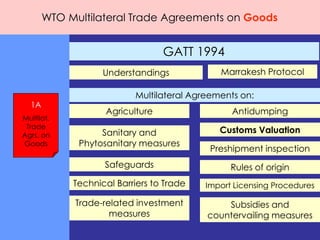

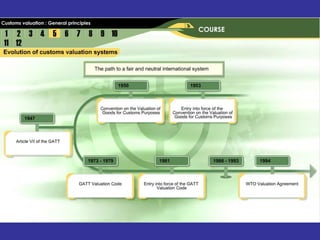

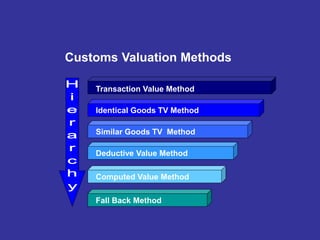

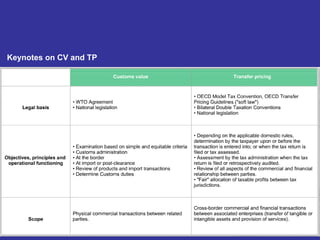

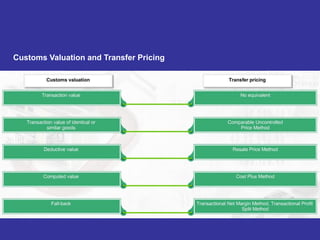

The document discusses the World Trade Organization (WTO) and its role in establishing agreements covering trade in goods, services, and intellectual property rights. It outlines the WTO's key agreements and understanding, including the General Agreement on Tariffs and Trade (GATT) and the Customs Valuation Agreement. The Customs Valuation Agreement establishes transaction value as the primary method for customs valuation and provides guidelines for related party transactions and transfer pricing between related entities. Adjustments may need to be made to the transfer price to reflect the true value of goods for customs purposes.