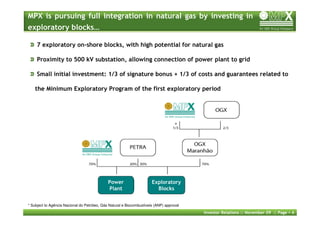

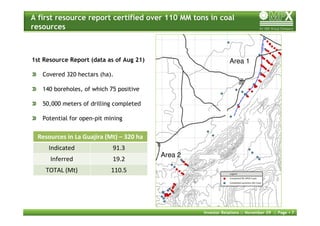

MPX provides an update on its natural gas and coal resources and 3Q09 earnings. For natural gas, MPX has acquired exploratory blocks in the Parnaíba Basin with certified contingent resources of 1.7 trillion cubic feet. For coal, over 110 million tons have been certified in Colombia with potential for open-pit and underground mining. Regarding earnings, construction of three power plants is on schedule with the first receiving financing. However, 3Q09 showed a net loss due to non-cash hedging derivatives, while adjusted net income was positive. Looking ahead, MPX has a mix of power generation and integrated fuel resources representing long-term upside.