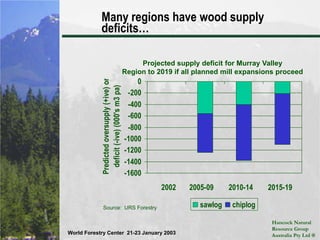

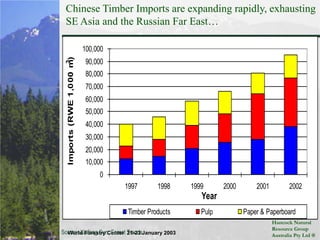

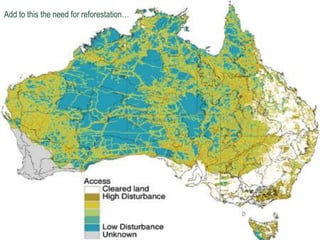

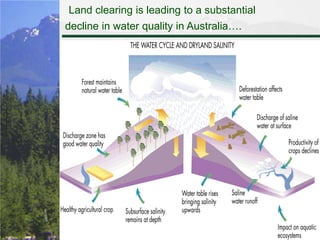

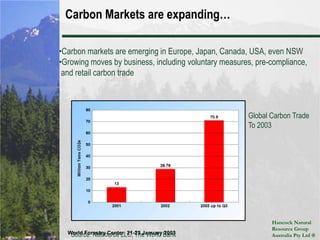

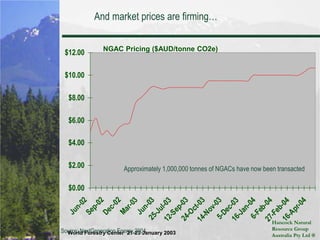

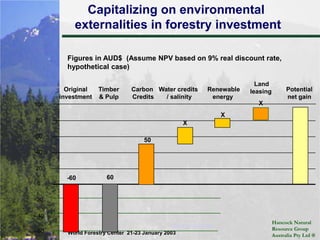

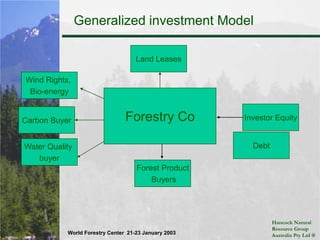

Hancock Natural Resource Group manages $3 billion in forest assets for over 50 institutional clients. It established operations in Australia in 1998 and has expanded through acquisitions. The presentation outlines an emerging opportunity for institutional investment in Australian forests to generate returns through carbon credits, environmental services, and wood products while addressing issues like climate change, salinity, and biodiversity loss. It proposes investment structures like separate accounts and commingled funds to capitalize on these opportunities in a growing market.