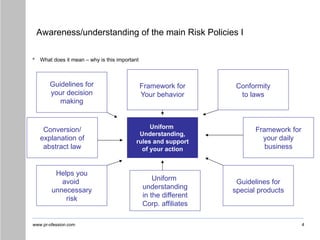

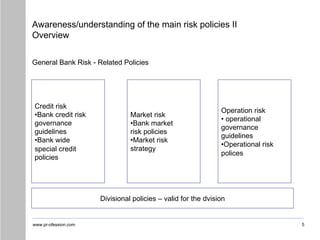

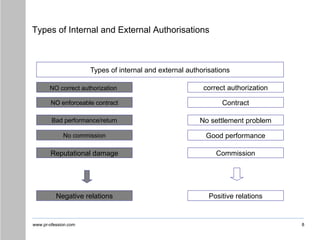

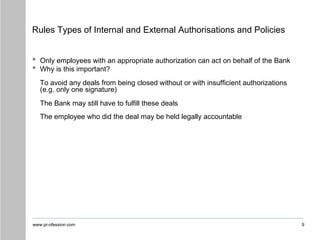

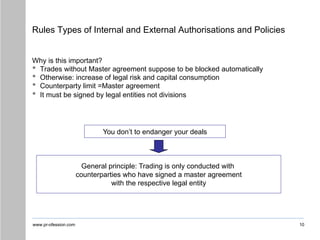

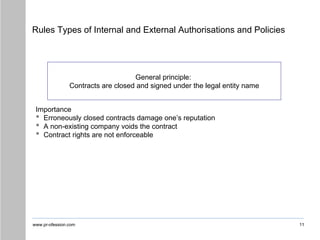

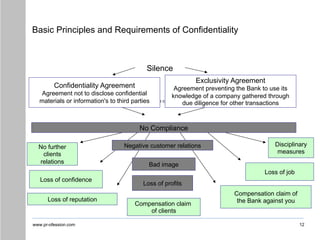

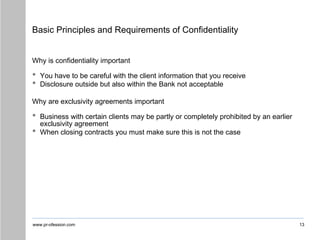

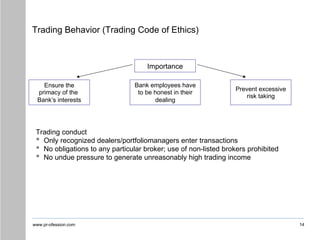

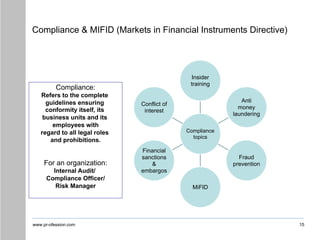

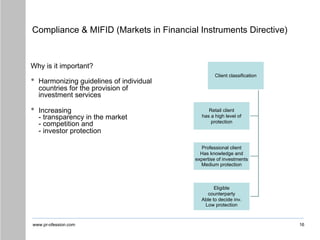

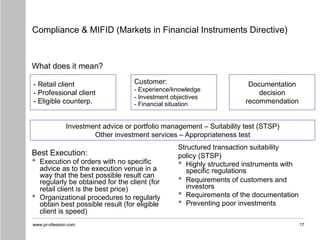

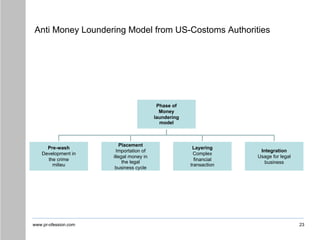

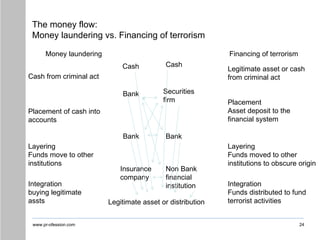

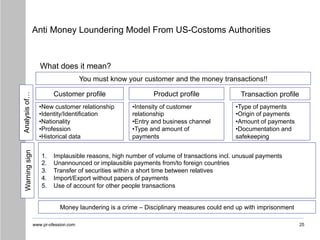

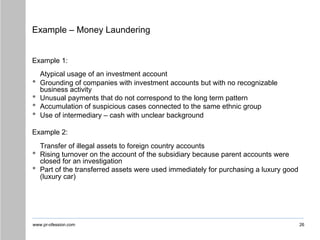

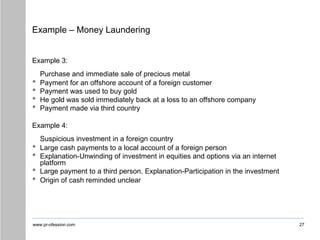

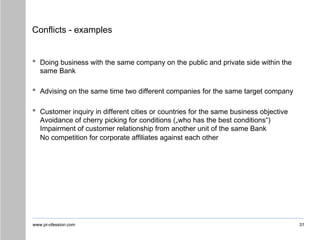

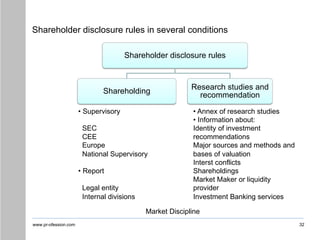

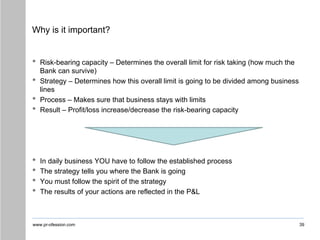

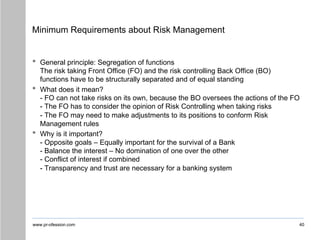

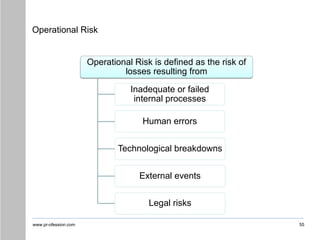

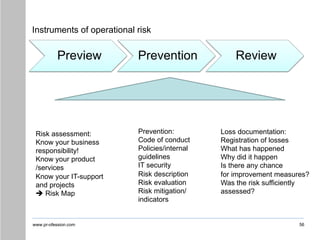

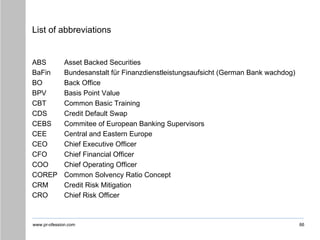

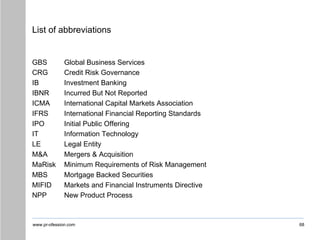

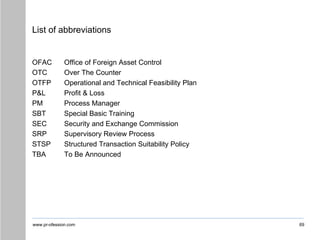

The document outlines a banking training program emphasizing the importance of trust, understanding risk policies, and adherence to ethical standards in banking operations. It covers various essential topics including compliance with regulations, types of authorizations, confidentiality, and the prevention of fraud and money laundering. The training aims to equip employees with the necessary knowledge to uphold the bank's interests while effectively serving clients.