Embed presentation

Downloaded 11 times

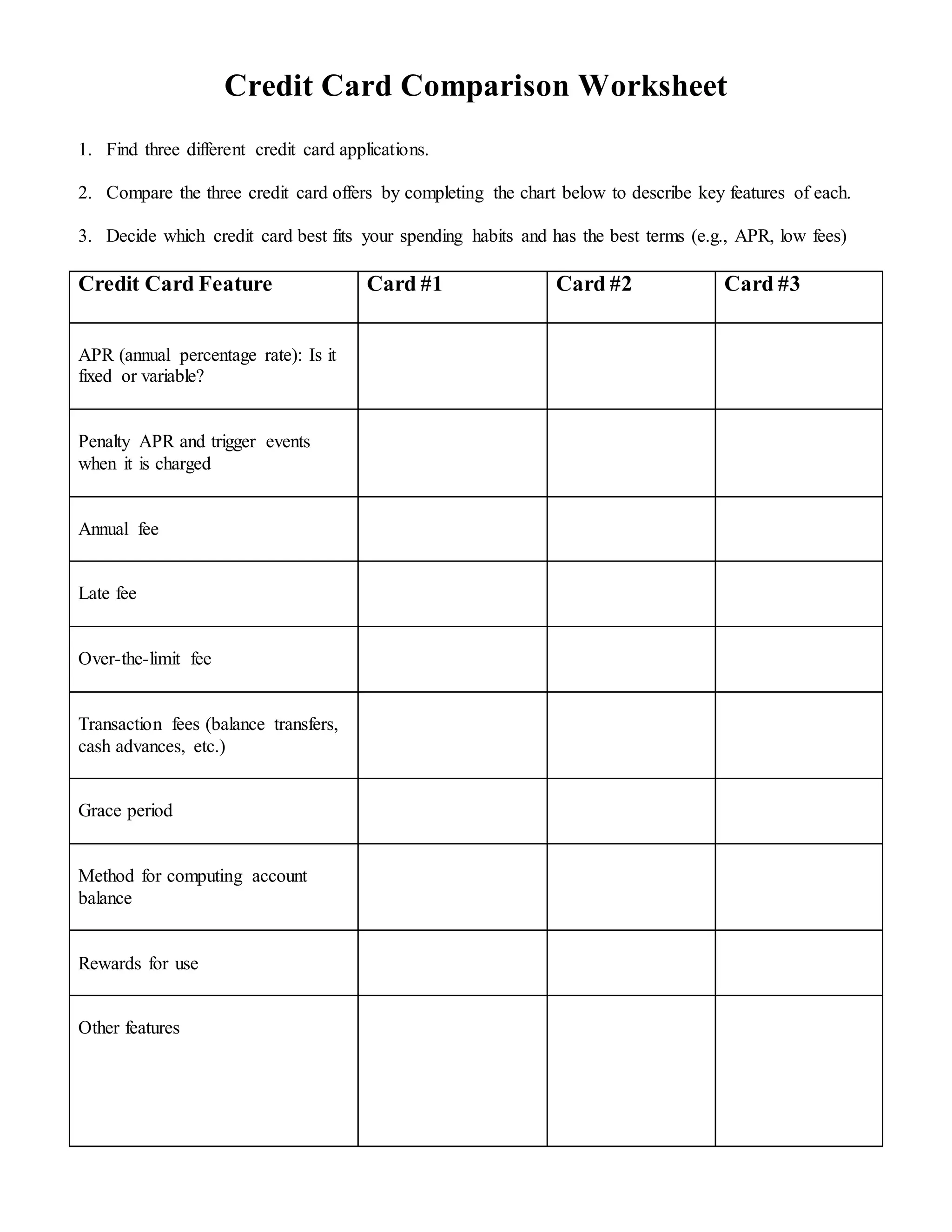

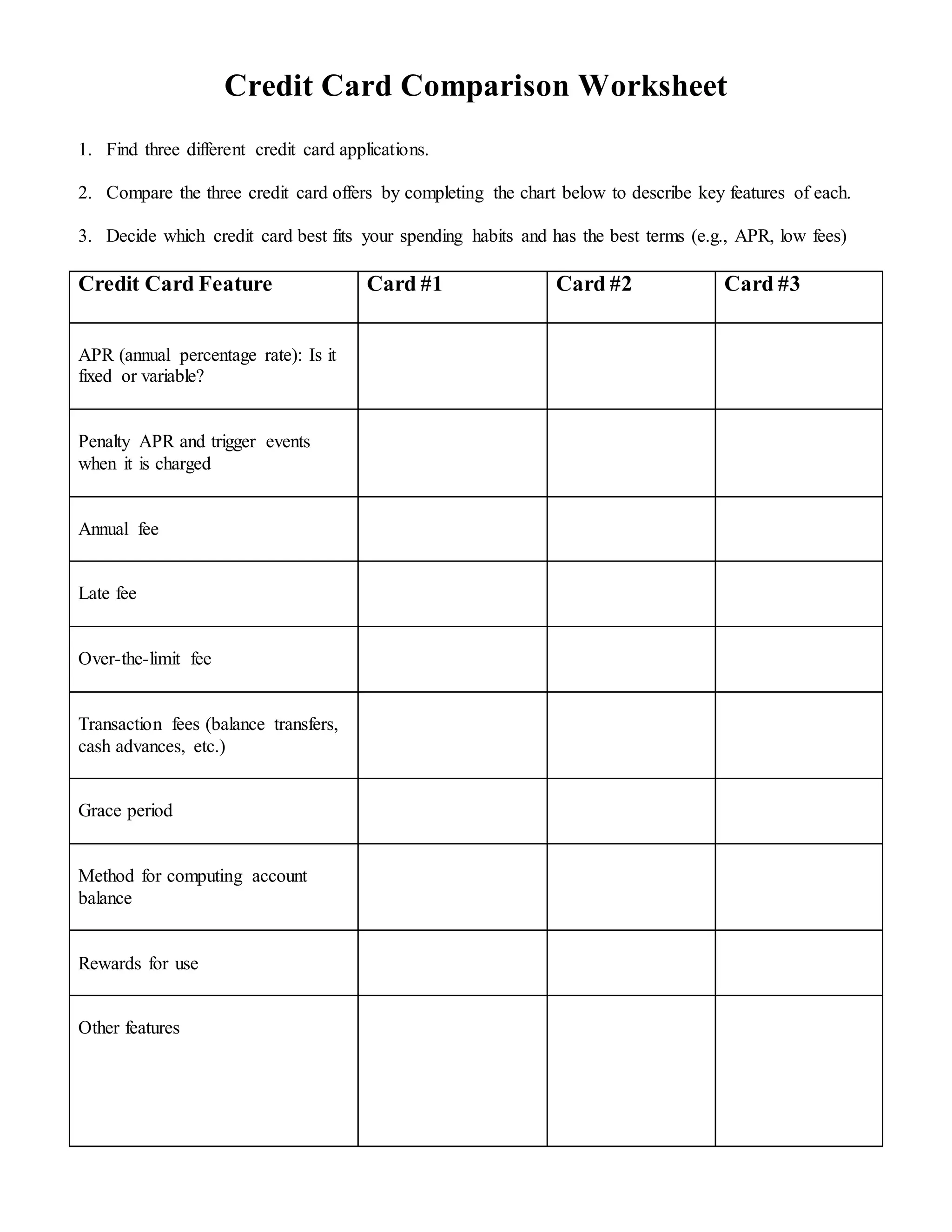

This document provides instructions for comparing key features of three different credit card offers such as annual percentage rates, penalty rates, fees, grace periods, and rewards programs. Users are directed to find applications for three credit cards, complete a chart describing each card's features, and determine which card best fits their spending habits and has the most favorable terms.