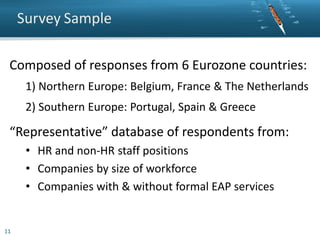

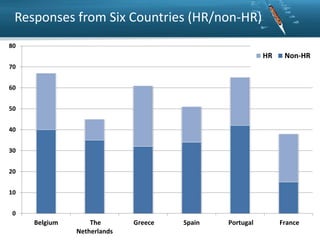

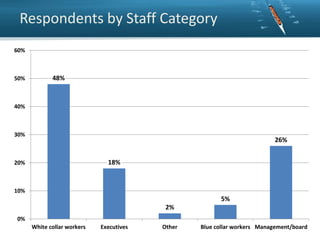

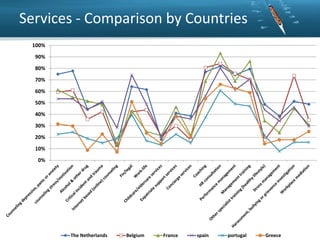

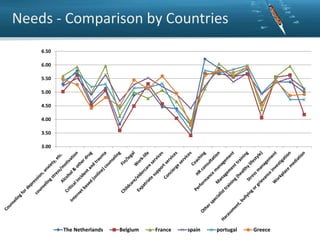

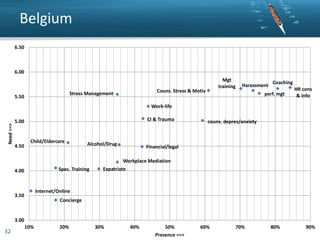

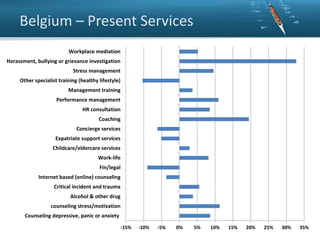

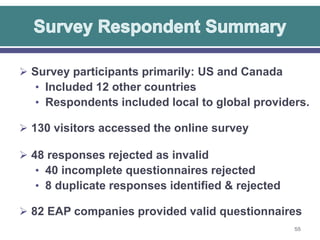

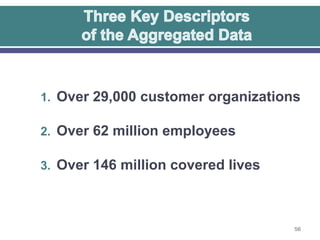

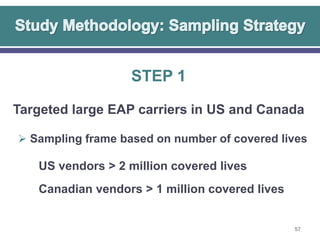

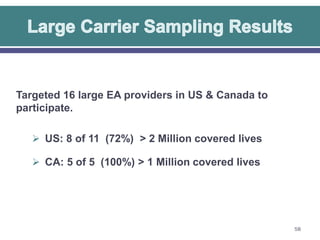

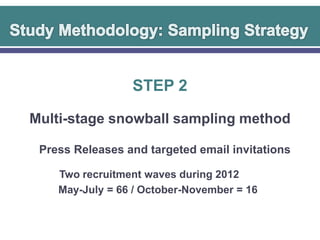

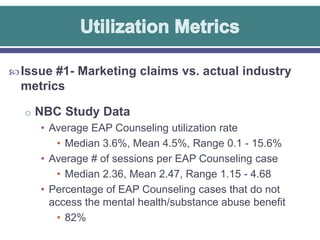

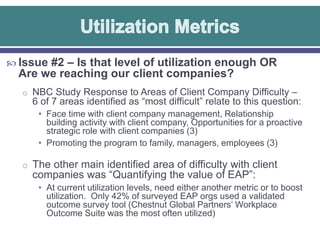

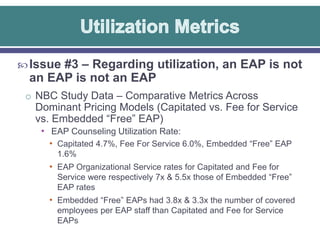

This document summarizes two studies funded by the Employee Assistance Research Foundation (EARF) on the current state of employee assistance programs (EAPs) in North America and Europe. The first study, called the Eureka Project, examined EAP services in several European countries and found that while needs for services are similar across countries, availability varies significantly. The second study profiled major external EAP vendors in North America to provide the first publicly available comparative data on a large number of providers. Both studies aim to advance EAP services through rigorous research.