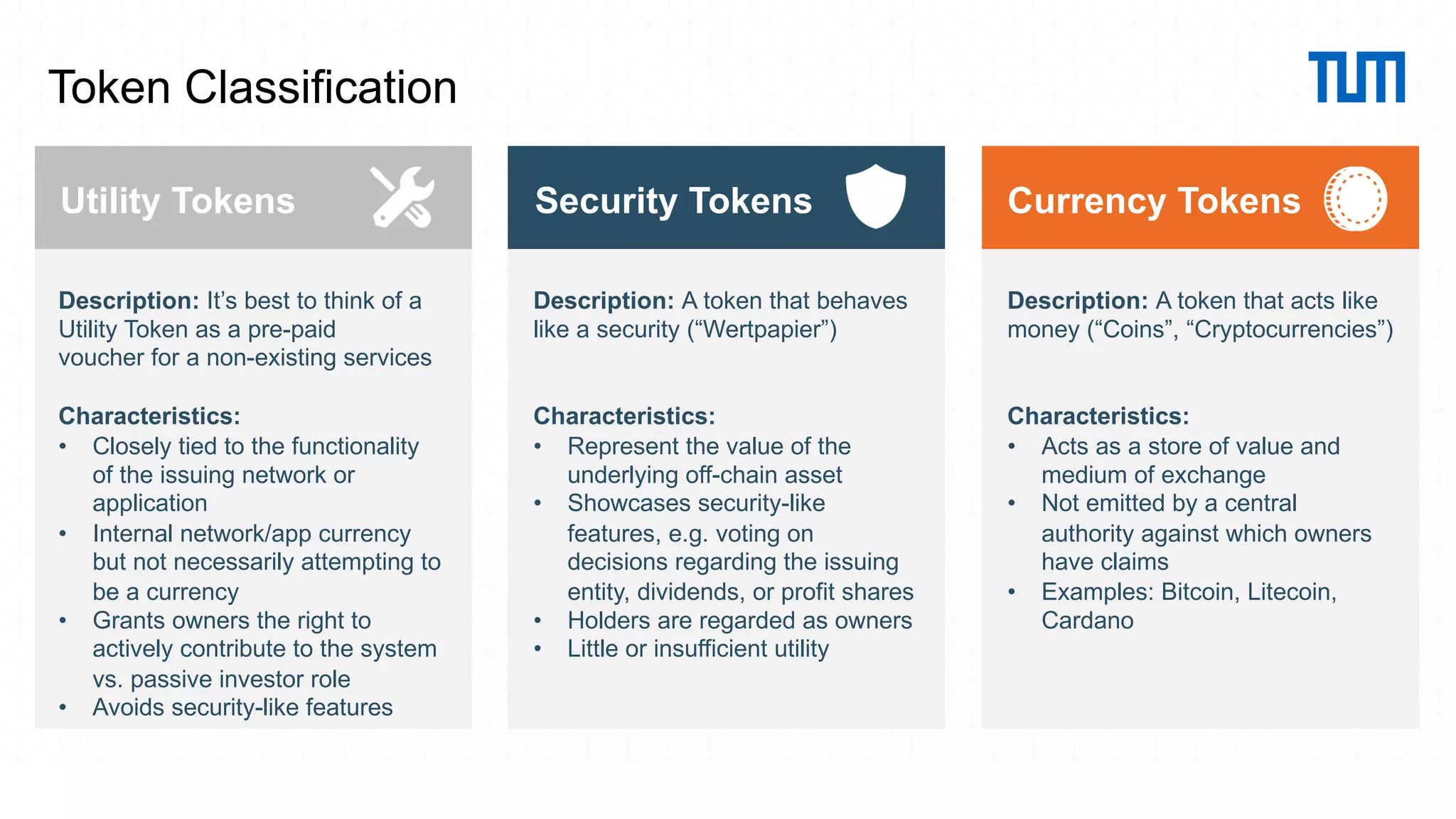

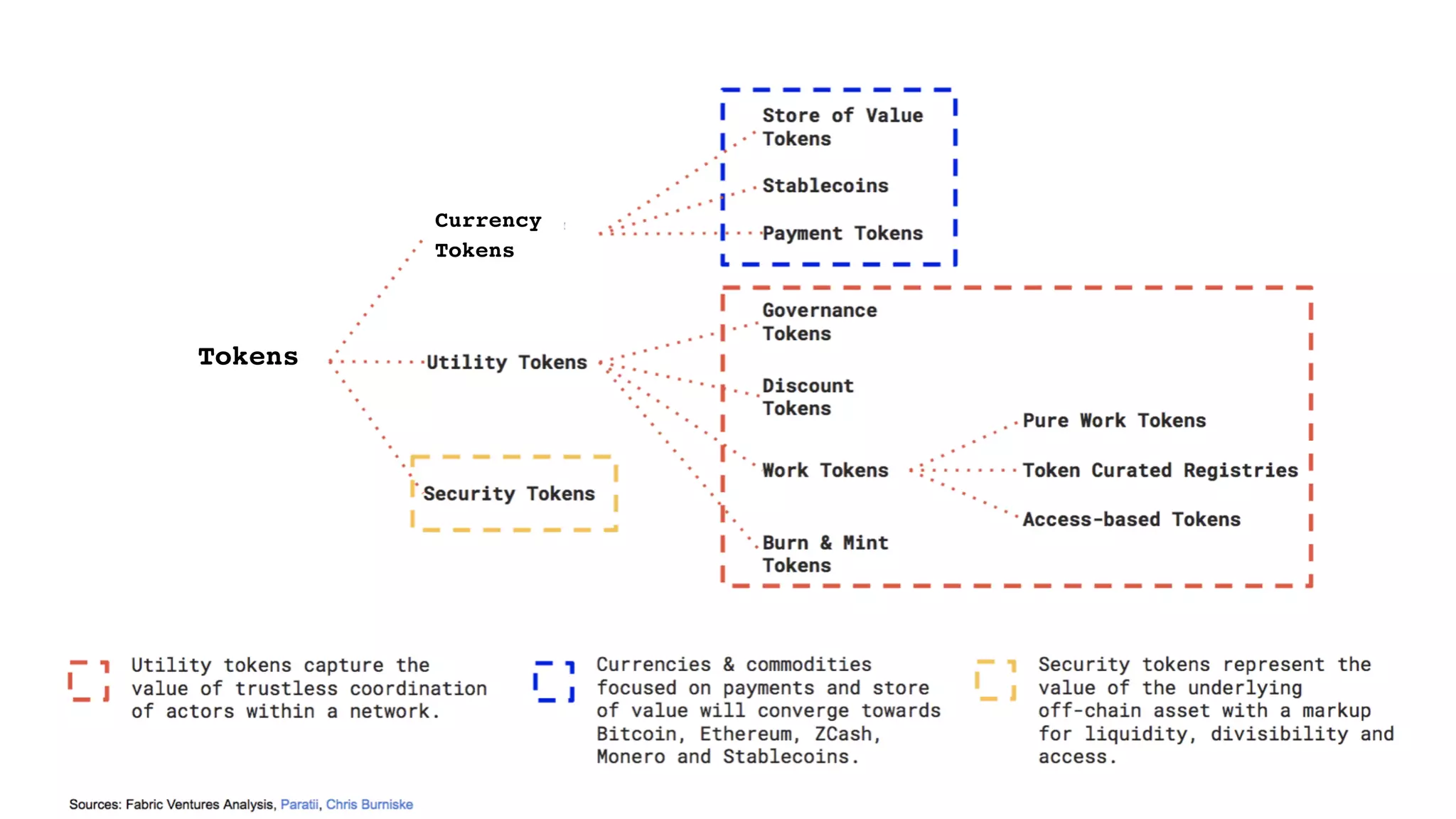

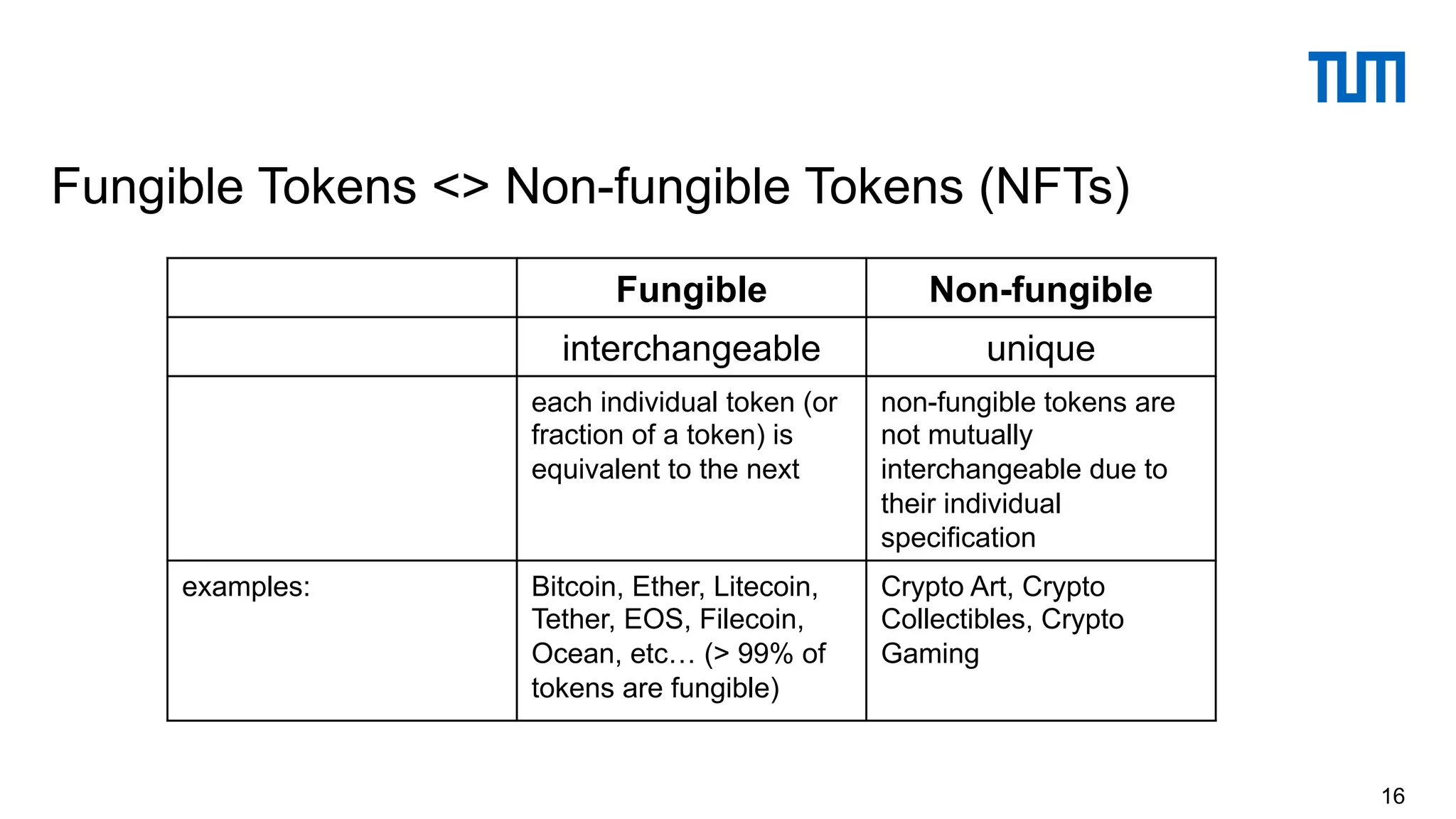

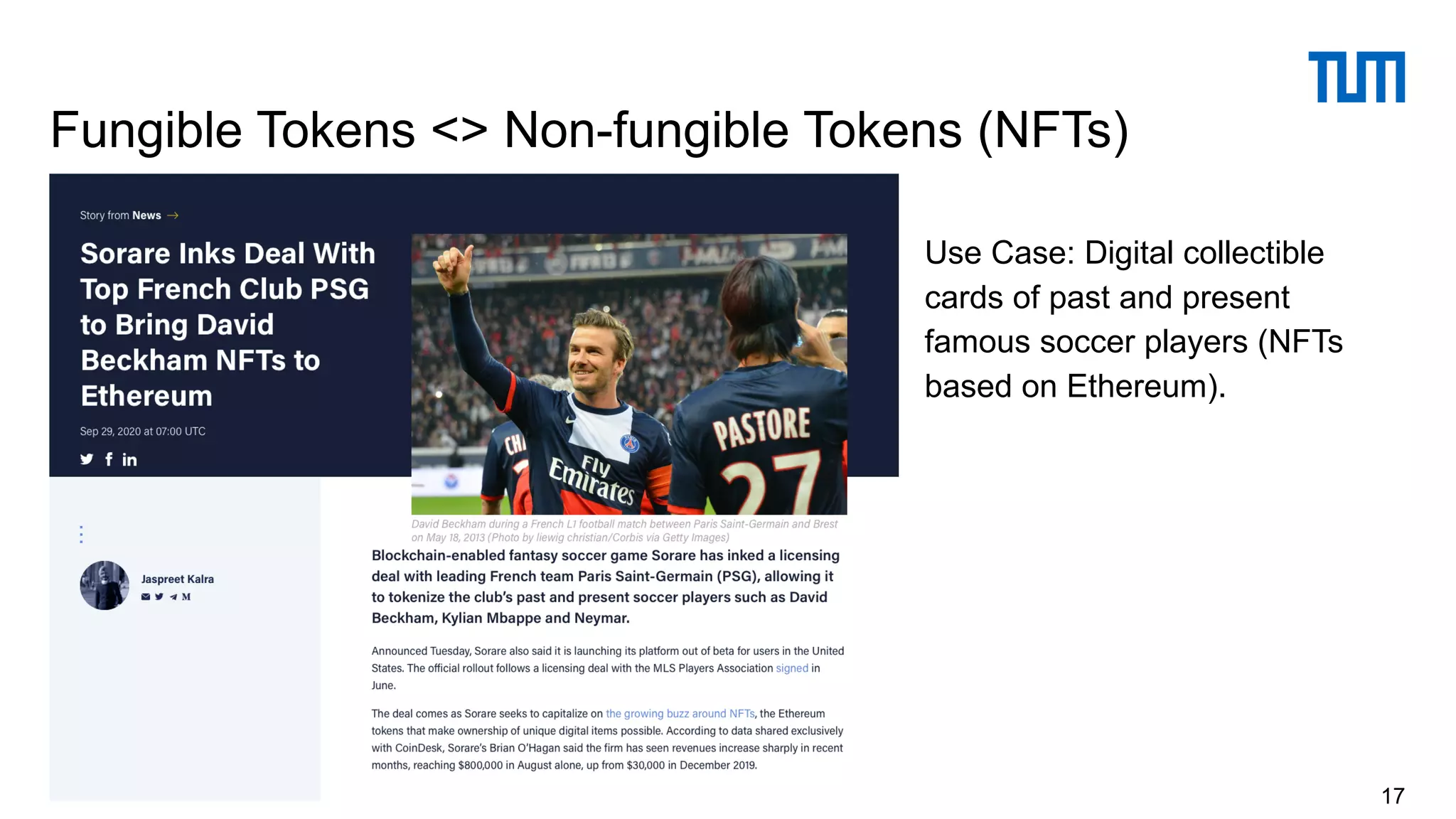

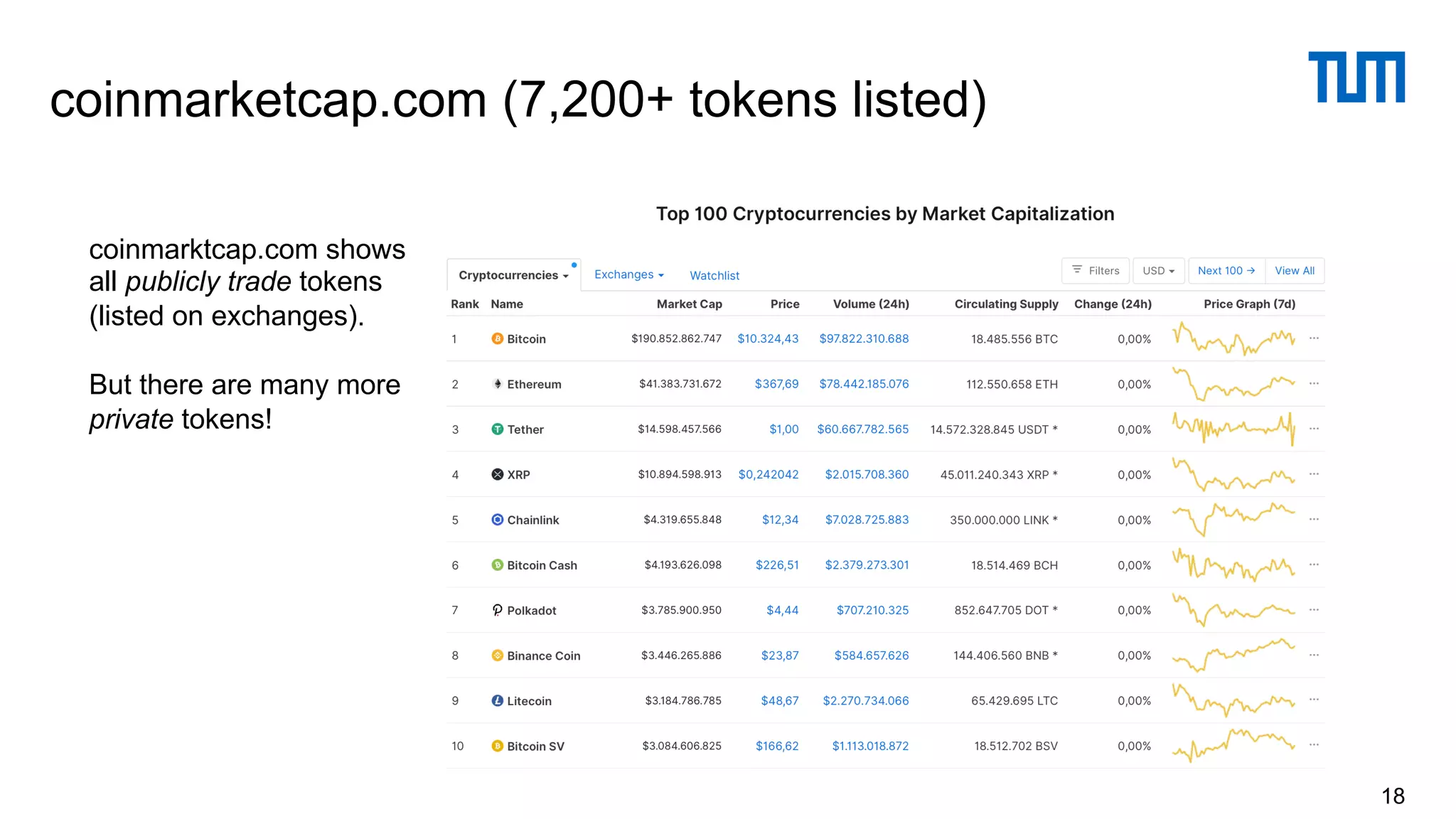

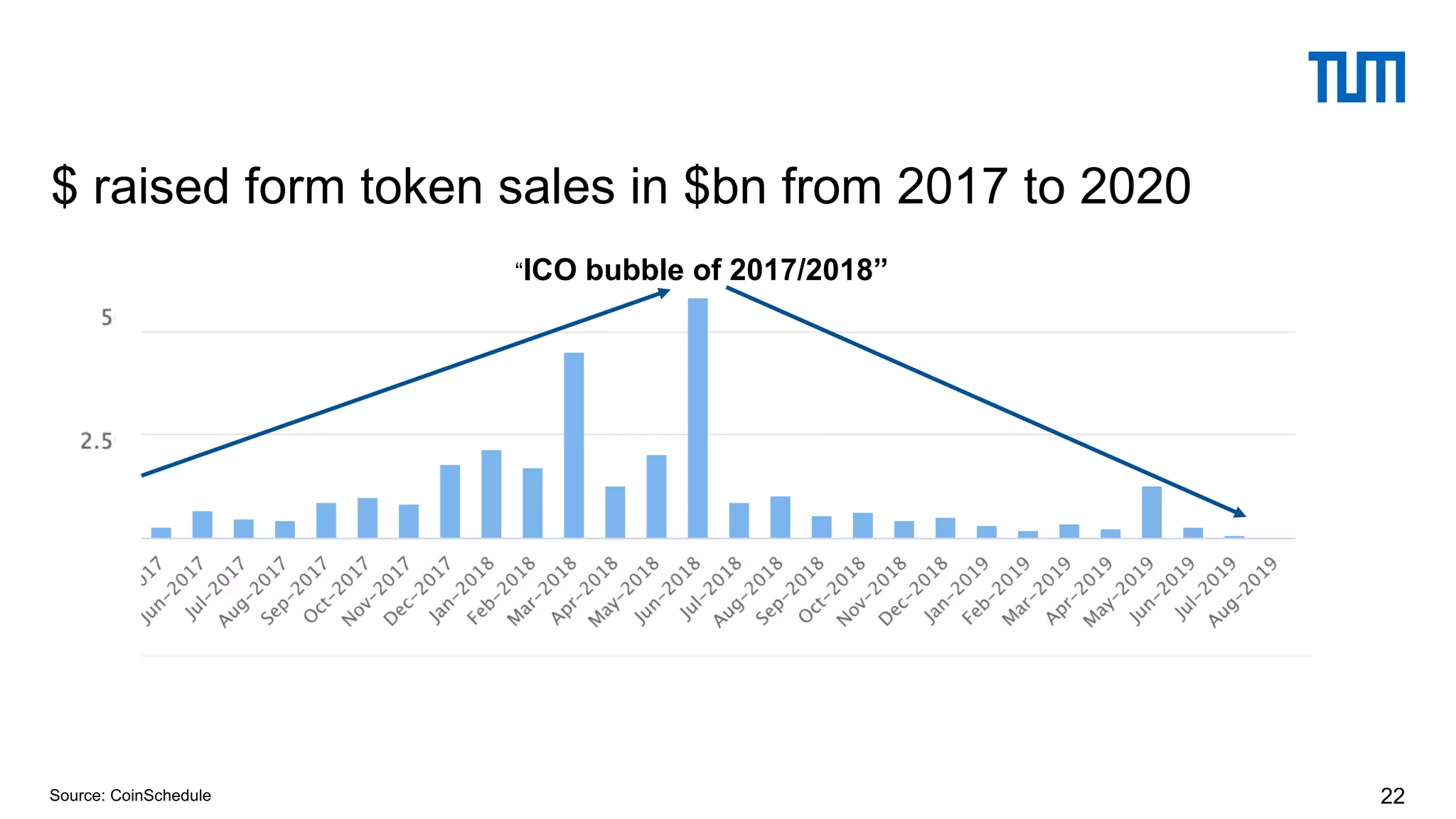

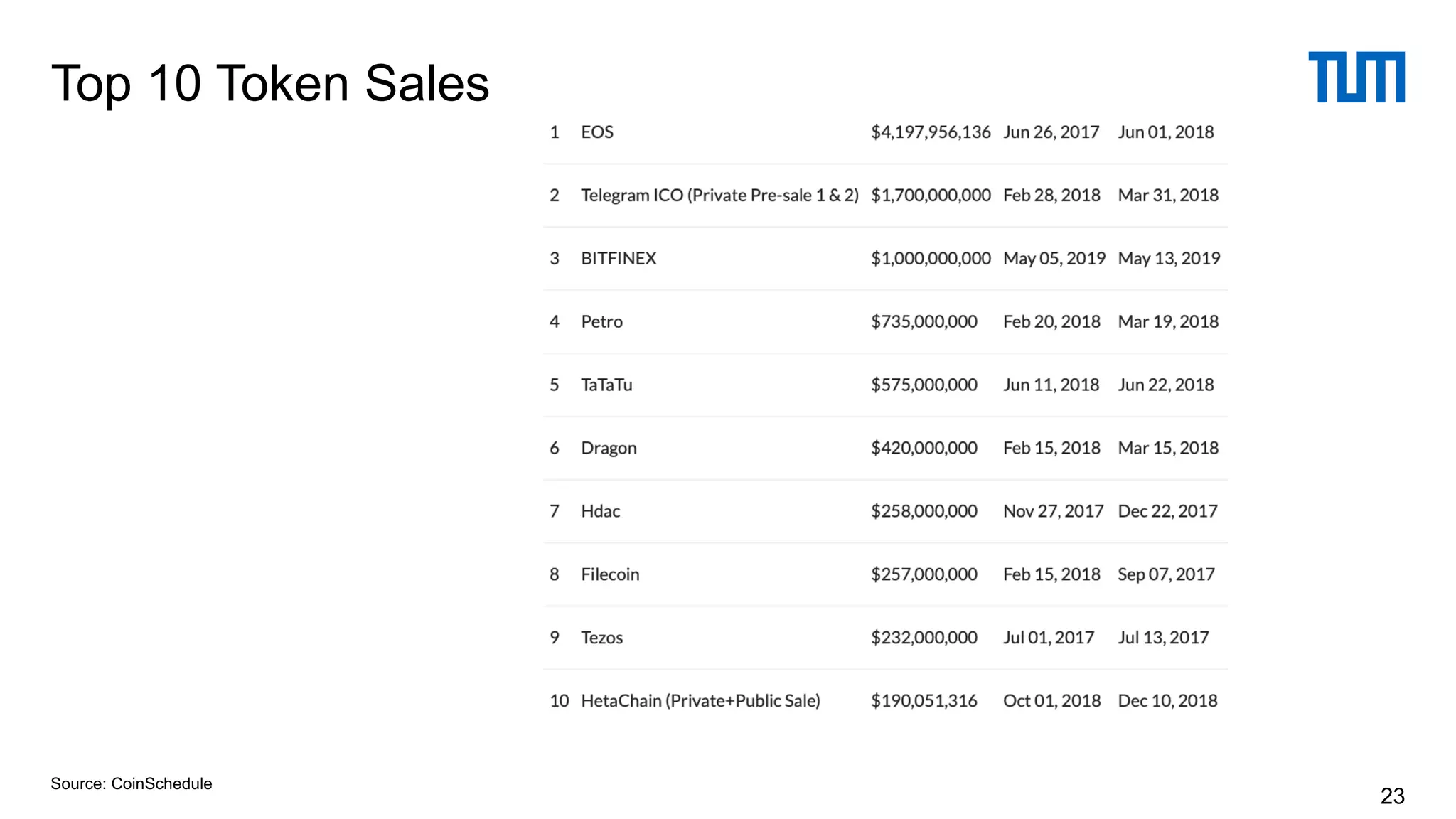

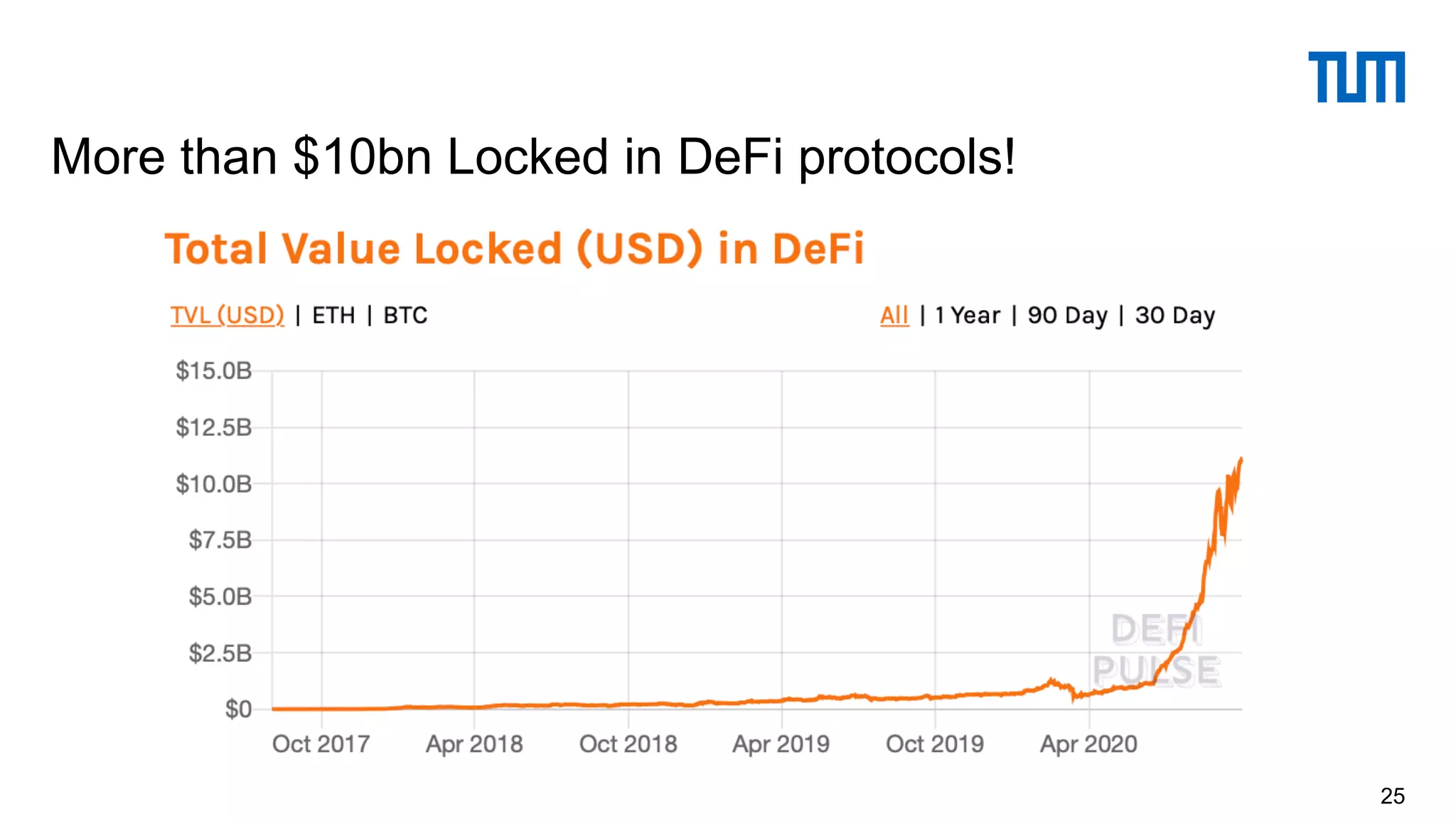

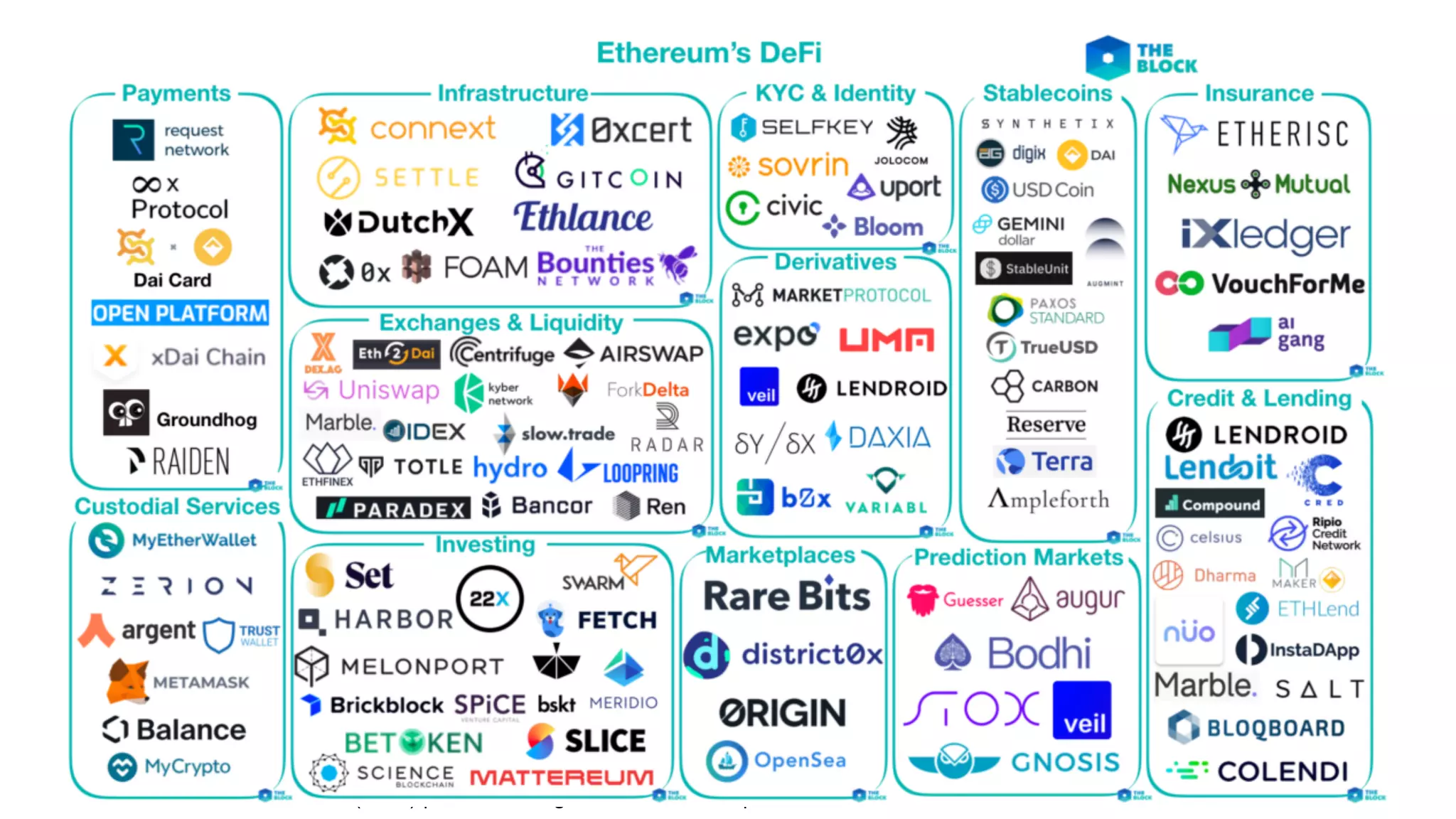

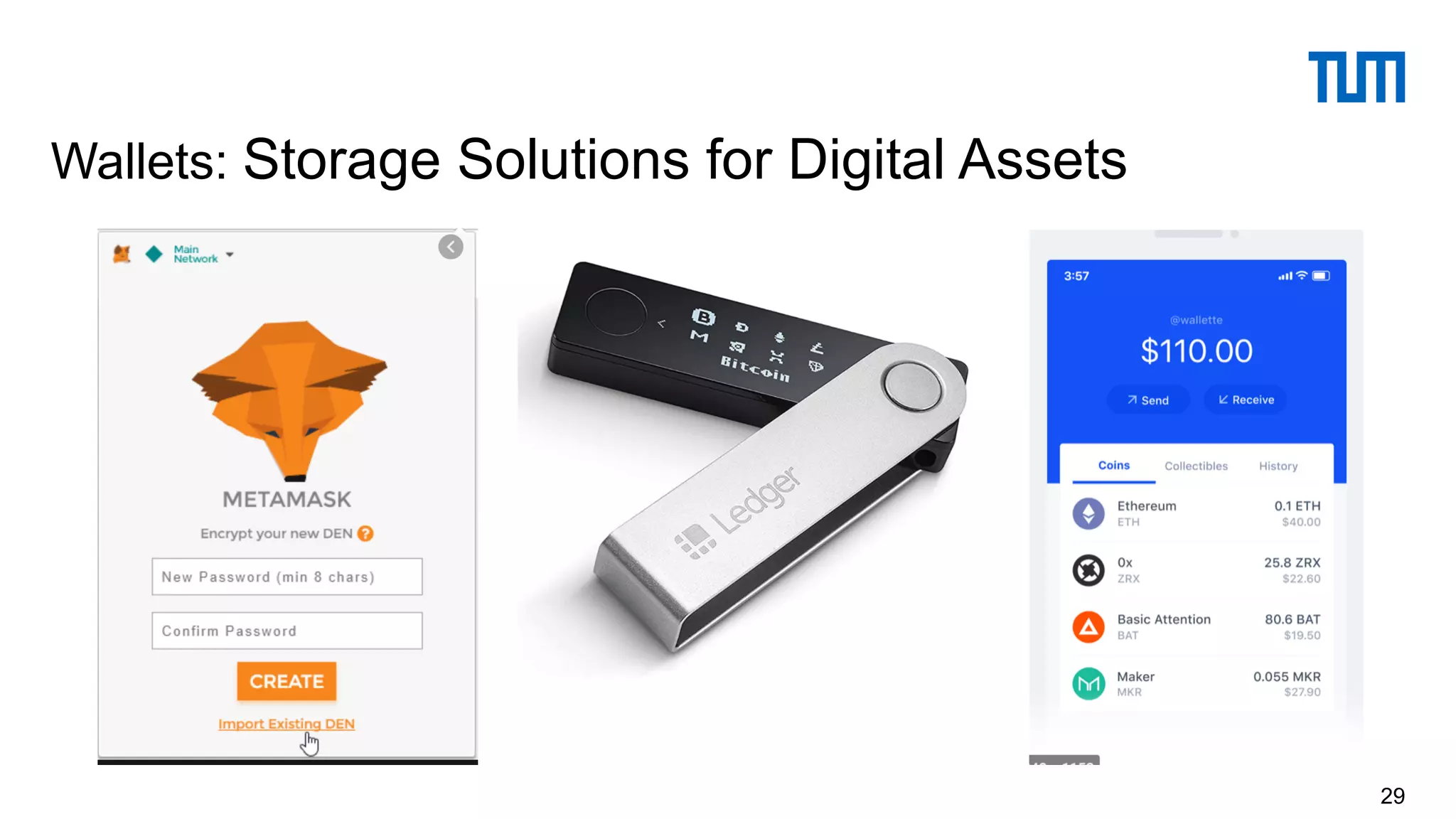

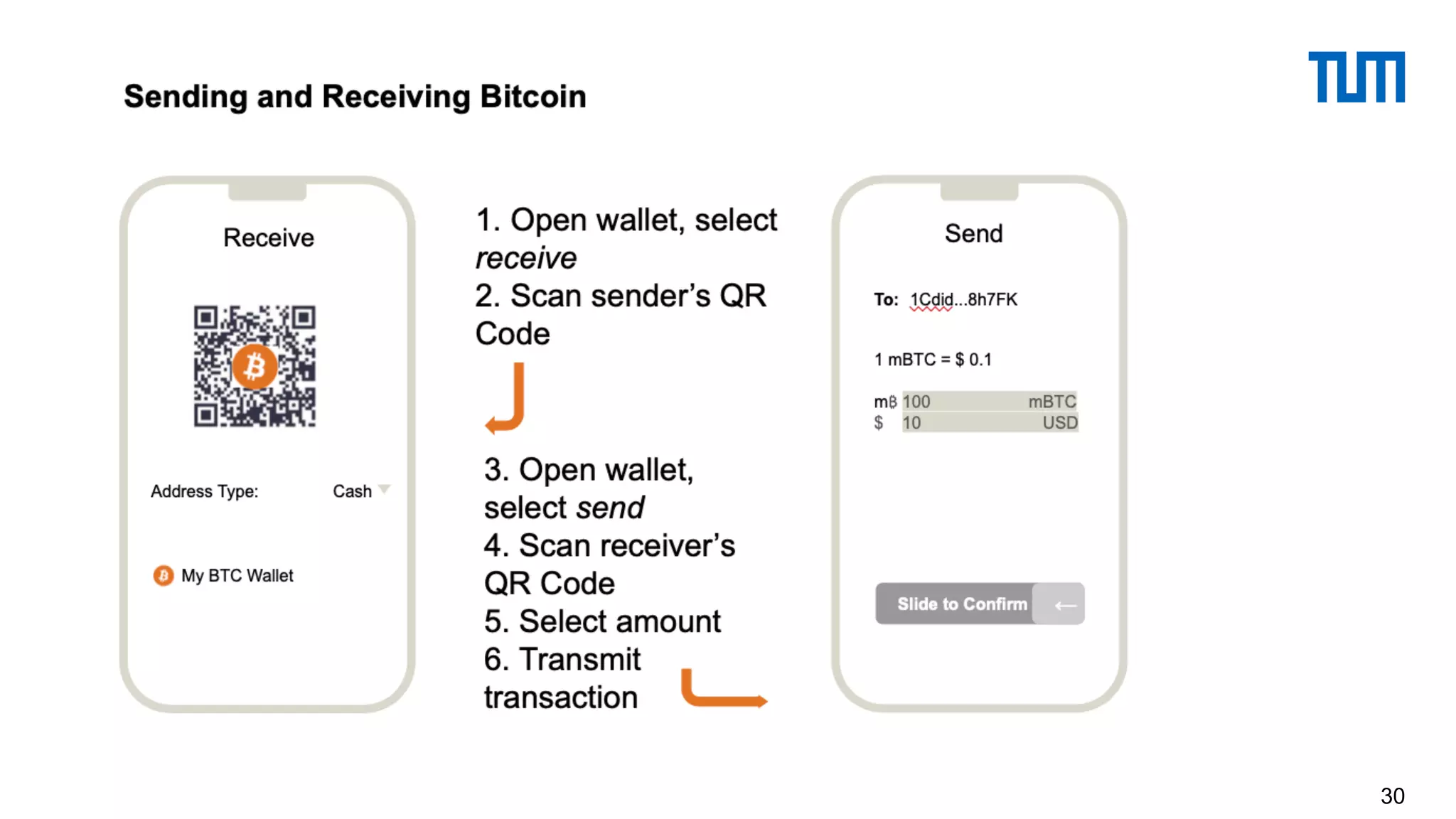

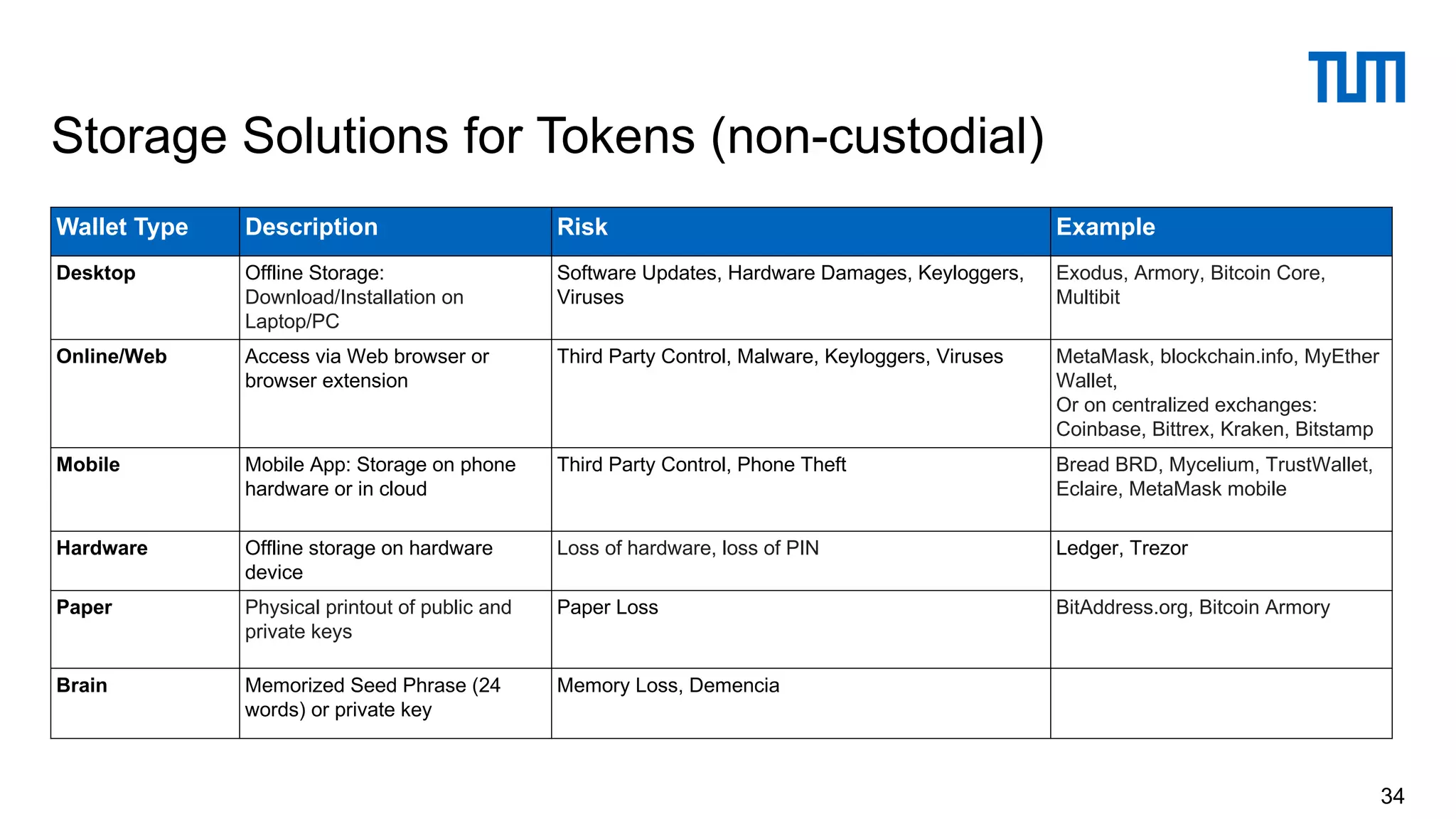

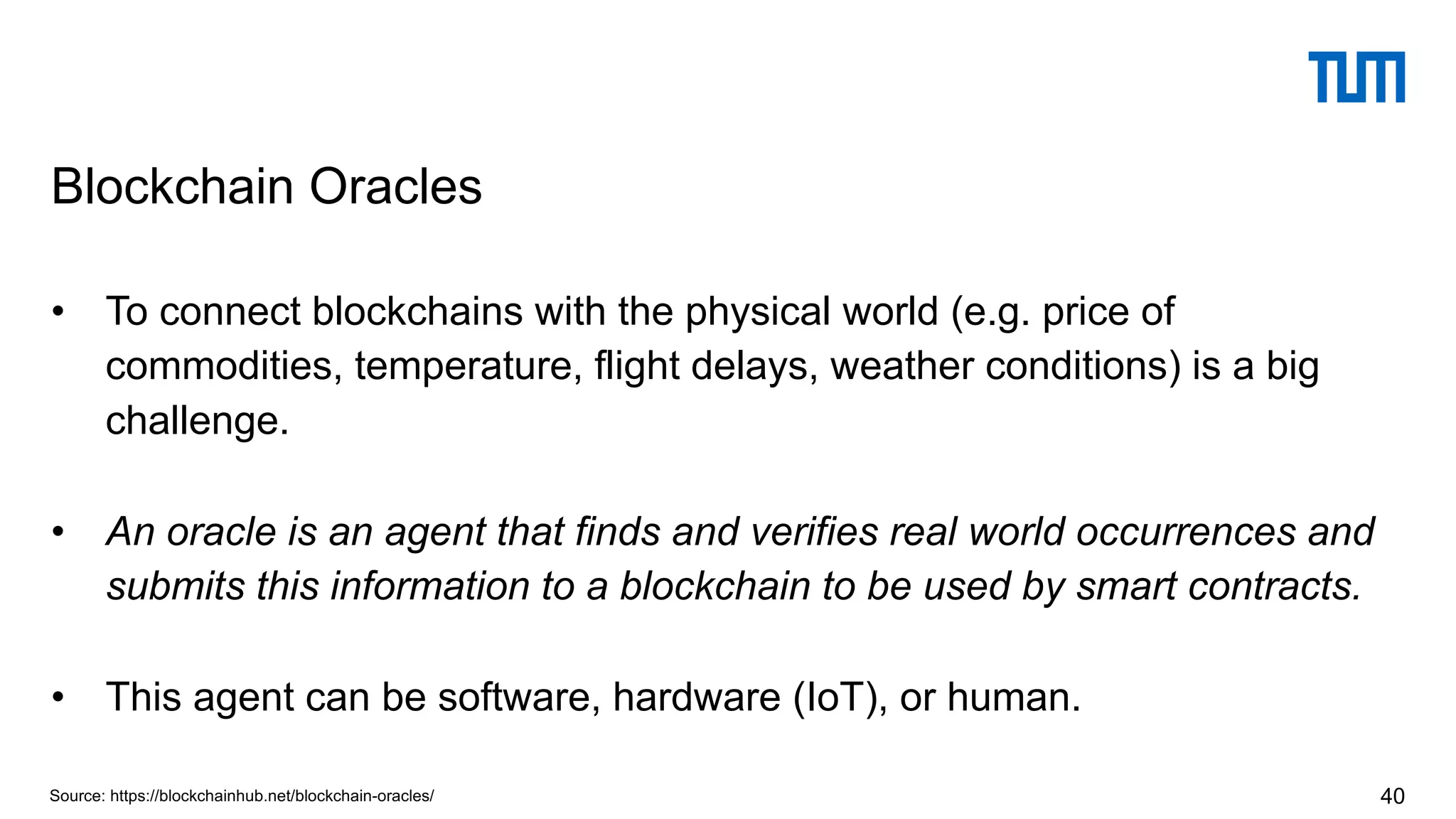

The document provides a comprehensive overview of digital assets, specifically focusing on tokens and coins, including their definitions, classifications, and design mechanisms. It outlines the evolution from traditional centralized token systems to decentralized economies enabled by blockchain technology and describes various types of tokens such as utility, security, and currency tokens. Additionally, it discusses the role of decentralized finance (DeFi) and the importance of secure wallet solutions for managing these digital assets.