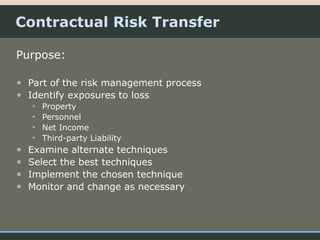

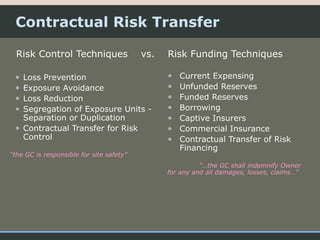

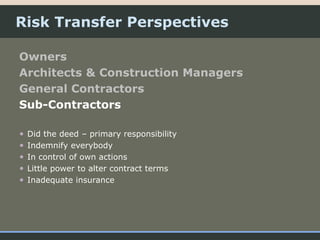

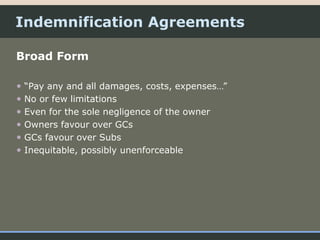

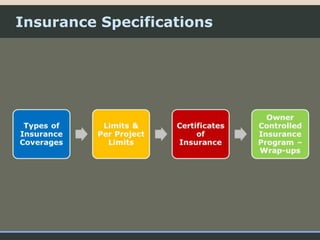

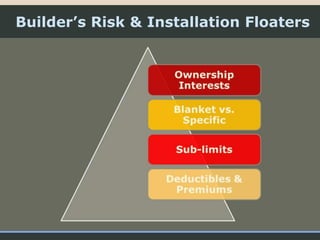

The document outlines the concept of contractual risk transfer in construction contracts, emphasizing its role in shifting responsibilities among parties for effective risk management. It details various perspectives of the stakeholders—owners, architects, general contractors, and subcontractors—along with indemnification agreements, insurance specifications, and essential checklists for contractors to navigate risk transfer. The document serves as a guide for managing contract risks and optimizing insurance coverage in construction projects.