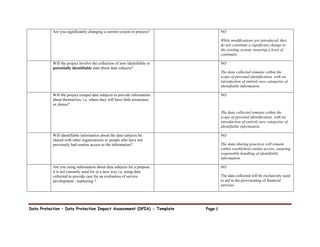

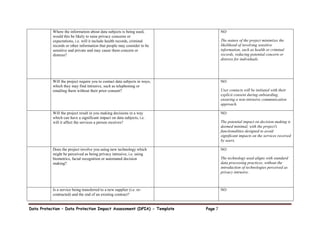

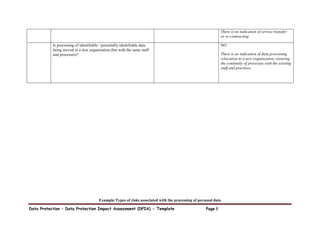

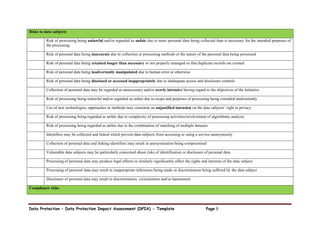

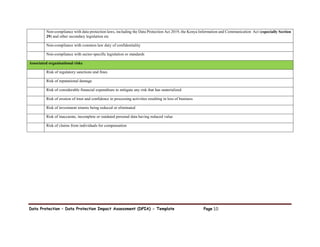

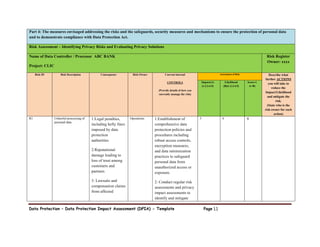

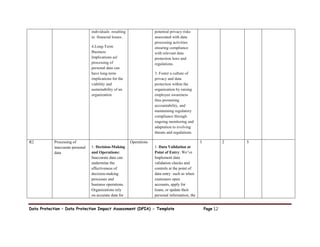

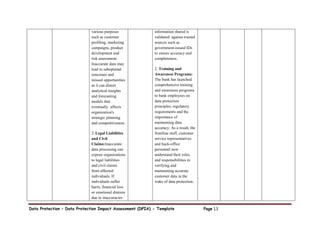

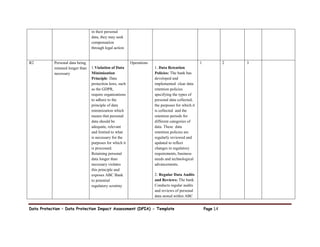

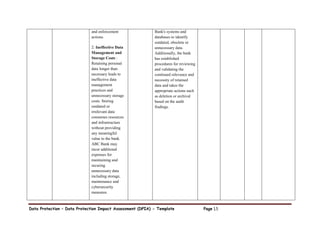

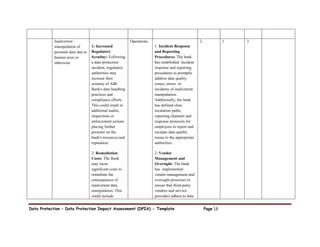

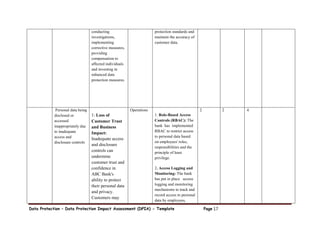

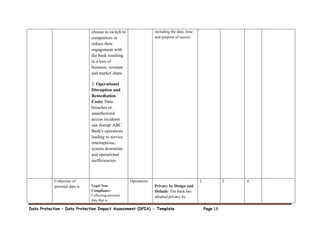

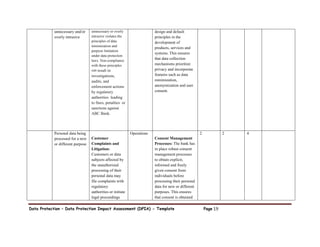

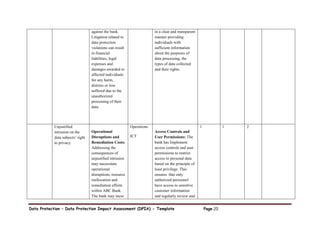

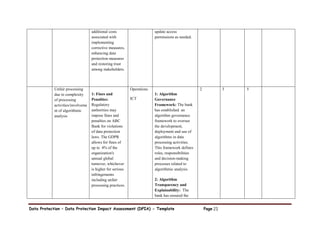

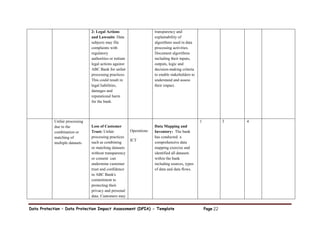

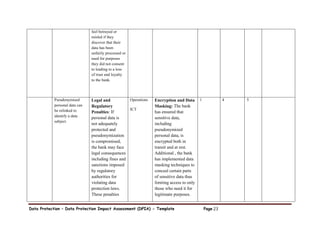

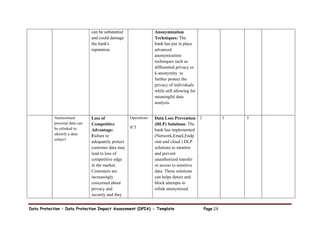

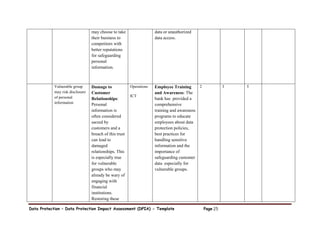

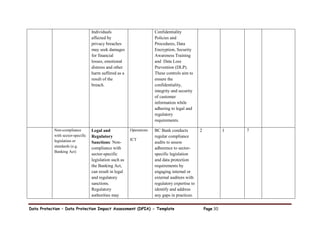

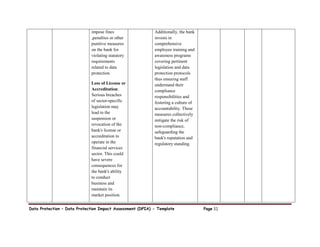

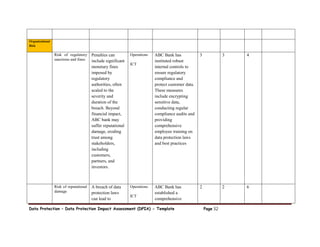

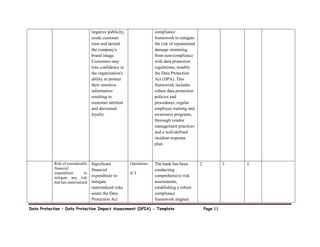

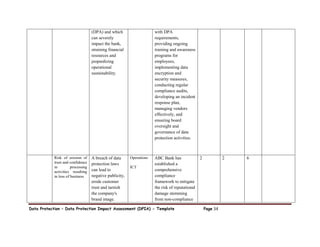

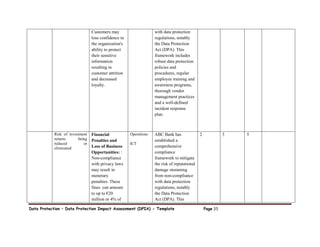

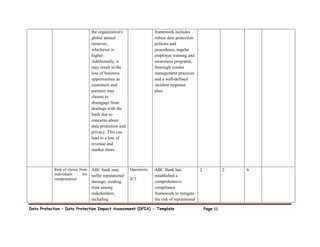

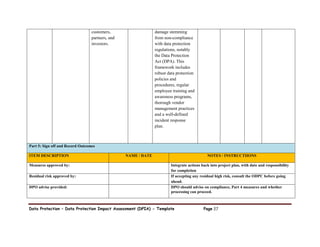

The document is a Data Protection Impact Assessment (DPIA) template for the CLIC project aimed at providing financial inclusion to the unbanked population through digital wallets, social banking, and a marketplace hub. It details the processing of personal data, including the collection, storage, usage, and protection of user information, while ensuring compliance with data protection principles and regulations. Additionally, it addresses potential risks and outlines measures to mitigate them, emphasizing user consent and the secure management of personal data.