1. The document defines various types of companies under Indian law such as Indian company, domestic company, foreign company, and company in which the public are substantially interested.

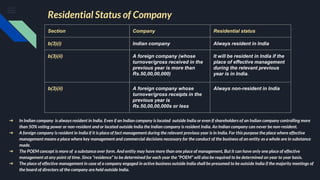

2. It explains the residential status of companies in India, noting that an Indian company is always resident in India regardless of control or location, while a foreign company's residence is determined by its place of effective management.

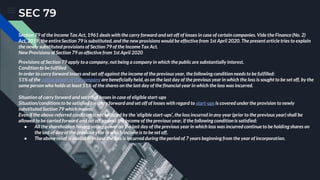

3. Tax planning tips are provided for the Minimum Alternate Tax (MAT) under section 115JB, such as recognizing revenue conservatively, using written down value depreciation, timing asset sales, writing off goodwill, and amortizing certain expenditures.

![● It may be noted that in respect of the following amounts debited to the statement of profit and loss, no adjustment is required under

section 115JB : a. any penalty or fine paid or payable under the Income-taxAct ; b. any tax, penalty or interest paid or payable under

the Wealth-taxAct ; c. any tax, penalty or interest paid or payable under the Gift-tax Act ; or d. any tax, penalty, or interest paid or

payable under the Companies (Profits) Surtax Act ; and e. any tax or duty which is not allowed as deduction while calculating taxable

income by virtue of section 43B f. securities transaction tax; g. banking cash transaction tax; and h. fringe benefit tax. The aforesaid

sums are not added to net profit in order to compute book profit for the purpose of section 115JB, though some of these expenses are

not allowed as deduction while calculating/ determining taxable income.

● Arrears of depreciation not provided in books in earlier years may be provided in the current year.

● Where the assessee has changed method of providing depreciation from straight line to written down value method which resulted in

shortfall in depreciation provided and resultant shortfall in depreciation is charged to statement of profit and loss for the current year,

the Assessing Officer is not justified in disallowing assessee’s claim of such additional depreciation while computing book profit on the

ground that such depreciation was not provided for in books of account of the assessee for the earlier years – CIT v. Farmson

Pharmaceuticals Gujarat Ltd. [ 2011] 241 CTR (Guj.) 568.

● Depreciation can be provided in books of account at rates higher than those specified in the Companies Act. Extra depreciation

(pertaining to earlier years) arising because of a bona fide change in depreciation method can be debitedto statement of profit and loss

for computing book profit.

● Guidance Note of ICAI indicates that depreciation also includes depletion of natural resources through process of extraction or use.

Book profit under section 115JB would be computed after allowing claim of depletion of natural resources.

● Refund of tax not credited to statement of profit and loss cannot be added to book profit.

● The Delhi High Court in CIT v. G E Power Services India Ltd. [2008] 171 Taxman 10 held that software expenditure debited to

statement of profit and loss is an allowable deduction in computing book profits. The Court refuted the argument of the revenue that

such expenditure would be capital in nature after amendment to section 32. The Court found such argument as unworthy, perhaps for

the reason that section 32 has no relevance as far as determination of book profits goes.

● This judgment thus provides a good tax planning method and, thus, an assessee can charge off software costs in accounts even while it

resorts to depreciation claim in tax computation after taking disallowance first. Before the statutory auditor, the assessee can take the

contention that the software in use has a short span of life and further it needs updating from time to time.

ASTHA JAIN 10557](https://image.slidesharecdn.com/unit2ctpppt-221226142056-a628dc4c/85/corporate-tax-planning-pptx-12-320.jpg)

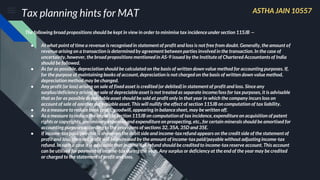

![Minimum Alternate Tax [Sec. 115JB]

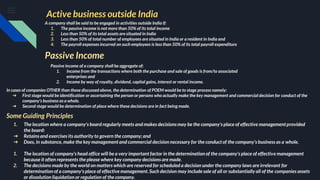

➢ MAT is applicable when tax computed under normal provisions is less than tax computed under

Sec 115JB provisions.

➢ In the case of a company (may be domestic or foreign company), the income tax payable on its total

income (computed after applying all provisions of income tax except section 115JB) is less than

15% of book profits + surcharge (if applicable) + cess, then such book profits shall be deemed to be

total income.

➢ Book profit shall be calculated on the basis of profit and loss account prepared in accordance with

the provisions of schedule VI of the Companies Act.

➢ Exceptions - Life Insurance business, Shipping income liable to tonnage taxation

➢ In the following two cases, the Assessing Officer can rewrite the profit and loss account:

○ If profit and loss account is not prepared according to the Companies Act

○ If accounting policies, accounting standards or rates or method of depreciation are different](https://image.slidesharecdn.com/unit2ctpppt-221226142056-a628dc4c/85/corporate-tax-planning-pptx-14-320.jpg)

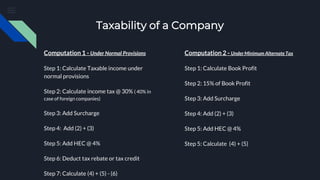

![Determining Book Profit [Sec 115JB]

Negative Adjustments (Less)

● Income tax or any provision for Income tax

● Transfer to Reserve

● Provision for unascertained liability

● Dividends (whether proposed or paid)

● Loss/Provision for loss of Subsidiary company

● Provision for diminution in the value of assets

● Deferred tax or any provision for deferred tax

● Depreciation as per books of account

● Expenditure on income which are exempt u/s

10,11,12

● Expenditure relatable to income from share in

AOP or BOI.

● Amount standing in Revaluation reserve in

respect of an asset which has been sold or

disposed off but not credited to P&L A/c.

● Any Amount withdrawn from Reserves

● Depreciation as per books of account. (ignoring

revaluation)

● Amount withdrawn from provision for deferred

tax.

● Any amount of income which is exempt.

● Share of Profit from AOP/ BOI.

● Amount withdrawn from revaluation reserve

and credited to Profit and loss account to the

extent it doesn’t exceed the amount of

depreciation on account of revaluation.

● Amount of unabsorbed loss or unabsorbed

depreciation whichever is lower as per

Companies Act. (Aggregate Amount will be

considered not year wise amount.)

Positive Adjustments (Add)

Adjustments to Net Profit -](https://image.slidesharecdn.com/unit2ctpppt-221226142056-a628dc4c/85/corporate-tax-planning-pptx-15-320.jpg)

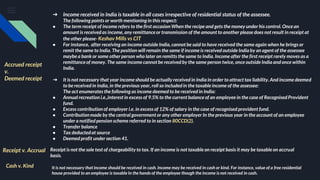

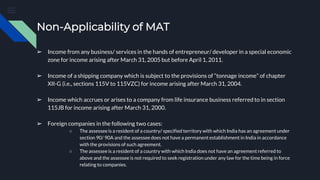

![Tax Credit [Sec. 115JAA]

➢ The extra tax which the company has to pay because of MAT will be available for “tax credit” under

section 115JAA.

➢ Tax credit can be set off against future tax liability of the company but only in that year in which

the tax computed under normal provisions is more than MAT.

➢ The maximum amount which can be set off in respect of the brought forward tax credit shall be

allowed for any assessment year to the extent of the difference between the tax on the total

income and the tax which would have been payable under section 115JB for that assessment year.

➢ Tax credit can be carry forward up to a maximum of 15 years. For example, if MAT is paid in the

assessment year 2018-19, then 2033-34 is the last assessment year for adjustment of MAT credit.

➢ Carry forward and set off of MAT credit shall not apply to a limited liability partnership which has

been converted from a private company or unlisted public company](https://image.slidesharecdn.com/unit2ctpppt-221226142056-a628dc4c/85/corporate-tax-planning-pptx-16-320.jpg)

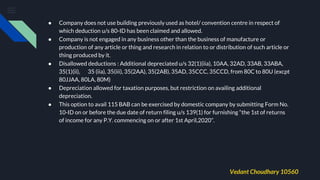

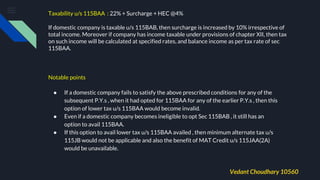

![Alternate Tax Regime [Sec 115 BAA]

● Must be a domestic company.

● Disallowed deductions : Additional depreciated u/s 32(1)(iia), 10AA, 32AD, 33AB, 33ABA, 35(1)(ii),

35 (iia), 35(iii), 35(2AA), 35(2AB), 35AD, 35CCC, 35CCD, from 80C to 80U (excpt 80JJAA, 80LA,

80M)

● Adjustment of loss : Brought forward losses and unabsorbed depreciation are disallowed.

However, unadjusted additional depreciation in respect of block of asset which has not been given

full effect prior to A.Y. 2020-21, corresponding adjustment to be made to such block on 1st April,

2019(if 115BAA is opted)

● Depreciation allowed for taxation purposes, but restriction on availing additional depreciation.

● This option to avail 115 BAA can be exercised by domestic company by submitting Form No. 10-IC

on or before the due date of return filing u/s 139(1).

Conditions for availing benefit of lower tax :](https://image.slidesharecdn.com/unit2ctpppt-221226142056-a628dc4c/85/corporate-tax-planning-pptx-18-320.jpg)

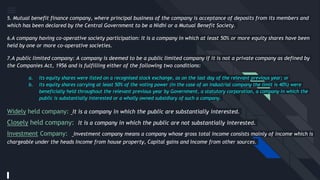

![Alternate Tax Regime for Manufacturing cos.

[115BAB]

Conditions for availing benefit of lower tax :

● Must be a domestic company.

● Such company is set up on or after 1st October,2019( not formed by split or reconstruction

of already existing business) and commenced manufacturing / production on or before 31st

March, 2024.

● It includes manufacturing / production of any article(including generation of electricity), but

excludes the following business:

Development of computer software in any form

Conversion of marble blocks into slabs

Bottling of gas into cylinders

Printing of books / production of cinematographic films

Mining business

Any other business notified by Central govt.

● Company does not any plant / machinery , previously used for any other purpose

Exception : i) 20% of old plant / machinery permitted

ii) Second hand imported plant / machinery to be treated as new](https://image.slidesharecdn.com/unit2ctpppt-221226142056-a628dc4c/85/corporate-tax-planning-pptx-20-320.jpg)