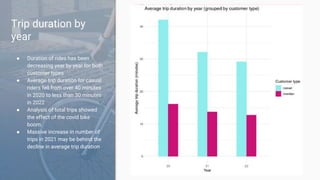

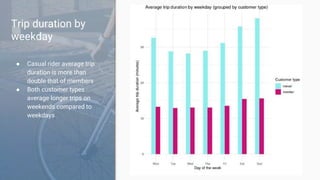

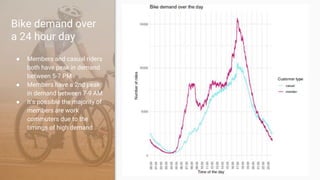

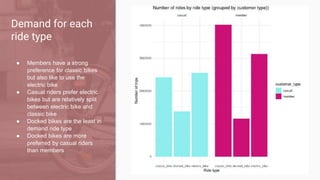

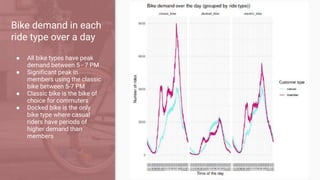

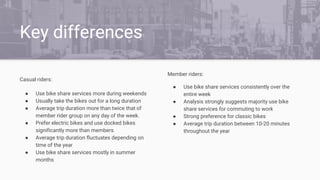

Cyclistic, a bike-share service launched in 2016, aims to convert casual riders into annual members by understanding the differences in usage patterns through extensive trip data analysis. Casual riders tend to use the service predominantly on weekends with longer trip durations, while members utilize the service consistently throughout the week for commuting, favoring classic bikes. Recommendations include creating a weekend-only membership option and running targeted promotions to balance the usage between casual and member riders.