Deployment entitlements fact sheet 29 oct 13v6[1]

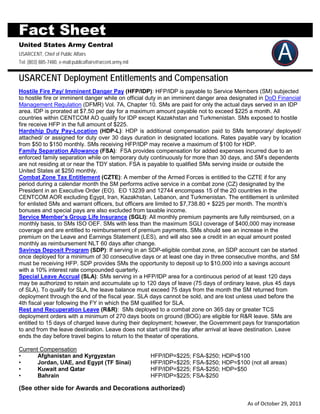

- 1. Fact Sheet United States Army Central USARCENT, Chief of Public Affairs Tel: (803) 885-7480, e-mail:publicaffairs@arcent.army.mil USARCENT Deployment Entitlements and Compensation Hostile Fire Pay/ Imminent Danger Pay (HFP/IDP): HFP/IDP is payable to Service Members (SM) subjected to hostile fire or imminent danger while on official duty in an imminent danger area designated in DoD Financial Management Regulation (DFMR) Vol. 7A, Chapter 10. SMs are paid for only the actual days served in an IDP area. IDP is prorated at $7.50 per day for a maximum amount payable not to exceed $225 a month. All countries within CENTCOM AO qualify for IDP except Kazakhstan and Turkmenistan. SMs exposed to hostile fire receive HFP in the full amount of $225. Hardship Duty Pay-Location (HDP-L): HDP is additional compensation paid to SMs temporary/ deployed/ attached/ or assigned for duty over 30 days duration in designated locations. Rates payable vary by location from $50 to $150 monthly. SMs receiving HFP/IDP may receive a maximum of $100 for HDP. Family Separation Allowance (FSA): FSA provides compensation for added expenses incurred due to an enforced family separation while on temporary duty continuously for more than 30 days, and SM’s dependents are not residing at or near the TDY station. FSA is payable to qualified SMs serving inside or outside the United States at $250 monthly. Combat Zone Tax Entitlement (CZTE): A member of the Armed Forces is entitled to the CZTE if for any period during a calendar month the SM performs active service in a combat zone (CZ) designated by the President in an Executive Order (EO). EO 13239 and 12744 encompass 15 of the 20 countries in the CENTCOM AOR excluding Egypt, Iran, Kazakhstan, Lebanon, and Turkmenistan. The entitlement is unlimited for enlisted SMs and warrant officers, but officers are limited to $7,738.80 + $225 per month. The month’s bonuses and special pays are also excluded from taxable income. Service Member’s Group Life Insurance (SGLI): All monthly premium payments are fully reimbursed, on a monthly basis, to SMs ISO OEF. SMs with less than the maximum SGLI coverage of $400,000 may increase coverage and are entitled to reimbursement of premium payments. SMs should see an increase in the premium on the Leave and Earnings Statement (LES), and will also see a credit in an equal amount posted monthly as reimbursement NLT 60 days after change. Savings Deposit Program (SDP): If serving in an SDP-eligible combat zone, an SDP account can be started once deployed for a minimum of 30 consecutive days or at least one day in three consecutive months, and SM must be receiving HFP. SDP provides SMs the opportunity to deposit up to $10,000 into a savings account with a 10% interest rate compounded quarterly. Special Leave Accrual (SLA): SMs serving in a HFP/IDP area for a continuous period of at least 120 days may be authorized to retain and accumulate up to 120 days of leave (75 days of ordinary leave, plus 45 days of SLA). To qualify for SLA, the leave balance must exceed 75 days from the month the SM returned from deployment through the end of the fiscal year. SLA days cannot be sold, and are lost unless used before the 4th fiscal year following the FY in which the SM qualified for SLA. Rest and Recuperation Leave (R&R): SMs deployed to a combat zone on 365 day or greater TCS deployment orders with a minimum of 270 days boots on ground (BOG) are eligible for R&R leave. SMs are entitled to 15 days of charged leave during their deployment; however, the Government pays for transportation to and from the leave destination. Leave does not start until the day after arrival at leave destination. Leave ends the day before travel begins to return to the theater of operations. Current Compensation • Afghanistan and Kyrgyzstan • Jordan, UAE, and Egypt (TF Sinai) • Kuwait and Qatar • Bahrain HFP/IDP=$225; FSA-$250; HDP=$100 HFP/IDP=$225; FSA-$250; HDP=$100 (not all areas) HFP/IDP=$225; FSA-$250; HDP=$50 HFP/IDP=$225; FSA-$250 (See other side for Awards and Decorations authorized) As of October 29, 2013

- 2. Fact Sheet United States Army Central USARCENT, Chief of Public Affairs Tel: (803) 885-7480, e-mail:publicaffairs@arcent.army.mil USARCENT Deployment Awards and Authorized Decorations Shoulder Sleeve Insignia Former Wartime Service (SSI/FWTS) and Combat Service Identification Badge (CSIB): SMs are eligible to wear a SSI/FWTS or CSIB for participating in OEF while assigned to Afghanistan, Pakistan, Tajikistan, Turkmenistan, and Uzbekistan from 19 September 2001 to a date TBD; and from July 31, 2002 to a date TBD, for SMs deployed to the CENTCOM area of operations (AO) ISO OEF and authorized CZTE. Overseas Service Bars: One overseas service bar is authorized for each six-month period a SM serves ISO OEF or the CENTCOM AO from Sept. 19, 2001 to a date TBD. The months of arrival and departure from the CENTCOM AO are counted as whole months. For less than six months duration, service may be combined by adding the number of months to determine creditable service toward the total number of overseas service bars authorized for OEF and OIF. Valor Awards and Combat Badges: May be awarded to any SM for meritorious or valorous acts in direct support of combat operations. However, SM must be performing assigned duties in an area where HFP/IDP is authorized. SM must be personally present and actively engaging or being engaged by the enemy. SM must be assigned or attached to a qualifying unit. Valor awards include the Silver Star, the Bronze Star and Army Commendation Medal with Valor device. Combat badges are the Combat Infantry Badge, Combat Medic Badge and Combat Action Badge. Afghanistan Campaign Medal (ACM): Awarded to SMs deployed to Afghanistan ISO OEF on or after Oct. 24, 2001. The ACM cannot be awarded for the same period of service as the GWOTEM; SM may request the ACM in lieu of the GWOTEM if all other qualifications are met. Iraq Campaign Medal (ICM): Awarded to SMs deployed to Iraq ISO OIF on or after March 19, 2003 through Dec. 31, 2011.The ICM cannot be awarded for the same period of service as the GWOTEM; SM may request the ICM in lieu of the GWOTEM if all other qualifications are met. ACM and ICM Campaign Stars: Each ICM and ACM will have at least one star; each period counts for one Campaign Star and SMs can earn more than one star per deployment. Global War on Terror Service Medal (GWOTSM): Authorized to SMs who have participated in or served in support of GWOT outside the designated areas of eligibility (AOE) for the Global War on Terrorism Expeditionary Medal, on or after Sept. 11, 2001 to a date TBD. Only one award of the GWOTSM may be authorized for any individual. Global War on Terror Expeditionary Medal (GWOTEM): Authorized to SMs who have participated in or served in support of GWOT inside the designated AOE for the Global War on Terrorism Expeditionary Medal, on or after Sept. 11, 2001 to a date TBD. The GWOTEM is no longer authorized to be awarded for service in Afghanistan and/or Iraq for the same period of service. The ACM or ICM may be awarded for subsequent tours. The AOE includes all the countries in the CENTCOM AO and the following countries and areas: Bulgaria, Crete, Cyprus, Diego Garcia, Djibouti, Eritrea, Ethiopia, Israel, Kenya, Philippines, Romania, Somalia, and Turkey. Dwell Time and Deployment Credit: A combat deployment is a named operation in a designated combat zone, or an area identified by an EO or listed in the DFMR as a combat zone and eligible for CZTE. Combat and operational deployments will reset dwell upon credit for a completed deployment. (See other side for Entitlements and Compensation authorized) As of October 29, 2013